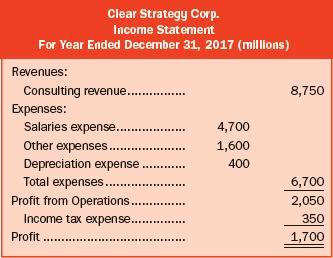

Clear Strategy Corp., a strategic marketing consulting firm, began operations on January 1, 2016. Its post-closing trial

Question:

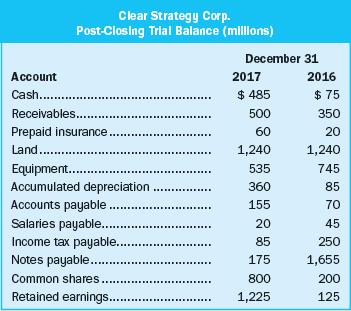

Clear Strategy Corp., a strategic marketing consulting firm, began operations on January 1, 2016. Its post-closing trial balance at December 31, 2016, and 2017, is shown below along with some other information.

Other information regarding Clear Strategy Corp. and its activities during 2017:

- Assume all accounts have normal balances.

- Share dividends were declared and issued during the year.

- Equipment was sold for cash equal to its book value.

Required:

Using the information provided, prepare a statement of cash flows (applying the indirect method) for the year ended December 31, 2017.

2:

Required: Refer to the information in Question 1. Prepare a statement of cash flows for 2017 using the direct method to report cash inflows and outflows from operating activities.

Other information:

- All accounts payable balances result from other expenses.

- All consulting revenue is done on credit.

- All credits to accounts receivable are receipts from customers.

- All debits to accounts payable result from payments for other expenses.

Required:

Prepare a statement of cash flows for 2017 that reports the cash inflows and outflows from operating activities according to the indirect method. Show your supporting calculations. Also, prepare a note describing non-cash investing and financing activities.

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann