GoldSands specialises in manufacturing chocolates for wholesale customers. The following are the operating data of GoldSands...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

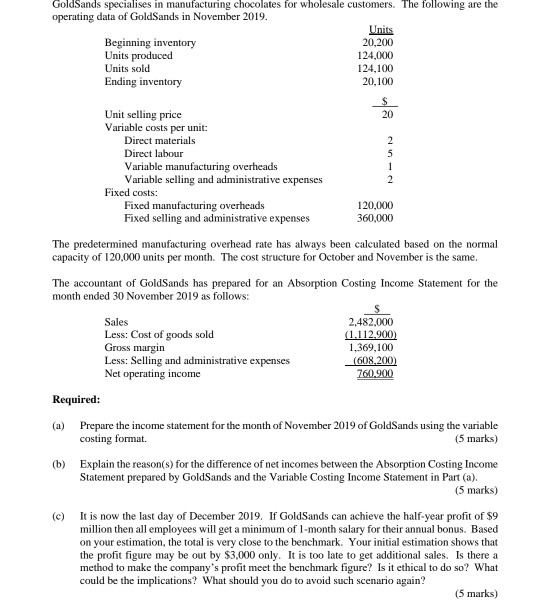

GoldSands specialises in manufacturing chocolates for wholesale customers. The following are the operating data of GoldSands in November 2019. Beginning inventory Units produced Units sold Ending inventory Unit selling price Variable costs per unit: Direct materials Direct labour Variable manufacturing overheads Variable selling and administrative expenses Fixed costs: Fixed manufacturing overheads Fixed selling and administrative expenses Units 20,200 124,000 124,100 20,100 Sales Less: Cost of goods sold Gross margin Less: Selling and administrative expenses Net operating income 20 5 1 120,000 360,000 The predetermined manufacturing overhead rate has always been calculated based on the normal capacity of 120,000 units per month. The cost structure for October and November is the same. The accountant of GoldSands has prepared for an Absorption Costing Income Statement for the month ended 30 November 2019 as follows: 2,482,000 (1.112.900) 1,369,100 (608,200) 760.900 Required: Prepare the income statement for the month of November 2019 of GoldSands using the variable costing format. (5 marks) (b) Explain the reason(s) for the difference of net incomes between the Absorption Costing Income Statement prepared by GoldSands and the Variable Costing Income Statement in Part (a). (5 marks) It is now the last day of December 2019. If GoldSands can achieve the half-year profit of $9 million then all employees will get a minimum of 1-month salary for their annual bonus. Based on your estimation, the total is very close to the benchmark. Your initial estimation shows that the profit figure may be out by $3,000 only. It is too late to get additional sales. Is there a method to make the company's profit meet the benchmark figure? Is it ethical to do so? What could be the implications? What should you do to avoid such scenario again? (5 marks) GoldSands specialises in manufacturing chocolates for wholesale customers. The following are the operating data of GoldSands in November 2019. Beginning inventory Units produced Units sold Ending inventory Unit selling price Variable costs per unit: Direct materials Direct labour Variable manufacturing overheads Variable selling and administrative expenses Fixed costs: Fixed manufacturing overheads Fixed selling and administrative expenses Units 20,200 124,000 124,100 20,100 Sales Less: Cost of goods sold Gross margin Less: Selling and administrative expenses Net operating income 20 5 1 120,000 360,000 The predetermined manufacturing overhead rate has always been calculated based on the normal capacity of 120,000 units per month. The cost structure for October and November is the same. The accountant of GoldSands has prepared for an Absorption Costing Income Statement for the month ended 30 November 2019 as follows: 2,482,000 (1.112.900) 1,369,100 (608,200) 760.900 Required: Prepare the income statement for the month of November 2019 of GoldSands using the variable costing format. (5 marks) (b) Explain the reason(s) for the difference of net incomes between the Absorption Costing Income Statement prepared by GoldSands and the Variable Costing Income Statement in Part (a). (5 marks) It is now the last day of December 2019. If GoldSands can achieve the half-year profit of $9 million then all employees will get a minimum of 1-month salary for their annual bonus. Based on your estimation, the total is very close to the benchmark. Your initial estimation shows that the profit figure may be out by $3,000 only. It is too late to get additional sales. Is there a method to make the company's profit meet the benchmark figure? Is it ethical to do so? What could be the implications? What should you do to avoid such scenario again? (5 marks)

Expert Answer:

Answer rating: 100% (QA)

a INCOME STATEMENT VARIABLE COSTING FORMAT Sales Revenue 2482000 12410020 Variable Costs Direct ... View the full answer

Related Book For

Financial Accounting

ISBN: 978-0324645576

10th edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice

Posted Date:

Students also viewed these accounting questions

-

The following are selected operating data for the production and service departments of Bluestone Company for 2016. Departments Service Production 1 2 1 2 Overhead costs (identified by department)...

