a. Evaluate the effectiveness of CTIs control environment. b. Assess risk at the financial statement level. 1.

Question:

a. Evaluate the effectiveness of CTI’s control environment.

b. Assess risk at the financial statement level.

1. Evaluate inherent risk at the financial statement level.

2. Evaluate the risk of fraud. Specifically, consider each aspect of the fraud triangle; (i) incentives and pressures, (ii) opportunity, and (iii) attitudes and rationalization.

c. What is the potential for the effectiveness of the management performance reviews performed by Rob and Jessica with respect to the following assertions?

1. Existence of inventory.

2. Valuation of inventory and cost of sales.

d. Prepare a letter with any internal control recommendations that you have for management. Each specific recommendation should describe the current system, explain the risk involved, and make specific recommendations for improvement. You may assume that issues have already been discussed with management regarding the audit adjustments found in prior audits, so focus your attention on other issues that are of concern to you.

Phase I: Company History and Background

You are about to begin the audit of Circuits Technology Inc. (CTI) for the year ended December 31, 2022. CTI resells, installs, and provides computer networking products (client software, and gateway hardware and software) to other businesses. Jessica Freeman founded the business in the late 1990s and grew the business to a stable and profitable enterprise in a major metropolitan area. Jessica owns 60% of the business and four other shareholders (a brother, a sister, her father, and a friend) own 10% each. The minority shareholders contributed capital to the company when it was getting started and the owners make up the board of directors. They usually meet only once a year to discuss dividends to be declared. During the rest of the year, the minority owners leave the day-to-day management decisions to Jessica, who also has controlling interest in the company.

The business grew rapidly in the first five years and then it settled into a steady performance mode. In 2011, during its growth stage, Jessica was approached about merging the business with a larger company, but she decided that she did not want to merge the company, even if it meant limiting the growth of the business. CTI was her baby. Jessica enjoyed being CEO, she knew the business inside and out, and she did not want to be subordinate to someone else. The business was organized as a Subchapter S Corporation and it was distributing a nice return to shareholders, so family members and friends were happy with her decisions. Jessica had her fingers in every aspect of the business and she was boss.

CTI performed solidly until 2019. Then the entire industry became much more competitive. A significant portion of the demand that had been generated by cloud computing had been met, competition increased, and the steady business slowed down such that cash flow did not come as easily. Jessica and her sales staff had to work harder to close deals as the industry became more competitive. Rob Kaiser, the CFO, began complaining about Jessica’s increasing intrusion into the company’s finances in late 2020. During the period of steady performance, he and Jessica met quarterly to discuss the company’s performance and finances. They would go over the entity’s operating performance, its investing activities, and cash management; the primary focus of attention was the annual distribution of earnings to shareholders. On occasion, Jessica would want to structure a client contract in a particular way, or she would come in and insist on an additional discount for a particular customer, but Jessica generally let Rob manage the finances of the business.

Now things had changed, particularly in the competitive environment where there were numerous vendors chasing each customer. Jessica regularly discussed the accounting for particular transactions. It was not uncommon for Jessica to come in and tell someone in accounting to change a sales invoice to offer a particular price discount to a customer. Further, there were often heated discussions between Rob and Jessica over the monthly financial statements. Jessica knew the business and sometimes would not accept his explanations for draft financial statements that showed performance falling below Jessica’s expectations. She had built the business, was involved in key decisions, and she knew what profit margins should result. For example, gross margins should not fall below 52% as they did in 2019. In her view, this was due to problems in the accounting system.

In some cases, Jessica was correct. Accounting was not a high priority. The first priority had to be sales and customer satisfaction. Jessica swallowed hard when she had to hire Rob, but it was clear that it would be more cost-effective to hire someone in-house to manage finances than to subcontract to a CPA firm. However, accounting never had a significant budget. It could invest in technology and software, but it was always several people short of full staffing for the accounting system. Rob and his two salaried employees were cross-trained on most aspects of the accounting system, and everyone worked long hours. As a result, errors happened. The previous audit detected problems in the purchasing process and some vendors’ invoices had been paid twice. These problems usually surrounded rush purchases for clients where the vendor was asking for significant upfront payments. The auditors also noted some cutoff problems in sales and purchases, and proposed an audit adjustment to the allowance for doubtful accounts. In Rob’s opinion, this was the result of his department being stretched too thin.

In recent years, Jessica has paid considerable attention to the financial performance in the last two quarters of the year. Her major concern has focused on the company’s profitability and ability to pay shareholder distributions. During the year-end close last year, Jessica stopped by Rob’s office daily to ask about the journal entries being made that day and their impact on earnings. This just added to the pressure on Rob to “get the job done.”

