The City of Monroe maintains a Water and Sewer Fund to provide utility services to its...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

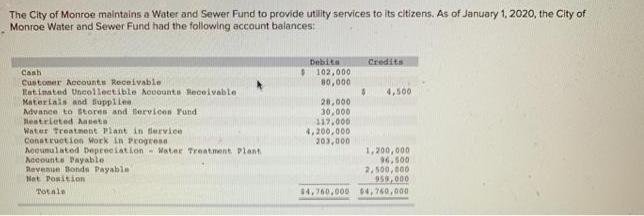

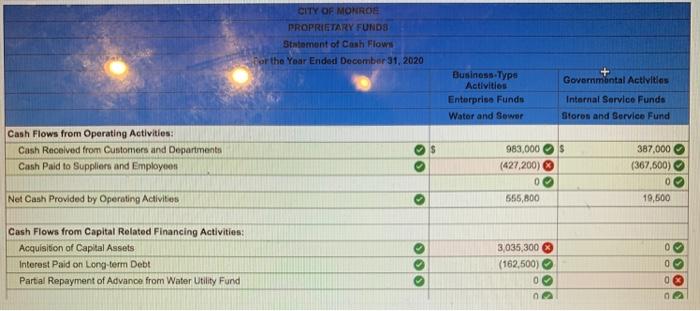

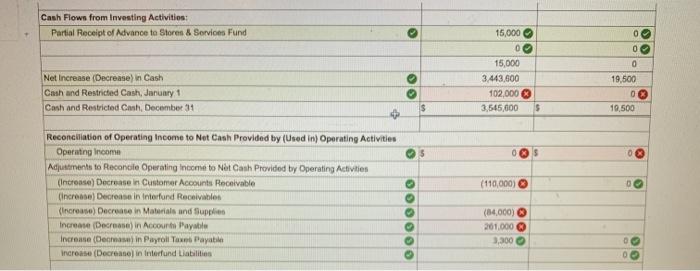

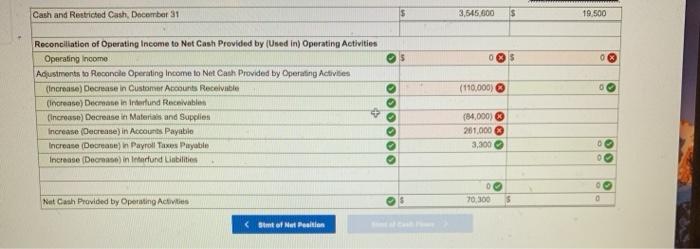

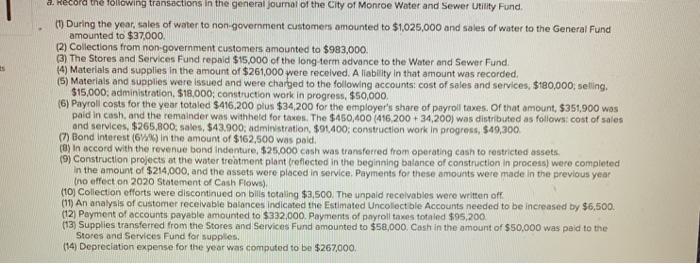

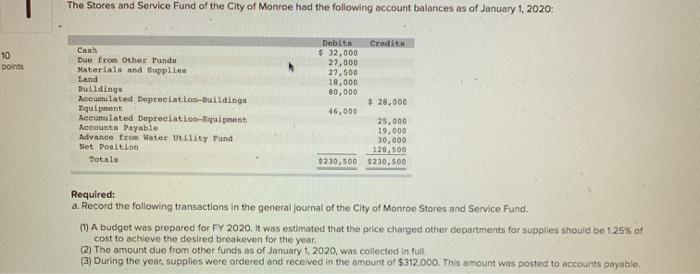

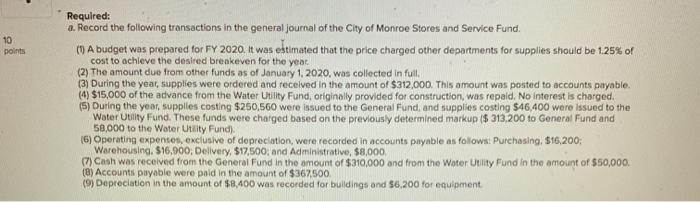

The City of Monroe maintains a Water and Sewer Fund to provide utility services to its citizens. As of January 1, 2020, the City of Monroe Water and Sewer Fund had the following account balances: Cash Customer Accounts Receivable Estimated Uncollectible Accounts Receivable Materials and Supplies Advance to stores and Services Fund Restricted Aaseta Water Treatment Plant in service Construction Work in Progress Accumulated Depreciation Water Treatment Plant Accounts Payable Revenue Bonds Payable Net Position Totale Debita $102,000 80,000 20,000 30,000 117,000 4,200,000 303,000 Credits $ 4,500 1,200,000 96,500 2,500,000 959,000 $4,760,000 $4,760,000 Cash Flows from Operating Activities: Cash Received from Customers and Departments Cash Paid to Suppliers and Employees Net Cash Provided by Operating Activities Cash Flows from Capital Related Financing Activities: Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Water Utility Fund CITY OF MONROE PROPRIETARY FUNDS Statement of Cash Flows For the Year Ended December 31, 2020 000 S Business-Type Activities Enterprise Funds Water and Sewer 983,000 $ (427,200) 00 555,800 3,035,300 (162,500) Governmental Activities Internal Service Funds Stores and Service Fund 00 07 387,000 (367,500) 0 19,500 00 00 00 D Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund Net Increase (Decrease) in Cash Cash and Restricted Cash, January 11 Cash and Restricted Cash, December 31 Reconciliation of Operating Income to Net Cash Provided by (Used in) Operating Activities Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities (Increase) Decrease in Customer Accounts Receivable (Increase) Decrease in Interfund Receivables (Increase) Decrease in Materials and Supplies Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities O • 000000 $ S 15,000 00 15,000 3,443,600 102,000 3,545,000 $ 0 ® (110,000) O (84,000) 261,000 O 3,300 00 00 0 19,500 00 19,500 00 DO 00 00 Cash and Restricted Cash, December 31 Reconciliation of Operating Income to Net Cash Provided by (Used in) Operating Activities Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities (Increase) Decrease in Customer Accounts Receivable (Increase) Decrease in Interfund Receivables (increase) Decrease in Materials and Supplies Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities Net Cash Provided by Operating Activities <Simt of Net Position * $ Os 000000 3,545,000 00$ (110,000) (84,000) 261,000 3,300 00 $ 70,300 19,500 00 DO 00 00 0 a. Record the following transactions in the general journal of the City of Monroe Water and Sewer Utility Fund. (1) During the year, sales of water to non-government customers amounted to $1,025,000 and sales of water to the General Fund amounted to $37,000. (2) Collections from non-government customers amounted to $983,000. (3) The Stores and Services Fund repaid $15,000 of the long-term advance to the Water and Sewer Fund. (4) Materials and supplies in the amount of $261,000 were received. A liability in that amount was recorded. (5) Materials and supplies were issued and were charged to the following accounts: cost of sales and