Interserve and Kier Group can borrow for one year at the following rates: Interserve 4.50% Kier...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

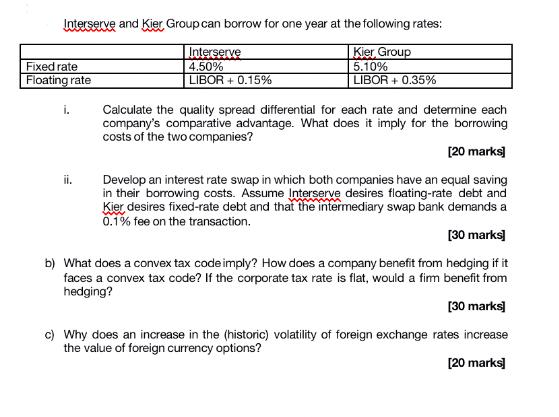

Interserve and Kier Group can borrow for one year at the following rates: Interserve 4.50% Kier Group 5.10% LIBOR + 0.15% LIBOR +0.35% Fixed rate Floating rate Calculate the quality spread differential for each rate and determine each company's comparative advantage. What does it imply for the borrowing costs of the two companies? [20 marks] Develop an interest rate swap in which both companies have an equal saving in their borrowing costs. Assume Interserve desires floating-rate debt and Kier desires fixed-rate debt and that the intermediary swap bank demands a 0.1% fee on the transaction. [30 marks] b) What does a convex tax code imply? How does a company benefit from hedging if it faces a convex tax code? If the corporate tax rate is flat, would a firm benefit from hedging? i. ii. [30 marks] c) Why does an increase in the (historic) volatility of foreign exchange rates increase the value of foreign currency options? [20 marks] Interserve and Kier Group can borrow for one year at the following rates: Interserve 4.50% Kier Group 5.10% LIBOR + 0.15% LIBOR +0.35% Fixed rate Floating rate Calculate the quality spread differential for each rate and determine each company's comparative advantage. What does it imply for the borrowing costs of the two companies? [20 marks] Develop an interest rate swap in which both companies have an equal saving in their borrowing costs. Assume Interserve desires floating-rate debt and Kier desires fixed-rate debt and that the intermediary swap bank demands a 0.1% fee on the transaction. [30 marks] b) What does a convex tax code imply? How does a company benefit from hedging if it faces a convex tax code? If the corporate tax rate is flat, would a firm benefit from hedging? i. ii. [30 marks] c) Why does an increase in the (historic) volatility of foreign exchange rates increase the value of foreign currency options? [20 marks]

Expert Answer:

Answer rating: 100% (QA)

a Quality spread differential refers to the difference between the borrowing rate of two companies with similar credit ratings In this case the qualit... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

(a) Prawn and Lobster are two companies that can borrow for a five year term at the following rates. Prawn Lobster International credit rating A B Fixed-rate borrowing cost 6.5% 10.5% Floating-rate...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

At December 31, 2018, Landy Products has cash of $24,000, receivables of $18,000, and inventory of $80,000. The companys equipment totals $182,000. Landy owes accounts payable of $22,000 and...

-

What are the primary aspects of documentary evidence?

-

Explain how the money supply is measured and how it is linked to economic growth and inflation.

-

a. Describe how an express warranty is created. b. Describe how an implied warranty of merchantability is created. c. Describe how an implied warrant of fitness for a particular purpose is created.

-

During 2012, Maverick Inc. became involved in a tax dispute with the IRS. Mavericks attorneys have indicated that they believe it is probable that Maverick will lose this dispute. They also believe...

-

1. Which of the following is a CORRECT statement? 2. 3. (a) 2.3056+10.138-7.4671 = 4.9765 (b) 2.38 x 1.0 = 2.38 8.05 (c) -=2.6 3.1 (d) (1.11 0.1) x 9.0 = 9.0 A projectile travels at 0 below...

-

You are part of the engagement team for the audit of Suzuki Manufacturing for the year ended December 31, 2019, and are responsible for auditing the acquisition cycle. Download the Excel file for the...

-

Write a program to calculate mean scores per spending range. Spending Ranges (Per Student)

-

Which of the following functions are neoclassical production functions? Why/why not? Show all your work for your conclusions. i. Y=2K0.30.6 ii. Y=5K iii. Y=K+2L iv. Y=5K0.50.5+ 4K0.40.6

-

Based on the information in Table 4-2, and assuming the company's stock price is $50 per share, the P/E ratio is Table 4-2 Drummond Company Balance Sheet Assets: Cash and marketable securities...

-

The bent rod AB is supported by cable BC and a square-shaft bearing at A as shown below. Please complete the following tasks: 1. Draw the free body diagram of the bent rod AB 2. Define the...

-

You own two lots of BHM stock which you bought two years ago. Now, it is traded at RM3.00 and has been very stable at this price. You have been receiving a 2.50 percent dividend over the last two...

-

Emotional Intelligence Assignment Explain emotional intelligence. Explain how emotional intelligence might affect your leadership abilities. Include ways you can capitalize on (or increase) your...

-

At Collins Company, manufacturing each job requires work in two departments - Production Department A and Production Department B. The Collins Company uses departmental predetermined factory overhead...

-

Burberrys competitive advantage is through its differentiation strategy. What risk should Burberry remain aware of?

-

Suppose a firm estimates its required rate of return for the coming year to be 10 percent. What are reasonable required rates of return for evaluating average-risk projects, high-risk projects, and...

-

The after-tax cash flows for two mutually exclusive projects have been estimated, and the following information has been provided: The companys required rate of return is 14 percent, and it can get...

-

Four years ago, Ideal Solutions issued convertible preferred stock with a par value of $50 and a stated dividend of 8 percent. Each share of preferred stock can be converted to four shares of common...

-

Smart Manufacturing Systems Pty Ltds accountant recently prepared the following data from the companys accounting records for the year ended 30 June 2019. Factory overhead is applied at the rate of...

-

During the year ended 30 June 2019, Beautiful Bottles Pty Ltd incurred the following costs in connection with its production activities. Required (a) Calculate the relationship between factory...

-

Telecommunications company Toronto Ltd signed a 15year deal to sell capacity on its cable network to a rival company for $200 million. The deal was completed on the last day of Toronto Ltds financial...

Study smarter with the SolutionInn App