Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

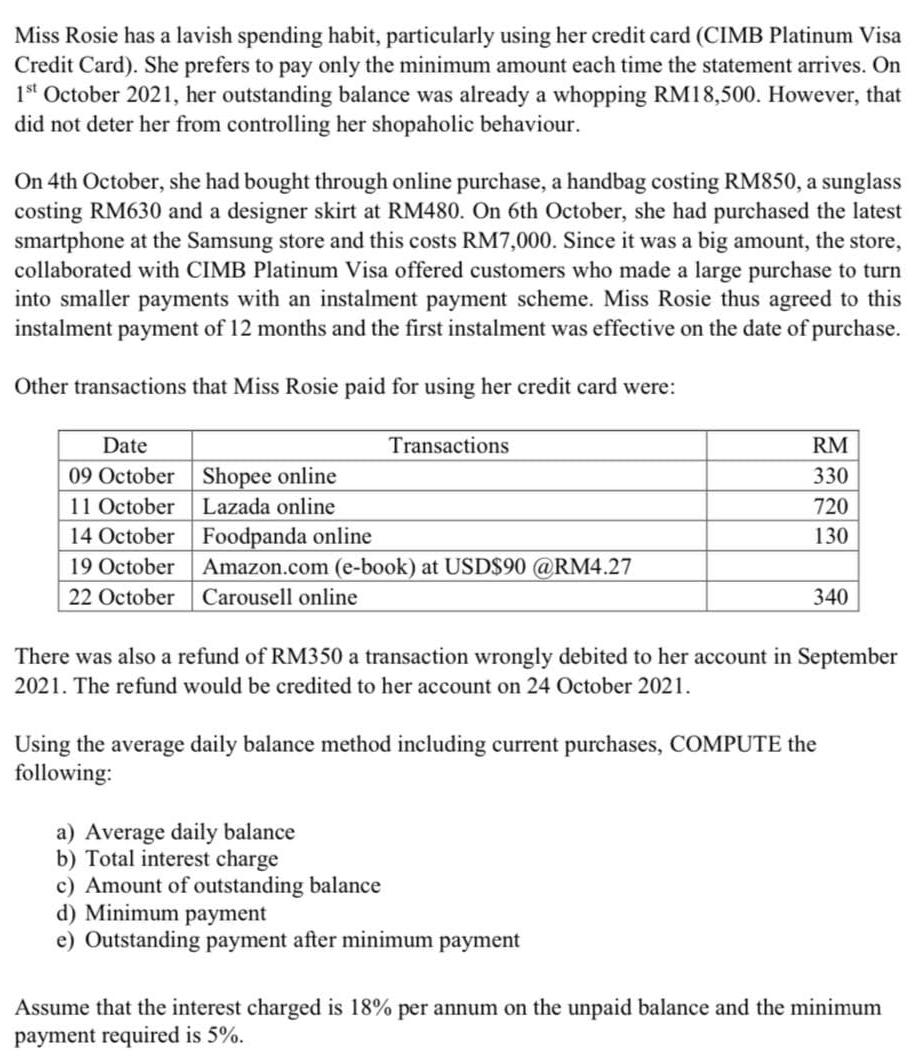

Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit Card). She prefers to pay only the minimum amount each time the statement arrives. On 1st October 2021, her outstanding balance was already a whopping RM18,500. However, that did not deter her from controlling her shopaholic behaviour. On 4th October, she had bought through online purchase, a handbag costing RM850, a sunglass costing RM630 and a designer skirt at RM480. On 6th October, she had purchased the latest smartphone at the Samsung store and this costs RM7,000. Since it was a big amount, the store, collaborated with CIMB Platinum Visa offered customers who made a large purchase to turn into smaller payments with an instalment payment scheme. Miss Rosie thus agreed to this instalment payment of 12 months and the first instalment was effective on the date of purchase. Other transactions that Miss Rosie paid for using her credit card were: Date 09 October 11 October 14 October 19 October 22 October Shopee online Lazada online Transactions Foodpanda online Amazon.com (e-book) at USD$90 @RM4.27 Carousell online RM 330 720 130 340 There was also a refund of RM350 a transaction wrongly debited to her account in September 2021. The refund would be credited to her account on 24 October 2021. a) Average daily balance b) Total interest charge c) Amount of outstanding balance d) Minimum payment e) Outstanding payment after minimum payment Using the average daily balance method including current purchases, COMPUTE the following: Assume that the interest charged is 18% per annum on the unpaid balance and the minimum payment required is 5%. Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit Card). She prefers to pay only the minimum amount each time the statement arrives. On 1st October 2021, her outstanding balance was already a whopping RM18,500. However, that did not deter her from controlling her shopaholic behaviour. On 4th October, she had bought through online purchase, a handbag costing RM850, a sunglass costing RM630 and a designer skirt at RM480. On 6th October, she had purchased the latest smartphone at the Samsung store and this costs RM7,000. Since it was a big amount, the store, collaborated with CIMB Platinum Visa offered customers who made a large purchase to turn into smaller payments with an instalment payment scheme. Miss Rosie thus agreed to this instalment payment of 12 months and the first instalment was effective on the date of purchase. Other transactions that Miss Rosie paid for using her credit card were: Date 09 October 11 October 14 October 19 October 22 October Shopee online Lazada online Transactions Foodpanda online Amazon.com (e-book) at USD$90 @RM4.27 Carousell online RM 330 720 130 340 There was also a refund of RM350 a transaction wrongly debited to her account in September 2021. The refund would be credited to her account on 24 October 2021. a) Average daily balance b) Total interest charge c) Amount of outstanding balance d) Minimum payment e) Outstanding payment after minimum payment Using the average daily balance method including current purchases, COMPUTE the following: Assume that the interest charged is 18% per annum on the unpaid balance and the minimum payment required is 5%.

