ABC company is buying and selling strollers as a wholesaler. The following events took place in...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

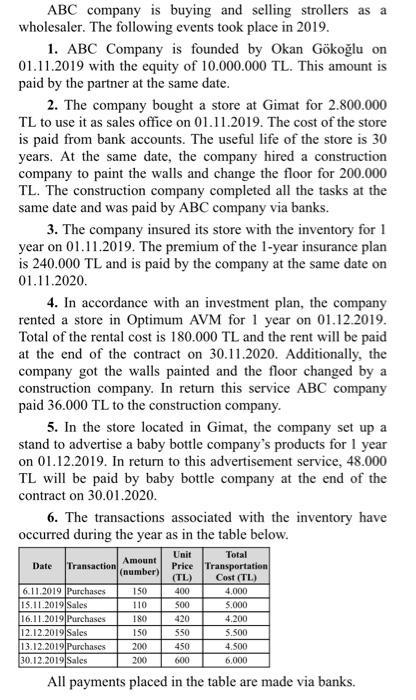

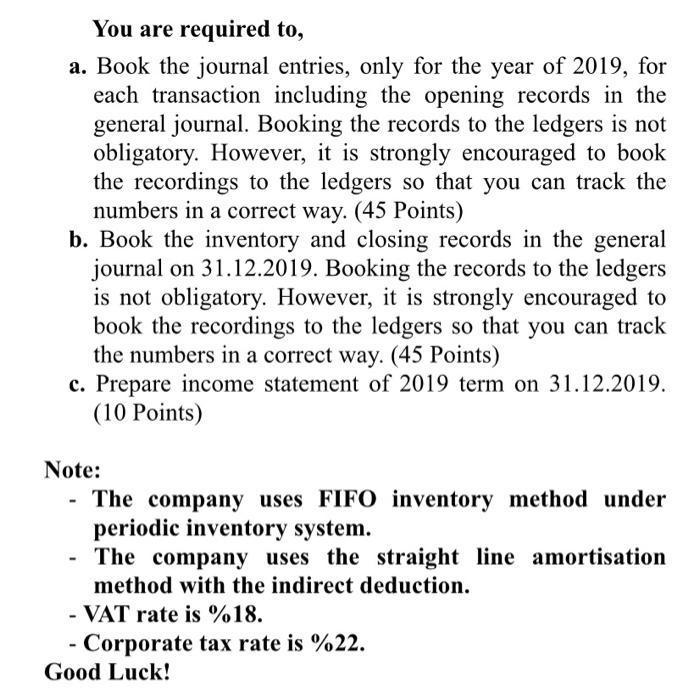

ABC company is buying and selling strollers as a wholesaler. The following events took place in 2019. 1. ABC Company is founded by Okan Gökoğlu on 01.11.2019 with the equity of 10.000.000 TL. This amount is paid by the partner at the same date. 2. The company bought a store at Gimat for 2.800.000 TL to use it as sales office on 01.11.2019. The cost of the store is paid from bank accounts. The useful life of the store is 30 years. At the same date, the company hired a construction company to paint the walls and change the floor for 200.000 TL. The construction company completed all the tasks at the same date and was paid by ABC company via banks. 3. The company insured its store with the inventory for 1 year on 01.11.2019. The premium of the 1-year insurance plan is 240.000 TL and is paid by the company at the same date on 01.11.2020. 4. In accordance with an investment plan, the company rented a store in Optimum AVM for 1 year on 01.12.2019. Total of the rental cost is 180.000 TL and the rent will be paid at the end of the contract on 30.11.2020. Additionally, the company got the walls painted and the floor changed by a construction company. In return this service ABC company paid 36.000 TL to the construction company. 5. In the store located in Gimat, the company set up a stand to advertise a baby bottle company's products for 1 year on 01.12.2019. In return to this advertisement service, 48.000 TL will be paid by baby bottle company at the end of the contract on 30.01.2020. 6. The transactions associated with the inventory have occurred during the year as in the table below. Total Price Transportation Cost (TL) Unit Amount Date Transaction (number) (TL) 6.11.2019 Purchases 15.11.2019 Sales 16.11.2019 Purchases 12.12.2019 Sales 13.12.2019 Purchases 30.12.2019 Sales 150 400 4.000 110 500 5.000 180 420 4.200 150 550 5.500 200 450 4.500 200 600 6.000 All payments placed in the table are made via banks. You are required to, a. Book the journal entries, only for the year of 2019, for each transaction including the opening records in the general journal. Booking the records to the ledgers is not obligatory. However, it is strongly encouraged to book the recordings to the ledgers so that you can track the numbers in a correct way. (45 Points) b. Book the inventory and closing records in the general journal on 31.12.2019. Booking the records to the ledgers is not obligatory. However, it is strongly encouraged to book the recordings to the ledgers so that you can track the numbers in a correct way. (45 Points) c. Prepare income statement of 2019 term on 31.12.2019. (10 Points) Note: The company uses FIFO inventory method under periodic inventory system. The company uses the straight line amortisation method with the indirect deduction. - VAT rate is %18. - Corporate tax rate is %22. Good Luck! ABC company is buying and selling strollers as a wholesaler. The following events took place in 2019. 1. ABC Company is founded by Okan Gökoğlu on 01.11.2019 with the equity of 10.000.000 TL. This amount is paid by the partner at the same date. 2. The company bought a store at Gimat for 2.800.000 TL to use it as sales office on 01.11.2019. The cost of the store is paid from bank accounts. The useful life of the store is 30 years. At the same date, the company hired a construction company to paint the walls and change the floor for 200.000 TL. The construction company completed all the tasks at the same date and was paid by ABC company via banks. 3. The company insured its store with the inventory for 1 year on 01.11.2019. The premium of the 1-year insurance plan is 240.000 TL and is paid by the company at the same date on 01.11.2020. 4. In accordance with an investment plan, the company rented a store in Optimum AVM for 1 year on 01.12.2019. Total of the rental cost is 180.000 TL and the rent will be paid at the end of the contract on 30.11.2020. Additionally, the company got the walls painted and the floor changed by a construction company. In return this service ABC company paid 36.000 TL to the construction company. 5. In the store located in Gimat, the company set up a stand to advertise a baby bottle company's products for 1 year on 01.12.2019. In return to this advertisement service, 48.000 TL will be paid by baby bottle company at the end of the contract on 30.01.2020. 6. The transactions associated with the inventory have occurred during the year as in the table below. Total Price Transportation Cost (TL) Unit Amount Date Transaction (number) (TL) 6.11.2019 Purchases 15.11.2019 Sales 16.11.2019 Purchases 12.12.2019 Sales 13.12.2019 Purchases 30.12.2019 Sales 150 400 4.000 110 500 5.000 180 420 4.200 150 550 5.500 200 450 4.500 200 600 6.000 All payments placed in the table are made via banks. You are required to, a. Book the journal entries, only for the year of 2019, for each transaction including the opening records in the general journal. Booking the records to the ledgers is not obligatory. However, it is strongly encouraged to book the recordings to the ledgers so that you can track the numbers in a correct way. (45 Points) b. Book the inventory and closing records in the general journal on 31.12.2019. Booking the records to the ledgers is not obligatory. However, it is strongly encouraged to book the recordings to the ledgers so that you can track the numbers in a correct way. (45 Points) c. Prepare income statement of 2019 term on 31.12.2019. (10 Points) Note: The company uses FIFO inventory method under periodic inventory system. The company uses the straight line amortisation method with the indirect deduction. - VAT rate is %18. - Corporate tax rate is %22. Good Luck!

Expert Answer:

Answer rating: 100% (QA)

solution of all the parts is given below Solution Ans a Date General Journal Debit Credit 01112019 Bank 10000000 To Equity Share Capital 10000000 bein... View the full answer

Related Book For

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Posted Date:

Students also viewed these accounting questions

-

The following events took place for Air Temp Manufacturing Company during January, the first month of its operations as a producer of digital thermometers: a. Purchased $68,000 of materials. b. Used...

