I want you to fill in the blanks and show formulas. please let me know if you

Fantastic news! We've Found the answer you've been seeking!

Question:

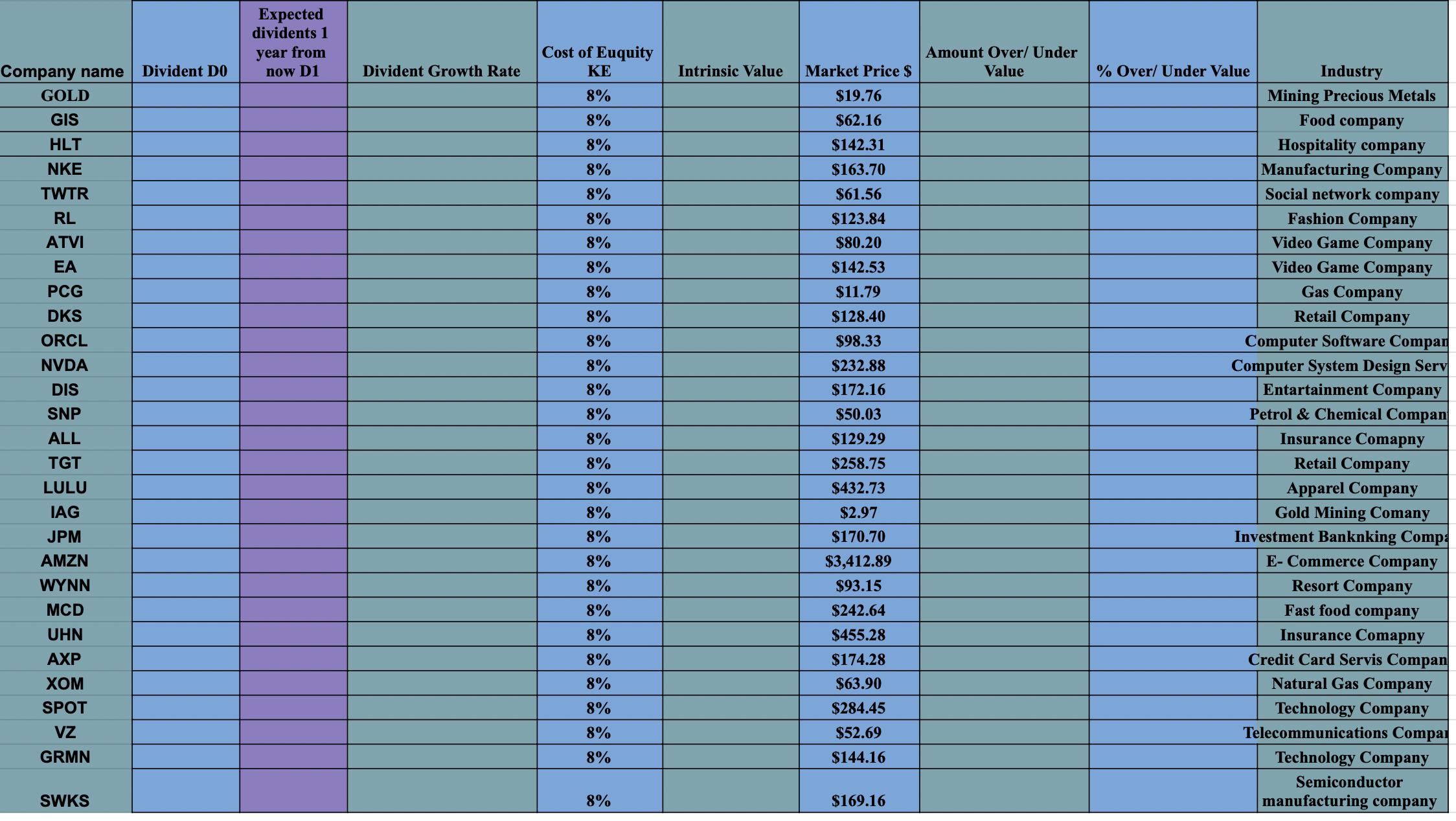

I want you to fill in the blanks and show formulas.

please let me know if you need anything that I have missed to give. some of them are in google

Transcribed Image Text:

Company name Divident DO GOLD GIS HLT NKE TWTR RL ATVI EA PCG DKS ORCL NVDA DIS SNP ALL TGT LULU IAG JPM AMZN WYNN MCD UHN AXP XOM SPOT VZ GRMN SWKS Expected dividents 1 year from now D1 Divident Growth Rate Cost of Euquity KE 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% Intrinsic Value Market Price $ $19.76 $62.16 $142.31 $163.70 $61.56 $123.84 $80.20 $142.53 $11.79 $128.40 $98.33 $232.88 $172.16 $50.03 $129.29 $258.75 $432.73 $2.97 $170.70 $3,412.89 $93.15 $242.64 $455.28 $174.28 $63.90 $284.45 $52.69 $144.16 $169.16 Amount Over/Under Value % Over/Under Value Industry Mining Precious Metals Food company Hospitality company Manufacturing Company Social network company Fashion Company Video Game Company Video Game Company Gas Company Retail Company Computer Software Compan Computer System Design Serv Entertainment Company Petrol & Chemical Compan Insurance Comapny Retail Company Apparel Company Gold Mining Comany Investment Banknking Compa E-Commerce Company Resort Company Fast food company Insurance Comapny Credit Card Servis Compan Natural Gas Company Technology Company Telecommunications Compar Technology Company manufacturing company Semiconductor Company name Divident DO GOLD GIS HLT NKE TWTR RL ATVI EA PCG DKS ORCL NVDA DIS SNP ALL TGT LULU IAG JPM AMZN WYNN MCD UHN AXP XOM SPOT VZ GRMN SWKS Expected dividents 1 year from now D1 Divident Growth Rate Cost of Euquity KE 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% 8% Intrinsic Value Market Price $ $19.76 $62.16 $142.31 $163.70 $61.56 $123.84 $80.20 $142.53 $11.79 $128.40 $98.33 $232.88 $172.16 $50.03 $129.29 $258.75 $432.73 $2.97 $170.70 $3,412.89 $93.15 $242.64 $455.28 $174.28 $63.90 $284.45 $52.69 $144.16 $169.16 Amount Over/Under Value % Over/Under Value Industry Mining Precious Metals Food company Hospitality company Manufacturing Company Social network company Fashion Company Video Game Company Video Game Company Gas Company Retail Company Computer Software Compan Computer System Design Serv Entertainment Company Petrol & Chemical Compan Insurance Comapny Retail Company Apparel Company Gold Mining Comany Investment Banknking Compa E-Commerce Company Resort Company Fast food company Insurance Comapny Credit Card Servis Compan Natural Gas Company Technology Company Telecommunications Compar Technology Company manufacturing company Semiconductor