services, $180,000, selling. $15,000; administration, $18,000; construction work in progress, $50,000. (6) Payroll costs for the year totaled $416,200 plus $34,200 for the employer's share of payroll taxes. Of that amount, $351,900 was paid in cash, and the remainder was withheld for taxes. The $450,400 (416,200+ 34,200) was distributed as follows: cost of sales and services, $265,800, sales, $43.900; administration, $91,400; construction work in progress, $49,300 (7) Bond interest (6%) in the amount of $162,500 was paid. (8) In accord with the revenue bond indenture, $25,000 cash was transferred from operating cash to restricted assets. (9) Construction projects at the water treatment plant (reflected in the beginning balance of construction in process) were completed i in the amount of $214,000, and the assets were placed in service. Payments for these amounts were made in the previous year (no effect on 2020 Statement of Cash Flows). (10) Collection efforts were discontinued on bills totaling $3,500. The unpaid receivables were written off. (11) An analysis of customer receivable balances indicated the Estimated Uncollectible Accounts needed to be increased by $6,500. (12) Payment of accounts payable amounted to $332,000. Payments of payroll taxes totaled $95,200 (13) Supplies transferred from the Stores and Services Fund amounted to $58,000. Cash in the amount of $50,000 was paid to the Stores and Services Fund for supplies. (14) Depreciation expense for the year was computed to be $267,000. 10 points The Stores and Service Fund of the City of Monroe had the following account balances as of January 1, 2020: Cash Due from Other Funds Materials and Supplies Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Advance from Water Utility Fund Net Position Totals Debits $ 32,000 27,000 27,500 18,000 80,000 46,000 Credits $ 28,000 25,000 19,000 30,000 120,500 $230,500 $230,500 Required: a. Record the following transactions in the general journal of the City of Monroe Stores and Service Fund. (1) A budget was prepared for FY 2020. It was estimated that the price charged other departments for supplies should be 1.25% of cost to achieve the desired breakeven for the year. (2) The amount due from other funds as of January 1, 2020, was collected in full. (3) During the year, supplies were ordered and received in the amount of $312,000. This amount was posted to accounts payable. 10 points Required: a. Record the following transactions in the general journal of the City of Monroe Stores and Service Fund. (1) A budget was prepared for FY 2020. It was estimated that the price charged other departments for supplies should be 1.25% of cost to achieve the desired breakeven for the year. (2) The amount due from other funds as of January 1, 2020, was collected in full.. (3) During the year, supplies were ordered and received in the amount of $312,000. This amount was posted to accounts payable. (4) $15,000 of the advance from the Water Utility Fund, originally provided for construction, was repaid. No interest is charged. (5) During the year, supplies costing $250,560 were issued to the General Fund, and supplies costing $46,400 were issued to the Water Utility Fund. These funds were charged based on the previously determined markup ($ 313,200 to General Fund and 58,000 to the Water Utility Fund). (6) Operating expenses, exclusive of depreciation, were recorded in accounts payable as follows: Purchasing, $16,200; Warehousing, $16,900; Delivery, $17,500; and Administrative, $8,000. (7) Cash was received from the General Fund in the amount of $310,000 and from the Water Utility Fund in the amount of $50,000. (8) Accounts payable were paid in the amount of $367,500. (9) Depreciation in the amount of $8,400 was recorded for buildings and $6,200 for equipment The City of Monroe maintains a Water and Sewer Fund to provide utility services to its citizens. As of January 1, 2020, the City of Monroe Water and Sewer Fund had the following account balances: Cash Customer Accounts Receivable Estimated Uncollectible Accounts Receivable Materials and Supplies Advance to stores and Services Fund Restricted Aaseta Water Treatment Plant in service Construction Work in Progress Accumulated Depreciation Water Treatment Plant Accounts Payable Revenue Bonds Payable Net Position Totale Debita $102,000 80,000 20,000 30,000 117,000 4,200,000 303,000 Credits $ 4,500 1,200,000 96,500 2,500,000 959,000 $4,760,000 $4,760,000 Cash Flows from Operating Activities: Cash Received from Customers and Departments Cash Paid to Suppliers and Employees Net Cash Provided by Operating Activities Cash Flows from Capital Related Financing Activities: Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Water Utility Fund CITY OF MONROE PROPRIETARY FUNDS Statement of Cash Flows For the Year Ended December 31, 2020 000 S Business-Type Activities Enterprise Funds Water and Sewer 983,000 $ (427,200) 00 555,800 3,035,300 (162,500) Governmental Activities Internal Service Funds Stores and Service Fund 00 07 387,000 (367,500) 0 19,500 00 00 00 D Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund Net Increase (Decrease) in Cash Cash and Restricted Cash, January 11 Cash and Restricted Cash, December 31 Reconciliation of Operating Income to Net Cash Provided by (Used in) Operating Activities Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities (Increase) Decrease in Customer Accounts Receivable (Increase) Decrease in Interfund Receivables (Increase) Decrease in Materials and Supplies Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities O • 000000 $ S 15,000 00 15,000 3,443,600 102,000 3,545,000 $ 0 ® (110,000) O (84,000) 261,000 O 3,300 00 00 0 19,500 00 19,500 00 DO 00 00 Cash and Restricted Cash, December 31 Reconciliation of Operating Income to Net Cash Provided by (Used in) Operating Activities Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities (Increase) Decrease in Customer Accounts Receivable (Increase) Decrease in Interfund Receivables (increase) Decrease in Materials and Supplies Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities Net Cash Provided by Operating Activities <Simt of Net Position * $ Os 000000 3,545,000 00$ (110,000) (84,000) 261,000 3,300 00 $ 70,300 19,500 00 DO 00 00 0 a. Record the following transactions in the general journal of the City of Monroe Water and Sewer Utility Fund. (1) During the year, sales of water to non-government customers amounted to $1,025,000 and sales of water to the General Fund amounted to $37,000. (2) Collections from non-government customers amounted to $983,000. (3) The Stores and Services Fund repaid $15,000 of the long-term advance to the Water and Sewer Fund. (4) Materials and supplies in the amount of $261,000 were received. A liability in that amount was recorded. (5) Materials and supplies were issued and were charged to the following accounts: cost of sales and services, $180,000, selling. $15,000; administration, $18,000; construction work in progress, $50,000. (6) Payroll costs for the year totaled $416,200 plus $34,200 for the employer's share of payroll taxes. Of that amount, $351,900 was paid in