Nandipha-Thabo partnership has built up a small but successful business that has been in operation for...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

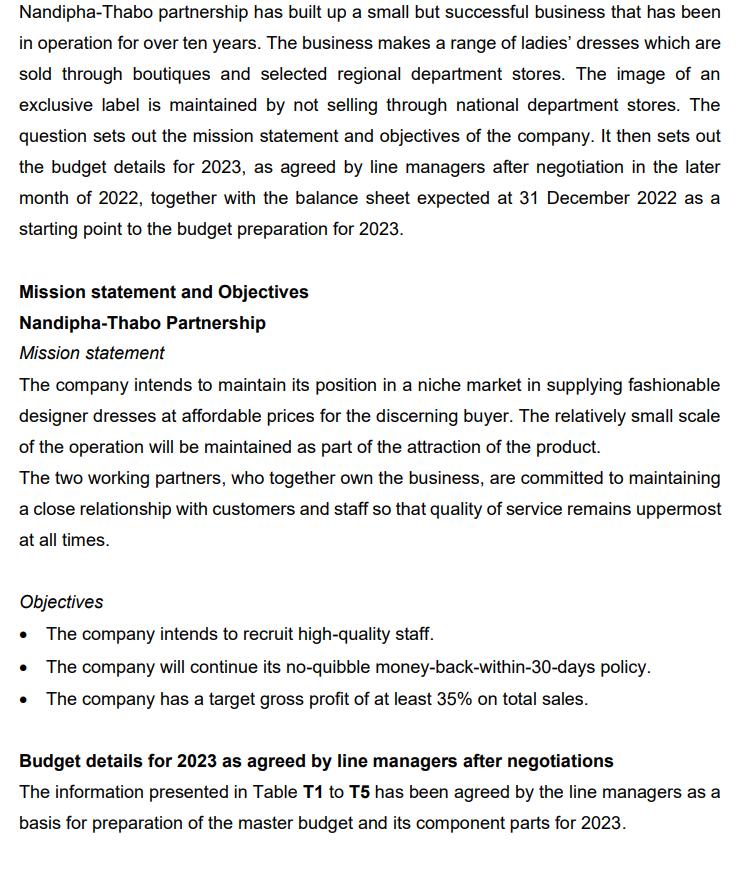

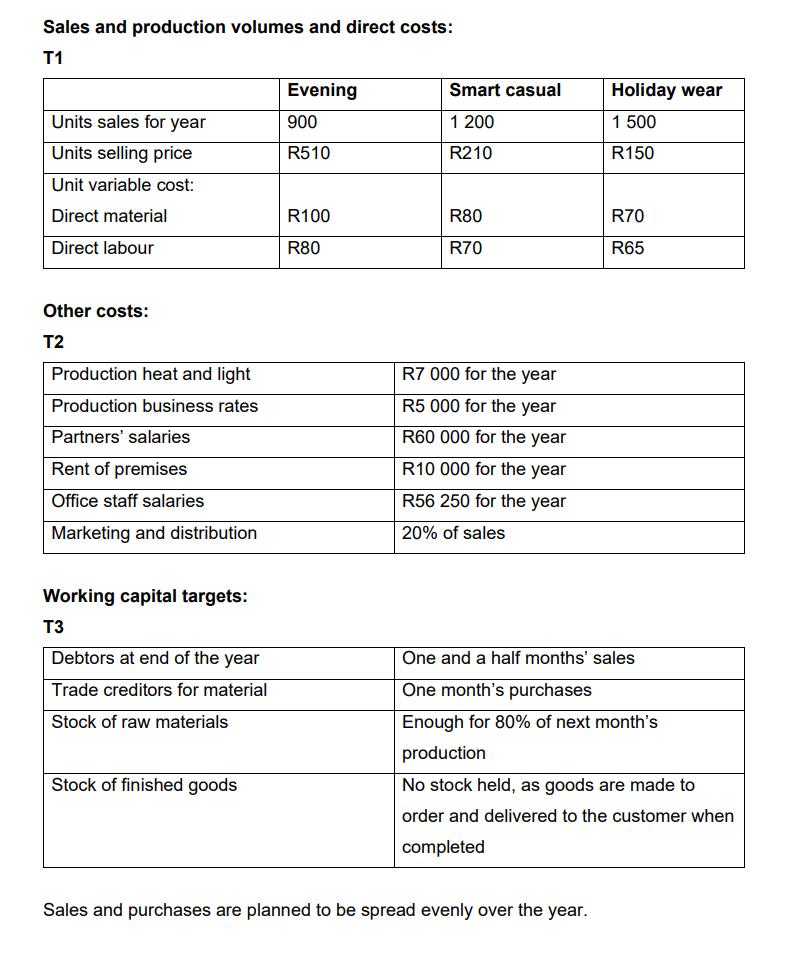

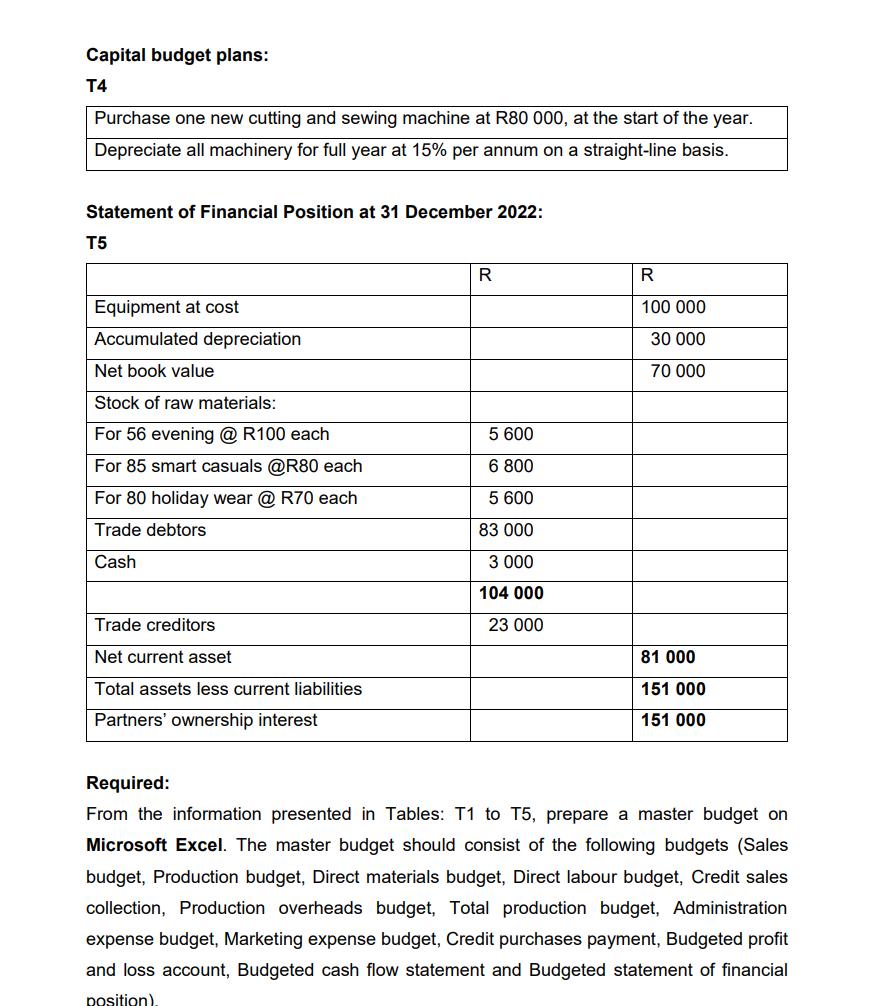

Nandipha-Thabo partnership has built up a small but successful business that has been in operation for over ten years. The business makes a range of ladies' dresses which are sold through boutiques and selected regional department stores. The image of an exclusive label is maintained by not selling through national department stores. The question sets out the mission statement and objectives of the company. It then sets out the budget details for 2023, as agreed by line managers after negotiation in the later month of 2022, together with the balance sheet expected at 31 December 2022 as a starting point to the budget preparation for 2023. Mission statement and Objectives Nandipha-Thabo Partnership Mission statement The company intends to maintain its position in a niche market in supplying fashionable designer dresses at affordable prices for the discerning buyer. The relatively small scale of the operation will be maintained as part of the attraction of the product. The two working partners, who together own the business, are committed to maintaining a close relationship with customers and staff so that quality of service remains uppermost at all times. Objectives • The company intends to recruit high-quality staff. • The company will continue its no-quibble money-back-within-30-days policy. The company has a target gross profit of at least 35% on total sales. Budget details for 2023 as agreed by line managers after negotiations The information presented in Table T1 to T5 has been agreed by the line managers as a basis for preparation of the master budget and its component parts for 2023. Sales and production volumes and direct costs: T1 Units sales for year Units selling price Unit variable cost: Direct material Direct labour Other costs: T2 Production heat and light Production business rates Partners' salaries Rent of premises Office staff salaries Marketing and distribution Working capital targets: T3 Debtors at end of the year Trade creditors for material Stock of raw materials Stock of finished goods Evening 900 R510 R100 R80 Smart casual 1 200 R210 R80 R70 R7 000 for the year R5 000 for the year R60 000 for the year R10 000 for the year R56 250 for the year 20% of sales Holiday wear 1 500 R150 Sales and purchases are planned to be spread evenly over the year. R70 R65 One and a half months' sales One month's purchases Enough for 80% of next month's production No stock held, as goods are made to order and delivered to the customer when completed Capital budget plans: T4 Purchase one new cutting and sewing machine at R80 000, at the start of the year. Depreciate all machinery for full year at 15% per annum on a straight-line basis. Statement of Financial Position at 31 December 2022: T5 Equipment at cost Accumulated depreciation Net book value Stock of raw materials: For 56 evening @ R100 each For 85 smart casuals @R80 each For 80 holiday wear @ R70 each Trade debtors Cash Trade creditors Net current asset Total assets less current liabilities Partners' ownership interest R 5 600 6 800 5 600 83 000 3 000 104 000 23 000 R 100 000 30 000 70 000 81 000 151 000 151 000 Required: From the information presented in Tables: T1 to T5, prepare a master budget on Microsoft Excel. The master budget should consist of the following budgets (Sales budget, Production budget, Direct materials budget, Direct labour budget, Credit sales collection, Production overheads budget, Total production budget, Administration expense budget, Marketing expense budget, Credit purchases payment, Budgeted profit and loss account, Budgeted cash flow statement and Budgeted statement of financial position). Nandipha-Thabo partnership has built up a small but successful business that has been in operation for over ten years. The business makes a range of ladies' dresses which are sold through boutiques and selected regional department stores. The image of an exclusive label is maintained by not selling through national department stores. The question sets out the mission statement and objectives of the company. It then sets out the budget details for 2023, as agreed by line managers after negotiation in the later month of 2022, together with the balance sheet expected at 31 December 2022 as a starting point to the budget preparation for 2023. Mission statement and Objectives Nandipha-Thabo Partnership Mission statement The company intends to maintain its position in a niche market in supplying fashionable designer dresses at affordable prices for the discerning buyer. The relatively small scale of the operation will be maintained as part of the attraction of the product. The two working partners, who together own the business, are committed to maintaining a close relationship with customers and staff so that