Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

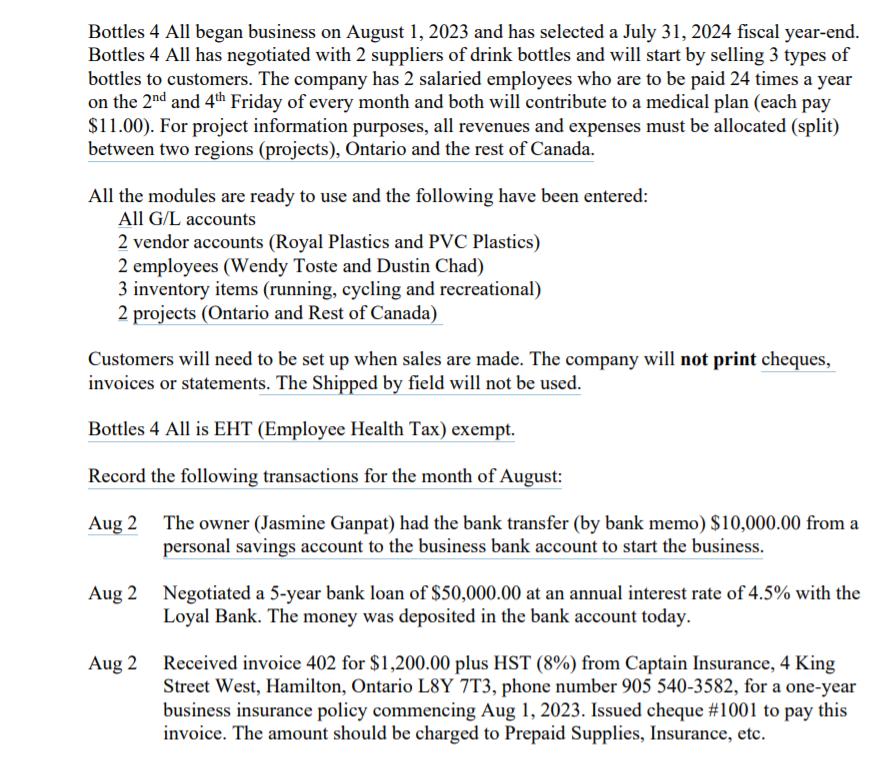

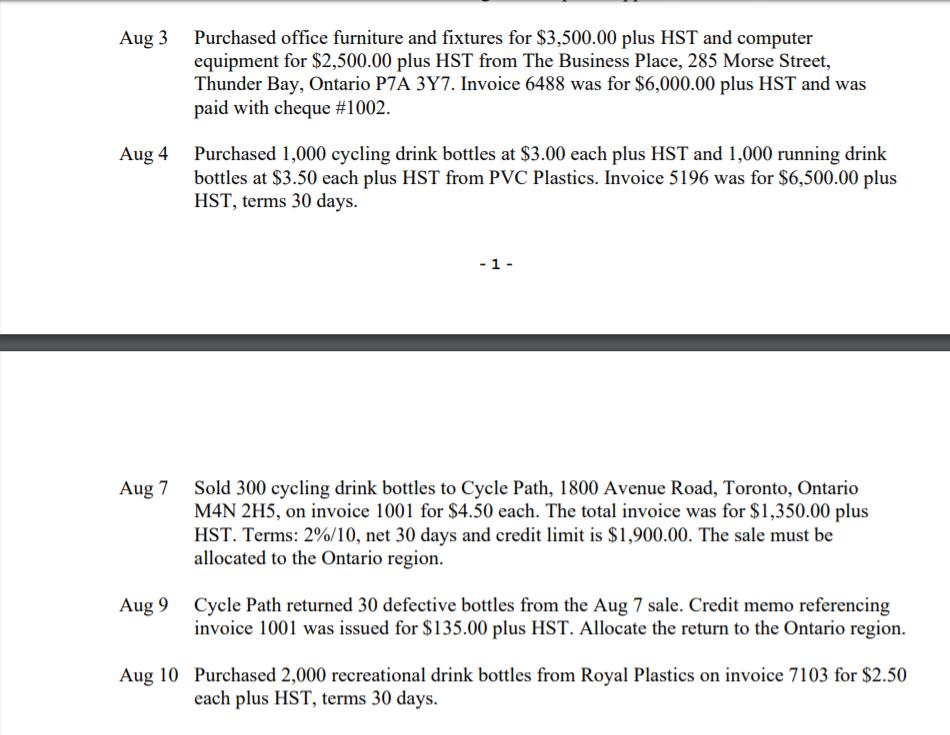

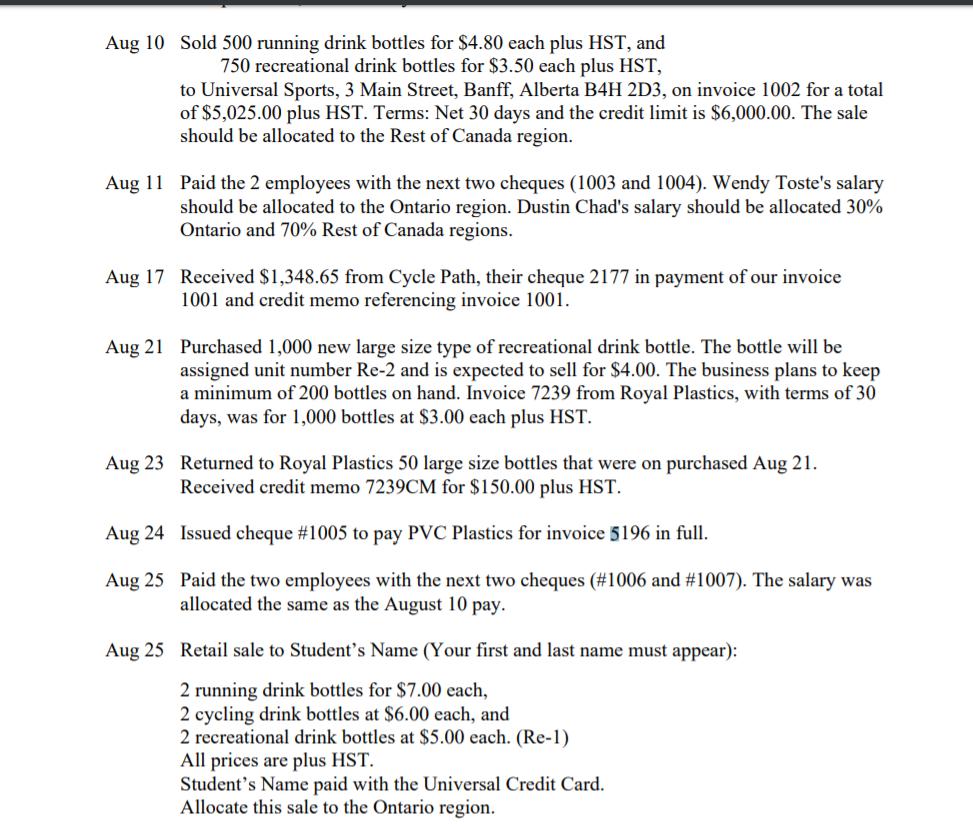

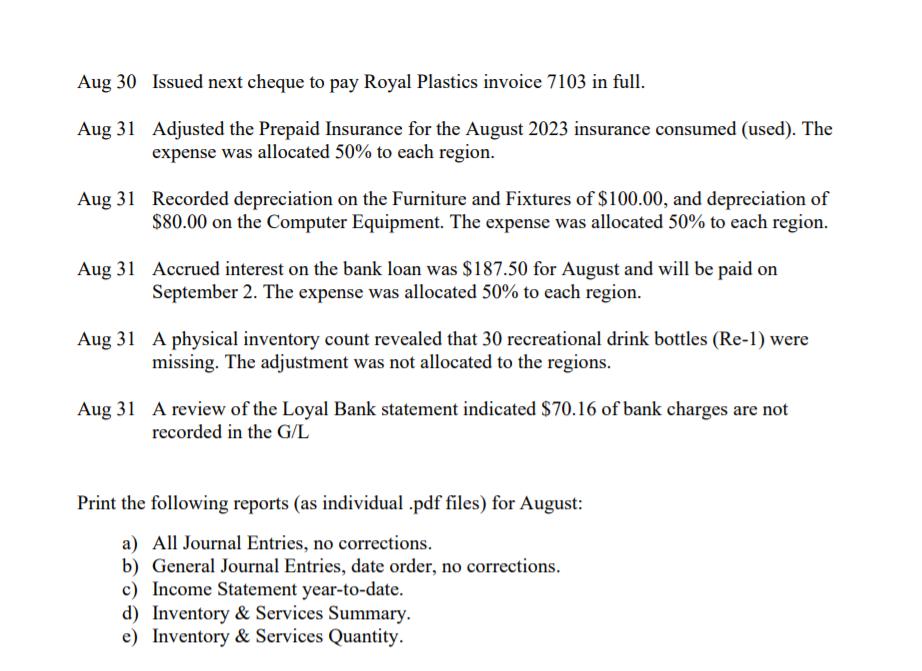

Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024 fiscal year-end. Bottles 4 All has negotiated with 2 suppliers of drink bottles and will start by selling 3 types of bottles to customers. The company has 2 salaried employees who are to be paid 24 times a year on the 2nd and 4th Friday of every month and both will contribute to a medical plan (each pay $11.00). For project information purposes, all revenues and expenses must be allocated (split) between two regions (projects), Ontario and the rest of Canada. All the modules are ready to use and the following have been entered: All G/L accounts 2 vendor accounts (Royal Plastics and PVC Plastics) 2 employees (Wendy Toste and Dustin Chad) 3 inventory items (running, cycling and recreational) 2 projects (Ontario and Rest of Canada) Customers will need to be set up when sales are made. The company will not print cheques, invoices or statements. The Shipped by field will not be used. Bottles 4 All is EHT (Employee Health Tax) exempt. Record the following transactions for the month of August: Aug 2 The owner (Jasmine Ganpat) had the bank transfer (by bank memo) $10,000.00 from a personal savings account to the business bank account to start the business. Negotiated a 5-year bank loan of $50,000.00 at an annual interest rate of 4.5% with the Loyal Bank. The money was deposited in the bank account today. Aug 2 Received invoice 402 for $1,200.00 plus HST (8%) from Captain Insurance, 4 King Street West, Hamilton, Ontario L8Y 7T3, phone number 905 540-3582, for a one-year business insurance policy commencing Aug 1, 2023. Issued cheque #1001 to pay this invoice. The amount should be charged to Prepaid Supplies, Insurance, etc. Aug 2 Aug 3 Purchased office furniture and fixtures for $3,500.00 plus HST and computer equipment for $2,500.00 plus HST from The Business Place, 285 Morse Street, Thunder Bay, Ontario P7A 3Y7. Invoice 6488 was for $6,000.00 plus HST and was paid with cheque #1002. Purchased 1,000 cycling drink bottles at $3.00 each plus HST and 1,000 running drink bottles at $3.50 each plus HST from PVC Plastics. Invoice 5196 was for $6,500.00 plus HST, terms 30 days. Aug 4 -1 - Aug 7 Sold 300 cycling drink bottles to Cycle Path, 1800 Avenue Road, Toronto, Ontario M4N 2H5, on invoice 1001 for $4.50 each. The total invoice was for $1,350.00 plus HST. Terms: 2%/10, net 30 days and credit limit is $1,900.00. The sale must be allocated to the Ontario region. Aug 9 Cycle Path returned 30 defective bottles from the Aug 7 sale. Credit memo referencing invoice 1001 was issued for $135.00 plus HST. Allocate the return to the Ontario region. Aug 10 Purchased 2,000 recreational drink bottles from Royal Plastics on invoice 7103 for $2.50 each plus HST, terms 30 days. Aug 10 Sold 500 running drink bottles for $4.80 each plus HST, and 750 recreational drink bottles for $3.50 each plus HST, to Universal Sports, 3 Main Street, Banff, Alberta B4H 2D3, on invoice 1002 for a total of $5,025.00 plus HST. Terms: Net 30 days and the credit limit is $6,000.00. The sale should be allocated to the Rest of Canada region. Aug 11 Paid the 2 employees with the next two cheques (1003 and 1004). Wendy Toste's salary should be allocated to the Ontario region. Dustin Chad's salary should be allocated 30% Ontario and 70% Rest of Canada regions. Aug 17 Received $1,348.65 from Cycle Path, their cheque 2177 in payment of our invoice 1001 and credit memo referencing invoice 1001. Aug 21 Purchased 1,000 new large size type of recreational drink bottle. The bottle will be assigned unit number Re-2 and is expected to sell for $4.00. The business plans to keep a minimum of 200 bottles on hand. Invoice 7239 from Royal Plastics, with terms of 30 days, was for 1,000 bottles at $3.00 each plus HST. that were on purchased Aug 21. ics 50 large size bot Received credit memo 7239CM for $150.00 plus HST. Aug 23 Returned to Royal Pla Aug 24 Issued cheque #1005 to pay PVC Plastics for invoice 5196 in full. Aug 25 Paid the two employees with the next two cheques (#1006 and #1007). The salary was allocated the same as the August 10 pay. Aug 25 Retail sale to Student's Name (Your first and last name must appear): 2 running drink bottles for $7.00 each, 2 cycling drink bottles at $6.00 each, and 2 recreational drink bottles at $5.00 each. (Re-1) All prices are plus HST. Student's Name paid with the Universal Credit Card. Allocate this sale to the Ontario region. Aug 30 Issued next cheque to pay Royal Plastics invoice 7103 