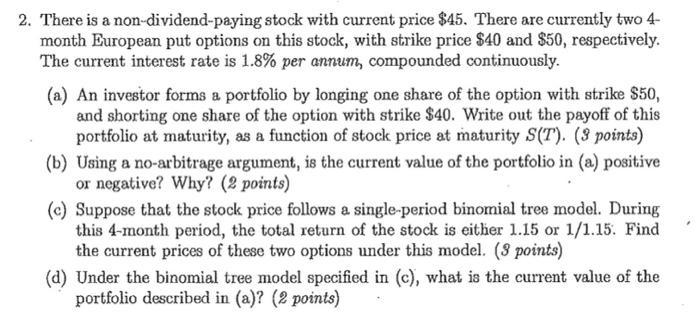

2. There is a non-dividend-paying stock with current price $45. There are currently two 4- month...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

2. There is a non-dividend-paying stock with current price $45. There are currently two 4- month European put options on this stock, with strike price $40 and $50, respectively. The current interest rate is 1.8% per annum, compounded continuously. (a) An investor forms a portfolio by longing one share of the option with strike $50, and shorting one share of the option with strike $40. Write out the payoff of this portfolio at maturity, as a function of stock price at maturity S(T). (3 points) (b) Using a no-arbitrage argument, is the current value of the portfolio in (a) positive or negative? Why? (2 points) (c) Suppose that the stock price follows a single-period binomial tree model. During this 4-month period, the total return of the stock is either 1.15 or 1/1.15. Find the current prices of these two options under this model. (3 points) (d) Under the binomial tree model specified in (c), what is the current value of the portfolio described in (a)? (2 points) 2. There is a non-dividend-paying stock with current price $45. There are currently two 4- month European put options on this stock, with strike price $40 and $50, respectively. The current interest rate is 1.8% per annum, compounded continuously. (a) An investor forms a portfolio by longing one share of the option with strike $50, and shorting one share of the option with strike $40. Write out the payoff of this portfolio at maturity, as a function of stock price at maturity S(T). (3 points) (b) Using a no-arbitrage argument, is the current value of the portfolio in (a) positive or negative? Why? (2 points) (c) Suppose that the stock price follows a single-period binomial tree model. During this 4-month period, the total return of the stock is either 1.15 or 1/1.15. Find the current prices of these two options under this model. (3 points) (d) Under the binomial tree model specified in (c), what is the current value of the portfolio described in (a)? (2 points)

Expert Answer:

Answer rating: 100% (QA)

SOLUTION a Let ST denote the stock price at maturity The payoff of the portfolio at maturity is given by Payoff Long Put with strike 50 Short Put with ... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

Consider the following network. ISP B provides national backbone service to regional ISP A. ISP C provides national backbone service to regional ISP D. Each ISP consists of one AS. Band C peer with...

-

(Tabular Output) Write a C++ program that uses a while statement and the tab escape sequence \t to print the following table of values: N 12345 10 N 100*N 1000 N 10 1000 20 2000 30 40 50 100 200 300...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Concentric with the circle x 2 + y 2 + 2x 8y + 8 = 0 and passes through (2, 3)

-

In analysis growth, should the analyst focus on residual earnings, abnormal earnings growth, or both?

-

Rationalize each denominator. Assume that all variables represent positive real numbers and that no denominators are 0. 4 5+ V6

-

Refer to the information in Exercise 24-3 and assume instead that double-declining depreciation is applied. Compute the machines payback period (ignore taxes). (Round the payback period to three...

-

Brecker Company leases an automobile with a fair value of $10,906 from Emporia Motors, Inc., on the following terms: 1. Non-cancelable term of 50 months. 2. Rental of $250 per month (at end of each...

-

Is discord supported by a relational database, hierarchical database, NoSQL database, or something else?Explain

-

write two pages review for the article The 4 dimensions of digital trust, charted across 42 countries by Bhaskar Chakravorti, Ajay Bhalla, and Ravi Shankar Chaturvedi to give a personal opinion about...

-

Sui Generis, Inc. (SGI), designs and sells solar energy cells to research laboratories, commercial businesses, and individual consumers. Later, without SGI's permission, Mimic Company begins to sell...

-

Smith was represented by Lewis, an attorney, in a divorce action against her husband, General Smith. General Smith was employed by the California National Guard and, as a state employee, belonged to...

-

Answer the following questions, which require you to think critically about the legal principles that you learned in this chapter. Tameny had worked for Atlantic Richfi eld Company (ARCO) for 15...

-

During construction at Alma College, an inadequately reinforced wall of an excavation caved in and killed Clark, a worker employed by Beard, the general contractor. The contract between the...

-

Mansfi eld contacted his insurance agent and asked him to obtain an automobile insurance liability policy to be effective as of February 10. On February 14, Mansfi eld was involved in an accident...

-

Assume that the indirect quote is for 115 Japanese yen per U.S. dollar and that the direct quote is for 1.25 U.S. dollars per euro. What is the yen per euro exchange rate?

-

(Please share only working code as the past solutions are yielding several error messages. ) Using the LC3 simulator, looking to compile a program where the user must enter a password that satisfies...

-

Halley's comet travels in an ellipti- cal orbit with a = 17.95 and b = 4.44 and passes by Earth roughly every 76 years. Note that each unit represents one astronomical unit, or 93 million miles. The...

-

Under what circumstances is it possible to make a European option on a stock index both gamma neutral and vega neutral by adding a position in one other European option?

-

How does a five-year n th-to-default credit default swap work. Consider a basket of 100 reference entities where each reference entity has a probability of defaulting in each year of 1%. As the...

-

The strike price of a futures option is 550 cents, the risk-free rate of interest is 3%, the volatility of the futures price is 20%, and the time to maturity of the option is 9 months. The futures...

-

How does a judge decide a case when there is no precedent available in earlier decisions?

-

What is a class action and when do parties use them?

-

One of the major purposes of private law is to settle disputes between businesses. How can the settlement of a particular private dispute make a contribution to the business community as a whole?

Study smarter with the SolutionInn App