Rob was also concerned about managing the relationship with First State Bank. Over the years, the business relationship changed from one where CTI had significant deposits with First State Bank and used occasional seasonal borrowing, to one where the line of credit has not been retired in the last 18 months. First State Bank, which had previously been satisfied with reviewed financial statements, now requested audited financial statements. Further, First State Bank established the following debtcovenants.

• Dividends are restricted to 90% of net income.

• CTI must keep a minimum current ratio of 2.50:1.

• CTI must keep a minimum quick ratio of 1.2:1.

• CTI’s debt-to-equity ratio cannot exceed 1.00:1.

Rob keeps a tight control on cash. An independent bank reconciliation is performed monthly. Further, Rob closely tracks when vendor payments are due. With the exception of 2020, he has been able to keep the accounts payable turnover somewhere between 30 and 38 days. Rob would like to collect receivables faster, but the nature of the company’s service, which involves installation of hardware and software to the customer’s satisfaction, results in collection periods approaching 90 days. The company does not rely on programmed control procedures to monitor individual transactions. CTI does not have the staff to follow up on exception reports that might be generated by the accounting system. The primary controls in place involve Rob’s independent review of transactions on a monthly basis. In addition, Jessica keeps a close eye on revenues, expenses, and profit margins, and she demands explanations from Rob when actual results deviate from her expectations.

Phase II

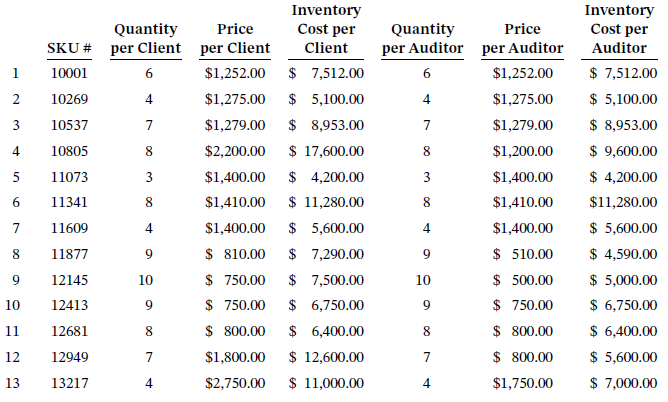

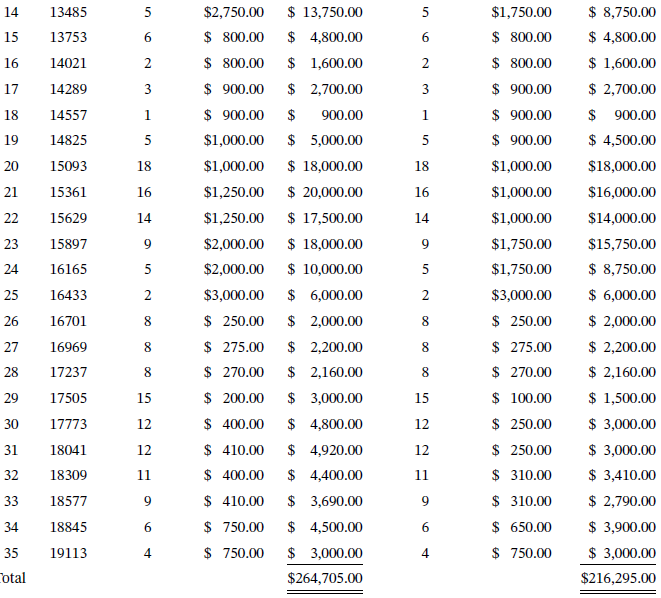

CTI prices its inventory at FIFO. You select a random sample of 35 items for price testing and find the following results as of year-end 2022. The total book value of inventory is $1,027,000. You should assume that errors exist in the unsampled portion of the population in the same proportion that they exist in the sample.

In addition, you find a journal entry where Rob has capitalized half of December’s payroll for six network installers’ work on two contracts as part of work in progress. The amount of gross payroll amounts to $15,600 plus 35% for the cost of payroll taxes and benefits. The total of payroll included in work in process amounted to $21,060. Further investigation shows that the client was billed for all work performed on those contracts as of December 31, 2022.

Step by Step Answer:

Auditing A Practical Approach with Data Analytics

ISBN: 978-1119401742

1st edition

Authors: Raymond N. Johnson, Laura Davis Wiley, Robyn Moroney, Fiona Campbell, Jane Hamilton