Eaton Electronic Company's treasurer uses both the capital asset pricing model and the dividend valuation model...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

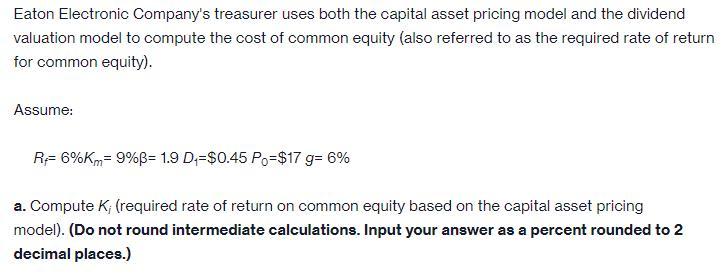

Eaton Electronic Company's treasurer uses both the capital asset pricing model and the dividend valuation model to compute the cost of common equity (also referred to as the required rate of return for common equity). Assume: R= 6%Km= 9%ß= 1.9 D+ $0.45 Po=$17 g= 6% a. Compute K; (required rate of return on common equity based on the capital asset pricing model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Eaton Electronic Company's treasurer uses both the capital asset pricing model and the dividend valuation model to compute the cost of common equity (also referred to as the required rate of return for common equity). Assume: R= 6%Km= 9%ß= 1.9 D+ $0.45 Po=$17 g= 6% a. Compute K; (required rate of return on common equity based on the capital asset pricing model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

Expert Answer:

Answer rating: 100% (QA)

The capital asset pricing model CAPM is K R Rm R where K required ... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Genevieve Shannara has always wanted to open her own kennel and grooming services; she had been grooming pets for friends and family from her apartment for extra cash since high school. When the...

-

Mount Everest is Earth's highest mountain above sea level, located in the Mahalangur Himal sub-range of the Himalayas. The ChinaNepal border runs across its summit point. Its elevation of 8,848.86 m...

-

When Tallman Haberdashery, Inc., merged with Meyers Mens Suits, Inc., Tallmans employees were switched from a weekly to a biweekly pay period. Tallmans weekly payroll amounted to $750,000. The cost...

-

Describe and correct the error in finding the x- and y-intercepts of the graph of 5x - 3y = -15. To find the x-intercept, let x = 0: 5x3y -15 5(0) 3y = -15 y = 5 - x To find the y-intercept, let y =...

-

Outline the general strategy used in metagenomics.

-

Income computation for a manufacturing firm. The following data relate to GenMet, a U.S.-based consumer goods manufacturing firm, for the fiscal year ending October 31, 2008. Reported amounts are in...

-

The figure depicts Jack - in - the - box: "Jack" is attached inside a box by a spring, as shown. You estimate Jack's mass to be 0 . 4 k g . As so often happens, a sign tells you the spring constant:...

-

Joy camera plans to expand to the European market. The company considers buying Enola Plc, a privately owned company headquartered in the UK. The EBIT (earnings before interest and taxes) for Enola...

-

Holmes Company produces a product that can be either sold as is or processed further. Holmes has already spent $92,000 to produce 1,600 units that can be sold now for $73,500 to another manufacturer....

-

You are considering investing in Starbucks Bond or Stock? The Starbucks bond matures in 10 years and your yield to maturity is 2.4%. Starbucks current stock price is $115, with a beta of 0.88 and...

-

American Eagle Outfitters Inc. (AEO) operates specialty retail stores, selling clothing such as denim, sweaters, t-shirts, and fleece outerwear that targets 15-to-25-year-old men and women. The...

-

The Gap Inc. (GPS) operates specialty retail stores under such brand names as GAP, Old Navy, and Banana Republic. The following asset and liability data (in millions) were adapted from recent...

-

The prepaid insurance account had a balance of $18,400 at the beginning of the year. The account was increased for $52,600 for premiums on policies purchased during the year. What is the adjustment...

-

(Question 6)(LA Jear, CAPM) (Normal, Delete, WILD) L.A.Jear Inc. makes air shoes that sell at $50 each and cost $30 each to manufacture. Their existing plant produces 1000 shoes per year, which...

-

The Latimer diagram for Fe, at pH = 0, is shown below: Fe4+ +1.21V Fe+ +0.77V What is the most stable oxidation state? Fe+ What is the least stable oxidation state? -0.44V Calculate the -AG/F values...

-

In the circuit shown in Figure 4, a battery supplies a constant voltage of 40 V, the inductance is 2 H, the resistance is 10, and l(0) = 0. (a) Find l(t). (b) Find the current after 0.1s.

-

If New Funds expense ratio (see the previous problem) was 1.1% and the management fee was .7%, what were the total fees paid to the funds investment managers during the year? What were other...

-

Suppose that borrowing is restricted so that the zero-beta version of the CAPM holds. The expected return on the market portfolio is 17%, and on the zero-beta portfolio it is 8%. What is the expected...

-

If each of the nine outcomes in Problem 3 is equally likely, find the standard deviation of both the pound- and dollar-denominated rates of return.

-

How does each of the following variables behave over the business cycle? Develop graphs to show your results and give economic explanations. a. Real imports b. Federal government receipts c. Housing...

-

In the FRED database, find a variable that is available in both a seasonally adjusted form and a not seasonally adjusted form. Plot both over time and describe how large the seasonal variation in the...

-

It has been argued that the stock market predicts recessions. Using quarterly data since 1961, plot the real value of the stock market index (the Wilshire 5000 index in the last month of the quarter...

Study smarter with the SolutionInn App