? ?? ? ? Assume that Alpha and Omega compete in the same four-digit SIC code industry

Fantastic news! We've Found the answer you've been seeking!

Question:

?

?  ??

??

? ?

?

Transcribed Image Text:

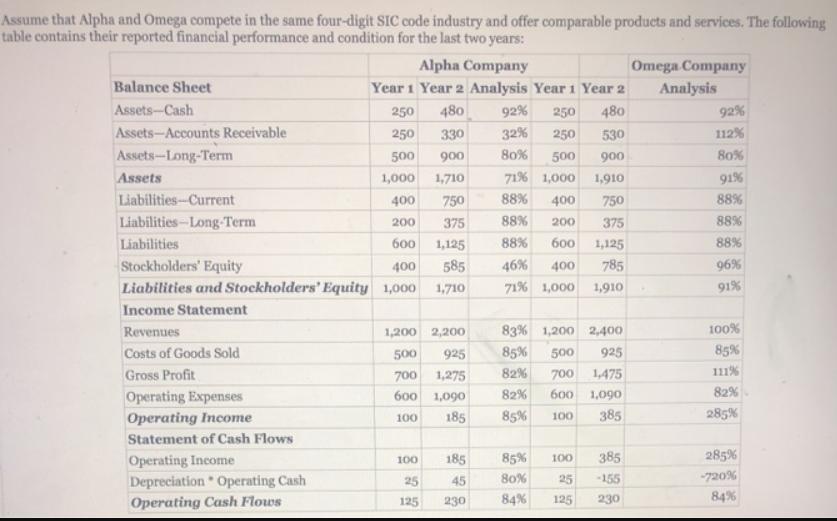

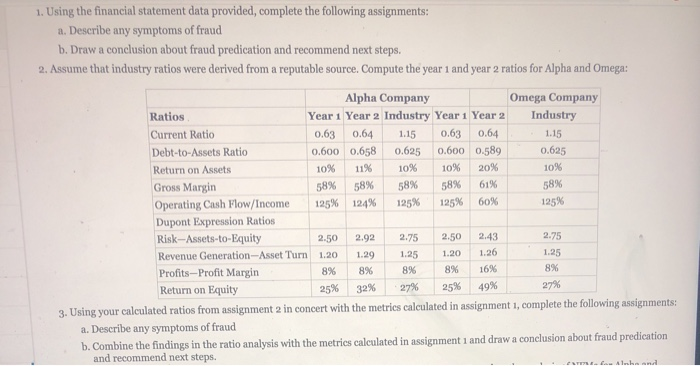

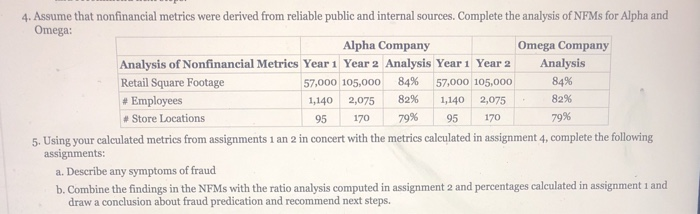

Assume that Alpha and Omega compete in the same four-digit SIC code industry and offer comparable products and services. The following table contains their reported financial performance and condition for the last two years: Balance Sheet Assets-Cash Assets-Accounts Receivable Assets-Long-Term Assets Liabilities-Current Liabilities-Long-Term Liabilities Stockholders' Equity 400 Liabilities and Stockholders' Equity 1,000 Income Statement Revenues Costs of Goods Sold Gross Profit Operating Expenses Operating Income Statement of Cash Flows Operating Income Alpha Company Year 1 Year 2 Analysis Year 1 Year 2 250 480 250 330 500 900 1,000 1,710 400 750 200 375 600 1,125 585 Depreciation Operating Cash Operating Cash Flows 1,200 500 700 600 100 100 25 125 1,710 2,200 925 1,275 1,090 92% 250 480 32% 250 530 80% 900 1,910 185 45 230 500 71% 1,000 88% 750 88% 375 88% 600 1,125 46% 400 785 71% 1,000 1,910 83% 1,200 2,400 85% 500 925 82% 700 1,475 82% 600 1,090 185 85% 100 385 400 200 85% 80% 84% 100 25 125 385 -155 230 Omega Company Analysis 92% 112% 80% 91% 88% 88% 88% 96% 91% 100% 85% 111% 82% 285% 285% -720% 84% 1. Using the financial statement data provided, complete the following assignments: a. Describe any symptoms of fraud b. Draw a conclusion about fraud predication and recommend next steps. 2. Assume that industry ratios were derived from a reputable source. Compute the year 1 and year 2 ratios for Alpha and Omega: Ratios Current Ratio Debt-to-Assets Ratio Return on Assets Gross Margin Operating Cash Flow/Income Dupont Expression Ratios Risk-Assets-to-Equity Alpha Company Year 1 Year 2 Industry Year 1 Year 2 0.63 0.64 0.600 0.658 11% 10% 58% 58% 125% 124% 2.50 2.92 1.29 8% 1.15 0.63 0.64 0.625 0.600 0.589 10% 58% 125% 10% 20% 58% 61% 125% 60% 2.50 2.43 1.20 1.26 8% 16% Omega Company Industry 1.15 0.625 10% 58% 125% 2.75 1.25 8% 27% 2.75 Revenue Generation-Asset Turn 1.20 1.25 Profits-Profit Margin 8% 8% Return on Equity 25% 32% 27% 25% 49% 3. Using your calculated ratios from assignment 2 in concert with the metrics calculated in assignment 1, complete the following assignments: a. Describe any symptoms of fraud b. Combine the findings in the ratio analysis with the metrics calculated in assignment 1 and draw a conclusion about fraud predication and recommend next steps. EXTRE, fo Alaha and 4. Assume that nonfinancial metrics were derived from reliable public and internal sources. Complete the analysis of NFMs for Alpha and Omega: Alpha Company Omega Company Analysis Analysis of Nonfinancial Metrics Year 1 Year 2 Analysis Year 1 Year 2 Retail Square Footage 57,000 105,000 84% 57,000 105,000 84% # Employees 1,140 82% 1,140 2,075 82% #Store Locations 95 79% 95 170 79% 5. Using your calculated metrics from assignments 1 an 2 in concert with the metrics calculated in assignment 4, complete the following assignments: 2,075 170 a. Describe any symptoms of fraud b. Combine the findings in the NFMs