Margaret Crusher is a licensed CPA. During the first movi operations of her business (a sole...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

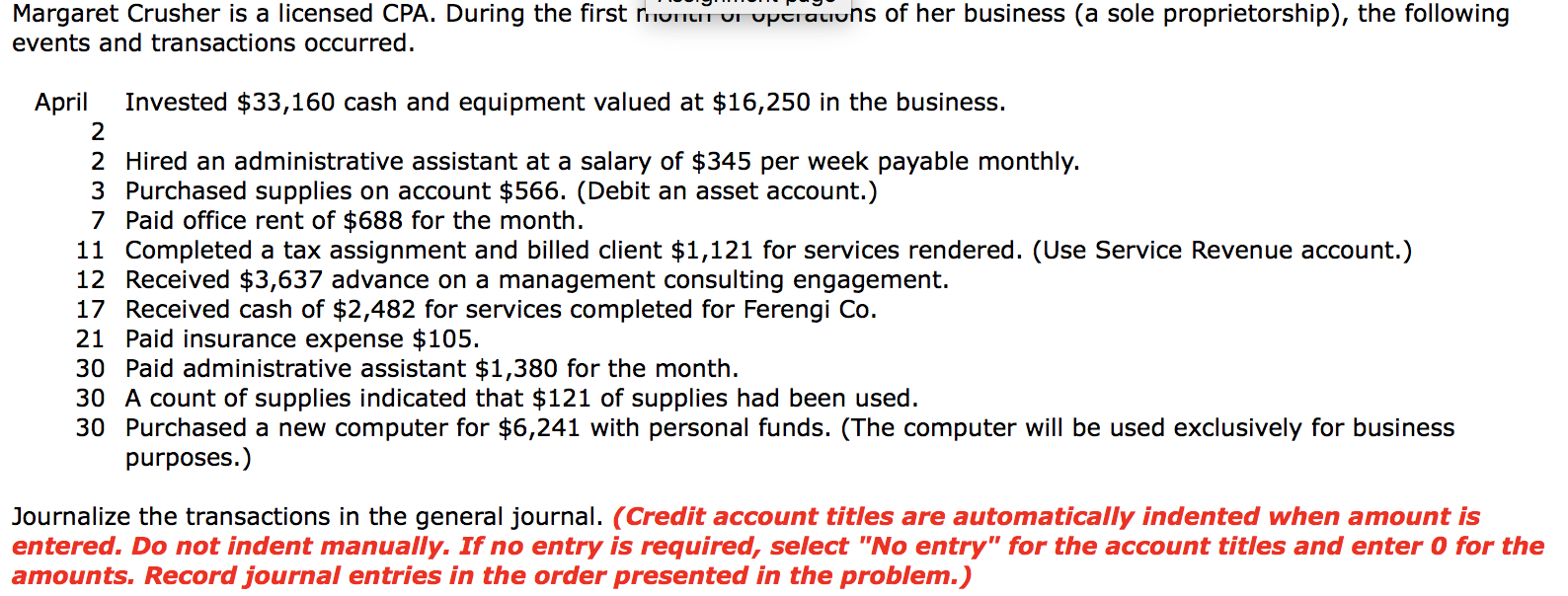

Margaret Crusher is a licensed CPA. During the first movi operations of her business (a sole proprietorship), the following events and transactions occurred. April Invested $33,160 cash and equipment valued at $16,250 in the business. 2 2 Hired an administrative assistant at a salary of $345 per week payable monthly. 3 Purchased supplies on account $566. (Debit an asset account.) 7 Paid office rent of $688 for the month. 11 Completed a tax assignment and billed client $1,121 for services rendered. (Use Service Revenue account.) 12 Received $3,637 advance on a management consulting engagement. 17 Received cash of $2,482 for services completed for Ferengi Co. 21 Paid insurance expense $105. 30 Paid administrative assistant $1,380 for the month. 30 A count of supplies indicated that $121 of supplies had been used. 30 Purchased a new computer for $6,241 with personal funds. (The computer will be used exclusively for business purposes.) Journalize the transactions in the general journal. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Margaret Crusher is a licensed CPA. During the first movi operations of her business (a sole proprietorship), the following events and transactions occurred. April Invested $33,160 cash and equipment valued at $16,250 in the business. 2 2 Hired an administrative assistant at a salary of $345 per week payable monthly. 3 Purchased supplies on account $566. (Debit an asset account.) 7 Paid office rent of $688 for the month. 11 Completed a tax assignment and billed client $1,121 for services rendered. (Use Service Revenue account.) 12 Received $3,637 advance on a management consulting engagement. 17 Received cash of $2,482 for services completed for Ferengi Co. 21 Paid insurance expense $105. 30 Paid administrative assistant $1,380 for the month. 30 A count of supplies indicated that $121 of supplies had been used. 30 Purchased a new computer for $6,241 with personal funds. (The computer will be used exclusively for business purposes.) Journalize the transactions in the general journal. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)

Expert Answer:

Answer rating: 100% (QA)

Apr 2 Cash 33160 Equipment16250 Owners Capital 49410 2 No entrynot a transaction 3 S... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

On January 31, 2019, Allison Company purchased supplies on account for $2,400. The purchase would cause current liabilities to: Multiple Choice Decrease $2,400 Increase $2,400 Increase $2,300 Would...

