Jones, the investor, proposes taking participating preferred stock1 with 1x liquidation preference in return for her $5

Question:

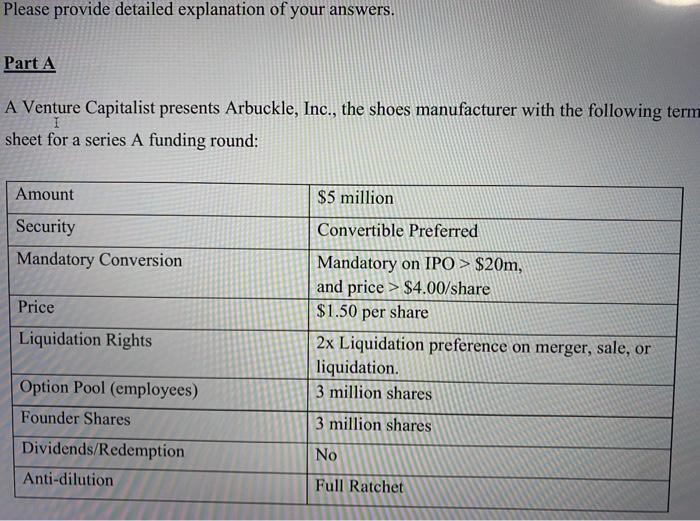

Jones, the investor, proposes taking participating preferred stock1 with 1x liquidation preference in return for her $5 million investment. Draw the payoff diagram for this security from Jones’ perspective, assuming she invests $5 million at a pre-money valuation of $14.75 million with no option pool.

What is her cash-on-cash return (money received divided by investment) if NewVenture exits in December 2020 at a $150 million valuation?

Thompson, the founder, provides a counter-proposal in which the security will be a standard convertible preferred stock with a liquidation of 2X. Draw the payoff diagram for this security from Jones’ perspective.

If NewVenture exits in December 2020 at a $150 million valuation what would be Jones payoff? which type of a security would Jones prefer? Why?

At what company valuation would the two securities have an equal payout?

Systems analysis and design

ISBN: 978-0136089162

8th Edition

Authors: kenneth e. kendall, julie e. kendall