cash, and the remainder was withheld for taxes. The $450,400 (416,200+ 34,200) was distributed as follows: cost of sales and services, $265,800, sales, $43.900; administration, $91,400; construction work in progress, $49,300 (7) Bond interest (6%) in the amount of $162,500 was paid. (8) In accord with the revenue bond indenture, $25,000 cash was transferred from operating cash to restricted assets. (9) Construction projects at the water treatment plant (reflected in the beginning balance of construction in process) were completed i in the amount of $214,000, and the assets were placed in service. Payments for these amounts were made in the previous year (no effect on 2020 Statement of Cash Flows). (10) Collection efforts were discontinued on bills totaling $3,500. The unpaid receivables were written off. (11) An analysis of customer receivable balances indicated the Estimated Uncollectible Accounts needed to be increased by $6,500. (12) Payment of accounts payable amounted to $332,000. Payments of payroll taxes totaled $95,200 (13) Supplies transferred from the Stores and Services Fund amounted to $58,000. Cash in the amount of $50,000 was paid to the Stores and Services Fund for supplies. (14) Depreciation expense for the year was computed to be $267,000. 10 points The Stores and Service Fund of the City of Monroe had the following account balances as of January 1, 2020: Cash Due from Other Funds Materials and Supplies Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Advance from Water Utility Fund Net Position Totals Debits $ 32,000 27,000 27,500 18,000 80,000 46,000 Credits $ 28,000 25,000 19,000 30,000 120,500 $230,500 $230,500 Required: a. Record the following transactions in the general journal of the City of Monroe Stores and Service Fund. (1) A budget was prepared for FY 2020. It was estimated that the price charged other departments for supplies should be 1.25% of cost to achieve the desired breakeven for the year. (2) The amount due from other funds as of January 1, 2020, was collected in full. (3) During the year, supplies were ordered and received in the amount of $312,000. This amount was posted to accounts payable. 10 points Required: a. Record the following transactions in the general journal of the City of Monroe Stores and Service Fund. (1) A budget was prepared for FY 2020. It was estimated that the price charged other departments for supplies should be 1.25% of cost to achieve the desired breakeven for the year. (2) The amount due from other funds as of January 1, 2020, was collected in full.. (3) During the year, supplies were ordered and received in the amount of $312,000. This amount was posted to accounts payable. (4) $15,000 of the advance from the Water Utility Fund, originally provided for construction, was repaid. No interest is charged. (5) During the year, supplies costing $250,560 were issued to the General Fund, and supplies costing $46,400 were issued to the Water Utility Fund. These funds were charged based on the previously determined markup ($ 313,200 to General Fund and 58,000 to the Water Utility Fund). (6) Operating expenses, exclusive of depreciation, were recorded in accounts payable as follows: Purchasing, $16,200; Warehousing, $16,900; Delivery, $17,500; and Administrative, $8,000. (7) Cash was received from the General Fund in the amount of $310,000 and from the Water Utility Fund in the amount of $50,000. (8) Accounts payable were paid in the amount of $367,500. (9) Depreciation in the amount of $8,400 was recorded for buildings and $6,200 for equipment

