b. Whizz Bhd, a manufacturing company entered into a cash-settled share-based payment to acquire equipment from...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

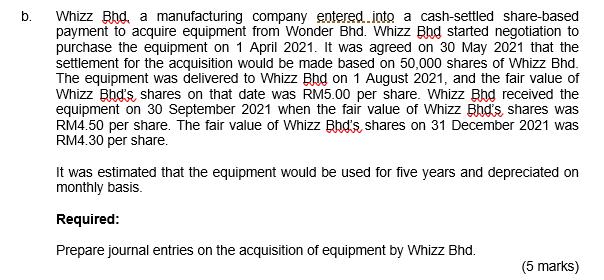

b. Whizz Bhd, a manufacturing company entered into a cash-settled share-based payment to acquire equipment from Wonder Bhd. Whizz Bhd started negotiation to purchase the equipment on 1 April 2021. It was agreed on 30 May 2021 that the settlement for the acquisition would be made based on 50,000 shares of Whizz Bhd. The equipment was delivered to Whizz Bhd on 1 August 2021, and the fair value of Whizz Bhd's, shares on that date was RM5.00 per share. Whizz Bhd received the equipment on 30 September 2021 when the fair value of Whizz Bhd's, shares was RM4.50 per share. The fair value of Whizz Bhd's, shares on 31 December 2021 was RM4.30 per share. It was estimated that the equipment would be used for five years and depreciated on monthly basis. Required: Prepare journal entries on the acquisition of equipment by Whizz Bhd. (5 marks) b. Whizz Bhd, a manufacturing company entered into a cash-settled share-based payment to acquire equipment from Wonder Bhd. Whizz Bhd started negotiation to purchase the equipment on 1 April 2021. It was agreed on 30 May 2021 that the settlement for the acquisition would be made based on 50,000 shares of Whizz Bhd. The equipment was delivered to Whizz Bhd on 1 August 2021, and the fair value of Whizz Bhd's, shares on that date was RM5.00 per share. Whizz Bhd received the equipment on 30 September 2021 when the fair value of Whizz Bhd's, shares was RM4.50 per share. The fair value of Whizz Bhd's, shares on 31 December 2021 was RM4.30 per share. It was estimated that the equipment would be used for five years and depreciated on monthly basis. Required: Prepare journal entries on the acquisition of equipment by Whizz Bhd. (5 marks)

Expert Answer:

Answer rating: 100% (QA)

In the given case the acquisition should be recorded ... View the full answer

Related Book For

Operations Management Creating Value Along the Supply Chain

ISBN: 978-0470525906

7th Edition

Authors: Roberta S. Russell, Bernard W. Taylor

Posted Date:

Students also viewed these accounting questions

-

As part of its effort to schedule television coverage for its major events, the ATP (Association of Tennis Professionals) keeps track of match times in tournaments. The organization has found that...

-

In its year-end earnings announcement press release, Ransome Corp. announced that its earnings increased by SI 5 million relative to the previous year. This represented a 20% increase. Inspection of...

-

John Fuji (age 37) moved from California to Washington in December 2011. He lives at 468 Cameo Street, Yakima, WA 98901. John's Social Security number is 571-78-5974 and he is single. His earnings...

-

The following selected financial information was obtained from the 2012 financial reports of Robotranics, Inc. and Technology, Limited: Assume that total assets, total liabilities, and total...

-

Use a word processing thesaurus to select short words to replace these long words.

-

Receivables Costs what costs are associated with carrying receivables? What costs are associated with not granting credit? What do we call the sum of the costs for different levels of receivables?

-

Beng-Yu Woo, Xiaoming Li, and Vivian Hsiun created and patented an invention titled Full Duplex Single Chip Video Codec. At the time, Woo, Li, and Hsiun were employees of Infochips Systems, Inc....

-

The Molokai Nut Company (MNC) makes four different products from macadamia nuts grown in the Hawaiian Islands: chocolate-coated whole nuts (Whole), chocolate-coated nut clusters (Cluster),...

-

Instructions: Place the six steps of the accounting cycle in the correct order. Rank the options below. Prepare financial statements.Prepare financial statements. open choices for ranking No answer...

-

On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,780 in assets in exchange for its common stock to launch the business. On December 31, the company's...

-

In communicating technical information, one needs to use illustrations either in addition to words or instead of words to convey the message. See the below given illustration of circle graph and...

-

Our common law system involves the application of legal principles applied in earlier cases a. with different facts. b. with similar facts. c. whether or not the facts are similar. d. none of the...

-

What are some of the remedies that a party can obtain from a court to make a wrong situation right?

-

Consideration, in contract terms, refers to a partys competency to enter into a contract. (True/False)

-

To learn about the coverage of a statute and how the statute is applied, a person must a. only read the statute. b. only see how courts in their jurisdiction have interpreted the statute. c. read the...

-

For each of the business transactions listed below, you are to enter in the Workbook: a the account name, with debit account first b if the account entry is a debit or credit c the chart of account...

-

Bayesian Networks, Netica (12+14+22+3+1x 10+ 7 = 40 marks) Expand the Bayes Net you developed in the BN tutorial (available on moodle under the name SmokeAlarm.dne) to include three more events:...

-

(a) Explain why the concentration of dissolved oxygen in freshwater is an important indicator of the quality of the water. (b) How is the solubility of oxygen in water affected by increasing...

-

What type of layout(s) would be appropriate for: a. A grocery store? b. Home construction? c. Electronics assembly? d. A university?

-

Schedule the wait staff at Vincents Restaurant based on the following estimates of demand. Each employee should have two or more days off perweek. Days of the Week M T W Th F Sa Su Employees Needed 2...

-

What does a learning curve specifically measure?

-

Why does spreading feet apart help a surfer stay on the board?

-

If you stood atop a super-tall ladder three times as far from Earths center as at Earths surface, how would your weight compare with it present value?

-

How was Pioneer 10 able to escape the solar system with an initial speed less than escape speed?

Study smarter with the SolutionInn App