in full. Aug 31 Adjusted the Prepaid Insurance for the August 2023 insurance consumed (used). The expense was allocated 50% to each region. Aug 31 Recorded depreciation on the Furniture and Fixtures of $100.00, and depreciation of $80.00 on the Computer Equipment. The expense was allocated 50% to each region. Aug 31 Accrued interest on the bank loan was $187.50 for August and will be paid on September 2. The expense was allocated 50% to each region. Aug 31 A physical inventory count revealed that 30 recreational drink bottles (Re-1) were missing. The adjustment was not allocated to the regions. Aug 31 A review of the Loyal Bank statement indicated $70.16 of bank charges are not recorded in the G/L Print the following reports (as individual .pdf files) for August: a) All Journal Entries, no corrections. b) General Journal Entries, date order, no corrections. c) Income Statement year-to-date. d) Inventory & Services Summary. e) Inventory & Services Quantity. Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024 fiscal year-end. Bottles 4 All has negotiated with 2 suppliers of drink bottles and will start by selling 3 types of bottles to customers. The company has 2 salaried employees who are to be paid 24 times a year on the 2nd and 4th Friday of every month and both will contribute to a medical plan (each pay $11.00). For project information purposes, all revenues and expenses must be allocated (split) between two regions (projects), Ontario and the rest of Canada. All the modules are ready to use and the following have been entered: All G/L accounts 2 vendor accounts (Royal Plastics and PVC Plastics) 2 employees (Wendy Toste and Dustin Chad) 3 inventory items (running, cycling and recreational) 2 projects (Ontario and Rest of Canada) Customers will need to be set up when sales are made. The company will not print cheques, invoices or statements. The Shipped by field will not be used. Bottles 4 All is EHT (Employee Health Tax) exempt. Record the following transactions for the month of August: Aug 2 The owner (Jasmine Ganpat) had the bank transfer (by bank memo) $10,000.00 from a personal savings account to the business bank account to start the business. Negotiated a 5-year bank loan of $50,000.00 at an annual interest rate of 4.5% with the Loyal Bank. The money was deposited in the bank account today. Aug 2 Received invoice 402 for $1,200.00 plus HST (8%) from Captain Insurance, 4 King Street West, Hamilton, Ontario L8Y 7T3, phone number 905 540-3582, for a one-year business insurance policy commencing Aug 1, 2023. Issued cheque #1001 to pay this invoice. The amount should be charged to Prepaid Supplies, Insurance, etc. Aug 2 Aug 3 Purchased office furniture and fixtures for $3,500.00 plus HST and computer equipment for $2,500.00 plus HST from The Business Place, 285 Morse Street, Thunder Bay, Ontario P7A 3Y7. Invoice 6488 was for $6,000.00 plus HST and was paid with cheque #1002. Purchased 1,000 cycling drink bottles at $3.00 each plus HST and 1,000 running drink bottles at $3.50 each plus HST from PVC Plastics. Invoice 5196 was for $6,500.00 plus HST, terms 30 days. Aug 4 -1 - Aug 7 Sold 300 cycling drink bottles to Cycle Path, 1800 Avenue Road, Toronto, Ontario M4N 2H5, on invoice 1001 for $4.50 each. The total invoice was for $1,350.00 plus HST. Terms: 2%/10, net 30 days and credit limit is $1,900.00. The sale must be allocated to the Ontario region. Aug 9 Cycle Path returned 30 defective bottles from the Aug 7 sale. Credit memo referencing invoice 1001 was issued for $135.00 plus HST. Allocate the return to the Ontario region. Aug 10 Purchased 2,000 recreational drink bottles from Royal Plastics on invoice 7103 for $2.50 each plus HST, terms 30 days. Aug 10 Sold 500 running drink bottles for $4.80 each plus HST, and 750 recreational drink bottles for $3.50 each plus HST, to Universal Sports, 3 Main Street, Banff, Alberta B4H 2D3, on invoice 1002 for a total of $5,025.00 plus HST. Terms: Net 30 days and the credit limit is $6,000.00. The sale should be allocated to the Rest of Canada region. Aug 11 Paid the 2 employees with the next two cheques (1003 and 1004). Wendy Toste's salary should be allocated to the Ontario region. Dustin Chad's salary should be allocated 30% Ontario and 70% Rest of Canada regions. Aug 17 Received $1,348.65 from Cycle Path, their cheque 2177 in payment of our invoice 1001 and credit memo referencing invoice 1001. Aug 21 Purchased 1,000 new large size type of recreational drink bottle. The bottle will be assigned unit number Re-2 and is expected to sell for $4.00. The business plans to keep a minimum of 200 bottles on hand. Invoice 7239 from Royal Plastics, with terms of 30 days, was for 1,000 bottles at $3.00 each plus HST. that were on purchased Aug 21. ics 50 large size bot Received credit memo 7239CM for $150.00 plus HST. Aug 23 Returned to Royal Pla Aug 24 Issued cheque #1005 to pay PVC Plastics for invoice 5196 in full. Aug 25 Paid the two employees with the next two cheques (#1006 and #1007). The salary was allocated the same as the August 10 pay. Aug 25 Retail sale to Student's Name (Your first and last name must appear): 2 running drink bottles for $7.00 each, 2 cycling drink bottles at $6.00 each, and 2 recreational drink bottles at $5.00 each. (Re-1) All prices are plus HST. Student's Name paid with the Universal Credit Card. Allocate this sale to the Ontario region. Aug 30 Issued next cheque to pay Royal Plastics invoice 7103 in full. Aug 31 Adjusted the Prepaid Insurance for the August 2023 insurance consumed (used). The expense was allocated 50% to each region. Aug 31 Recorded depreciation on the Furniture and Fixtures of $100.00, and depreciation of $80.00 on the Computer Equipment. The expense was allocated 50% to each region. Aug 31 Accrued interest on the bank loan was $187.50 for August and will be paid on September 2. The expense was allocated 50% to each region. Aug 31 A physical inventory count revealed that 30 recreational drink bottles (Re-1) were missing. The adjustment was not allocated to the regions. Aug 31 A review of the Loyal Bank statement indicated $70.16 of bank charges are not recorded in the G/L Print the following reports (as individual .pdf files) for August: a) All Journal Entries, no corrections. b) General Journal Entries, date order, no corrections. c) Income Statement year-to-date. d) Inventory & Services Summary. e) Inventory & Services Quantity. Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024 fiscal year-end. Bottles 4 All has negotiated with 2 suppliers of drink bottles and will start by selling 3 types of bottles to customers. The company has 2 salaried employees who are to be paid 24 times a year on the 2nd and 4th Friday of every month and both will contribute to a medical plan (each pay $11.00). For project information purposes, all revenues and expenses must be allocated (split) between two regions (projects), Ontario and the rest of Canada. All the modules are ready to use and the following have been entered: All G/L accounts 2 vendor accounts (Royal Plastics and PVC Plastics) 2 employees (Wendy Toste and Dustin Chad) 3 inventory items (running, cycling and recreational) 2 projects (Ontario and Rest of Canada) Customers will need to be set up when sales are made. The company will not print cheques, invoices or statements. The Shipped by field will not be used. Bottles 4 All is EHT (Employee Health Tax) exempt. Record the following transactions for the month of August: Aug 2 The owner (Jasmine Ganpat) had the bank transfer (by bank memo) $10,000.00 from a personal savings account to the business bank account to start the business. Negotiated a 5-year bank loan of $50,000.00 at an annual interest rate of 4.5% with the Loyal Bank. The money was deposited in the bank account today. Aug 2 Received invoice 402 for $1,200.00 plus HST (8%) from Captain Insurance, 4 King Street West, Hamilton, Ontario L8Y 7T3, phone number 905 540-3582, for a one-year business insurance policy commencing Aug 1, 2023. Issued cheque #1001 to pay this invoice. The amount should be charged to Prepaid Supplies, Insurance, etc. Aug 2 Aug 3 Purchased office furniture and fixtures for $3,500.00 plus HST and computer equipment for $2,500.00 plus HST from The Business Place, 285 Morse Street, Thunder Bay, Ontario P7A 3Y7. Invoice 6488 was for $6,000.00 plus HST and was paid with cheque #1002. Purchased 1,000 cycling drink bottles at $3.00 each plus HST and 1,000 running drink bottles at $3.50 each plus HST from PVC Plastics. Invoice 5196 was for $6,500.00 plus HST, terms 30 days. Aug 4 -1 - Aug 7 Sold 300 cycling drink bottles to Cycle Path, 1800 Avenue Road, Toronto, Ontario M4N 2H5, on invoice 1001 for $4.50 each. The total invoice was for $1,350.00 plus HST. Terms: 2%/10, net 30 days and credit limit is $1,900.00. The sale must be allocated to the Ontario region. Aug 9 Cycle Path returned 30 defective bottles from the Aug 7 sale. Credit memo referencing invoice 1001 was issued for $135.00 plus HST. Allocate the return to the Ontario region. Aug 10 Purchased 2,000 recreational drink bottles from Royal Plastics on invoice 7103 for $2.50 each plus HST, terms 30 days. Aug 10 Sold 500 running drink bottles for $4.80 each plus HST, and 750 recreational drink bottles for $3.50 each plus HST, to Universal Sports, 3 Main Street, Banff, Alberta B4H 2D3, on invoice 1002 for a total of $5,025.00 plus HST. Terms: Net 30 days