with the ratio analysis computed in assignment 2 and percentages calculated in assignment 1 and draw a conclusion about fraud predication and recommend next steps. Assume that Alpha and Omega compete in the same four-digit SIC code industry and offer comparable products and services. The following table contains their reported financial performance and condition for the last two years: Balance Sheet Assets-Cash Assets-Accounts Receivable Assets-Long-Term Assets Liabilities-Current Liabilities-Long-Term Liabilities Stockholders' Equity 400 Liabilities and Stockholders' Equity 1,000 Income Statement Revenues Costs of Goods Sold Gross Profit Operating Expenses Operating Income Statement of Cash Flows Operating Income Alpha Company Year 1 Year 2 Analysis Year 1 Year 2 250 480 250 330 500 900 1,000 1,710 400 750 200 375 600 1,125 585 Depreciation Operating Cash Operating Cash Flows 1,200 500 700 600 100 100 25 125 1,710 2,200 925 1,275 1,090 92% 250 480 32% 250 530 80% 900 1,910 185 45 230 500 71% 1,000 88% 750 88% 375 88% 600 1,125 46% 400 785 71% 1,000 1,910 83% 1,200 2,400 85% 500 925 82% 700 1,475 82% 600 1,090 185 85% 100 385 400 200 85% 80% 84% 100 25 125 385 -155 230 Omega Company Analysis 92% 112% 80% 91% 88% 88% 88% 96% 91% 100% 85% 111% 82% 285% 285% -720% 84% 1. Using the financial statement data provided, complete the following assignments: a. Describe any symptoms of fraud b. Draw a conclusion about fraud predication and recommend next steps. 2. Assume that industry ratios were derived from a reputable source. Compute the year 1 and year 2 ratios for Alpha and Omega: Ratios Current Ratio Debt-to-Assets Ratio Return on Assets Gross Margin Operating Cash Flow/Income Dupont Expression Ratios Risk-Assets-to-Equity Alpha Company Year 1 Year 2 Industry Year 1 Year 2 0.63 0.64 0.600 0.658 11% 10% 58% 58% 125% 124% 2.50 2.92 1.29 8% 1.15 0.63 0.64 0.625 0.600 0.589 10% 58% 125% 10% 20% 58% 61% 125% 60% 2.50 2.43 1.20 1.26 8% 16% Omega Company Industry 1.15 0.625 10% 58% 125% 2.75 1.25 8% 27% 2.75 Revenue Generation-Asset Turn 1.20 1.25 Profits-Profit Margin 8% 8% Return on Equity 25% 32% 27% 25% 49% 3. Using your calculated ratios from assignment 2 in concert with the metrics calculated in assignment 1, complete the following assignments: a. Describe any symptoms of fraud b. Combine the findings in the ratio analysis with the metrics calculated in assignment 1 and draw a conclusion about fraud predication and recommend next steps. EXTRE, fo Alaha and 4. Assume that nonfinancial metrics were derived from reliable public and internal sources. Complete the analysis of NFMs for Alpha and Omega: Alpha Company Omega Company Analysis Analysis of Nonfinancial Metrics Year 1 Year 2 Analysis Year 1 Year 2 Retail Square Footage 57,000 105,000 84% 57,000 105,000 84% # Employees 1,140 82% 1,140 2,075 82% #Store Locations 95 79% 95 170 79% 5. Using your calculated metrics from assignments 1 an 2 in concert with the metrics calculated in assignment 4, complete the following assignments: 2,075 170 a. Describe any symptoms of fraud b. Combine the findings in the NFMs with the ratio analysis computed in assignment 2 and percentages calculated in assignment 1 and draw a conclusion about fraud predication and recommend next steps.