-

The Tilots Corporations segmented absorption costing income statement for the last quarter for its three metropolitan stores is given below: Management is very concerned about the Downtown Stores...

-

R B The graph of y = G av 2 + 1 2 -1 cv 22. bv 2+1 2 is shown in black (K). Match each equation with a graph above. a. red (R) b. green (G) c. orange (0) d. blue (B)

-

The Cano Company is decentralized, and divisions are considered investment centers. Cano has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division...

-

A person's cholesterol level C can be measured by three different tests. Test-a returns a value Xa with a mean C and a standard deviation 1.2, test- returns a value X with a mean C and a standard...

-

We have a digital medium with a data rate of 10 Mbps. How many 64-kbps voice channels can be carried by this medium if we use DSSS with the Barker sequence?

-

A project has been selected for implementation. The net cash flow (NCF) profile associated with the project is shown below. MARR is 10 percent/year. a. What is the annual worth of this investment? b....

-

In January 2012, the management of Sarah Company concludes that it has sufficient cash to purchase some short-term investments in debt and stock securities. During the year, the following...

-

What will be the output from the following code? void myFunction(int &b){ } b = 1; int main(){ int a = 0; cout < < a < < " "; myFunction(a); cout < < a; return 0; }

-

Determine V o in the circuit in Fig. 2.80. 14 2 16 2 25 V Vo 10 V +,

-

The following select balances are from Muin Co's year end 2019 financial statements: Common Shares $680,000 Preferred Shares $300,000 Retained Earnings $380,000 At the end of 2020 the company had...

-

10. Consider a square plate of length 1=400 m. The plate has N = 36 uniformly distributed circular holes, each hole of a radius ro = 4 m. (a) Find the ratio of the SQFD coefficient of the perforated...

-

Create an application that calculates the Body Mass Index (BMI) of a person. The application should get the height and mass of the person and show the result in the second activity. Regarding the...

-

What are some good sources to learning about debt management?

-

A2.class program will read a text file named "A2.input", and produce a file named "A2.output" which contains following five lines: identifiers : NumberOfIdentifiers keywords : NumberOfKeyowrds...

-

7. In a single subject experimental design, you measure an observed behavior during a baseline and then a treatment period. What is the purpose of using a reversal design (i.e., including another...

-

Item 1 - When the financial controller was providing details on the employee share schemes at Knappa, it was identified that share options granted to the production staff on 1 July 2 0 2 2 were not...

-

Phosgene, COCl2, is a toxic gas used in the manufacture of urethane plastics. The gas dissociates at high temperature. At 400oC, the equilibrium constant Kc is 8.05 104. Find the percentage of...

-

Refer to PE 4-16. Using the adjusted trial balance prepared in part (2), prepare an income statement for the year. PE 4-16 Before any adjusting entries were made, the company prepared the following...

-

Refer to the data in PE 6-10. Assume that one customer, whose account had previously been written off, returned from exile in the Bahamas and paid his account of $7,000. Make the journal entry or...

-

What is the Foreign Corrupt Practices Act, and how is it important to financial reporting?

-

The volume control on a stereo is designed so that three clicks of the dial increase the output by \(10 \mathrm{~dB}\). How many clicks are required to increase the power output of the loudspeakers...

-

Some bat species have auditory systems that work best over a narrow range of frequencies. To account for this, the bats adjust the sound frequencies they emit so that the returning, Doppler shifted...

-

A laser beam has intensity \(I_{0}\). a. What is the intensity, in terms of \(I_{0}\), if a lens focuses the laser beam to \(1 / 10\) its initial diameter? b. What is the intensity, in terms of...

Study smarter with the SolutionInn App