and the credit limit is $6,000.00. The sale should be allocated to the Rest of Canada region. Aug 11 Paid the 2 employees with the next two cheques (1003 and 1004). Wendy Toste's salary should be allocated to the Ontario region. Dustin Chad's salary should be allocated 30% Ontario and 70% Rest of Canada regions. Aug 17 Received $1,348.65 from Cycle Path, their cheque 2177 in payment of our invoice 1001 and credit memo referencing invoice 1001. Aug 21 Purchased 1,000 new large size type of recreational drink bottle. The bottle will be assigned unit number Re-2 and is expected to sell for $4.00. The business plans to keep a minimum of 200 bottles on hand. Invoice 7239 from Royal Plastics, with terms of 30 days, was for 1,000 bottles at $3.00 each plus HST. that were on purchased Aug 21. ics 50 large size bot Received credit memo 7239CM for $150.00 plus HST. Aug 23 Returned to Royal Pla Aug 24 Issued cheque #1005 to pay PVC Plastics for invoice 5196 in full. Aug 25 Paid the two employees with the next two cheques (#1006 and #1007). The salary was allocated the same as the August 10 pay. Aug 25 Retail sale to Student's Name (Your first and last name must appear): 2 running drink bottles for $7.00 each, 2 cycling drink bottles at $6.00 each, and 2 recreational drink bottles at $5.00 each. (Re-1) All prices are plus HST. Student's Name paid with the Universal Credit Card. Allocate this sale to the Ontario region. Aug 30 Issued next cheque to pay Royal Plastics invoice 7103 in full. Aug 31 Adjusted the Prepaid Insurance for the August 2023 insurance consumed (used). The expense was allocated 50% to each region. Aug 31 Recorded depreciation on the Furniture and Fixtures of $100.00, and depreciation of $80.00 on the Computer Equipment. The expense was allocated 50% to each region. Aug 31 Accrued interest on the bank loan was $187.50 for August and will be paid on September 2. The expense was allocated 50% to each region. Aug 31 A physical inventory count revealed that 30 recreational drink bottles (Re-1) were missing. The adjustment was not allocated to the regions. Aug 31 A review of the Loyal Bank statement indicated $70.16 of bank charges are not recorded in the G/L Print the following reports (as individual .pdf files) for August: a) All Journal Entries, no corrections. b) General Journal Entries, date order, no corrections. c) Income Statement year-to-date. d) Inventory & Services Summary. e) Inventory & Services Quantity. Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024 fiscal year-end. Bottles 4 All has negotiated with 2 suppliers of drink bottles and will start by selling 3 types of bottles to customers. The company has 2 salaried employees who are to be paid 24 times a year on the 2nd and 4th Friday of every month and both will contribute to a medical plan (each pay $11.00). For project information purposes, all revenues and expenses must be allocated (split) between two regions (projects), Ontario and the rest of Canada. All the modules are ready to use and the following have been entered: All G/L accounts 2 vendor accounts (Royal Plastics and PVC Plastics) 2 employees (Wendy Toste and Dustin Chad) 3 inventory items (running, cycling and recreational) 2 projects (Ontario and Rest of Canada) Customers will need to be set up when sales are made. The company will not print cheques, invoices or statements. The Shipped by field will not be used. Bottles 4 All is EHT (Employee Health Tax) exempt. Record the following transactions for the month of August: Aug 2 The owner (Jasmine Ganpat) had the bank transfer (by bank memo) $10,000.00 from a personal savings account to the business bank account to start the business. Negotiated a 5-year bank loan of $50,000.00 at an annual interest rate of 4.5% with the Loyal Bank. The money was deposited in the bank account today. Aug 2 Received invoice 402 for $1,200.00 plus HST (8%) from Captain Insurance, 4 King Street West, Hamilton, Ontario L8Y 7T3, phone number 905 540-3582, for a one-year business insurance policy commencing Aug 1, 2023. Issued cheque #1001 to pay this invoice. The amount should be charged to Prepaid Supplies, Insurance, etc. Aug 2 Aug 3 Purchased office furniture and fixtures for $3,500.00 plus HST and computer equipment for $2,500.00 plus HST from The Business Place, 285 Morse Street, Thunder Bay, Ontario P7A 3Y7. Invoice 6488 was for $6,000.00 plus HST and was paid with cheque #1002. Purchased 1,000 cycling drink bottles at $3.00 each plus HST and 1,000 running drink bottles at $3.50 each plus HST from PVC Plastics. Invoice 5196 was for $6,500.00 plus HST, terms 30 days. Aug 4 -1 - Aug 7 Sold 300 cycling drink bottles to Cycle Path, 1800 Avenue Road, Toronto, Ontario M4N 2H5, on