Melanie Ltd requires a Statement of Cash Flows to be prepared for the year ended 31 March

Question:

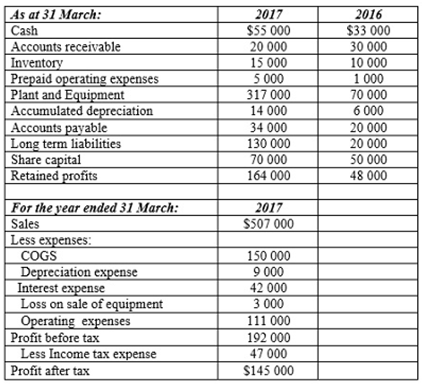

Melanie Ltd requires a Statement of Cash Flows to be prepared for the year ended 31 March 2017; the following information kaa. ketatzaxited for this purpose.

Additional information:

CO During the year ended 31 March 2017 an item of equipment, which originally cost S8 000, was sold.

(ii) Melanie Ltd uses the direct method for presenting cash flows from operating activities. (iii) Classify any dividends paid and interest paid as cash flows from financing activities. c,bauxstat items of plant and equipment were purchased during the year ended 31 March 2017; a long-term liability of $110 000 was specifically arranged for the purchases.

Required:

Prepare a Statement of Cash Flows for Melanie Ltd, for the year ended 31 March 2017, in accordance with AZ/AS 7 Statement ofCash Flows. A reconciliation is required to be prepared. GST is not applicable. All workings, in the form of selected general ledger accounts

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott