1. Company XYZ has less than one year since starting the activity, the monthly installments of...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

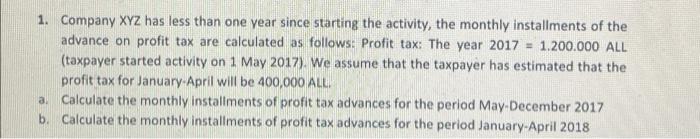

1. Company XYZ has less than one year since starting the activity, the monthly installments of the advance on profit tax are calculated as follows: Profit tax: The year 2017 = 1.200.000 ALL (taxpayer started activity on 1 May 2017). We assume that the taxpayer has estimated that the profit tax for January-April will be 400,000 ALL. a. Calculate the monthly installments of profit tax advances for the period May-December 2017 b. Calculate the monthly installments of profit tax advances for the period January-April 2018 1. Company XYZ has less than one year since starting the activity, the monthly installments of the advance on profit tax are calculated as follows: Profit tax: The year 2017 = 1.200.000 ALL (taxpayer started activity on 1 May 2017). We assume that the taxpayer has estimated that the profit tax for January-April will be 400,000 ALL. a. Calculate the monthly installments of profit tax advances for the period May-December 2017 b. Calculate the monthly installments of profit tax advances for the period January-April 2018

Expert Answer:

Answer rating: 100% (QA)

a Calculate the monthly installments of profit tax advances for ... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

elow is selected financial information for SunRise Company. Selected Balance Sheet Data - As of Dec. 31, 2018 Dec. 31, 2017 Cash and short-term investments $ 958,245 $ 745,800 Accounts Receivable...

-

You are one of Chryslers biggest suppliers of certain parts. You are shocked at the decree by the new management of Chrysler that you must cut your prices by 5 percent immediately, and another 10...

-

Explain two examples of how the advantages and disadvantages of an annuity and a lump-sum distribution counter, or offset, each other. Why is this important to understand when choosing a of...

-

When the current through an inductor is decreasing at a rate of \(2.0 \mathrm{~A} / \mathrm{s}\), the magnitude of the induced emf is \(6.0 \mathrm{~V}\). What is the inductance of the inductor?

-

Data for Schmidt Company is presented in the following table of rates of return on investment and residual incomes: Determine the missing items, identifying each item by the appropriateletter. Income...

-

The definition, " ' Chiropractor ' means a person who is a medical quack with no legitimate scientific background," is an example of: Theoretical definition Definition by subclass Persuasive...

-

Problem 3 addressed the cross-sectional variation in the number of financial analysts who follow a company. In that problem, company size and debt-to-equity ratios were the independent variables. You...

-

Fiona Willis had a lot happening in her life right now, and she didn't really need an angry client on the phone. Fiona was newly married and newly accredited as a Chartered Accountant in the firm...

-

3. Huron Co. pays a $2 per share dividend and has a 4% dividend yield. a. (3 points) What is the price per share for Huron Co.? b. (3 points) If you hold the stock and one year from now Huron Co. has...

-

The Essentials of Technical Communication (Tebeaux & Dragga), Oxford U. Press, Third Edition - Chapter 7 This chapter offers a comprehensive overview of tips, concerns, and issues associated with...

-

Write a c++ program to calculate the area of rectangle and area of triangle Input for rectangle: length, width Input for triangle: base, height .Out put Rectangle triangle Length = base= Width =...

-

You are working with a child named Vivienne. You have noticed that Vivienne often sits by herself while other children are playing she does not seem to know how to make friends or how to enter...

-

The following information is extracted from Shelton Corporations accounting records at the beginning of 2019: Accounts Receivable $78,000 Allowance for Doubtful Accounts 1,300 (credit) During 2019,...

-

You are about to get hired to sell a building for $4,700,000 at a 3.50% cap rate with a 5% fee and estimate 1% in additional transaction costs. The seller's original loan was $1,500,000 at a 5.00%...

-

(a) What do data breach notification laws require? (b) Why has this caused companies to think more about security?

-

The following adjustments need to be made in the accounts of Ricksu at the year-end 31.03.03. (a) Bad debts of £3,000 are to be written off against total trade receivables balance of...

-

Trade payables balances at 1st June, per control account and per list of individual purchase ledger balances 306,895 Purchases for the month, per list of purchase invoices 1,206,790 Payments to...

-

Highway Ltd bought 80% of the share capital in Sideway Ltd for £260,000, some time ago when reserves in Sideway were £40,000. At acquisition the non-current assets of Sideway were...

-

Suppose that a speculative-grade bond issuer announces, just before bond markets open, that it will default on an upcoming interest payment. In the announcement, the issuer confirms various reports...

-

The expected effect on market efficiency of opening a securities market to trading by foreigners would be to: A. Decrease market efficiency. B. Leave market efficiency unchanged. C. Increase market...

-

1. An analyst estimates that a securitys intrinsic value is lower than its market value. The security appears to be: A. Undervalued. B. Fairly valued. C. Overvalued. 2. A market in which assets...

Study smarter with the SolutionInn App