Donor Corporation had the following income and deductions for last year: $5,000,000 3,500,000 Other operating expenses...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

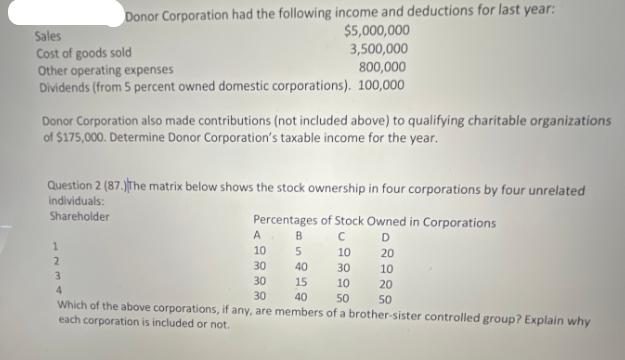

Donor Corporation had the following income and deductions for last year: $5,000,000 3,500,000 Other operating expenses 800,000 Dividends (from 5 percent owned domestic corporations). 100,000 Sales Cost of goods sold Donor Corporation also made contributions (not included above) to qualifying charitable organizations of $175,000. Determine Donor Corporation's taxable income for the year. Question 2 (87.) The matrix below shows the stock ownership in four corporations by four unrelated individuals: Shareholder Percentages of Stock Owned in Corporations A B C D 10 5 10 20 30 40 30 10 30 15 10 20 30 40 50 50 Which of the above corporations, if any, are members of a brother-sister controlled group? Explain why each corporation is included or not. 1 2 3 4 Donor Corporation had the following income and deductions for last year: $5,000,000 3,500,000 Other operating expenses 800,000 Dividends (from 5 percent owned domestic corporations). 100,000 Sales Cost of goods sold Donor Corporation also made contributions (not included above) to qualifying charitable organizations of $175,000. Determine Donor Corporation's taxable income for the year. Question 2 (87.) The matrix below shows the stock ownership in four corporations by four unrelated individuals: Shareholder Percentages of Stock Owned in Corporations A B C D 10 5 10 20 30 40 30 10 30 15 10 20 30 40 50 50 Which of the above corporations, if any, are members of a brother-sister controlled group? Explain why each corporation is included or not. 1 2 3 4

Expert Answer:

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these accounting questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

A bakery with a December 31 st year end purchased new equipment on October 31 st 2000 for $10,000. This was their first equipment purchase. Required: What are the tax consequences if the equipment is...

-

Carey Company is borrowing $200,000 for one year at 12 percent from Second Intrastate Bank. The bank requires a 20 percent compensating balance. What is the effective rate of interest? What would the...

-

The Frate Company was formed on December 1, 2006. The following information is available from Frate's inventory records for Product Ply: A physical inventory on March 31, 2007 shows 1,600 units on...

-

Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks. Slim purchased $150,000 of roots in 20X7 and...

-

What is the primary purpose of admission-seeking questions?

-

(Entries for Life Cycle of Bonds) On April 1, 2010, Seminole Company sold 15,000 of its 11%, 15-year, $1,000 face value bonds at 97. Interest payment dates are April 1 and October 1, and the company...

-

Amazon, Inc. Presentation Your chief executive officer (CEO) has asked you to present the company's (Amazon, Inc.) process on making decisions under risks and uncertainty at the annual shareholders'...

-

American Auto is evaluating their marketing plan for the sedans, SUVs, and trucks they produce. A TV ad featuring this SUV has been developed. The company estimates that each showing of this...

-

what do you think is/are the reason/s why the route of utilizing petroleum is preferred over glucose fermentation in the production of industrial chemicals?

-

For the simplex tableau X2 $1 52 P RHS 4 1 0 0 29 3 0 1 0 50 -4 0 01 0 perform one pivot operation and enter the resulting tableau below. The pivot element has a box around it. X X2 X 3 3 -10 $2 P RHS

-

Discuss some of the key principles of Quantum Physics, such as Heisenberg's Uncertainty principle, the concept of superposition, and the phenomenon of quantum tunneling. Question 4. Application of...

-

Define and explain the formation of polar and non-polar covalent bonds. State and discuss the cause of their similarities and differences. Use the case of water and hydrocarbons as the basis for your...

-

YAG laser operates at approximately 1.06 m wavelength and has gain with spectral width = 150 GHz. a) For a simple air-filled resonator based on parallel-plane mirrors spaced by 10 cm, how many...

-

What process does the "GU-AG Rule" apply to in eukaryotes. If the AG sequence was mutated in exon 1 in a gene with 3 exons, how would this process be affected?

-

23. Chiral and optically active molecule among the following molecule is, Me H H H (a) I, II H C=C=C II (b) II, III Me H C=C=C III (c) II only H (d) I only

-

You are thinking of investing in one of two companies. In one annual report, the auditors opinion states that the financial statements were prepared in accordance with generally accepted accounting...

-

If Charles, a 16-year-old child model, earns $50,000 a year and is completely self supporting even though he lives with his parents, can his parents claim him as a dependent? Why or why not?...

-

Sherry rents her vacation home for 6 months and lives in it for 6 months during the year. Her gross rental income during the year is $4,000. Total real estate taxes for the home are $950, and...

-

How are qualified dividends taxed in 2012? Please give the two rates of tax which apply to qualified dividends, and specify when each of these rates applies._________________________...

-

We can make a static measurement to deduce the spring constant to use in the model. If a \(61 \mathrm{~kg}\) woman stands on a low wall with her full weight on the ball of one foot and the heel free...

-

A \(1.00 \mathrm{~kg}\) block is attached to a horizontal spring with spring INT constant \(2500 \mathrm{~N} / \mathrm{m}\). The block is at rest on a frictionless surface. A \(10.0 \mathrm{~g}\)...

-

If, during a stride, the stretch causes her center of mass to lower by \(10 \mathrm{~mm}\), what is the stored energy? A. \(3.0 \mathrm{~J}\) B. \(6.0 \mathrm{~J}\) C. \(9.0 \mathrm{~J}\) D. \(12...

Study smarter with the SolutionInn App