-

The following events took place for Fed Inc. during October 2012, the first month of operations as a producer of road bikes: Purchased $427,000 of materials. Used $367,500 of direct materials in...

-

The following events took place for Salsa Inc. during May 2010, the first month of operations, as a producer of road bikes: Purchased $244,000 of materials. Used $210,000 of direct materials in...

-

Multiple Choice Questions 1. If a company has a $25,000 reduction in sales and an increase of $7,000 in fixed costs with a contribution margin ratio of 34 percent, by how much will net income change?...

-

A bank offers a corporate client a choice between borrowing cash at 11% per annum and borrowing gold at 2% per annum. (If gold is borrowed, interest must be repaid in gold. Thus, 100 ounces borrowed...

-

Figure shows two equal masses of 0.6 kg glued to each other and connected to a spring of spring constant k = 240 N/m. The masses, which rest on a frictionless horizontal surface, are displaced 0.6 m...

-

Fraud deterrence is centered on the fear of getting caught and the fear of getting punished. In your opinion, which is stronger and why?

-

Babble, Inc. buys 400 blank cassette tapes per month for use in producing foreign language courseware. The ordering cost is $12.50. Holding cost is $0.12 per cassette per year. a. How many tapes...

-

K 1 A waffle recipe that serves 7 calls for 1 cups of flour. How many cups of flour will be needed if the chef must serve 28 people? 10- The chef needs cups of flour. (Type an integer or a simplified...

-

a) Draw on a single well-labelled diagram, two cases to show how optimal allocation changes when Angela is a slave and when Angela is a tenant on the land owned by Bruno. (10 marks) b) Suppose Angela...

-

How can rational decisions be made under uncertainty? How do individuals and organizations make choices in situations where the alternatives have uncertain outcomes?

-

Wash Company sells washing machines. On January 1, 2018, it had 20 units in inventory, valued at \(\$ 400\) per unit. During 2018, it sold 200 units at \(\$ 700\) per machine. Wash Company purchased...

-

Discuss the role of organisational theories and HR interventions to provide strategies to manage the process of downsizing more effectively;

-

Describe some of the difficulties users have encountered with MRP.

-

John's basis in the painting in problem 67 is: a. \(\$ 0\) b. \(\$ 25,000\) c. \(\$ 30,000\) d. \(\$ 39,000\) e. \(\$ 42,250\) problem 67 John sold a painting in February 2018 for \(\$ 40,000\). He...

-

Discuss the benefits and requirements of MRP.

-

Perform the following operations (a) Convert 111(base 10) into binary system (b) Convert -123(base 10) into binary system using 1-s complement+1 method (c) Compute the 111-123 using addition of the...

-

Eleni Cabinet Company sold 2,200 cabinets during 2011 at $160 per cabinet. Its beginning inventory on January 1 was 130 cabinets at $56. Purchases made during the year were as follows: February . 225...

-

Identify the errors in the following schedule of cost of merchandise sold for the current year ended March 31,2012: Cost of merchandise sold: $ 75,000 Merchandise inventory, March 31, 2012...

-

Dell Inc. and Hewlett-Packard Development Company, LP. (HP) are both manufacturers of computer equipment and peripherals. However, the two companies follow two different strategies. Dell follows...

-

There phases of the management process are controlling, planning, and decision making. Match the following descriptions to the proper phase. Phase of management process Description Controlling...

-

Beginning in the 1920s, Russian physicist Pyotr Kapitza or Kapitsa (18941984, Nobel laureate in physics 1978) measured the Paschen-Back effect to an accuracy of 1 percent to 3 percent in various...

-

Consider transitions from a \({ }^{2} D\) state to a \(2 P\) state in the strong field PaschenBack regime. List all allowed transitions and show that there are only three different spectral lines.

-

What is the longest wavelength of the Paschen series spectrum? Would it be visible to the human eye?

Study smarter with the SolutionInn App