1. A 3-year bond with 10% coupon rate and $1000 face value yields 8% APR. Assuming...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

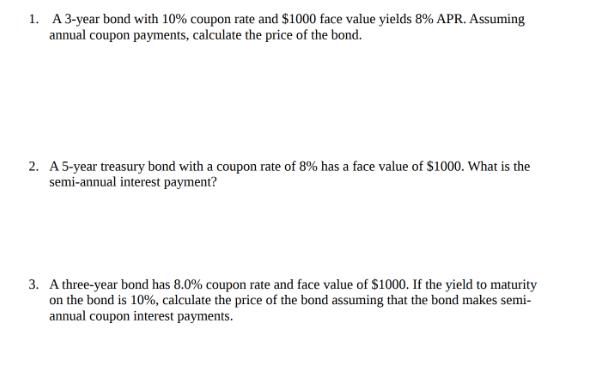

1. A 3-year bond with 10% coupon rate and $1000 face value yields 8% APR. Assuming annual coupon payments, calculate the price of the bond. 2. A 5-year treasury bond with a coupon rate of 8% has a face value of $1000. What is the semi-annual interest payment? 3. A three-year bond has 8.0% coupon rate and face value of $1000. If the yield to maturity on the bond is 10%, calculate the price of the bond assuming that the bond makes semi- annual coupon interest payments. 1. A 3-year bond with 10% coupon rate and $1000 face value yields 8% APR. Assuming annual coupon payments, calculate the price of the bond. 2. A 5-year treasury bond with a coupon rate of 8% has a face value of $1000. What is the semi-annual interest payment? 3. A three-year bond has 8.0% coupon rate and face value of $1000. If the yield to maturity on the bond is 10%, calculate the price of the bond assuming that the bond makes semi- annual coupon interest payments.

Expert Answer:

Answer rating: 100% (QA)

1 To calculate the price of the bond we need to calculate the present value of its cash flows coupon ... View the full answer

Related Book For

Introduction to Operations Research

ISBN: 978-1259162985

10th edition

Authors: Frederick S. Hillier, Gerald J. Lieberman

Posted Date:

Students also viewed these finance questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

We have the opportunity to buy a 10-year (original term) bond with 8 years of semi-annual coupon payments remaining. The annual coupon rate is set at 6% ($30 semi-annual payment). If the current...

-

The Slice & Dice Investment Co. needs some help understanding the intricacies of bond pricing. It has observed the following prices for zero coupon bonds that have no risk of default: a. How much...

-

A- Farah Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product which it sells at $132.7 per unit...

-

On January 1, 2006 the Sato Company adopted the dollar-value LIFO method of inventory costing. The company's ending inventory records appear as follows: Required Compute the ending inventory for the...

-

In Problems 1122, use elementary row operations to transform each augmented coefficient matrix to echelon form. Then solve the system by back substitution. 2x 1 + 8x 2 + 3x 3 = 2 x 1 + 3x 2 + 2x 3 =...

-

Repeat the calculations of Example 9.5, but for a total solution normality of 0.5. Data From Example 9.5:- For the Cu 2+ /Na + exchange with a strong-acid resin, show how the fraction CuR2 in the...

-

Musixscore.com is an online service providing sheet music to customers. On the browse music Web page, customers select a genre of music from a drop-down list. The Web page uses Ajax to obtain a list...

-

Joe is 25 and has a wage of $30,000. He is single with no dependents, and files as single. He rents and makes no contributions to charity. He contributed $800 to a Roth IRA in 2022. What is his Total...

-

Jill Connor is employed as a salesperson in the men's department of Fashion Line. In addition to her weekly base salary of $440, Connor is paid a commission of 2% on her total net sales for the week...

-

You just got a job at Do We Cheatem Inc. This company is always interested in helping its employees financially. They offer employees an option whereby they increase the amount of federal income tax...

-

What techniques do the credit companies use to market their credit?

-

P(n) says that a postage of 5n cents can be formed using just 10-cent and 15-cent stamps. We prove that P(n) is true for n>2, i.e., any amount of 10-cents or more postage that is a multiple of 5 can...

-

Question 3 (Extra Credit) - Assuming a MARR of 10%, calculate the rate of return of the following investment. Is it a good investment? (1 point) year 0 1 2 345 Cash Flow -25,000 6500 6500 6500 6500...

-

Please demonstrate your behaviour within the text boxes below. We recommend that you structure your example as Situation, Task, Action and Result. Find out more about Success Profiles and Behaviours....

-

Which credit option appeals to you most? Why?

-

Describe the four functions of the respiratory system and identify the structures involved in each. What happens when one of those structures is not working properly? Select one structure and...

-

SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended...

-

Use the parametric linear programming procedure for making systematic changes in the bi parameters to find an optimal solution for the following problem as a function of , for 0 25. Maximize Z() =...

-

The Childfair Company has three plants producing child push chairs that are to be shipped to four distribution centers. Plants 1, 2, and 3 produce 12, 17, and 11 shipments per month, respectively....

-

Reconsider Prob. 27.7-11. Despite some fluctuations from year to year, note that there has been a basic trend upward in the annual demand for copper ore over the past 10 years. Therefore, by...

-

A running mountain lion can make a leap 10.0 m long, reaching a maximum height of 3.0 m. a. What is the speed of the mountain lion just as it leaves the ground? b. At what angle does it leave the...

-

The moon completes one (circular) orbit of the earth in 27.3 days. The distance from the earth to the moon is 3.84 10 8 m. What is the moons centripetal acceleration?

-

A soccer player takes a free kick from a spot that is 20 m from the goal. The ball leaves his foot at an angle of 32, and it eventually hits the crossbar of the goal, which is 2.4 m from the ground....

Study smarter with the SolutionInn App