As of January 1, 2021, the City of Summerville began operating a municipal bus operation. The...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

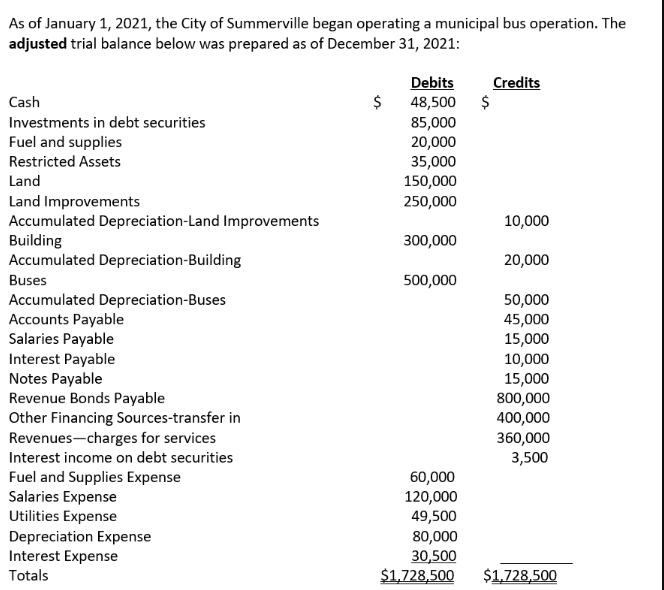

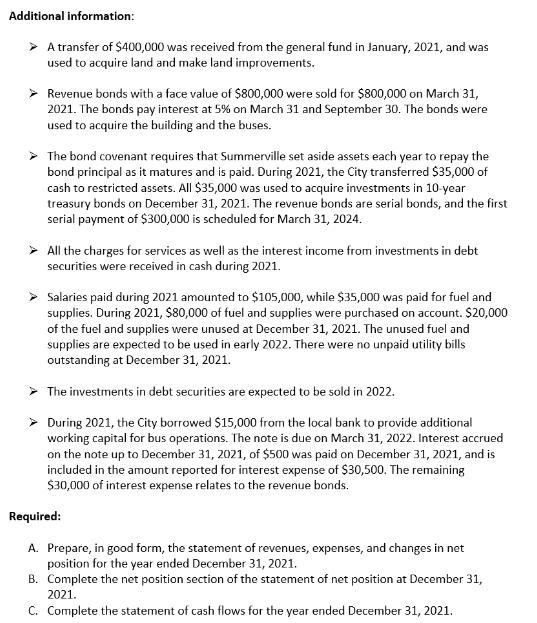

As of January 1, 2021, the City of Summerville began operating a municipal bus operation. The adjusted trial balance below was prepared as of December 31, 2021: Cash Investments in debt securities Fuel and supplies Restricted Assets Land Land Improvements Accumulated Depreciation-Land Improvements Building Accumulated Depreciation-Building Buses Accumulated Depreciation-Buses Accounts Payable Salaries Payable Interest Payable Notes Payable Revenue Bonds Payable Other Financing Sources-transfer in Revenues-charges for services Interest income on debt securities Fuel and Supplies Expense Salaries Expense Utilities Expense Depreciation Expense Interest Expense Totals $ Debits 48,500 $ 85,000 20,000 35,000 150,000 250,000 300,000 500,000 60,000 120,000 49,500 80,000 30,500 $1,728,500 Credits 10,000 20,000 50,000 45,000 15,000 10,000 15,000 800,000 400,000 360,000 3,500 $1,728,500 Additional information: A transfer of $400,000 was received from the general fund in January, 2021, and was used to acquire land and make land improvements. > Revenue bonds with a face value of $800,000 were sold for $800,000 on March 31, 2021. The bonds pay interest at 5% on March 31 and September 30. The bonds were used to acquire the building and the buses. > The bond covenant requires that Summerville set aside assets each year to repay the bond principal as it matures and is paid. During 2021, the City transferred $35,000 of cash to restricted assets. All $35,000 was used to acquire investments in 10-year treasury bonds on December 31, 2021. The revenue bonds are serial bonds, and the first serial payment of $300,000 is scheduled for March 31, 2024. ➤ All the charges for services as well as the interest income from investments in debt securities were received in cash during 2021. > Salaries paid during 2021 amounted to $105,000, while $35,000 was paid for fuel and supplies. During 2021, $80,000 of fuel and supplies were purchased on account. $20,000 of the fuel and supplies were unused at December 31, 2021. The unused fuel and supplies are expected to be used in early 2022. There were no unpaid utility bills outstanding at December 31, 2021. The investments in debt securities are expected to be sold in 2022. > During 2021, the City borrowed $15,000 from the local bank to provide additional working capital for bus operations. The note is due on March 31, 2022. Interest accrued on the note up to December 31, 2021, of $500 was paid on December 31, 2021, and is included in the amount reported for interest expense of $30,500. The remaining $30,000 of interest expense relates to the revenue bonds. Required: A. Prepare, in good form, the statement of revenues, expenses, and changes in net position for the year ended December 31, 2021. B. Complete the net position section of the statement of net position at December 31, 2021. C. Complete the statement of cash flows for the year ended December 31, 2021. As of January 1, 2021, the City of Summerville began operating a municipal bus operation. The adjusted trial balance below was prepared as of December 31, 2021: Cash Investments in debt securities Fuel and supplies Restricted Assets Land Land Improvements Accumulated Depreciation-Land Improvements Building Accumulated Depreciation-Building Buses Accumulated Depreciation-Buses Accounts Payable Salaries Payable Interest Payable Notes Payable Revenue Bonds Payable Other Financing Sources-transfer in Revenues-charges for services Interest income on debt securities Fuel and Supplies Expense Salaries Expense Utilities Expense Depreciation Expense Interest Expense Totals $ Debits 48,500 $ 85,000 20,000 35,000 150,000 250,000 300,000 500,000 60,000 120,000 49,500 80,000 30,500 $1,728,500 Credits 10,000 20,000 50,000 45,000 15,000 10,000 15,000 800,000 400,000 360,000 3,500 $1,728,500 Additional information: A transfer of $400,000 was received from the general fund in January, 2021, and was used to acquire land and make land improvements. > Revenue bonds with a face value of $800,000 were sold for $800,000 on March 31, 2021. The bonds pay interest at 5% on March 31 and September 30. The bonds were used to acquire the building and the buses. > The bond covenant requires that Summerville set aside assets each year to repay the bond principal as it matures and is paid. During 2021, the City transferred $35,000 of cash to restricted assets. All $35,000 was used to acquire investments in 10-year treasury bonds on December 31, 2021. The revenue bonds are serial bonds, and the first serial payment of $300,000 is scheduled for March 31, 2024. ➤ All the charges for services as well as the interest income from investments in debt securities were received in cash during 2021. > Salaries paid during 2021 amounted to $105,000, while $35,000 was paid for fuel and supplies. During 2021, $80,000 of fuel and supplies were purchased on account. $20,000 of the fuel and supplies were unused at December 31, 2021. The unused fuel and supplies are expected to be used in early 2022. There were no unpaid utility bills outstanding at December 31, 2021. The investments in debt securities are expected to be sold in 2022. > During 2021, the City borrowed $15,000 from the local bank to provide additional working capital for bus operations. The note is due on March 31, 2022. Interest accrued on the note up to December 31, 2021, of $500 was paid on December 31, 2021, and is included in the amount reported for interest expense of $30,500. The remaining $30,000 of interest expense relates to the revenue bonds. Required: A. Prepare, in good form, the statement of revenues, expenses, and changes in net position for the year ended December 31, 2021. B. Complete the net position section of the statement of net position at December 31, 2021. C. Complete the statement of cash flows for the year ended December 31, 2021.

Expert Answer:

Answer rating: 100% (QA)

I understand you are tasked with preparing a statement of revenues expenses and changes in net position and a statement of cash flows for the City of Summerville for the year ended December 31 2021 Le... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

An old-fashioned electric toaster has two spring-loaded base-hinged doors. The two doors open outward in opposite directions away from the heating element. A slice of bread is toasted one side at a...

