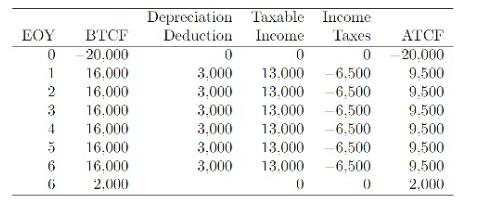

The below table shows the calculations for an after-tax analysis of a machine purchase alternative (a) Find

Fantastic news! We've Found the answer you've been seeking!

Question:

The below table shows the calculations for an after-tax analysis of a machine purchase alternative

(a) Find answers to the below questions

i. What are the cost basis (price) and “annual revenues less expenses" ?

ii. What is the terminal market value (or salvage value) ?

iii. What is the income tax rate?

iv. What is the method used for depreciation deductions?

V. What is the book's value at the end of useful life?

(b) Calculate the equivalent present worth (PW) and the equivalent annual worth (AW) at an after-tax MARR of 10%

Related Book For

Introduction to Corporate Finance What Companies Do

ISBN: 978-1111222284

3rd edition

Authors: John Graham, Scott Smart

Posted Date: