Bonds 1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time

Question:

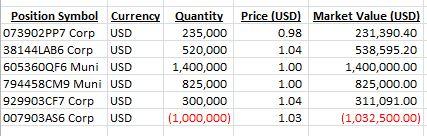

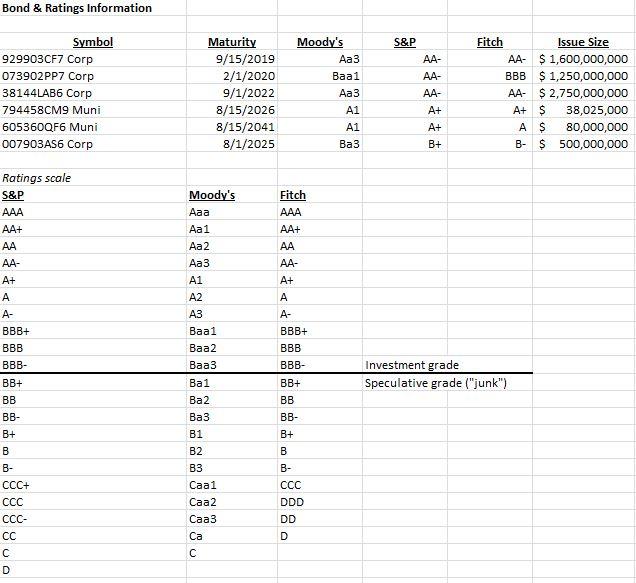

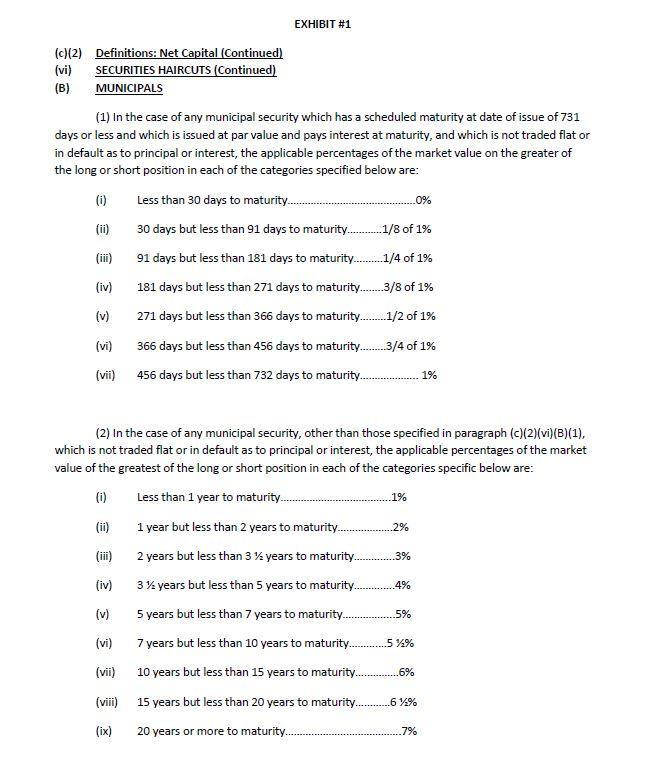

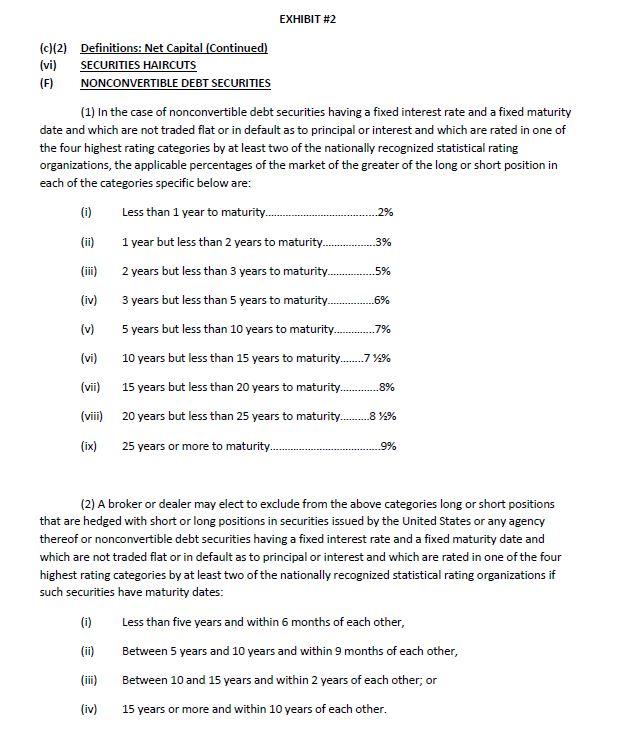

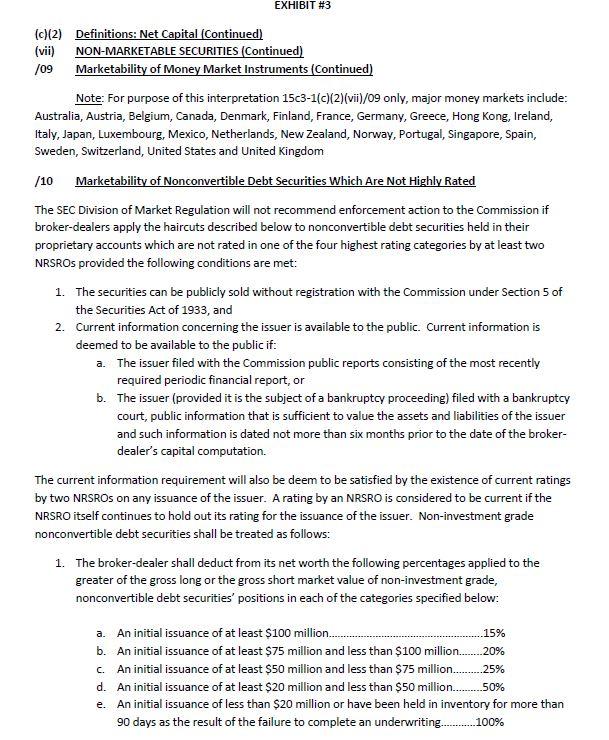

Bonds 1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time to maturity and scheduled maturity at date of issue. 2. Corporate Bonds - Corporate bonds are haircut based on both their time to maturity and whether they are rated as investment grade (defined by S&P and Fitch as BBB- and above and by Moody's as Baa3 and above)1 by at least two of the nationally recognized statistical rating organizations. If the bonds qualify as investment grade, use Exhibit 2 to determine the haircut of the bonds. If they do not qualify as investment grade, then they are considered non-marketable and follow the haircut rules as stated in Exhibit 3. It is important to note that the haircut is calculated using the absolute value of the market value of the relevant bond. What is the total haircut in USD on the positions in the accompanying spreadsheet?

Corporate Finance A Focused Approach

ISBN: 978-1439078082

4th Edition

Authors: Michael C. Ehrhardt , Eugene F. Brigham