invoice 1001 for $4.50 each. The total invoice was for $1,350.00 plus HST. Terms: 2%/10, net 30 days and credit limit is $1,900.00. The sale must be allocated to the Ontario region. Aug 9 Cycle Path returned 30 defective bottles from the Aug 7 sale. Credit memo referencing invoice 1001 was issued for $135.00 plus HST. Allocate the return to the Ontario region. Aug 10 Purchased 2,000 recreational drink bottles from Royal Plastics on invoice 7103 for $2.50 each plus HST, terms 30 days. Aug 10 Sold 500 running drink bottles for $4.80 each plus HST, and 750 recreational drink bottles for $3.50 each plus HST, to Universal Sports, 3 Main Street, Banff, Alberta B4H 2D3, on invoice 1002 for a total of $5,025.00 plus HST. Terms: Net 30 days and the credit limit is $6,000.00. The sale should be allocated to the Rest of Canada region. Aug 11 Paid the 2 employees with the next two cheques (1003 and 1004). Wendy Toste's salary should be allocated to the Ontario region. Dustin Chad's salary should be allocated 30% Ontario and 70% Rest of Canada regions. Aug 17 Received $1,348.65 from Cycle Path, their cheque 2177 in payment of our invoice 1001 and credit memo referencing invoice 1001. Aug 21 Purchased 1,000 new large size type of recreational drink bottle. The bottle will be assigned unit number Re-2 and is expected to sell for $4.00. The business plans to keep a minimum of 200 bottles on hand. Invoice 7239 from Royal Plastics, with terms of 30 days, was for 1,000 bottles at $3.00 each plus HST. that were on purchased Aug 21. ics 50 large size bot Received credit memo 7239CM for $150.00 plus HST. Aug 23 Returned to Royal Pla Aug 24 Issued cheque #1005 to pay PVC Plastics for invoice 5196 in full. Aug 25 Paid the two employees with the next two cheques (#1006 and #1007). The salary was allocated the same as the August 10 pay. Aug 25 Retail sale to Student's Name (Your first and last name must appear): 2 running drink bottles for $7.00 each, 2 cycling drink bottles at $6.00 each, and 2 recreational drink bottles at $5.00 each. (Re-1) All prices are plus HST. Student's Name paid with the Universal Credit Card. Allocate this sale to the Ontario region. Aug 30 Issued next cheque to pay Royal Plastics invoice 7103 in full. Aug 31 Adjusted the Prepaid Insurance for the August 2023 insurance consumed (used). The expense was allocated 50% to each region. Aug 31 Recorded depreciation on the Furniture and Fixtures of $100.00, and depreciation of $80.00 on the Computer Equipment. The expense was allocated 50% to each region. Aug 31 Accrued interest on the bank loan was $187.50 for August and will be paid on September 2. The expense was allocated 50% to each region. Aug 31 A physical inventory count revealed that 30 recreational drink bottles (Re-1) were missing. The adjustment was not allocated to the regions. Aug 31 A review of the Loyal Bank statement indicated $70.16 of bank charges are not recorded in the G/L Print the following reports (as individual .pdf files) for August: a) All Journal Entries, no corrections. b) General Journal Entries, date order, no corrections. c) Income Statement year-to-date. d) Inventory & Services Summary. e) Inventory & Services Quantity. Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024 fiscal year-end. Bottles 4 All has negotiated with 2 suppliers of drink bottles and will start by selling 3 types of bottles to customers. The company has 2 salaried employees who are to be paid 24 times a year on the 2nd and 4th Friday of every month and both will contribute to a medical plan (each pay $11.00). For project information purposes, all revenues and expenses must be allocated (split) between two regions (projects), Ontario and the rest of Canada. All the modules are ready to use and the following have been entered: All G/L accounts 2 vendor accounts (Royal Plastics and PVC Plastics) 2 employees (Wendy Toste and Dustin Chad) 3 inventory items (running, cycling and recreational) 2 projects (Ontario and Rest of Canada) Customers will need to be set up when sales are made. The company will not print cheques, invoices or statements. The Shipped by field will not be used. Bottles 4 All is EHT (Employee Health Tax) exempt. Record the following transactions for the month of August: Aug 2 The owner (Jasmine Ganpat) had the bank transfer (by bank memo) $10,000.00 from a personal savings account to the business bank account to start the business. Negotiated a 5-year bank loan of $50,000.00 at an annual interest rate of 4.5% with the Loyal Bank. The money was deposited in the bank account today. Aug 2 Received invoice 402 for $1,200.00 plus HST (8%) from Captain Insurance, 4 King Street West, Hamilton, Ontario L8Y 7T3, phone number 905 