Fellalova Corporation has recently abandoned an industrial site near the heart of a major city. The...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

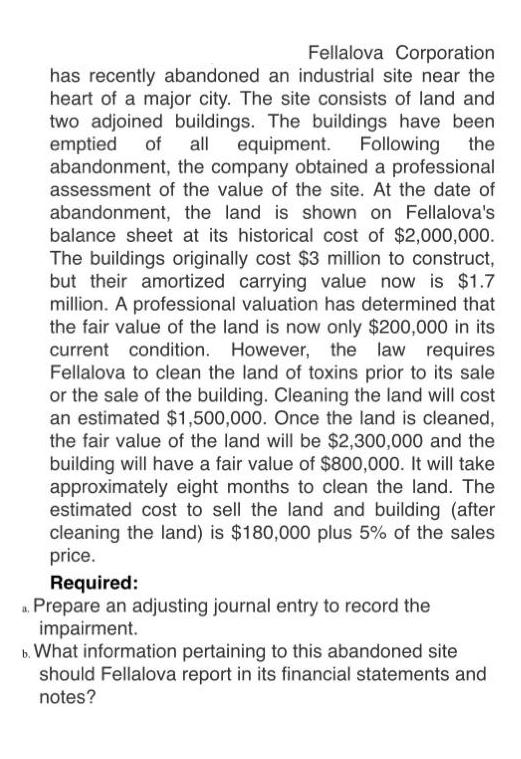

Fellalova Corporation has recently abandoned an industrial site near the heart of a major city. The site consists of land and two adjoined buildings. The buildings have been emptied of all equipment. Following the abandonment, the company obtained a professional assessment of the value of the site. At the date of abandonment, the land is shown on Fellalova's balance sheet at its historical cost of $2,000,000. The buildings originally cost $3 million to construct, but their amortized carrying value now is $1.7 million. A professional valuation has determined that the fair value of the land is now only $200,000 in its current condition. However, the law requires Fellalova to clean the land of toxins prior to its sale or the sale of the building. Cleaning the land will cost an estimated $1,500,000. Once the land is cleaned, the fair value of the land will be $2,300,000 and the building will have a fair value of $800,000. It will take approximately eight months to clean the land. The estimated cost to sell the land and building (after cleaning the land) is $180,000 plus 5% of the sales price. Required: a. Prepare an adjusting journal entry to record the impairment. b. What information pertaining to this abandoned site should Fellalova report in its financial statements and notes? Fellalova Corporation has recently abandoned an industrial site near the heart of a major city. The site consists of land and two adjoined buildings. The buildings have been emptied of all equipment. Following the abandonment, the company obtained a professional assessment of the value of the site. At the date of abandonment, the land is shown on Fellalova's balance sheet at its historical cost of $2,000,000. The buildings originally cost $3 million to construct, but their amortized carrying value now is $1.7 million. A professional valuation has determined that the fair value of the land is now only $200,000 in its current condition. However, the law requires Fellalova to clean the land of toxins prior to its sale or the sale of the building. Cleaning the land will cost an estimated $1,500,000. Once the land is cleaned, the fair value of the land will be $2,300,000 and the building will have a fair value of $800,000. It will take approximately eight months to clean the land. The estimated cost to sell the land and building (after cleaning the land) is $180,000 plus 5% of the sales price. Required: a. Prepare an adjusting journal entry to record the impairment. b. What information pertaining to this abandoned site should Fellalova report in its financial statements and notes?

Expert Answer:

Related Book For

Business Statistics

ISBN: 9780321925831

3rd Edition

Authors: Norean Sharpe, Richard Veaux, Paul Velleman

Posted Date:

Students also viewed these accounting questions

-

The police department of a major city needs to update its budget. For this purpose, they need to under-stand the variation in their fines collected from motorists for speeding. As a sample, they...

-

The motor pool of a major city provides automobiles for the use of various city departments. Currently, the motor pool has 50 autos. A recent study showed that it costs $4,800 of annual fixed cost...

-

The vehicle pool of a major city provides cars for the use of various city departments. Currently, the vehicle pool has 50 cars. A recent study showed that it costs $2,400 in annual fixed costs per...

-

Giroud plc is considering two alternative investment opportunities. Each of the two projects has an expected life of five years and requires an initial investment of $100,000. A feasibility study...

-

Blake and Anna Carlson are preparing a plan to submit to venture capitalists to fund their business, Music Masters. The company plans to spend $380,000 on equipment in the first quarter of 20X7....

-

Find the work for Problem 3.82.

-

Refer to the information in QS 19-16. The company sells its product for $50 per unit. Due to new regulations, the company must now incur $2 per unit of hazardous waste disposal costs and $8,500 per...

-

As a hospital administrator of a large hospital, you are concerned with the absenteeism among nurses aides. The issue has been raised by registered nurses, who feel they often have to perform work...

-

How would you import a relational model design and generate a logical model from a relational model?

-

On June 1, John Sullivan opened a real estate office in Hamilton called Sullivan Realty. The following transactions were completed for the month of June. Note that facsimile documents have been...

-

Our company has been acquired by another and will now have the money it needs to begin and expand its original goals. You, the Communication Officer, and your team must create a communication plan....

-

Corporation sells 66,000 iPhone covers each year. These covers are sold evenly throughout the year. Ordering costs are 120 per order, and carrying costs are $11.00 per unit per year. What is the...

-

Do you think every employee of an organization must have organizational citizenship behavior to achieve its goal? Justify.

-

You are looking through a filter that makes the sun just barely visible to your eye. What is the optical depth of the filter?

-

A company is embarking on a "lean" initiative -- they plan to do more with less. The lean initiative will reduce inventory levels and reduce net working capital in the operation for each of the years...

-

Prepare the 2020 and 2021 common-size balance sheets for Just Dew It. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Just Dew...

-

Use the spot interest rates contained in the following table to calculate the forward interest rate between year 2 and year 4, F2,4- Years to Maturity 1 2 3 4 5 Spot Interest Rate 0.92% 1.12% 1.55%...

-

Write a paper about the Working relationship in the organization- collaboration within and outside the organization

-

The data set provided contains the data from Exercise 30 on the price of gas for 55 stations around San Francisco in January 2013. Create a stem-and-leaf display of the data. Point out any unusual...

-

The U.S. Department of Labor (www.bls.gov) collects data on the number of U.S. workers who are employed at or below the minimum wage. Here is a table showing the number of hourly workers by Age and...

-

As part of the human resource group of your company you are asked to summarize the educational levels of the 512 employees in your division. From company records, you find that 164 have no college...

-

A surface with \(N_{0}\) adsorption centers has \(N\left(\leq N_{0}ight)\) gas molecules adsorbed on it. Show that the chemical potential of the adsorbed molecules is given by \[ \mu=k T \ln...

-

Assuming that the latent heat of vaporization of water \(L_{\mathrm{V}}=2260 \mathrm{~kJ} / \mathrm{kg}\) is independent of temperature and the specific volume of the liquid phase is negligible...

-

Define a quantity \(J\) as \[ J=E-N \mu=T S-P V \] Show that for a system in the grand canonical ensemble \[ \overline{(\Delta J)^{2}}=k T^{2} C_{V}+\left\{\left(\frac{\partial U}{\partial...

Study smarter with the SolutionInn App