quality of service remains uppermost at all times. Objectives • The company intends to recruit high-quality staff. • The company will continue its no-quibble money-back-within-30-days policy. The company has a target gross profit of at least 35% on total sales. Budget details for 2023 as agreed by line managers after negotiations The information presented in Table T1 to T5 has been agreed by the line managers as a basis for preparation of the master budget and its component parts for 2023. Sales and production volumes and direct costs: T1 Units sales for year Units selling price Unit variable cost: Direct material Direct labour Other costs: T2 Production heat and light Production business rates Partners' salaries Rent of premises Office staff salaries Marketing and distribution Working capital targets: T3 Debtors at end of the year Trade creditors for material Stock of raw materials Stock of finished goods Evening 900 R510 R100 R80 Smart casual 1 200 R210 R80 R70 R7 000 for the year R5 000 for the year R60 000 for the year R10 000 for the year R56 250 for the year 20% of sales Holiday wear 1 500 R150 Sales and purchases are planned to be spread evenly over the year. R70 R65 One and a half months' sales One month's purchases Enough for 80% of next month's production No stock held, as goods are made to order and delivered to the customer when completed Capital budget plans: T4 Purchase one new cutting and sewing machine at R80 000, at the start of the year. Depreciate all machinery for full year at 15% per annum on a straight-line basis. Statement of Financial Position at 31 December 2022: T5 Equipment at cost Accumulated depreciation Net book value Stock of raw materials: For 56 evening @ R100 each For 85 smart casuals @R80 each For 80 holiday wear @ R70 each Trade debtors Cash Trade creditors Net current asset Total assets less current liabilities Partners' ownership interest R 5 600 6 800 5 600 83 000 3 000 104 000 23 000 R 100 000 30 000 70 000 81 000 151 000 151 000 Required: From the information presented in Tables: T1 to T5, prepare a master budget on Microsoft Excel. The master budget should consist of the following budgets (Sales budget, Production budget, Direct materials budget, Direct labour budget, Credit sales collection, Production overheads budget, Total production budget, Administration expense budget, Marketing expense budget, Credit purchases payment, Budgeted profit and loss account, Budgeted cash flow statement and Budgeted statement of financial position).

