Shimmer Products is considering which bad debt estimation method works best for its company. It is deciding

Question:

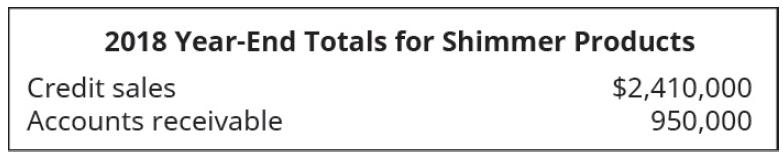

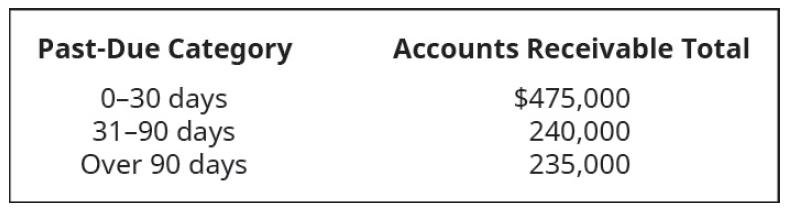

Shimmer Products is considering which bad debt estimation method works best for its company. It is deciding between the income statement method, balance sheet method of receivables, and balance sheet aging of receivables method. If it uses the income statement method, bad debt would be estimated at 5.6% of credit sales. If it were to use the balance sheet method, it would estimate bad debt at 13.7% percent of accounts receivable. If it were to use the balance sheet aging of receivables method, it would split its receivables into three categories: 0–30 days past due at 5%, 31–90 days past due at 21%, and over 90 days past due at 30%. There is currently a zero balance, transferred from the prior year’s Allowance for Doubtful Accounts. The following information is available from the year-end income statement and balance sheet.

There is also additional information regarding the distribution of accounts receivable by age.

Prepare the year-end adjusting entry for bad debt, using

A. Income statement method

B. Balance sheet method of receivables

C. Balance sheet aging of receivables method

D. Which method should the company choose, and why?

Step by Step Answer:

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax