QUESTION 2 Chestor Sdn Bhd is considering the manufacture of the 2 following products: PARK RM20...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

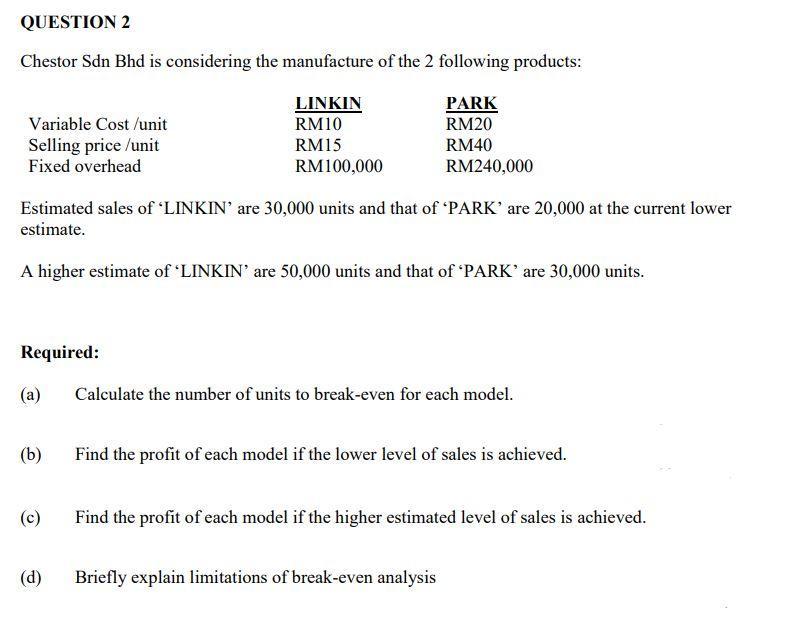

QUESTION 2 Chestor Sdn Bhd is considering the manufacture of the 2 following products: PARK RM20 RM40 RM240,000 Variable Cost /unit Selling price /unit Fixed overhead Estimated sales of 'LINKIN' are 30,000 units and that of 'PARK' are 20,000 at the current lower estimate. A higher estimate of 'LINKIN' are 50,000 units and that of 'PARK' are 30,000 units. Required: (a) (b) (c) LINKIN RM10 RM15 RM100,000 (d) Calculate the number of units to break-even for each model. Find the profit of each model if the lower level of sales is achieved. Find the profit of each model if the higher estimated level of sales is achieved. Briefly explain limitations of break-even analysis QUESTION 2 Chestor Sdn Bhd is considering the manufacture of the 2 following products: PARK RM20 RM40 RM240,000 Variable Cost /unit Selling price /unit Fixed overhead Estimated sales of 'LINKIN' are 30,000 units and that of 'PARK' are 20,000 at the current lower estimate. A higher estimate of 'LINKIN' are 50,000 units and that of 'PARK' are 30,000 units. Required: (a) (b) (c) LINKIN RM10 RM15 RM100,000 (d) Calculate the number of units to break-even for each model. Find the profit of each model if the lower level of sales is achieved. Find the profit of each model if the higher estimated level of sales is achieved. Briefly explain limitations of break-even analysis

Expert Answer:

Answer rating: 100% (QA)

aLINKIN 30000 PARK 60000 The number of units to breakeven for each model is 30000 for LINKIN and 600... View the full answer

Related Book For

Principles of Risk Management and Insurance

ISBN: 978-0132992916

12th edition

Authors: George E. Rejda, Michael McNamara

Posted Date:

Students also viewed these accounting questions

-

The Johnsons recently decided to invest in municipal bonds because their marginal tax rate is 40 percent. The return on municipal bonds is currently 3.5 percent and the return on similar taxable...

-

Michael Margolis is a single parent and motivational training consultant from Palatine, Illinois. He is wondering about potential returns on investments given certain amounts of risk. Michael...

-

Sharon, age 28, is a single parent who earns $30,000 annually as a secretary at a local university. She is the sole support of her son, age 3. Sharon is concerned about the financial well-being of...

-

Kendall Corners Inc. recently reported net income of $4.8 million and depreciation of $600,000. What was its net cash flow? Assume it had no amortization expense. Enter your answer in dollars. For...

-

The Hungry Heifer diner offers an all-you-can-eat buffet at $25.90 per adult and $17.90 per child. On a particular day, the diner had total buffet revenue of $6609.40 from 266 customers. How many of...

-

The December cash records of Dunlap Insurance follow: Dunlap's Cash account shows a balance of $16,740 at December 31. On December 31, Dunlap Insurance received the following bank statement:...

-

Refer to the statements for Google in Appendix A. For the year ended December 31, 2015, what was its debt-to-equity ratio? What does this ratio tell us? Data From Statement Google In Appendix A...

-

Energy Consulting Company was formed on January 1, 2012. Events Affecting the 2012 Accounting Period 1. Acquired cash of $80,000 from the issue of common stock. 2. Purchased $4,200 of supplies on...

-

Q6). For the Given Functions determine the following a). f(x) = 3 x2+2x-1 What is f(-2). Show your work 0 What is a). f(-2)= b). f(0), c). f(-1)

-

Show the contents in hexadecimal of registers PC, AR, DR, IR, and SC of the basic computer when an ISZ indirect instruction is fetched from memory and executed. The initial content of PC is 7FF. The...

-

A fixed percentage of water is taken from a well each day. Write a C++ program that request values for W and P where: W is the amount (in litres) of water in the well at the start of the first day ...

-

Robinson, Inc. reports the following aging schedule for accounts receivable at December 31, 2015. Probability Days outstandingAmountof collection 0 30$87,50098% 31 60$13,50068% 61 90$9,30030% over...

-

What is the last value of Number 1 and Counter after executing the following C++ statements int Counter = 0, Number1= 0; do{ if(Counter % 5 == 0){ cout <

-

A piece of equipment is purchased on 1/1/2009 and booked for $8,000 with a salvage value of $500 and a useful life of 7 years. For the first 2 years double declining balance was used. Starting in...

-

Slater Company uses the cash basis of accounting. Slater Company collected $950,000 from its customers during 2015. Customers owed Slater $150,000 of accounts receivable at the beginning of 2015, and...

-

Viviana is a self-employed Therapist whose 2019 net earnings from her trade or business (before the H.R. 10 plan contribution but after the deduction for one-half of self-employment taxes) is...

-

You are an actuary at a medium-sized general insurance company. One of the business units writes two annually renewable binding authorities, whereby underwriting authority is delegated to a third...

-

Coastal Refining Company operates a refinery with a distillation capacity of 12,000 barrels per day. As a new member of Coastal's management team, you have been given the task of developing a...

-

Kim, age 20, is a college student who recently purchased her first car from a friend who had financial problems. The vehicle is a high mileage, 2001 Toyota Corolla with a current market value of...

-

Describe the risk-based capital standards that insurers must meet.

-

a. What is enterprise risk management? b. How does enterprise risk management differ from traditional risk management?

-

Two blocks of equal mass \(m\), connected by a Hooke's-law spring of unstretched length \(\ell\), are free to move in one dimension. Find the equations of motion of the system, using the relative and...

-

In certain situations, it is possible to incorporate frictional effects in a simple way into a Lagrangian problem. As an example, consider the Lagrangian (a) Find the equation of motion for the...

-

Consider a vertical circular hoop of radius \(R\) rotating about its vertical symmetry axis with constant angular velocity \(\Omega\). A bead of mass \(m\) is threaded onto the hoop, so is free to...

Study smarter with the SolutionInn App