Expert Answer:

Answer rating: 100% (QA)

It appears that you are asking for a comprehensive master budget preparation based on the information provided in Tables T1 to T5 Preparing the entire budget suite requested such as Sales budget Produ... View the full answer

Related Book For

Cornerstones of Financial and Managerial Accounting

ISBN: 978-1111879044

2nd edition

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

Posted Date:

Students also viewed these accounting questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The tasks must you complete as part of building the subledger applications while implementing Oracle Accounting Hub Cloud? Explain.

-

The Gayton Menswear company was founded by Fred Williams in 1986 and has grown steadily over the years. Fred now has 17 stores located throughout the central and northern parts of the state. Because...

-

Complete the following for the given f(x). (a) Find f(x + h). (b) Find the difference quotient of f and simplify. f(x) = 1 = x

-

Tennessee law imposes durational-residency requirements on persons and companies wishing to operate retail liquor stores, requiring applicants for an initial license to have resided in the state for...

-

Below is a payroll sheet for Otis Import Company for the month of September 2014. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8%...

-

2. A plain concrete cylinder with dimensions of 12" height and 6" diameter is tested using spilt tension test. The failure load was measured to be 70 kN. What is the indirect tensile strength of...

-

a. Draw a UML class diagram that describes the Tablet Store's purchases and payments process. b. Using Microsoft Access, implement a relational database from your UML class diagram. Identify at least...

-

Superior Micro Products uses the weighted average method in its process costing system. The data from the Assembly Department for the month of May is shown below: Materials Labor overhead Work in...

-

What steps are involved in establishing a credit policy?

-

In 2008/09 the British pound depreciated by approximately 25 per cent on a trade-weight basis after the Bank of England reduced interest rates to a historically low level. In your opinion, did the...

-

Which of the following companies are likely to have high short-term financing needs? Why? (a) The Hilton. (b) British Gas. (c) Manchester United. (d) Thomas Cook. (e) Private Infrastructure...

-

Provide an overview of the empirical determinants of hedging. If you were the corporate treasurer for a company, would you recommend hedging as a risk management strategy? Explain.

-

Wuttke plc wants to raise 3.65 million via a rights issue. The company currently has 490,000 ordinary shares outstanding that sell for 30 per share. Its underwriter has set a subscription price of 22...

-

(05.05 MC) What are the measures of Angles a, b, and c? Show your work and explain your answers. (10 points) 70 35 12pt a Jo Edit View Insert Format Tools Table Paragraph BI UA

-

With your classmates, form small teams of skunkworks. Your task is to identify an innovation that you think would benefit your school, college, or university, and to outline an action plan for...

-

As pointed out earlier in Heres the Real Kicker, Kicker changed banks a couple of years ago because the loan officer at its bank moved out of state. Kicker saw that as an opportunity to take bids for...

-

The accountant for Bellows Corp. was preparing a bank reconciliation as of April 30. The following items were identified: Bellows book balance ............ $28,750 Outstanding checks ................

-

Explain the difference between the direct method and the sequential method. Discuss.

-

Classify each of the following as either a policy instrument or an intermediary target. Explain your answer. a. Long-term interest rates b. Central bank interest rates c. M2 d. Reserve requirements

-

The New York Fed executes foreign exchange interventions for the Federal Reserve system. Go to https://www.newyorkfed.org/markets/quar_reports.html to see quarterly summaries of the Feds foreign...

-

The New Zealand dollar to U.S. dollar exchange rate is 1.38, and the British pound to U.S. dollar exchange rate is 0.65. If you find that the British pound to New Zealand dollar is trading at 0.5,...

Study smarter with the SolutionInn App