At the beginning of the current (non-leap) year, Douglass owns all of Lighthouse Supply Corporation's outstanding...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

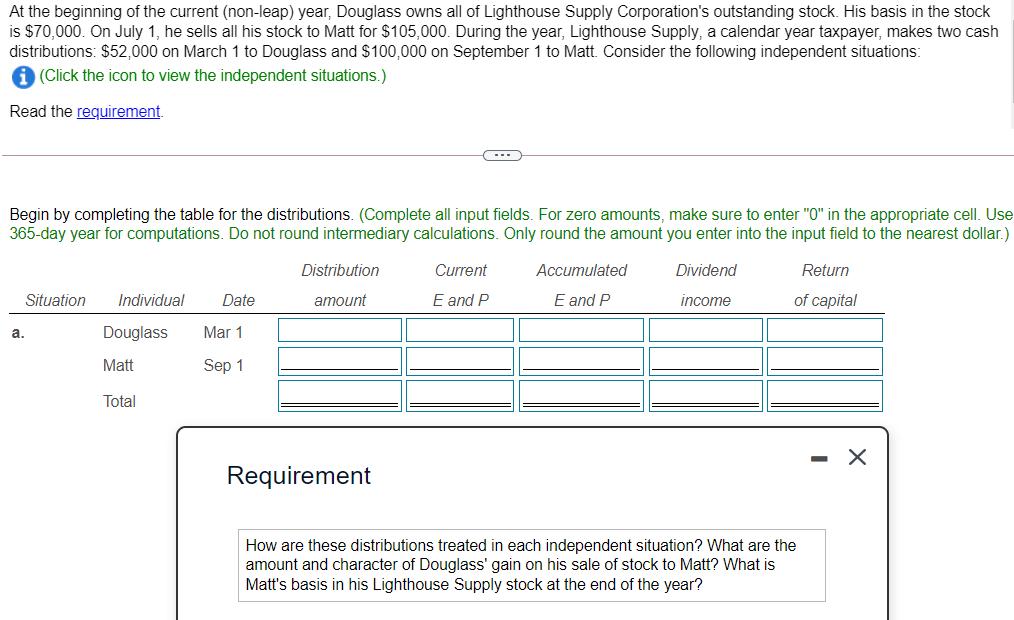

At the beginning of the current (non-leap) year, Douglass owns all of Lighthouse Supply Corporation's outstanding stock. His basis in the stock is $70,000. On July 1, he sells all his stock to Matt for $105,000. During the year, Lighthouse Supply, a calendar year taxpayer, makes two cash distributions: $52,000 on March 1 to Douglass and $100,000 on September 1 to Matt. Consider the following independent situations: i (Click the icon to view the independent situations.) Read the requirement. Begin by completing the table for the distributions. (Complete all input fields. For zero amounts, make sure to enter "0" in the appropriate cell. Use 365-day year for computations. Do not round intermediary calculations. Only round the amount you enter into the input field to the nearest dollar.) Situation Individual Date Douglass Mar 1 Matt Sep 1 Total a. Distribution amount Requirement Current E and P Accumulated E and P Dividend income Return of capital How are these distributions treated in each independent situation? What are the amount and character of Douglass' gain on his sale of stock to Matt? What is Matt's basis in his Lighthouse Supply stock at the end of the year? At the beginning of the current (non-leap) year, Douglass owns all of Lighthouse Supply Corporation's outstanding stock. His basis in the stock is $70,000. On July 1, he sells all his stock to Matt for $105,000. During the year, Lighthouse Supply, a calendar year taxpayer, makes two cash distributions: $52,000 on March 1 to Douglass and $100,000 on September 1 to Matt. Consider the following independent situations: i (Click the icon to view the independent situations.) Read the requirement. Begin by completing the table for the distributions. (Complete all input fields. For zero amounts, make sure to enter "0" in the appropriate cell. Use 365-day year for computations. Do not round intermediary calculations. Only round the amount you enter into the input field to the nearest dollar.) Situation Individual Date Douglass Mar 1 Matt Sep 1 Total a. Distribution amount Requirement Current E and P Accumulated E and P Dividend income Return of capital How are these distributions treated in each independent situation? What are the amount and character of Douglass' gain on his sale of stock to Matt? What is Matt's basis in his Lighthouse Supply stock at the end of the year?

Expert Answer:

Answer rating: 100% (QA)

a b C Situation a b C Hans Tom Total Situation Hans Tom Total Hans Tom Total Individual Stock ... View the full answer

Related Book For

Federal Taxation 2016 Comprehensive

ISBN: 9780134104379

29th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Posted Date:

Students also viewed these accounting questions

-

At the beginning of his current tax year, Eric bought a corporate bond with a maturity value of $50,000 from the secondary market for $45,000. The bond has a stated annual interest rate of 5 percent...

-

At the beginning of the current year, Heath Company had 20,000 shares of $10 par common stock outstanding. During the year, it engaged in the following transactions related to its common stock , so...

-

At the beginning of the current year, Andy Company has equipment that originally cost $50,000, has $35,000 accumulated depreciation, and is being depreciated at $5,000 per year. Andy Company sells...

-

Factor each trinomial. 4(m 5)2 4(m 5) 15

-

Explain how accounting standards are established.

-

In Figure P16-51, the three buses are interconnected by transmission lines with wire impedances of \(Z_{\mathrm{W}_{1}}=100+j\) \(600 \Omega /\) phase and \(Z_{\mathrm{W}_{2}}=120+j 800 \Omega /\)...

-

What does argv provide to our program?

-

Black and Blue Sports Inc., manufactures two products: snowboards and skis. The factory overhead incurred is as follows: Indirect labor ............ $ 507,000 Cutting Department ......... 156,000...

-

Nick went out for dinner with a few friends. The restaurant bill should have been $175, but instead, the waitress brings the bill for $160. Find the absolute error and relative percentage error for...

-

Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is the sale of fine European juicing machines. The owner of...

-

Explain Database Administrator (DBA). The explanation will include but not be limited to the following. a.What do they do and why are they needed? b.The different roles and tasks of a DBA. ...

-

The two-sided transfer function of a linear time-invariant (LTI) system, H(z), is described as H(z) = (1-2z-)(1+2) (1-0.2z-)(1-0.4z-) (a) Classify whether H(z) is maximum, minimum or mixed phase...

-

What is the output of the following code fragment? int x = 0; while( x < 8) cout < < x < < X ++; cout < < x < < endl; 11

-

Harrison and Gloria have been negotiating over the sale of bulk raw materials (lumber, iron and steel). Each party has had an army of lawyers acting on both sides trying to get the deal done and it...

-

35y2(x-3) (x+3) Simplify 21y (x-3)

-

What is one of the primary objectives of the PCI DSS (Payment Card Industry Data Security Standard)?

-

(Evaluating liquidity) Aylward Inc. currently has $2,172,000 in current assets and $836,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be...

-

The MIT Sloan School of Management is one of the leading business schools in the U.S. The following table contains the tuition data for the masters program in the Sloan School of Management. a. Use...

-

The personal holding company tax and the accumulated earnings tax reflect efforts to prevent use of the corporate entity to avoid taxation. Explain the congressional intent behind these two tax...

-

Ralph and Tina (husband and wife) transferred taxable bonds worth $30,000 to Pam, their 12-year-old daughter. Pam received $3,500 of interest on the bonds in the current year. Ralph and Tina have a...

-

Rick has a $50,000 basis in the RKS General Partnership on January 1 of the current year, and he owns no other investments. He has a 20% capital interest, a 30% profits interest, and a 40% loss...

-

A leading financial publication reported that the average baby boomer credit user will pay approximately $1,200 in interest annually. If, instead of paying interest, this amount was saved every year,...

-

With the availability of free credit reports, consumers are encouraged to check their report every 4 months-one report from each of the three major bureaus. In the past, consumers also were...

-

Working in a small group, collect credit card marketing information or the summary of account information sent to cardholders for three to five different cards. Be sure to protect the identity of the...

Study smarter with the SolutionInn App