3. Entity H acquired 80% of Entity S's ordinary shares on 1 July 2020. The purchase...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

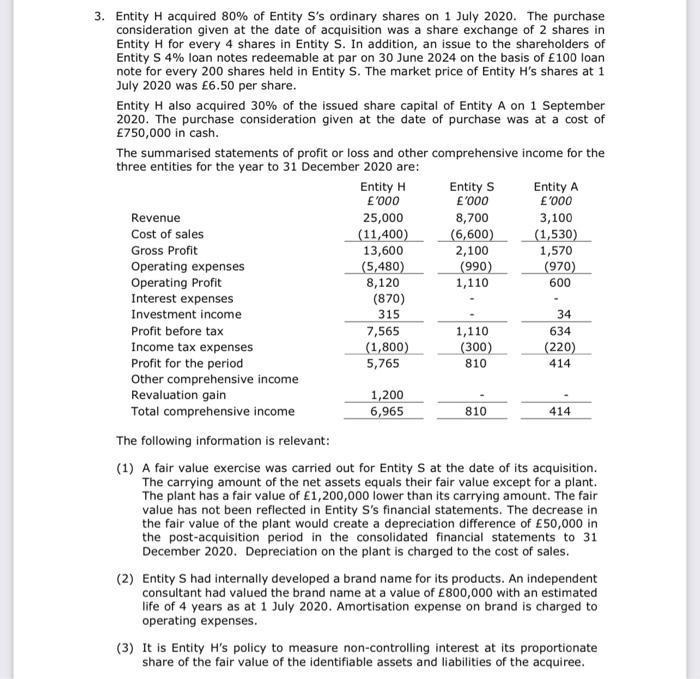

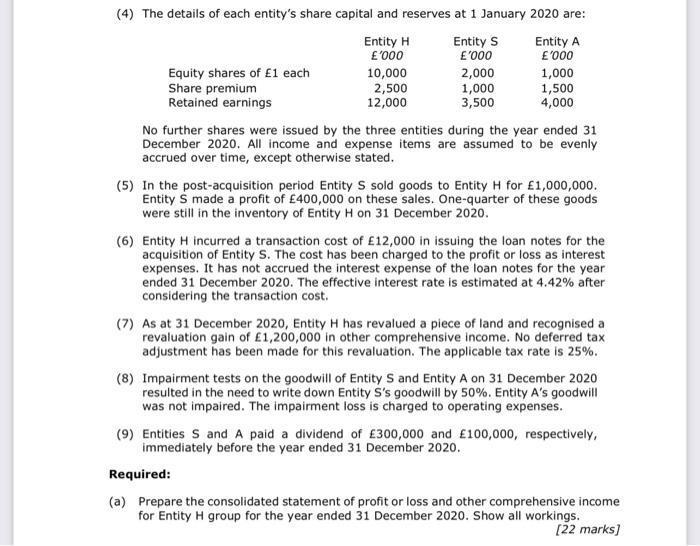

3. Entity H acquired 80% of Entity S's ordinary shares on 1 July 2020. The purchase consideration given at the date of acquisition was a share exchange of 2 shares in Entity H for every 4 shares in Entity S. In addition, an issue to the shareholders of Entity S 4% loan notes redeemable at par on 30 June 2024 on the basis of £100 loan note for every 200 shares held in Entity S. The market price of Entity H's shares at 1 July 2020 was £6.50 per share. Entity H also acquired 30% of the issued share capital of Entity A on 1 September 2020. The purchase consideration given at the date of purchase was at a cost of £750,000 in cash. The summarised statements of profit or loss and other comprehensive income for the three entities for the year to 31 December 2020 are: Entity H E'000 Entity S E'000 Entity A £'000 Revenue 25,000 8,700 3,100 (6,600) 2,100 (990) 1,110 (1,530) 1,570 (970) 600 Cost of sales (11,400) 13,600 Gross Profit Operating expenses Operating Profit Interest expenses (5,480) 8,120 (870) 315 Investment income 34 Profit before tax 7,565 1,110 634 Income tax expenses Profit for the period (1,800) 5,765 (300) (220) 810 414 Other comprehensive income Revaluation gain Total comprehensive income 1,200 6,965 810 414 The following information is relevant: (1) A fair value exercise was carried out for Entity S at the date of its acquisition. The carrying amount of the net assets equals their fair value except for a plant. The plant has a fair value of £1,200,000 lower than its carrying amount. The fair value has not been reflected in Entity S's financial statements. The decrease in the fair value of the plant would create a depreciation difference of £50,000 in the post-acquisition period in the consolidated financial statements to 31 December 2020. Depreciation on the plant is charged to the cost of sales. (2) Entity S had internally developed a brand name for its products. An independent consultant had valued the brand name at a value of £800,000 with an estimated life of 4 years as at 1 July 2020. Amortisation expense on brand is charged to operating expenses. (3) It is Entity H's policy to measure non-controlling interest at its proportionate share of the fair value of the identifiable assets and liabilities of the acquiree. (4) The details of each entity's share capital and reserves at 1 January 2020 are: Entity H £'000 Entity S E'000 Entity A £'000 Equity shares of £1 each Share premium Retained earnings 2,000 1,000 3,500 10,000 2,500 12,000 1,000 1,500 4,000 No further shares were issued by the three entities during the year ended 31 December 2020. All income and expense items are assumed to be evenly accrued over time, except otherwise stated. (5) In the post-acquisition period Entity S sold goods to Entity H for £1,000,000. Entity S made a profit of £400,000 on these sales. One-quarter of these goods were still in the inventory of Entity H on 31 December 2020. (6) Entity H incurred a transaction cost of £12,000 in issuing the loan notes for the acquisition of Entity S. The cost has been charged to the profit or loss as interest expenses. It has not accrued the interest expense of the loan notes for the year ended 31 December 2020. The effective interest rate is estimated at 4.42% after considering the transaction cost. (7) As at 31 December 2020, Entity H has revalued a piece of land and recognised a revaluation gain of £1,200,000 in other comprehensive income. No deferred tax adjustment has been made for this revaluation. The applicable tax rate is 25%. (8) Impairment tests on the goodwill of Entity S and Entity A on 31 December 2020 resulted in the need to write down Entity S's goodwill by 50%. Entity A's goodwill was not impaired. The impairment loss is charged to operating expenses. (9) Entities S and A paid a dividend of £300,000 and £100,000, respectively, immediately before the year ended 31 December 2020. Required: (a) Prepare the consolidated statement of profit or loss and other comprehensive income for Entity H group for the year ended 31 December 2020. Show all workings. [22 marks) 3. Entity H acquired 80% of Entity S's ordinary shares on 1 July 2020. The purchase consideration given at the date of acquisition was a share exchange of 2 shares in Entity H for every 4 shares in Entity S. In addition, an issue to the shareholders of Entity S 4% loan notes redeemable at par on 30 June 2024 on the basis of £100 loan note for every 200 shares held in Entity S. The market price of Entity H's shares at 1 July 2020 was £6.50 per share. Entity H also acquired 30% of the issued share capital of Entity A on 1 September 2020. The purchase consideration given at the date of purchase was at a cost of £750,000 in cash. The summarised statements of profit or loss and other comprehensive income for the three entities for the year to 31 December 2020 are: Entity H E'000 Entity S E'000 Entity A £'000 Revenue 25,000 8,700 3,100 (6,600) 2,100 (990) 1,110 (1,530) 1,570 (970) 600 Cost of sales (11,400) 13,600 Gross Profit Operating expenses Operating Profit Interest expenses (5,480) 8,120 (870) 315 Investment income 34 Profit before tax 7,565 1,110 634 Income tax expenses Profit for the period (1,800) 5,765 (300) (220) 810 414 Other comprehensive income Revaluation gain Total comprehensive income 1,200 6,965 810 414 The following information is relevant: (1) A fair value exercise was carried out for Entity S at the date of its acquisition. The carrying amount of the net assets equals their fair value except for a plant. The plant has a fair value of £1,200,000 lower than its carrying amount. The fair value has not been reflected in Entity S's financial statements. The decrease in the fair value of the plant would create a depreciation difference of £50,000 in the post-acquisition period in the consolidated financial statements to 31 December 2020. Depreciation on the plant is charged to the cost of sales. (2) Entity S had internally developed a brand name for its products. An independent consultant had valued the brand name at a value of £800,000 with an estimated life of 4 years as at 1 July 2020. Amortisation expense on brand is charged to operating expenses. (3) It is Entity H's policy to measure non-controlling interest at its proportionate share of the fair value of the identifiable assets and liabilities of the acquiree. (4) The details of each entity's share capital and reserves at 1 January 2020 are: Entity H £'000 Entity S E'000 Entity A £'000 Equity shares of £1 each Share premium Retained earnings 2,000 1,000 3,500 10,000 2,500 12,000 1,000 1,500 4,000 No further shares were issued by the three entities during the year ended 31 December 2020. All income and expense items are assumed to be evenly accrued over time, except otherwise stated. (5) In the post-acquisition period Entity S sold goods to Entity H for £1,000,000. Entity S made a profit of £400,000 on these sales. One-quarter of these goods were still in the inventory of Entity H on 31 December 2020. (6) Entity H incurred a transaction cost of £12,000 in issuing the loan notes for the acquisition of Entity S. The cost has been charged to the profit or loss as interest expenses. It has not accrued the interest expense of the loan notes for the year ended 31 December 2020. The effective interest rate is estimated at 4.42% after considering the transaction cost. (7) As at 31 December 2020, Entity H has revalued a piece of land and recognised a revaluation gain of £1,200,000 in other comprehensive income. No deferred tax adjustment has been made for this revaluation. The applicable tax rate is 25%. (8) Impairment tests on the goodwill of Entity S and Entity A on 31 December 2020 resulted in the need to write down Entity S's goodwill by 50%. Entity A's goodwill was not impaired. The impairment loss is charged to operating expenses. (9) Entities S and A paid a dividend of £300,000 and £100,000, respectively, immediately before the year ended 31 December 2020. Required: (a) Prepare the consolidated statement of profit or loss and other comprehensive income for Entity H group for the year ended 31 December 2020. Show all workings. [22 marks)