Expert Answer:

Answer rating: 100% (QA)

Date Transactions RM Daily Outstanding Balance 01102021 RM1850000 02102021 RM1850000 03102021 RM1850... View the full answer

Related Book For

Smith and Roberson Business Law

ISBN: 978-0538473637

15th Edition

Authors: Richard A. Mann, Barry S. Roberts

Posted Date:

Students also viewed these accounting questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

machine element is made of an alloy with Yield strength of 200 Mpa and fracture strain is 0.08. A machine element is characterized by the normal stress components as shown in the figure. The Answer...

-

On March 31, 2013, Alternative Landscapes discarded equipment that had a cost of $ 20,000. Accumulated Depreciation as of December 31, 2012, was $ 18,000. Assume annual depreciation on the equipment...

-

Suppose that a decision maker has the opportunity to invest in an oil well drilling operation that has a .3 chance of yielding a profit of $1,000,000, a .4 chance of yielding a profit of $400,000,...

-

As the owner of a landmark Chicago skyscraper, you decide to purchase insurance that will pay $1 billion in the event the building is destroyed by terrorists. Suppose the likelihood of such a loss is...

-

Lesley Chomski is the supervisor of the New Product Division of MCO Corporation. Her annual bonus is based on the success of new products and is computed on the number of sales that exceed each new...

-

Kazibwe, a businessman does not maintain a complete set of books for his business transactions. The following is a summary of his cash transactions for the year ended December 31, 2015. Receipts Kshs...

-

On January 1, Year 1, the Vine Company purchased 60,000 of the 80,000 ordinary shares of the Devine Company for $80 per share. On that date, Devine had ordinary shares of $3,500,000, and retained...

-

Is there a relationship between a CEO's retirement and the R&D expenses in a firm? Explain.

-

1) The importance of Legal and Ethical Aspects of Credit Investigation in credit and collection. 2) Opinion about Legal and Ethical Aspects of Credit Investigation. 3) Give 2 reasons and examples of...

-

what can be done to improve employee communication methods

-

Discuss the importance of benefits as a part of employee compensation.

-

critically discuss the significance of employee benefits within an organization of your choice ?

-

Please answer fast and in a detailed manner. For this exercise, assume you are the HR Benefits Administrator for a medium-sized, high- tech company. You are developing an employee benefits brochure....

-

1. You are the new director of a large youth sport program in a city with the population of 1 million. You want to create an innovative youth sport program and you propose guidelines that do not...

-

Provide a few individual examples who revealed what aspects of emotional intelligence?

-

Anita and Duncan had been partners for many years in a mercantile business. Their relationship deteriorated to the point at which Anita threatened to bring an action for an accounting and dissolution...

-

J, B & J, Certified Public Accountants, has audited the High credit Corporation for the past five years. Recently, the Securities and Exchange Commission (SEC) has commenced an investigation of High...

-

Wilson engages Ruth to sell Wilsons antique walnut chest to Harold for $2,500. The next day, Ruth learns that Sandy is willing to pay $3,000 for Wilsons chest. Ruth nevertheless sells the chest to...

-

Maribel Ortiz is puzzled. Her company had a profit margin of 10% in 2025. She feels that this is an indication that the company is doing well. Gordon Liddy, her accountant, says that more information...

-

At December 31, 2025, the fair value of non-trading securities is 41,300 and the cost is 39,800. At January 1, 2025, there was a credit balance of 900 in the Fair Value Adjustment Non-Trading...

-

On January 1, 2025, Lennon Enterprises acquires 100% of Ono Ltd. for 220,000 in cash. The condensed statements of financial position of the two companies immediately following the acquisition are as...

Study smarter with the SolutionInn App