540-3582, for a one-year business insurance policy commencing Aug 1, 2023. Issued cheque #1001 to pay this invoice. The amount should be charged to Prepaid Supplies, Insurance, etc. Aug 2 Aug 3 Purchased office furniture and fixtures for $3,500.00 plus HST and computer equipment for $2,500.00 plus HST from The Business Place, 285 Morse Street, Thunder Bay, Ontario P7A 3Y7. Invoice 6488 was for $6,000.00 plus HST and was paid with cheque #1002. Purchased 1,000 cycling drink bottles at $3.00 each plus HST and 1,000 running drink bottles at $3.50 each plus HST from PVC Plastics. Invoice 5196 was for $6,500.00 plus HST, terms 30 days. Aug 4 -1 - Aug 7 Sold 300 cycling drink bottles to Cycle Path, 1800 Avenue Road, Toronto, Ontario M4N 2H5, on invoice 1001 for $4.50 each. The total invoice was for $1,350.00 plus HST. Terms: 2%/10, net 30 days and credit limit is $1,900.00. The sale must be allocated to the Ontario region. Aug 9 Cycle Path returned 30 defective bottles from the Aug 7 sale. Credit memo referencing invoice 1001 was issued for $135.00 plus HST. Allocate the return to the Ontario region. Aug 10 Purchased 2,000 recreational drink bottles from Royal Plastics on invoice 7103 for $2.50 each plus HST, terms 30 days. Aug 10 Sold 500 running drink bottles for $4.80 each plus HST, and 750 recreational drink bottles for $3.50 each plus HST, to Universal Sports, 3 Main Street, Banff, Alberta B4H 2D3, on invoice 1002 for a total of $5,025.00 plus HST. Terms: Net 30 days and the credit limit is $6,000.00. The sale should be allocated to the Rest of Canada region. Aug 11 Paid the 2 employees with the next two cheques (1003 and 1004). Wendy Toste's salary should be allocated to the Ontario region. Dustin Chad's salary should be allocated 30% Ontario and 70% Rest of Canada regions. Aug 17 Received $1,348.65 from Cycle Path, their cheque 2177 in payment of our invoice 1001 and credit memo referencing invoice 1001. Aug 21 Purchased 1,000 new large size type of recreational drink bottle. The bottle will be assigned unit number Re-2 and is expected to sell for $4.00. The business plans to keep a minimum of 200 bottles on hand. Invoice 7239 from Royal Plastics, with terms of 30 days, was for 1,000 bottles at $3.00 each plus HST. that were on purchased Aug 21. ics 50 large size bot Received credit memo 7239CM for $150.00 plus HST. Aug 23 Returned to Royal Pla Aug 24 Issued cheque #1005 to pay PVC Plastics for invoice 5196 in full. Aug 25 Paid the two employees with the next two cheques (#1006 and #1007). The salary was allocated the same as the August 10 pay. Aug 25 Retail sale to Student's Name (Your first and last name must appear): 2 running drink bottles for $7.00 each, 2 cycling drink bottles at $6.00 each, and 2 recreational drink bottles at $5.00 each. (Re-1) All prices are plus HST. Student's Name paid with the Universal Credit Card. Allocate this sale to the Ontario region. Aug 30 Issued next cheque to pay Royal Plastics invoice 7103 in full. Aug 31 Adjusted the Prepaid Insurance for the August 2023 insurance consumed (used). The expense was allocated 50% to each region. Aug 31 Recorded depreciation on the Furniture and Fixtures of $100.00, and depreciation of $80.00 on the Computer Equipment. The expense was allocated 50% to each region. Aug 31 Accrued interest on the bank loan was $187.50 for August and will be paid on September 2. The expense was allocated 50% to each region. Aug 31 A physical inventory count revealed that 30 recreational drink bottles (Re-1) were missing. The adjustment was not allocated to the regions. Aug 31 A review of the Loyal Bank statement indicated $70.16 of bank charges are not recorded in the G/L Print the following reports (as individual .pdf files) for August: a) All Journal Entries, no corrections. b) General Journal Entries, date order, no corrections. c) Income Statement year-to-date. d) Inventory & Services Summary. e) Inventory & Services Quantity. Bottles 4 All began business on August 1, 2023 and has selected a July 31, 2024 fiscal year-end. Bottles 4 All has negotiated with 2 suppliers of drink bottles and will start by selling 3 types of bottles to customers. The company has 2 salaried employees who are to be paid 24 times a year on the 2nd and 4th Friday of every month and both will contribute to a medical plan (each pay $11.00). For project information purposes, all revenues and expenses must be allocated (split) between two regions (projects), Ontario and the rest of Canada. All the modules are ready to use and the following have been entered: All G/L accounts 2 vendor accounts (Royal Plastics and PVC Plastics) 2 employees (Wendy Toste and Dustin Chad) 3 inventory items (running, cycling and