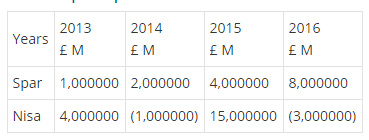

The case below about Spar and Nisa companies, both firms in the same industry (Selling agricultural machinery)

Question:

The case below about Spar and Nisa companies, both firms in the same industry (Selling agricultural machinery) in UK and have provided you with the following financial information. Please read the case and answer the required questions.

Based on the information above and the materials given about the topic, answer the following questions.

A. When you compare the profit of both companies, do you think there is earnings management? If so, in which company and which method of creative accounting that the company used to do earnings management.

B. Which firm do you think might be favored by the stock market? Why.

In 2013 Spar company has only one asset, inventory, worth say ?20,000000, then if the equity is ?19,000000 and this year?s profit is ?1,000000. If the company could first, adopt more generous inventories valuation policy to decrease provisions for obsolete inventories by ?200,000. Second revaluate the value of the inventories based on market value not on book value to increase the inventories by 1,000000.

A. How is the balance sheet of the company looks like before and after adopting these polices?. 1.5 marks

B. Do you think by adopting these polices to decrease provisions for obsolete inventories and increase inventories effect the company?s profit? Explain your answer using the calculation when it needs it.

Nisa Company in UK, where the tax system gives capital allowance (money deducted from the overall income tax) The tax year runs from 10thof April to 9thof April. The financial year of the company end was 30 of June. Tom is farmer and wants to buy machine in March and wanted the machinery invoiced in in March, but would pay in August when the machine will be delivered.

A. Why do you think Tom wished to do this?

B. The manager of Nisa Company accepted and decided to send the bill to the farmer Tom and record the transaction as revenue as soon as the bill has been sent. Why do you think the manager accept and decided to do revenue recognition in the way that he decided to do? Is there profit management here? Explain your answer and show if there advantage and disadvantage of manager?s decision.

Assume that In 2014 Spar made profit of ?2,000000 before depreciation. The company has ?20,000000 worth of equipment. Currently it using the straight line method to depreciate its equipment over 10 years.

However, the company is thinking to change its depreciation policy by to 20 years estimated useful life instead of 10 years.

A. Do you think this change will affect the company?s profit? Explain your answer using the calculation to show the profit before and after the change. If there was effect on company?s profit, what is the amount of the change?

B. After you finish analyzing the case, now you need to conclude your assignment with the consequences of using creative accounting in managing the profits of companies.

Managerial accounting

ISBN: 978-0471467854

1st edition

Authors: ramji balakrishnan, k. s i varamakrishnan, Geoffrey b. sprin