Suppose the current stock price for A.B.C Corp is 100, the volatility is 0.25, the time...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

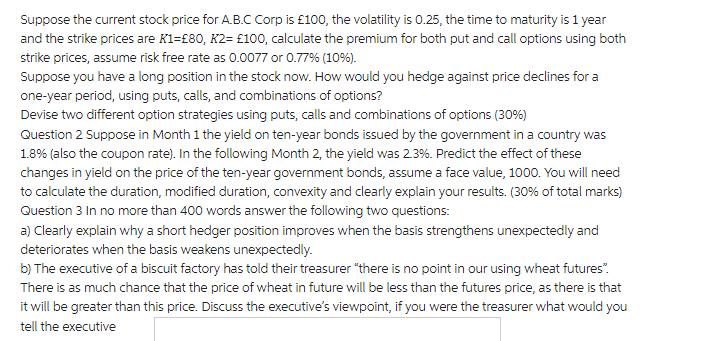

Suppose the current stock price for A.B.C Corp is £100, the volatility is 0.25, the time to maturity is 1 year and the strike prices are K1=£80, K2= £100, calculate the premium for both put and call options using both strike prices, assume risk free rate as 0.0077 or 0.77% (10%). Suppose you have a long position in the stock now. How would you hedge against price declines for a one-year period, using puts, calls, and combinations of options? Devise two different option strategies using puts, calls and combinations of options (30%) Question 2 Suppose in Month 1 the yield on ten-year bonds issued by the government in a country was 1.8% (also the coupon rate). In the following Month 2, the yield was 2.3%. Predict the effect of these changes in yield on the price of the ten-year government bonds, assume a face value, 1000. You will need to calculate the duration, modified duration, convexity and clearly explain your results. (30% of total marks) Question 3 In no more than 400 words answer the following two questions: a) Clearly explain why a short hedger position improves when the basis strengthens unexpectedly and deteriorates when the basis weakens unexpectedly. b) The executive of a biscuit factory has told their treasurer "there is no point in our using wheat futures". There is as much chance that the price of wheat in future will be less than the futures price, as there is that it will be greater than this price. Discuss the executive's viewpoint, if you were the treasurer what would you tell the executive Suppose the current stock price for A.B.C Corp is £100, the volatility is 0.25, the time to maturity is 1 year and the strike prices are K1=£80, K2= £100, calculate the premium for both put and call options using both strike prices, assume risk free rate as 0.0077 or 0.77% (10%). Suppose you have a long position in the stock now. How would you hedge against price declines for a one-year period, using puts, calls, and combinations of options? Devise two different option strategies using puts, calls and combinations of options (30%) Question 2 Suppose in Month 1 the yield on ten-year bonds issued by the government in a country was 1.8% (also the coupon rate). In the following Month 2, the yield was 2.3%. Predict the effect of these changes in yield on the price of the ten-year government bonds, assume a face value, 1000. You will need to calculate the duration, modified duration, convexity and clearly explain your results. (30% of total marks) Question 3 In no more than 400 words answer the following two questions: a) Clearly explain why a short hedger position improves when the basis strengthens unexpectedly and deteriorates when the basis weakens unexpectedly. b) The executive of a biscuit factory has told their treasurer "there is no point in our using wheat futures". There is as much chance that the price of wheat in future will be less than the futures price, as there is that it will be greater than this price. Discuss the executive's viewpoint, if you were the treasurer what would you tell the executive

Expert Answer:

Answer rating: 100% (QA)

Answer 1 The premium for the call option with a strike price of K1 80 is calculated as follows Premium S N d1 K N d2 Where S Current stock price 100 K Strike price 80 N d1 Standard normal cumulative d... View the full answer

Related Book For

Managerial Economics

ISBN: 978-0133020267

7th edition

Authors: Paul Keat, Philip K Young, Steve Erfle

Posted Date:

Students also viewed these finance questions

-

N balls labeled 1 through N are placed in Box 1 while a Box 2 is initially empty. At each time instant, one of the N balls is chosen (with equally probability) and moved to the other box. Let X [k]...