recreational) 2 projects (Ontario and Rest of Canada) Customers will need to be set up when sales are made. The company will not print cheques, invoices or statements. The Shipped by field will not be used. Bottles 4 All is EHT (Employee Health Tax) exempt. Record the following transactions for the month of August: Aug 2 The owner (Jasmine Ganpat) had the bank transfer (by bank memo) $10,000.00 from a personal savings account to the business bank account to start the business. Negotiated a 5-year bank loan of $50,000.00 at an annual interest rate of 4.5% with the Loyal Bank. The money was deposited in the bank account today. Aug 2 Received invoice 402 for $1,200.00 plus HST (8%) from Captain Insurance, 4 King Street West, Hamilton, Ontario L8Y 7T3, phone number 905 540-3582, for a one-year business insurance policy commencing Aug 1, 2023. Issued cheque #1001 to pay this invoice. The amount should be charged to Prepaid Supplies, Insurance, etc. Aug 2 Aug 3 Purchased office furniture and fixtures for $3,500.00 plus HST and computer equipment for $2,500.00 plus HST from The Business Place, 285 Morse Street, Thunder Bay, Ontario P7A 3Y7. Invoice 6488 was for $6,000.00 plus HST and was paid with cheque #1002. Purchased 1,000 cycling drink bottles at $3.00 each plus HST and 1,000 running drink bottles at $3.50 each plus HST from PVC Plastics. Invoice 5196 was for $6,500.00 plus HST, terms 30 days. Aug 4 -1 - Aug 7 Sold 300 cycling drink bottles to Cycle Path, 1800 Avenue Road, Toronto, Ontario M4N 2H5, on invoice 1001 for $4.50 each. The total invoice was for $1,350.00 plus HST. Terms: 2%/10, net 30 days and credit limit is $1,900.00. The sale must be allocated to the Ontario region. Aug 9 Cycle Path returned 30 defective bottles from the Aug 7 sale. Credit memo referencing invoice 1001 was issued for $135.00 plus HST. Allocate the return to the Ontario region. Aug 10 Purchased 2,000 recreational drink bottles from Royal Plastics on invoice 7103 for $2.50 each plus HST, terms 30 days. Aug 10 Sold 500 running drink bottles for $4.80 each plus HST, and 750 recreational drink bottles for $3.50 each plus HST, to Universal Sports, 3 Main Street, Banff, Alberta B4H 2D3, on invoice 1002 for a total of $5,025.00 plus HST. Terms: Net 30 days and the credit limit is $6,000.00. The sale should be allocated to the Rest of Canada region. Aug 11 Paid the 2 employees with the next two cheques (1003 and 1004). Wendy Toste's salary should be allocated to the Ontario region. Dustin Chad's salary should be allocated 30% Ontario and 70% Rest of Canada regions. Aug 17 Received $1,348.65 from Cycle Path, their cheque 2177 in payment of our invoice 1001 and credit memo referencing invoice 1001. Aug 21 Purchased 1,000 new large size type of recreational drink bottle. The bottle will be assigned unit number Re-2 and is expected to sell for $4.00. The business plans to keep a minimum of 200 bottles on hand. Invoice 7239 from Royal Plastics, with terms of 30 days, was for 1,000 bottles at $3.00 each plus HST. that were on purchased Aug 21. ics 50 large size bot Received credit memo 7239CM for $150.00 plus HST. Aug 23 Returned to Royal Pla Aug 24 Issued cheque #1005 to pay PVC Plastics for invoice 5196 in full. Aug 25 Paid the two employees with the next two cheques (#1006 and #1007). The salary was allocated the same as the August 10 pay. Aug 25 Retail sale to Student's Name (Your first and last name must appear): 2 running drink bottles for $7.00 each, 2 cycling drink bottles at $6.00 each, and 2 recreational drink bottles at $5.00 each. (Re-1) All prices are plus HST. Student's Name paid with the Universal Credit Card. Allocate this sale to the Ontario region. Aug 30 Issued next cheque to pay Royal Plastics invoice 7103 in full. Aug 31 Adjusted the Prepaid Insurance for the August 2023 insurance consumed (used). The expense was allocated 50% to each region. Aug 31 Recorded depreciation on the Furniture and Fixtures of $100.00, and depreciation of $80.00 on the Computer Equipment. The expense was allocated 50% to each region. Aug 31 Accrued interest on the bank loan was $187.50 for August and will be paid on September 2. The expense was allocated 50% to each region. Aug 31 A physical inventory count revealed that 30 recreational drink bottles (Re-1) were missing. The adjustment was not allocated to the regions. Aug 31 A review of the Loyal Bank statement indicated $70.16 of bank charges are not recorded in the G/L Print the following reports (as individual .pdf files) for August: a) All Journal Entries, no corrections. b) General Journal Entries, date order, no corrections. c) Income Statement year-to-date. d) Inventory & Services Summary. e) Inventory & Services Quantity.

Expert Answer:

Related Book For

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

Posted Date:

Students also viewed these accounting questions

-

When Torretti Company began business on August 1, it purchased a one-year fire insurance policy and debited the entire cost of $7,200 to Unexpired Insurance. Torretti adjusts its accounts at the end...

-

In a manufacturing cell, one repairman has to maintain four machines. For the machines, the time between breakdowns is exponentially distributed with an average of four hours. On the average, it...

-

White Ltd commenced business on 1 July 2017. An extract of the statement of financial position of White Ltd for the year ending 30 June 2019 and 2020 are shown below: 2019 $ 3,800 15,000 (600) Assets...

-

The technique of performance management that establishes and monitors four dimensions of performance: Question 11Answer a. Profit, sales, productivity, and asset management performance b. Financial,...

-

Under the terms of a long-term supply contract, Linde supplied United Aluminum Corporation (UAC) with nitrogen at $0.23 per unit. Upon expiration, that contract gave UAC the sole option to renew the...

-

Determine vo and the required PIV rating of each diode for the configuration of Fig. 2.168. 100 V Ideal diodes -100 V 2.2 k

-

If \(\mathbf{Z}\) is the \(n \times k\) matrix of standardized regressors and \(\mathbf{T}\) is the \(k \times k\) upper triangular matrix in Eq. (11.3), show that the transformed regressors...

-

Refer to the RadioShack Corporation, consolidated financial statements in Appendix B at the end of this book. Focus on the year ended December 31, 2010. 1. What is RadioShack Corporations main source...

-

Sonya is selling her jet ski and has the following offers to choose fre 1. $3.500 today OR 2. $1.700 today and $1,900 in 5 months If money carns 6.3% simple interest a. What is the current economic...

-

Name the bones of the pectoral girdle and upper limb?

-

1. A researcher claims that women who eat blue M&M candies have a better chance of having a baby boy, and 50 such women gave birth to 27 boys and 23 girls. What conclusion should be drawn? Use only...

-

What governance standards should be implemented to ensure the accountability of data trusts? in uk referencing.

-

We have a flat heater of 0.05 m length over which water at 15 atm. pressure and 400K temperature flows. The freestream velocity is 1.5 m/s and the heater is held to a uniform temperature of 420K....

-

Why the USALI is better for lodging companies than normal accounting systems that other companies use?

-

What are the tax consequences for Nonqualified Stock Options? Incentive Stock Options? What is Restricted Stock?

-

1) Where would a bank customer's account data be directly stored? 2) Which of the following manages the Bank database? 3) Which of the following would prevent unauthorized access to the Bank...

-

S Business behavior is derived in large part from the basic cultural environment in which the business operates and, as such, is subject to the extreme diversity encountered among various cultures...

-

Which of the following raises the credibility of areport? Which of the following raises the credibility of a report? Multiple Choice avoiding predictions avoiding the use of cause-effect statements...

-

Super Star, a Hollywood publicity firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end, an aging of the accounts receivable produced the following five...

-

Find the Consolidated Statement of Stockholders Equity and Comprehensive Income section of the Home Depot 2009 financial statements in Appendix A. Locate the translation adjustment for 2009. Was the...

-

Between The Ears (BTE.com) is a popular Internet music store. During the current year, the companys cost of goods available for sale amounted to $462,000. The retail sales value of this merchandise...

-

Companies are facing a great amount of change in every facet of their operations today. To remain competitive, companies must keep abreast of current developments in several areas. You recently got...

-

For each of the situations listed, identify the primary standard from the IMA Statement of Ethical Professional Practice that is violated (competence, confidentiality, integrity, or credibility.)...

-

Complete the following statements with one of the terms listed here. You may use a term more than once, and some terms may not be used at all. a. To quickly navigate to the end of the data in a...

Study smarter with the SolutionInn App