11. 10 Fine Contact Ltd. is an all equity firm having 40,000 equity shares of Rs.25...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

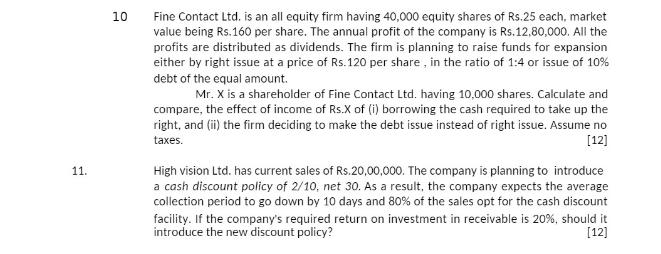

11. 10 Fine Contact Ltd. is an all equity firm having 40,000 equity shares of Rs.25 each, market value being Rs.160 per share. The annual profit of the company is Rs.12,80,000. All the profits are distributed as dividends. The firm is planning to raise funds for expansion either by right issue at a price of Rs.120 per share, in the ratio of 1:4 or issue of 10% debt of the equal amount. Mr. X is a shareholder of Fine Contact Ltd. having 10,000 shares. Calculate and compare, the effect of income of Rs.X of (i) borrowing the cash required to take up the right, and (ii) the firm deciding to make the debt issue instead of right issue. Assume no taxes. [12] High vision Ltd. has current sales of Rs.20,00,000. The company is planning to introduce a cash discount policy of 2/10, net 30. As a result, the company expects the average collection period to go down by 10 days and 80% of the sales opt for the cash discount facility. If the company's required return on investment in receivable is 20%, should it introduce the new discount policy? [12] 11. 10 Fine Contact Ltd. is an all equity firm having 40,000 equity shares of Rs.25 each, market value being Rs.160 per share. The annual profit of the company is Rs.12,80,000. All the profits are distributed as dividends. The firm is planning to raise funds for expansion either by right issue at a price of Rs.120 per share, in the ratio of 1:4 or issue of 10% debt of the equal amount. Mr. X is a shareholder of Fine Contact Ltd. having 10,000 shares. Calculate and compare, the effect of income of Rs.X of (i) borrowing the cash required to take up the right, and (ii) the firm deciding to make the debt issue instead of right issue. Assume no taxes. [12] High vision Ltd. has current sales of Rs.20,00,000. The company is planning to introduce a cash discount policy of 2/10, net 30. As a result, the company expects the average collection period to go down by 10 days and 80% of the sales opt for the cash discount facility. If the company's required return on investment in receivable is 20%, should it introduce the new discount policy? [12]

Expert Answer:

Answer rating: 100% (QA)

10 To calculate the effect of income for Mr X in the given scenarios lets consider the two options i Borrowing the cash required to take up the right issue Total number of equity shares 40000 Mr Xs nu... View the full answer

Related Book For

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Posted Date:

Students also viewed these finance questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

First United Bank Inc. is evaluating three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Instructions 1. Assuming...

-

The Harmes Company is a clothing store that uses the retail inventory method. The following information relates to its operations during 2007: Required Compute the ending inventory by the retail...

-

Milliken Corporation reported net income of $700,000 in 2023 and had 115,000 common shares outstanding throughout the year. Also outstanding all year were 9,500 cumulative preferred shares, with each...

-

What is the default filename that make will process if no other is given?

-

Princeton Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the following schedule for the three volumes shown. 2. Why does the average cost per garment...

-

On June 30, 2016, Flint Limited issued 13.75% bonds with a par value of $802,000 due in 20 years. They were issued at 99 and were callable at 102 at any date after June 30, 2023. Because of lower...

-

Use the template for the ABC Corp. valuation in section 2.7 to value Cisco stock. Assume that the weighted average cost of capital for Cisco is 12.6%, the growth rate for years 15 is 4%, and that the...

-

Consider the following information about a firms long-run total costs (assuming that other firms could produce at the same cost values): q A TC 0 0 100 2200 200 3600 300 5400 400 7600 500 10000 For...

-

Gloria earns $250,000 of pensionable earnings in her defined benefit pension plan. If her benefit entitlement is 1.5% of his pensionable earnings and the money purchase limit is $31,560, what is her...

-

Given the function f(t) = (t 1)(t + 7) (t 3) its f-intercept is its t-intercepts are

-

Some estimated the value of a certain island in 2011 to be about $800,000,000,000. Assuming this to be true, what would have been a fair price for a person to pay for the island in 1626, assuming an...

-

create an alternative "pro forma" markeStarting from the market value balance sheet you constructed in Question 2, create an alternative "pro forma" market value balance sheet assuming that Apple...

-

You believe the stock in Freeze Frame Co. is going to fall, so you short 950 shares at a price of $74. The initial margin is 50 percent. 1. Construct the equity balance sheet for the original trade....

-

Porcelain is produced by firing at high temperature of which all mixtures? O a. All of these O b. Quartz O C. Kaolin O d. Feldspar

-

Using the parallel-axis theorem, determine the product of inertia of the area shown with respect to the centroidal x and y axes. 6 in. 9 in. 9 in- 4.5 in. in. 4.5 in.

-

Obtain the latest Form 10-K for Facebook, Inc. (www.investor.fb.com). Locate and describe the significant risks the company identifies. Are any of these unexpected based on your previous familiarity...

-

Identify conditions that would lead an analyst to expect that management might attempt to manage earnings downward?

-

Assume that a corporation needs to enter the private debt market to raise funds for plant expansion. The corporation expects debt covenants to place restrictions on the levels of its current ratio...

-

Graph the following table: a. What is marginal product and average product at each level of production? b. Graph marginal product and average product. c. Label the areas of increasing marginal...

-

If average product is falling, what is happening to short-run average variable cost?

-

If marginal cost is increasing, what do we know about average cost?

Study smarter with the SolutionInn App