8. Guyman Co. had taxable income of $100,000 and an average tax rate of 21%. After...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

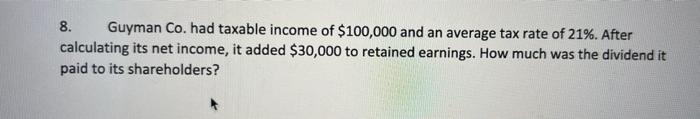

8. Guyman Co. had taxable income of $100,000 and an average tax rate of 21%. After calculating its net income, it added $30,000 to retained earnings. How much was the dividend it paid to its shareholders? 8. Guyman Co. had taxable income of $100,000 and an average tax rate of 21%. After calculating its net income, it added $30,000 to retained earnings. How much was the dividend it paid to its shareholders?

Expert Answer:

Answer rating: 100% (QA)

To calculate the amount of dividends paid we need to first determine the amount of ... View the full answer

Related Book For

Financial Accounting

ISBN: 978-1259103285

5th Canadian edition

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

Posted Date:

Students also viewed these finance questions

-

1. Hannah is applying for a life policy on her girlfriend Sarahs life. The policy is $500,000 and carries a large premium. Hannah is the main earner, so she is concerned about not being able to pay...

-

1. The financial statements of Auto precision limited reflect cash of $10,600, accounts receivable of $15,000, accounts payable of $22,900, inventory of $23,000, long-term debt of $45,000, and net...

-

A company has the following data to prepare the budgets for 2023: Budgeted Sales units: 1 st Qtr 5,000; 2 nd Qtr 5,500; 3 rd Qtr 6,000 Desired Ending Finished Goods Inventory: 20% of next Qtr Sales...

-

Question 1 of 5 Which statement best illustrates Crusoe's reasons for teaching Friday about his religion? OA. He does not see Friday as a savage but as a soul worthy of saving. B. He thinks Friday...

-

Charlene Jones is the office manager for MK Corporation. MK constructs, owns, and manages apartment complexes. Charlene has been involved in negotiations between MK and prospective lenders as MK...

-

Robert Sumargo, an equity analyst, is considering the valuation of Google (NDQ:- GOOG), in late 2013 when a recent closing price is \($896.57.\) Sumargo notes that in general GOOG had a fairly high...

-

An electron travels to the right at \(3.0 \times 10^{6} \mathrm{~m} / \mathrm{s}\) between two large, flat sheets that are parallel to each other and to the electron's line of motion. If currents per...

-

Suppose you are employed by MS Corporation. In year 1, you received nonqualified employee stock options (NQOs) to acquire 10,000 shares of MSs stock at an Exercise price of $40 share. On that date,...

-

61. The solubility product of CuS, AgS and HgS are 10 37, 104 and 1054 respectively. The solubility of these sulphides will be in the order (1) HgS> AgS > Cus (2) AgS>HgS > CuS (3) CuS AgS > HgS (4)...

-

Dwight Donovan, the president of Donovan Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to...

-

Over the last few years, the popularity of e-commerce channels such as Amazon and Flipkart has increased rapidly. How does this affect the bargaining power of logistics companies such as FedEx that...

-

Inflation is involved and it has become a news headline, in your opinion, what is the cause of the rise in prices for commodities such as eggs, bread, and other staples?

-

An airline is considering two types of engine systems for use in its planes. Each has the same life and the same maintenance and repair record. System A costs $90,000 and uses 36,000 gallons per...

-

1 3 and g(x): = 1 +3 Let f(x) = I showing the following. (a) (fog)(x)=r (b) (gof)(x)=1. Verify that and g are inverses

-

Angela made an 180-day investment arrangement involving two consecutive 90 day $100,000 bank bills. The maturity proceeds of the first bill will be used to purchase the second bank bill. The remain...

-

For the Year Ended December 31 Gross Sales $ 32,000,000.00 Cost of Goods Sold 20,360,000.00 Gross Profit 11,640,000.00 Other Income: Dividends 65,000.00 Interest 20,000.00 Tax-Exempt Interest...

-

If we want to test whether spread helps to predict output growth at horizon h, then: Why and how do we estimate a regression? The test relies on a t-statistic, and the validity of the test relies on...

-

A liquid flows upward through a valve situated in a vertical pipe. Calculate the differential pressure (kPa) between points A and B. The mean velocity of the flow is 4.1 m/s. The specific gravity of...

-

Gildan Active wear Inc. specializes in manufacturing and selling T-shirts, sport shirts, and fleece. The following is adapted from a recent statement of financial position dated September 30, 2012....

-

You are one of three partners who own and operate Sams Cleaning Service. The company has been operating for 10 years. One of the other partners has always prepared the companys annual financial...

-

RONA Inc. (www. rona. ca), founded in 1939, is Canadas leading distributor and retailer of hardware, home improvement, and gardening products. It has a network that exceeds 600 stores across Canada....

-

As the Internet continues to grow in its business influence, it is increasingly being used for applications that were formerly client/server based applications. What are some of the similarities in...

-

Fill in the blanks for the following statements: a. Source documents should be portioned into different zones for data, data, and depending upon the system inputs and reviewing form, for data that...

-

Why does the free-rider problem occur in the debt market?

Study smarter with the SolutionInn App