Expert Answer:

Answer rating: 100% (QA)

CITY OF MONROE PROPRETARY FUNDS Statement of Cash Flows For the Year Ended December 312020 BusinessType Activities Governmental Activities Enterprise Funds Internal service Funds Water and Sewer Store... View the full answer

Related Book For

Financial Accounting

ISBN: 978-0470507018

7th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Posted Date:

Students also viewed these accounting questions

-

The following cash data for the year ended December 31 were adapted from a recent annual report of Alphabet (GOOG), formerly known as Google. The cash balance as of January 1 was $12,918 (in...

-

The income statement for Delta-tec Inc. for the year ended December 31, 2016, was as follows: Delta-tec Inc. Income Statement (selected items) For the Year Ended December 31, 2016 1 Income from...

-

The following cash data for the year ended December 31 were adapted from a recent annual report of Alphabet (GOOG), formerly known as Google. The cash balance as of January 1 was $18,347 (in...

-

The roller coaster in Figure P6.36 starts with a velocity of 15 m/s. One of the riders is a small girl of mass 30 kg. Find her apparent weight when the roller coaster is at locations B and C. At...

-

The Morris-Thompson protection scheme with n-bit random numbers (salt) was designed to make it difficult for an intruder to discover a large number of passwords by encrypting common strings in...

-

A monthly depositor has accumulated $110,000 in fica and federal income taxes in their payable account as of July. 31. Which of the follow would be correct? Group of answer choices No deposit is...

-

What elements must be proven in order to be successful in a negligence suit? Illustrate your answer with a case (the facts of the case can be hypothetical).

-

Lighthouse Company anticipates total sales for June and July of $ 420,000 and $ 398,000, respectively. Cash sales are normally 60% of total sales. Of the credit sales, 20% are collected in the same...

-

Consider the following graph and the heuristic values of each state. The start state is S and the only goal state is G. B E S A Heuristic BCD E G 6 0 6 4 1 10 0 a) What path would uniform cost graph...

-

Do high school programs that emphasize science, technology, engineering and mathematics (STEM) lead to jobs? This was a question of interest in the second Longitudinal Study of Young People in...

-

Get Hitched Inc. is a production company that is in the process of testing a strategic initiative aimed at increasing gross profit. The companys current sales revenue is $2,100,000. Currently, the...

-

How many 13167= Gm3 are in 2.58 x 109 mL. ballpark: 3x10-14 Gm ZONE DEOJUE

-

3. Using the standard reduction potentials, decide if the following reaction will occur, (a) the reaction 2Fe+ (aq) + 21 (aq) - 2Fe+ (aq) + 1(s) will occur. (b) Fe(s) will be oxidized to Fe+ by...

-

2 H(g) + O(g) --> 2 HO(g) AHf of HO(g) = -241.8 kJ/mol Calculate the minimum mass (in grams) of oxygen gas required to produce 226.4 kJ of heat.

-

An X - ray photon with a wavelength of 0 . 9 9 5 nm strikes a surface. The emitted electron has a kinetic energy of 9 5 7 eV . What is the binding energy of the electron in kJ / mol ? [ Note that KE...

-

Curved arrows are used to illustrate the flow of electrons. Using the provided starting and product structures, draw the curved electron-pushing arrows for the following reaction or mechanistic...

-

5. A solid is bounded below the sphere x + y+z2 plane z = 2, with density 8(x, y, z) = M 1 2 4z and above the and mass m = 2. Use spherical coordinate to find z, which is the z-coordinate of the...

-

What impact has the Internet had on the globalization of small firms? How do you think small companies will use the Internet for business in the future?

-

Great Plains Accounting is one of the leading accounting software packages. Information related to this package is found at its website. Address: www.microsoft.com/dynamics/gp/product/demos.mspx, or...

-

Graves Drug Store has four employees who are paid on an hourly basis plus time-and a half for all hours worked in excess of 40 a week. Payroll data for the week ended February 15, 2011, are presented...

-

Jim Thome has prepared the following list of statements about bonds. 1. Bonds are a form of interest-bearing notes payable. 2. When seeking long-term financing, an advantage of issuing bonds over...

-

The circuit in Figure P32.96 represents your planned design for a wall power supply that will run a radio that usually runs on a 9-V battery. The power supply uses a transformer (not shown) to...

-

Your boss has purchased a new AC power source to run a high-voltage, low-current display, but it is not working. While he is fuming, you look at the owner's manual and discover that this power source...

-

Construct a phasor diagram representing the current and potential difference in Figure 32. 10 at \(t=T / 4, T / 2\), and \(3 T / 4\). Data from Figure 32.10 Ve maximum, current zero Ve minimum,...

Study smarter with the SolutionInn App