Expert Answer:

Answer rating: 100% (QA)

claim amount received will not be treated as extraordinary item AS5 Revised furtherstates ... View the full answer

Related Book For

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott

Posted Date:

Students also viewed these accounting questions

-

Statement of profit or loss and other comprehensive income Year ended 31 Nine-month Dec-18 period ended 31 Dec-17 Revenue 2,200,228 1,561,138 Cost of sales -1,199,154 -877,354 Gross profit 1,001,074...

-

On 1 July 2020 S Ltd acquired 60% of the issued shares of P Ltd. During the year ended 30 June 2021 the following intra group transactions occurred: a). Sales of inventory: P Ltd to S Ltd $200,000...

-

(Disclosures: Pension Expense and Other Comprehensive Income) Tavares Enterprises provides the following information relative to its defined benefit pension plan. (a) Prepare the note disclosing the...

-

Prepare a personal SWOT analysis (Your personal Strengths and Weaknesses and the external macroeconomic Opportunities and Threats that all of your competitors will assess criteria examples Advantages...

-

Refer to Problem 14-45. Explain how your answers would change for each independent situation indicated below: In problem 14-45 Holly funded the Holly Marx Trust in January 2015. The entire trust...

-

Company S is an 80%-owned subsidiary of Company P. Company S needed to borrow $500,000 on January 1, 2011. The best interest rate it could secure was 10% annual. Company P has a better credit rating...

-

Almetals, Inc., a Michigan company, entered into a contract with the German firm Wickeder Westfalenstahl regarding the purchase of clad metal, a specialty metal used in a variety of industries but...

-

You work for Nokia in its global cell phone group. You have been made project manager for the design of a new cell phone. Your supervisors have already scoped the project so you have a list showing...

-

Suppose a home's UATOTAL for heating is 1500 BTU/hr-F. Suppose the average outdoor temperature over a day is 28F and the desired indoor temperature is 68 F. Any electricity the heating system uses...

-

Bob purchased a property for $6,500,000 at a 5.50% cap rate. At the time of purchase, there were 15 years remaining on the lease with 7.50% rent increases every 5 years. Bob purchased the above...

-

Show that if w is a differentiable vector field on a surface S and w(p) 0 for some p e S, then it is possible to parametrize a neighborhood of p by x(u, v) in such a way that x, w.

-

Hulu announced a price increase for their ad-free plan from $11.99 to $12.99 monthly. The ad-supported plan will increase in price from $5.99 to $6.99 monthly. This price increase will not affect the...

-

For this discussion, you are welcome to choose any topic of interest to you. Choose a source from the library's databases page. Run a broad search in the database and notice the number of results...

-

1.A person is a lobster fisherwoman and spends $50 a year on purchasing 5 kilos of lobster at a store in 2010 ( the base year) and spends $60 a year on purchasing 4 kilos of lobster at a store in...

-

In this assignment, you are asked to complete a Java program that finds the shortest path that a hare needs to take to go through a grid-shape maze. The hare enters the maze from a specific square...

-

Housing developments in Salt Lake City. Landlords across the country are competing to keep tenants, especially at new buildings. When Tressy Coats looked to rent a somewhat worn-out, three-bedroom...

-

Critically evaluate how happiness is related to economic development. evaluate both sides of the argument and Include a graph in your answer.

-

What is a lobbyist in US? How did this term emerge?

-

The Housing Department of Chaldon District Council has invited tenders for re-roofing 80 houses on an estate. Chaldon Direct Services (CDS) is one of the Councils direct services organizations and it...

-

The directors of Apple Pie plc at the September 20X5 board meeting were expressing concern about falling sales and the lack of cash to meet a dividend for the current year ending 31 December at the...

-

Donna Inc Donna Inc operates a defined benefit pension scheme for staff. The pension scheme has been operating for a number of years but not following IAS 19. The finance director is unsure of which...

-

Calculate the principal direction corresponding to \(\sigma_{3}=-2\) in example 5.4. Data From Example 5.4: For the stress matrix given below, determine the principal stresses. 3 1 11 [0]=102 1 2 0

-

The state of stress at a point in the \(x y z\) coordinates is Determine the stress matrix relative to the \(x^{\prime} y^{\prime} z^{\prime}\) coordinates, which is obtained by rotating the \(x y...

-

If \(\sigma_{x x}=90 \mathrm{MPa}, \sigma_{y y}=-45 \mathrm{MPa}, \tau_{x y}=30 \mathrm{MPa}\), and \(\sigma_{z z}=\tau_{x z}=\tau_{y z}=0\), compute the surface traction...

Study smarter with the SolutionInn App