In this problem we merge two models of disclosure considered in the lecture. The manager maximizes...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

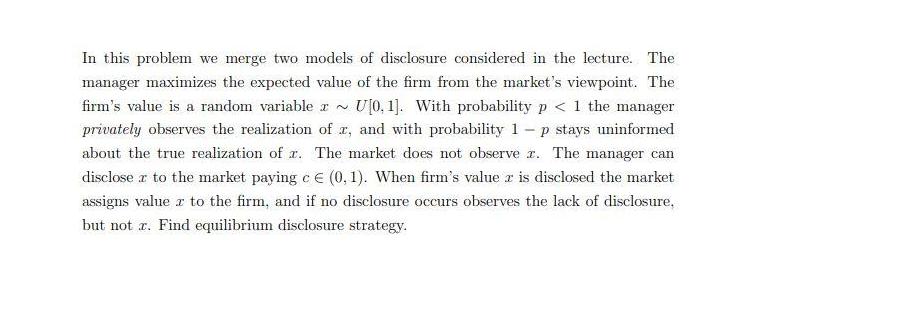

In this problem we merge two models of disclosure considered in the lecture. The manager maximizes the expected value of the firm from the market's viewpoint. The firm's value is a random variable ~ U[0, 1]. With probability p < 1 the manager privately observes the realization of x, and with probability 1 p stays uninformed about the true realization of r. The market does not observe z. The manager can discloser to the market paying c € (0, 1). When firm's value z is disclosed the market assigns value to the firm, and if no disclosure occurs observes the lack of disclosure. but not r. Find equilibrium disclosure strategy. In this problem we merge two models of disclosure considered in the lecture. The manager maximizes the expected value of the firm from the market's viewpoint. The firm's value is a random variable ~ U[0, 1]. With probability p < 1 the manager privately observes the realization of x, and with probability 1 p stays uninformed about the true realization of r. The market does not observe z. The manager can discloser to the market paying c € (0, 1). When firm's value z is disclosed the market assigns value to the firm, and if no disclosure occurs observes the lack of disclosure. but not r. Find equilibrium disclosure strategy.

Expert Answer:

Answer rating: 100% (QA)

In this problem the manager is trying to maximize the expected value of the firm from the markets ... View the full answer

Related Book For

Introduction to Corporate Finance

ISBN: 978-0324657937

2nd edition

Authors: Scott B. Smart, William L Megginson

Posted Date:

Students also viewed these finance questions

-

In this problem we investigate whether either UDP or TCP provides a degree of end-point authentication. a. Consider a server that receives a request within a UDP packet and responds to that request...

-

In this problem we consider annual U.S. lumber production over 30 years. The data were obtained from the U.S. Department of Commerce Survey of Current Business and are presented in Table 16.5 a. Plot...

-

The concentration of a reactant is a random variable with probability density function a. What is the probability that the concentration is greater than 0.5? b. Find the mean concentration. c. Find...

-

A bond has an expected return of 15.33%, sensitivity to the term factor of 1.95 and to the default factor of 0.65. The current term risk premium is 3.01%. The risk-free rate of return is 3%. What is...

-

Starbucks purchases and roasts high-quality, whole-bean coffees, its hallmark, and sells them along with other coffee-related products primarily through its company-operated retail stores. Suppose...

-

An insulated cylinder fitted with a piston contains 0.1 kg of superheated vapor steam. The steam expands to ambient pressure, 100 kPa, at which point the steam inside the cylinder is at 150C....

-

Redesign the fractionator of Example 6.8 for a reflux ratio that is twice the minimum. Determine the diameter of the tower, the height of packing in the stripping and rectifying sections, and the...

-

Jane Leeves declared voluntary Chapter 7 bankruptcy. The trustee included the following property in her bankruptcy estate: Janes wedding ring Janes computer for her consulting business that she...

-

A and has two danghters and one son. She has puast been diagnosed with a "ecucrence sf the lobalar breast cances treated with a humpectomy and adiation 4 years ago. Her father (Aaron) s still living...

-

Suppose that East-West airlines is a small airline that offers passanger air transportation between two major east coast cities, namely Boston and New York; two major west coast cities , namely San...

-

According to Buck et al there are specific changes that have redefined the modern marketing landscape. Which is NOT something that the founders of Headlands Distillery explicitly talk about? a.all...

-

Three point charges are shown below. q = 2.0 C, q2 = 4.0 C, and q3 = -2.0 C. d = 20 cm and d2 = 10 cm. What is the magnitude of the net electric force on 92, in Newtons? Use K = 9.0 109 Nm/c. Your...

-

A homebuyer wishes to take out a mortgage of 300,000 for a 30-year period. What monthly payment is required if the interest rate is 11%? What is the total amount paid during the term of the loan?...

-

QUESTIONS (answer with explanations): 1) How does particle size affect fluidisation? 2) What is the effect of density? 3) How do particle size distributions affect fluidisation parameters? 4) Is...

-

Let A be the adjacency matrix of an undirected graph. Explain what property of the matrix indicates that 1 . 1 . the graph is complete. 2 . 2 . the graph has a loop, i . . e . , . , an edge...

-

Dains Diamond Bit Drilling purchased the following assets this year. Purchase Original Asset Date Basis Drill bits (5-year) Jan-13 $ 130,500 Drill bits (5-year) Sep-01 149,750 Commercial building...

-

You grandfather has retired with a pension that is worth $340,000. His life expectancy is 16 more years. If the pensin payments are based on an assumed return of 11 percent per year, What will be...

-

In a system with light damping (c < cc), the period of vibration is commonly defined as the time interval d = 2/d corresponding to two successive points where the displacement-time curve touches one...

-

Why must manager intuition be part of the investment- decision process regardless of a project NPV or IRR? Why is it helpful to think about real options when making an investment decision?

-

Why do firms usually finance intangible assets with equity rather than with debt?

-

What factors should a manager consider when deciding on the amount and type of long- term debt to be used to finance a business?

-

Paul Simard was delighted when Ancol Ltd. offered him the job of manager at its Jonquiere, Quebec plant. Simard was happy enough managing a small metal stamping plant with another company, but the...

-

In 1979, Larry Merritt and his wife Bobbie bought The Cake Box, a small business located in a tiny 42-square metre store in Tulsa, Oklahoma. The couple were the only employees. "I would make cakes...

-

For Gilles LaCroix, there is nothing quite as beautiful as a handcrafted wood-framed window. LaCroix's passion for windows goes back to his youth in St. Jean, Quebec, where he was taught how to make...

Study smarter with the SolutionInn App