GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

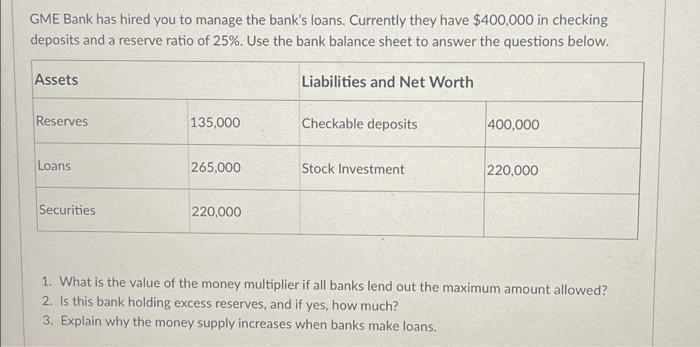

GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use the bank balance sheet to answer the questions below. Assets Reserves Loans Securities 135,000 265,000 220,000 Liabilities and Net Worth Checkable deposits Stock Investment 400,000 220,000 1. What is the value of the money multiplier if all banks lend out the maximum amount allowed? 2. Is this bank holding excess reserves, and if yes, how much? 3. Explain why the money supply increases when banks make loans. GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use the bank balance sheet to answer the questions below. Assets Reserves Loans Securities 135,000 265,000 220,000 Liabilities and Net Worth Checkable deposits Stock Investment 400,000 220,000 1. What is the value of the money multiplier if all banks lend out the maximum amount allowed? 2. Is this bank holding excess reserves, and if yes, how much? 3. Explain why the money supply increases when banks make loans. GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use the bank balance sheet to answer the questions below. Assets Reserves Loans Securities 135,000 265,000 220,000 Liabilities and Net Worth Checkable deposits Stock Investment 400,000 220,000 1. What is the value of the money multiplier if all banks lend out the maximum amount allowed? 2. Is this bank holding excess reserves, and if yes, how much? 3. Explain why the money supply increases when banks make loans. GME Bank has hired you to manage the bank's loans. Currently they have $400,000 in checking deposits and a reserve ratio of 25%. Use the bank balance sheet to answer the questions below. Assets Reserves Loans Securities 135,000 265,000 220,000 Liabilities and Net Worth Checkable deposits Stock Investment 400,000 220,000 1. What is the value of the money multiplier if all banks lend out the maximum amount allowed? 2. Is this bank holding excess reserves, and if yes, how much? 3. Explain why the money supply increases when banks make loans.

Expert Answer:

Answer rating: 100% (QA)

1 Value of money multiplier 1 reserve requirement 125 4 2 Required reserves ... View the full answer

Related Book For

Accounting Information Systems The Processes and Controls

ISBN: 978-1118162309

2nd edition

Authors: Leslie Turner, Andrea Weickgenannt

Posted Date:

Students also viewed these economics questions

-

A and B are partners with capitals of Rs. 10,000 and Rs. 20, 000 respectively and sharing profits equally. They admitted C as their third partner with one-fourth profits of the firm on the payment of...

-

Explain how an efficient supply chain management system can increase a retailer's level of product availability and decrease its inventory investment.

-

Explain how the knowledge management value chain supports management decision making. Explain how information systems can support decision making at different levels of management in an organization....

-

Austin and Anya Gould are a middle-aged couple with two childrenRusty, age 13, and Sam, age 11whom they adopted this year. They also bought a new home in the area to give the children a yard in which...

-

Use Gaussian elimination and three-digit chopping arithmetic to solve the following linear systems, and compare the approximations to the actual solution. a. 58.9x1 + 0.03x2 = 59.2, 6.10x1 + 5.31x2 =...

-

A pistoncylinder device contains helium gas initially at 150 kPa, 20°C, and 0.5 m3. The helium is now compressed in a polytropic process (PVn = constant) to 400 kPa and 140°C. Determine the...

-

Refer to Samsungs financial statements in Appendix A. Compute its debt ratio as of December 31, 2015, and December 31, 2014. Data From Samsung Financial Statement Appendix A Samsung Electronics Co.,...

-

The following are selected 2014 transactions of Yosuke Corporation. Jan. 1 Purchased a small company and recorded goodwill of $150,000. Its useful life is indefinite. May 1 Purchased for $84,000 a...

-

IKEA entered the United States in 1985 and China in 1998. But the company started in 1958; why did it take so long to move into the United States and China? Why do you think IKEA is not in more than...

-

Mr G is an accountant. Mr. G is 47 years old and is married to Claire who is 45 years old and blind. She has Net Income For Tax Purposes in 2020 of $9,000, all of which is interest on investments she...

-

Oriole Co. gathered the following information on power costs and factory machine usage for the last six months: Month Power Cost Factory Machine Hours January $27,760 15,500 February 35,152 20,800...

-

John Wick is 50 years old and has saved nothing for retirement. However, he has just inherited 150,000 from his great grandfather and wants to invest it in a retirement plan. He plans to put the...

-

Alumina Ltd. is considering establishing a zero-balance account. The company currently maintains an average of A$1,380,000 in its disbursement account. As compensation to the bank of maintaining the...

-

Boris Miller has contracted to sell a piece of land that he owns, which has permission for a residential development. A property developer is willing to buy the land and has proposed two methods of...

-

Anki is a Finnish manufacturer of rugs. Last year, it sold rugs for 350, with a variable operating cost of 200 per rug and a fixed operating expense of 1,050,000. a. How many rugs must Anki sell this...

-

Antonio and his friend, Giancarlo, are both talented painters. Last year they began painting original artistic postcards, which they gave to their friends as holiday gifts. In addition, they began...

-

SQL database the yellow box is the Order data mentioned in the Q CoursHeroTranscribedText Orders (cust, date, proc, memory, hd, od, quant, price) Exercise 7.4: In Exercise 6.1 we spoke of PC-order...

-

A non-charmed baryon has strangeness S = 2 and electric charge Q = 0. What are the possible values of its isospin I and of its third component I z ? What is it usually called if I = 1/2?

-

Caseline Analytics and XBRL. Required: Perform an online research of XBRL at www.xbrl.org and determine whether or not XBRL would be appropriate for Cases business. Would XBRL be more effective and...

-

At the beginning of the chapter, the real world example of Allstates IT expenditure is mentioned. Prior to the implementation of their IT governance committee, "whoever spoke the loudest or whoever...

-

Read the article at this link: www.itnews.com.au/News/121683,in-car-spy-units-to-catch-misuse.aspx Describe any ethics considerations in using such technology. Consider both the company and employee...

-

Assuming that the latent heat of sublimation of ice \(L_{\mathrm{S}}=2500 \mathrm{~kJ} / \mathrm{kg}\) is independent of temperature and the specific volume of the solid phase is negligible compared...

-

Calculate the slope of the solid-liquid transition line for water near the triple point \(T=273.16 \mathrm{~K}\), given that the latent heat of melting is \(80 \mathrm{cal} / \mathrm{g}\), the...

-

Study the state of equilibrium between a gaseous phase and an adsorbed phase in a singlecomponent system. Show that the pressure in the gaseous phase is given by the Langmuir equation \[...

Study smarter with the SolutionInn App