Using the free cash flow valuation model to price an IPO Assume that you have an opportunity

Question:

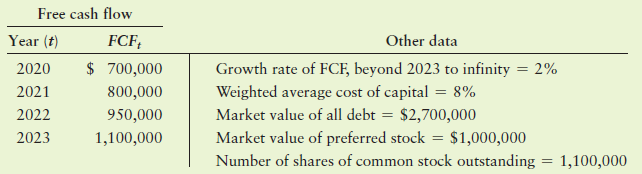

Using the free cash flow valuation model to price an IPO Assume that you have an opportunity to buy the stock of CoolTech Inc., an IPO being offered for $12.50 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm’s financial data that you’ve accumulated from a variety of data sources. The key values you have compiled are summarized in the following table.

a. Use the free cash flow valuation model to estimate CoolTech’s common stock value per share.

b. Judging by your finding in part a and the stock’s offering price, should you buy the stock?

c. On further analysis, you find that the growth rate of FCF beyond 2023 will be 3% rather than 2%. What effect would this finding have on your responses in parts a and b?

Free cash flow Year (t) Other data FCF; Growth rate of FCF, beyond 2023 to infinity Weighted average cost of capital = 8% Market value of all debt = $2,700,000 Market value of preferred stock = $1,000,000 Number of shares of common stock outstanding $ 700,000 2020 2% 2021 2022 2023 800,000 950,000 1,100,000 1,100,000

Step by Step Answer:

a The value of the firms common stock may be found in four steps Step 1 Find present value in 2023 o...View the full answer

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart

Related Video

The weighted average cost of capital (WACC) represents a firm\'s average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. WACC is the average rate that a company expects to pay to finance its assets

Students also viewed these Business questions

-

Your portfolio has three asset classes. U.S. government T-bills account for 45% of the portfolio, large-company stocks constitute another 40%, and small-company stocks make up the remaining 15%. If...

-

Taylor Systems has just issued preferred stock. The stock has an 8% annual dividend and a $100 par value and was sold at $99.50 per share. In addition, flotation costs of $1.50 per share must be...

-

A simple trust has the following receipts and expenditures for 2018. The trust instrument is silent with respect to capital gains, and state law concerning trust accounting income follows the Uniform...

-

On the income statement for the year ending December 31, Y1, the accountant for ABC calculated operating income before taxes of $300,000. This $300,000 did not include the effect of any of the...

-

Find the area of the ellipse b2x2 + a2y2 = a2b2.

-

A committee of fifty politicians is to be chosen from among our one hundred U.S. senators. If the selection is done at random, what is the probability that each state will be represented?

-

Refer to the information in Problem 21-1B. Tohono Companys actual income statement for 2017 follows. Required 1. Prepare a flexible budget performance report for 2017. Analysis Component 2. Analyze...

-

L. Houts Plastics is a large manufacturer of injection-molded plastics in North Carolina. An investigation of the companys manufacturing facility in Charlotte yields the information presented in the...

-

B2: Export Subsidy Consider a hypothetical market for alpaca wool socks in Peru. Assume the domestic supply and domestic demand for sweaters are respectively given by and Qs = 10+5P QD = 100 - 4P...

-

1. Refine and extend the domain model class diagram you developed in Chapter 5 as necessary. 2. Develop a use case diagram. Base it directly on the event table you created for Chapter 5. Be sure to...

-

Constant growth Over the past 6 years, Elk County Telephone has paid the dividends shown in the following table. Year Dividend per share 2019....................................... $2.87...

-

Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the companys computer products and believes that Hi-Tech is an...

-

An elastic band is hung on a hook and a mass is hung on the lower end of the band. When the mass is pulled downward and then released, it vibrates vertically. The equation of motion is s = 2 cos t +...

-

Collateral is required as enhancement of the borrowers credit. Elaborate on the purpose and extent of offering security from the perspective of the borrower.?

-

Intro Coca-Cola has expected earnings per share (EPS) of $2. Its competitors have the following P/E ratios: P/E ratio Dr Pepper Nestle Pepsico 22.07 23.71 21.37 Part 1 Attempt 1/10 for 10 pts. What...

-

What can cause a cell to become desensitized to a signal? What are two of the mechanisms that the cell can use to reduce or stop its response to a signal?

-

identify and explain the key features of the organizational policies and procedures related to financial administration. How do these policies influence the budget preparation process, resource...

-

You have found the home of your dreams. You have negotiated the best price for the home, $180,663. You have $13,506 to pay as a down payment. And the best interest rate you can get is 4.03%. Based on...

-

In what region of the electromagnetic spectrum is the resonant frequency of electrons in glass?

-

Reichenbach Co., organized in 2018, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2018 and 2019. Instructions...

-

A 2-year Treasury bond currently offers a 6% rate of return. A 3-year Treasury bond offers a 7% rate of return. Under the expectations theory, what rate of return do investors expect a 2-year...

-

Economic forecasters predict that the rate of inflation in Singapore will be at 3% over the next few decades. The following table shows the nominal interest paid on Treasury securities having...

-

Jack Trading and Brokerage Ltd. wishes to evaluate interest rate behavior. They have gathered data from five Treasury securities issued by Deutsche Bundesbank, Germanys central bank. Each security...

-

How does Ozy media differentiate itself from competitor? or how does it build brand identity?

-

Moe Glee's business acquired a group of assets two years ago to help with expansion plans, but Moe would now like to review the use of some of those assets. Moe's close friend Ana Maui Harry's has...

-

Analyze the centrality of Off Whites' significant collaborations with other luxury and sportswear brands for accruing valuable brand equity.?

Study smarter with the SolutionInn App