-

A physics textbook weighing 22 N rests on a desk. The coefficient of static friction between the book and the desk is μs = 0.60; the coefficient of kinetic friction is μk...

-

N sources of current with different emf's are connected as shown in Fig. 3.40. The emf's of the sources are proportional to their internal resistances, i.e. ε = aR, where a is an assigned...

-

Dylan Flaherty, marketing clerk for TipTop Marketing Agency, recorded the following information for last year: He would like to be able to estimate customer service costs using the number of...

-

The table below shows the yields on the fixed and floating borrowing choices available to three firms. Firms A and B want to be exposed to a floating interest rate while Firm C would prefer to pay a...

-

Parker Tool is considering lengthening its credit period from 30 to 60 days. All customers will continue to pay on the net date. The firm currently bills $450,000 for sales and has $345,000 in...

-

In 2014, Air Asia Flight No. 8501 crashed in the Java Sea while flying from Indonesia to Singapore. The crash resulted in the deaths of all passengers and crew on board. The plane involved in the...

-

Qwik Repairs has over 200 auto-maintenance service outlets nationwide. It provides primarily two lines of service: oil changes and brake repair. Oil changerelated services represent 70% of its sales...

-

Pinehurst Company was formed in Year 1 and experienced the following accounting events during the year: 1. Issued common stock for $18,400 cash. 2. Earned cash revenue of $26,100. 3. Paid cash...

-

1. Create and upload a histogram of the salary data for the city of Bell, where each bar width is about 50,000 US dollars. (Data for the histogram is at the bottom). a.) Is the distribution of the...

-

Here is a simple process flowchart for serving a patient in a hospital: (1) Get Register (10 min) Get Register (10 min) Capacity rate Utilization (2) 1 Record Health Condition (15 min) Record Health...

-

Given this breakdown of execution cycles in the processor with direct support for the ADDM instruction, what speedup is achieved by replacing this instruction with a 3-instruction sequence (LW, ADD,...

-

When the registrar of a university deals with students by an identification number rather than a name, which characteristic of bureaucracy is being displayed and what is its intended benefit? (a)...

-

John Ferret is the sole shareholder of two corporations. Unusual Pets Inc. is a pet shop with $240,000 in current and accumulated earnings, all invested in certificates of deposit and none of which...

-

Which management theorist would most agree with the statement If you treat people as grown-ups they will perform that way? (a) Argyris (b) Deming (c) Weber (d) Fuller

-

At February 15, 2017, Brent filed his 2016 income tax return (Due April 15, 2017), and he paid a tax of $15,000 at that time. on June 10, 2018, he filed an amended 2016 return showing an additional...

-

2. (27 points) On the picture below AABC is a triangle, in which AL and BM are altitudes and CL CM. Prove that: H (a) AL = BM; (b) AABC is an isosceles triangle. M B

-

Modify the counter from Exercise 5.44 such that the counter will either increment by 4 or load a new 32-bit value, D, on each clock edge, depending on a control signal Load. When Load = 1, the...

-

Suppose a chemical company was fined for violating certain antipollution laws. As the jokes person for the Environmental Protection Agency, how would you explain the economic reasons for these...

-

Explain the difference between time series data and cross-sectional data. Provide examples of each type of data.

-

How is NPV calculated? What is the decision rule for NPV? How is the internal rate of return calculated? What is the decision rule for IRR?

-

What are the three main types of assistance available to the general public for completing their tax forms?

-

Ask older friends or relatives about the cost of specific items (e.g., a gallon of gas, a cup of coffee, etc.) during their youth. Also inquire bout their average wages in the past. Compare the...

-

Develop and solve a future-value, a present-value, a future value of an annuity, and a present value of an annuity problem. Establish the three known variables in each problem and solve for the...

Study smarter with the SolutionInn App