-

Journalise the transactions given below: On 1 January 2020, Canada Ltd had the following equity accounts: Share capital Ordinary ($25 PV, 48 000 issued and outstanding) 1 200 000 Share premium -...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Your client has offered a 5-year, $1,000 par value bond with a 10 percent coupon. Interest on this bond is paid quarterly. 1) If your client is to earn a nominal rate of return of 12 percent,...

-

On May 6, 2006, Sterling Corporation signed a contract with Stony Associates under which Stony agreed (1) to construct an office building on land owned by Sterling, (2) to accept responsibility for...

-

Presented below is an aging schedule for Halleran Company at December 31, 2023: Instructions a. Prepare T accounts for Accounts Receivable and Allowance for Doubtful Accounts and enter the 2023...

-

What is the plain-meaning rule?

-

Use the following information to prepare a classified balance sheet for Alpha Co. at the end of 2016. Accounts receivable .....$26,500 Accounts payable ....... 12,200 Cash ............ 20,500 Common...

-

A young child pushes her stuffed plush cow down a frictionless slide at the playground. The slide has a height h. The cow exits the slide horizontally at the bottom. The cow slides along the level...

-

The figure shows a graph of r as a function of in Cartesian coordinates. Use it to sketch the corresponding polar curve. 2. 14 -1-

-

Acme Company Balance Sheet As of January 5, 2019 (amounts in thousands) Cash 8,400 Accounts Payable 2,800 Accounts Receivable 4,700 Debt 3,400 Inventory 4,200 Other Liabilities 900 Property Plant &...

-

As an employee of New Hampshire Industries, Kathleen has an opportunity to invest pre-tax income in an employer-sponsored retirement plan. Her employer will contribute 50 cents for every dollar that...

-

(a) Applying Cristian's algorithm for time synchronisation, a client's clock sends a request at time 3:07:58, the server response with time stamp of 3:08:20. The client receive the response at...

-

How does an association's vision, mission, and objectives influence its way to deal with key administration and estimation? Examine what top supervisory crews mean for a company's exhibition and its...

-

Company C, an automobile manufacturer, sold 2 trucks to a customer for $60,000 on January 5, 2014. Each of the trucks has a manufacturing cost of $20,000. What would be the entry to record the...

-

Suppose a light source emits a Gaussian spectrum centered at wavelength = 1300 nm with a full-width half max (FWHM) bandwidth = 10 nm. (a) Calculate the center frequency f0 of the light spectrum and...

-

A calendar year S corporation had dividend income of $10,000 and a net ordinary loss of $60,000 for the current year. At the beginning of the year, Z, a 45 percent shareholder, has a basis in the...

-

Audrey purchases a riding lawnmower using a 2-year, no-interest deferred payment plan at Lawn Depot for x dollars. There was a down payment of d dollars and a monthly payment of m dollars. Express...

-

Refer to the information in Exercise 23-8 and compute the (1) Direct materials price variance and (2) Direct materials quantity variance. Indicate whether each variance is favorable or unfavorable....

-

Key comparative figures for Samsung, Apple, and Google follow. Required 1. Compute profit margin for Samsung, Apple, and Google. 2. Which company is least successful on the basis of profit margin? $...

-

Selected comparative financial statements of Korbin Company follow. Required 1. Compute each years current ratio. Round ratios to one decimal. 2. Express the income statement data in common-size...

-

Based on your reading of this chapter, the following job description, and the two rsums below, analyze the two applicants for the position. What are their strengths and weaknesses as highlighted by...

-

Write a rsum that you could use in your job search. As your instructor directs, a. Write a rsum for the field in which you hope to find a job. b. Write two different rsums for two different job paths...

-

Use a web platform such as Wordpress to create a portfolio that highlights your professional and academic accomplishments. Include course projects, workplace samples, and other documents that support...

Study smarter with the SolutionInn App