Expert Answer:

Answer rating: 100% (QA)

1 a The data for both Alpha and Omega firms contain a number of possible fraud indicators With no equivalent rise in other assets Alphas balance sheet shows a huge increase in cash from year 1 to year ... View the full answer

Related Book For

Economics

ISBN: 978-0073375694

18th edition

Authors: Campbell R. McConnell, Stanley L. Brue, Sean M. Flynn

Posted Date:

Students also viewed these accounting questions

-

The model of section 5.1 includes costs of goods sold but not selling, general, and administrative (SG&A) expenses. Suppose that the firm has $200 of these expenses each year, irrespective of the...

-

The Down Towner has annual costs of goods sold of $42,600, interest expense of $650, selling and administrative expenses of $7,800, dividends paid of $1,200, depreciation of $1,100, and a tax rate of...

-

Frye inc has sales of 625,000. Costs of goods sold of $260,000, depreciation expense of $79,000 interest expense of $43,000 and an average tax rate of 35 percent if the firms beginning balance of...

-

EFG Manufacturing, a private company, produces light bulbs. It has 100 employees. 15 of their employees have asked for short breaks during the workday for religious purposes. They have also asked for...

-

Explain what we mean by noncash activities and provide an example.

-

Show that the liquid-level system consisting of two interacting tanks (Fig. 6.11) exhibits over damped dynamics; that is, show that the damping coefficient in Eq. 6-57 is larger than one. di h2 hi R2...

-

Pick an industry and a product or service. Engage in a creative-thinking process, as outlined in Chapter 11, to generate an improved offering. Do the same to create an entirely new offering that uses...

-

South Central Utilities has just announced the August 1 opening of its second nuclear generator at its Baton Rouge, Louisiana, nuclear power plant. Its personnel department has been directed to...

-

Why would you perform a silent installation? What is the purpose of a password complexity policy? Oracle offers a free download of all editions of the Oracle Database. How does the company derive...

-

Fulcrum Industries manufactures dining chairs and tables. The following information is available: Dining Chairs Tables Total Cost 600 470 2,400 Machine setups Inspections Labor hours Problem 2. 200...

-

Under the Covid-19 pandemic situation that pervades the world, what do you think is the suitable interview method to be used by the employer and why? Explain by giving only one reason. Irrespective...

-

Ruth and Greg are married and earned a joint income of $62,000 in 2020. They paid a total of $5,500 in 2020 for benefits, such as their health insurance coverage. They paid $3,298 in state and local...

-

Explain why adequate audit planning is essential before commencement of actual audit work. (b) Outline the deficiencies of the audit in the above case and elaborate with reasons.

-

Differentiate between the linear magnification and the focal length of an objective. 2. Why is the low-power objective placed in position when the microscope is stored or carried?

-

Vera Bradley Inc. reports the following results for the month of June: Sales Revenue (20,000 units) $1,200,000 Variable costs 800,000 Fixed costs 300,000 Net income $ 100,000 Management of...

-

In what capacity do non-human hosts facilitate the evolutionary trajectory and dissemination of influenza viruses? Furthermore, delineate the dual mechanisms through which influenza evolves, and...

-

Yazici Batteries, Inc.'s monthly sales were as follows: MES SALES January 20 February 21 March 15 April 14 Can 13 June sixteen Julio 17 August 18 September 20 October 20 November 21 December 23 Top...

-

You purchase a bond with a coupon rate of 6.7 percent, a par value $1,000, and a clean price of $905. Assume a par value of $1,000. If the next semiannual coupon payment is due in two months, what is...

-

In 2005 General Motors (GM) announced that it would reduce employment by 30,000 workers. What does this decision reveal about how it viewed its marginal revenue product (MRP) and marginal resource...

-

What is the basic objective of monetary policy? What are the major strengths of monetary policy? Why is monetary policy easier to conduct than fiscal policy in a highly divided national political...

-

Use graphical analysis to show how each of the following would affect the economy first in the short run and then in the long run. Assume that the United States is initially operating at its...

-

Case 1: Noncallable, Nonconvertible, Perpetual Preferred Shares The following facts concerning the Union Electric Company 4.75 percent perpetual preferred shares (CUSIP identifier: 906548821) are as...

-

1. An analyst is estimating the intrinsic value of a new company. The analyst has one year of financial statements for the company and has calculated the average values of a variety of price...

-

In asset-based valuation models, the intrinsic value of a common share of stock is based on the: A. Estimated market value of the companys assets. B. Estimated market value of the companys assets...

Study smarter with the SolutionInn App