Expert Answer:

Answer rating: 100% (QA)

here is the table in Excel The formulas used in the table are as follows DI Expected dividends 1 yea... View the full answer

Posted Date:

Students also viewed these finance questions

-

Based on the business idea created (cleaning service) I need to answer the following questions: Please prepare the Master Budget for the first establishment and operation year. - Provide details and...

-

Fill in the blanks 1. sin 2u = ______ 2. cos 2u = ______ 3. sin u cos v = ______ 4. 1 --- cos 2u / 1 + cos 2u = __________ 5. sin u / 2 =____________ 6. cos u cos v = ______

-

Fill in the blanks with an appropriate word, phrase, or symbol(s). The following Euler diagram represents the statement _________ As are Bs. U A

-

Energy of the emitted photon when an L-electron drops into the k-state in copper (z = 29) is -1 use R=109737 cm, cm =1.23910eV] 7994.6 eV 1094.6 eV 1293.6 eV 1097.3 eV

-

How do dividends and interest expense differ?

-

Donna Shader, manager of the Winter Park Hotel, is considering how to restructure the front desk to reach an optimum level of staff efficiency and guest service. At present, the hotel has five clerks...

-

In Figure 10.10, the ball's instantaneous velocity \(\vec{v}\) does not point in the same direction as the displacement \(\Delta \vec{r}\) (it points above the final position of the ball). Why?...

-

Garry Pipers rich uncle gave him $80,000 cash as a gift for his 40th birthday. Unlike his spoiled cousins who spend money carelessly, Mr. Piper wants to invest the money for his future retirement....

-

The Power of Trade and Comparative Advantage: Work It Out 3 ? Here's another specialization and exchange problem. This problem is wholly made-up, ? so that you won't be able to use your intuition...

-

Analyze the effect of the following errors on the net profit figures of Yokahama Trading Company (YTC) for 20X0 and 20X1. Choose one of three answers: understated (U), overstated (O), or no effect...

-

Movements for month of August for company "Devolucion PLC" are as follows: Date Movements N Units Unit cost Selling Price Total $ 08/01/10 Initial Inventory 100 75 $7,500 08/03/10 Purchase 50 70...

-

3. An antenna on a ground station can be geometrically approximated by a 60cm diameter sphere mounted on a 0.15m diameter cylinder 1.95m long. Estimate the bending moment to the root of the cylinder...

-

Part A I Can dimensional analysis determine whether the area of a circle is or 2? yes no Submit Request Answer Part B Complete previous part(s)

-

-28.1 x 10-6 C 91 Find the net force on 9. +25.5 x 106 C + 92 0.300 m 0.300 m F = force exerted on 92 by 91 F3 = force exerted on 92 by 93 F3 = N [F= F = [?] N Remember: Like charges repel; opposite...

-

A 4900 resistor is connected across a charged 0.850 nF capacitor. The initial current through the resistor, just after the connection is made, is measured to be 0.271 A. Part A What magnitude of...

-

Suppose the student in (Figure 1) is 58kg, and the board being stood on has a 12kg mass. Figure 1.5 m 2.0 m 1 of 1 Part A What is the reading on the left scale? Express your answer in newtons. mleft...

-

The Equal Employment Opportunity Commission ( ( EEOC ) ) does not allow discrimination in hiring except in the case of _ _ _ _ _ _ _ _ _ _ . _ _ _ _ _ _ _ _ _ _ . Question 2 2 options: a ) ) bona...

-

Represent each of the following combination of units in the correct SI form using an appropriate prefix: (a) m/ms, (b) k m, (c) k s /mg, and (d) k m N.

-

Consider the feedback system shown in Figure 10.26. a. Using Routh's stability criterion, determine the range of the control gain \(K\) for which the closed-loop system is stable. b. Use MATLAB...

-

Figure 10.40 shows a negative feedback control system. a. Design a P controller such that the damping ratio of the closed-loop system is 0.5 . b. Estimate the rise time, overshoot, and \(2 \%\)...

-

The transfer function of a dynamic system is given by \[G(s)=\frac{s+1}{4 s^{4}+5 s^{3}+2 s^{2}+s+6} \] a. Using Routh's stability criterion, determine the stability of the system. b. Using MATLAB,...

Study smarter with the SolutionInn App