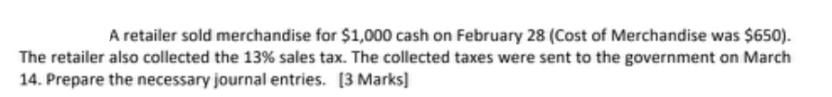

A retailer sold merchandise for $1,000 cash on February 28 (Cost of Merchandise was $650). The...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

A retailer sold merchandise for $1,000 cash on February 28 (Cost of Merchandise was $650). The retailer also collected the 13% sales tax. The collected taxes were sent to the government on March 14. Prepare the necessary journal entries. [3 Marks] A retailer sold merchandise for $1,000 cash on February 28 (Cost of Merchandise was $650). The retailer also collected the 13% sales tax. The collected taxes were sent to the government on March 14. Prepare the necessary journal entries. [3 Marks]

Expert Answer:

Answer rating: 100% (QA)

To record the sale and collection of sales tax the retailer would ma... View the full answer

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these accounting questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Journal Entries NEW Jan 1 Simon invested $60,000 cash into the business by purchasing capital stock at $10.00 par value. Jan 2 The Company borrowed $100,000 on a short-term 90 day, 12.0% note...

-

On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 200,000. The goods were delivered on September 30, with terms requiring cash on...

-

A portfolio manager estimates that the volatility of her daily portfolio returns is 1.2%. She also expects this portfolio to bring a return of 6% per year. Assume that there are 252 trading days in a...

-

Information on four investment proposals is given below: Required: 1. Compute the project profitability index for each investment proposal. 2. Rank the proposals in terms ofpreference. nvestment...

-

Use the figure to sketch a graph of the vector. To print an enlarged copy of the graph, go to MathGraphs.com. u - v y n X

-

Refer to the information in Exercise 17-7 to answer the following requirements. Required 1. Using ABC, compute the overhead cost per unit for each product line. 2. Determine the total cost per unit...

-

The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after taxes) on sales. Recently, the company has fallen behind in its accounts payable. Although its terms of...

-

ELLA'S ELECTRONICS ACCOUNTING PROJECT PART 2Adjusting InformationAt the end of February, the following information is determined:a. One month of the business insurance coverage has expired.b. At the...

-

Irreversible first-order reaction in a continuous reactor, a well-stirred reactor of volume V is initially completely filled with a solution of solute A in a solvent S at concentration C AO . At time...

-

A fluid is reported as having a plastic viscosity of 40 cp and a yield point of 7 lbf/100 sq ft. Compute a consistency index and flow-behavior index for this fluid. Answer: n 0.888;K = 94 eq cp. %3D

-

Given this breakdown of execution cycles in the processor with direct support for the ADDM instruction, what speedup is achieved by replacing this instruction with a 3-instruction sequence (LW, ADD,...

-

When the registrar of a university deals with students by an identification number rather than a name, which characteristic of bureaucracy is being displayed and what is its intended benefit? (a)...

-

John Ferret is the sole shareholder of two corporations. Unusual Pets Inc. is a pet shop with $240,000 in current and accumulated earnings, all invested in certificates of deposit and none of which...

-

Which management theorist would most agree with the statement If you treat people as grown-ups they will perform that way? (a) Argyris (b) Deming (c) Weber (d) Fuller

-

At February 15, 2017, Brent filed his 2016 income tax return (Due April 15, 2017), and he paid a tax of $15,000 at that time. on June 10, 2018, he filed an amended 2016 return showing an additional...

-

Aim:- Write a PROLOG/C program to implement an Expert System of your choice.

-

According to a recent survey, 40% of millennials (those born in the 1980s or 1990s) view themselves more as spenders than savers. The survey also reveals that 75% of millennials view social...

-

For each of the following situations, indicate whether the taxpayer(s) is (are) required to file a tax return for 2012. Explain your answer. a. Helen is a single taxpayer with interest income in 2012...

-

Bev and Ken Hair have been married for 3 years. They live at 3567 River Street, Springfield, MO 63126. Ken is a full-time student at Southwest Missouri State University (SMSU) and Bev works as an...

-

Bea Jones (age 32) moved from Texas to Florida in December 2011. She lives at 654 Ocean Way, Gulfport, FL 33707. Bea's Social Security number is 466-78-7359 and she is single. Her earnings and income...

-

Explain the effect of each of these on the shape and position of the countrys production-possibility curve: a. A proportionate increase in the total supplies (endowments) of all factors of...

-

Why does the HeckscherOhlin theory predict that most research and development (R&D) activity is done in the industrialized countries?

-

A free-trade equilibrium exists in which the United States exports machinery and imports clothing from the rest of the world. The goods are produced with two factors: capital and labor. The trade...

Study smarter with the SolutionInn App