-

Complete Problem 2-2B and submit your work to the drag & drop area below. P2-2B Iris Beck is a licensed CPA. During the first month of operations of her business, the following events and...

-

Kenneth Dolkart Optical Dispensary purchased supplies on account for $3,400. Two weeks later, the business paid half on account. Requirements 1. Journalize the two transactions for Kenneth Dolkart...

-

Assume that a patient has 80 percent coverage for medical services but no coverage for prescription drugs. An 80 percent drug benefi t is added. Show graphically what will happen to the relative...

-

Covalent bonding occurs in both molecular and covalent network solids. Why do these two kinds of solids differ so greatly in their hardness and melting points?

-

How does the Doppler effect aid police in detecting speeding motorists?

-

You are managing a pension fund with a goal of maximizing the long-term growth rate. There are three assets available. Asset 1 has a risk-free return of 5%. Assets 2 and 3 each are driven by...

-

Budgeted selling and administrative expenses for Royal Tire Co. in P7-2 for the year ended December 31, 2013, were as follows: In P7-2, Royal Tire Co.'s budgeted unit sales for the year 2013 were:...

-

8. Two forces of 40N and 80N act at an angle of 120 to each other. Find the magnitude and direction of the equilibrant force. (Include a diagram representing the forces) (5 marks 9. Determine the...

-

B52 Skate Training prepares adjustments annually and showed the following on its June 30, 2020, year-end: Additional information available at year-end: a. The Prepaid Arena Rental of $182,000 was...

-

The distribution of annual returns on common stock is roughly symmetric, but extreme observations are more frequent than in a Normal distribution. Because the distribution is not strongly non-Normal,...

-

Grab the vertical line on the left distribution (Sampling Distribution of the Mean) and drag it until the vertical line on the right distribution (Sampling Distribution of Corresponding z) is at...

-

Slave Lake Shoe Source purchases ladies shoes for $35 each pair and has a markup of 60% on selling price. What is the rate of markdown on these shoes if it sells them at the cost price during a New...

-

8. Show that if f : R" Rm is continuous at a point, then |f| is also continuous point. = 9. Show that f(x) -- sin x, where x = R, is continuous. Hint: sin x - sin y = 2 sin (2) cos (ty) and sin x <...

-

Make sure to include your null and alternative hypothesis, your test statistic, your p-value, decision, and conclusion in the context in your response: A baseball team claims that30%of their fans...

-

If a $1 coupon is distributed for a product that normally has a profit of $4 per unit, how much is the profitability reduced if coupon handling expenses are $0.30 per unit and coupon marketing...

-

Your bank offers you a personal loan of $10,000 at an interest rate of 6.01% compounded quarterly. At the end of the term, interest of $3,677.65 was charged on the loan. Calculate the term of this...

-

The following data are supplied for the common stocks of Nikola Corporation, Tesla, Inc. and General Motors: Nikola Corp (NKLA) Tesla Inc. (TSLA) Close Price ($) Close Price ($) 67.53 30.00 40.81...

-

In fiscal 2007, Circuit City invested $242 million in capital expenditures, including $108 million related to store relocations, remodeling, and new store construction. Assume that these projects...

-

RedTop Company anticipates total sales for June and July of $540,000 and $472,000, respectively. Cash sales are normally 30% of total sales. Of the credit sales, 25% are collected in the same month...

-

Refer to the information in Exercise 3-6 and complete its parts (1) and (2) using the FIFO method.

-

On December 1, 2023, Rebecca Ward, a single taxpayer, comes to you for tax advice. At the end of every year, she donates \($5,000\) to charity. She has no other itemized deductions. This year, she...

-

Kelly and Chanelle Chambers, ages 47 and 45, are married and live at 584 Thoreau Drive, Boston, MA 59483. Kellys Social Security number is 111-11-1111 and Chanelles is 222-22-2222. The Chambers have...

-

Following is a list of information for Peter and Amy Jones for the current tax year. Peter and Amy are married and have three children, Aubrynne, Bryson, and Caden. They live at 100 Main Street,...

Study smarter with the SolutionInn App