On January 7, 2021, Martin Corporation acquires two properties from a shareholder solely in exchange for...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

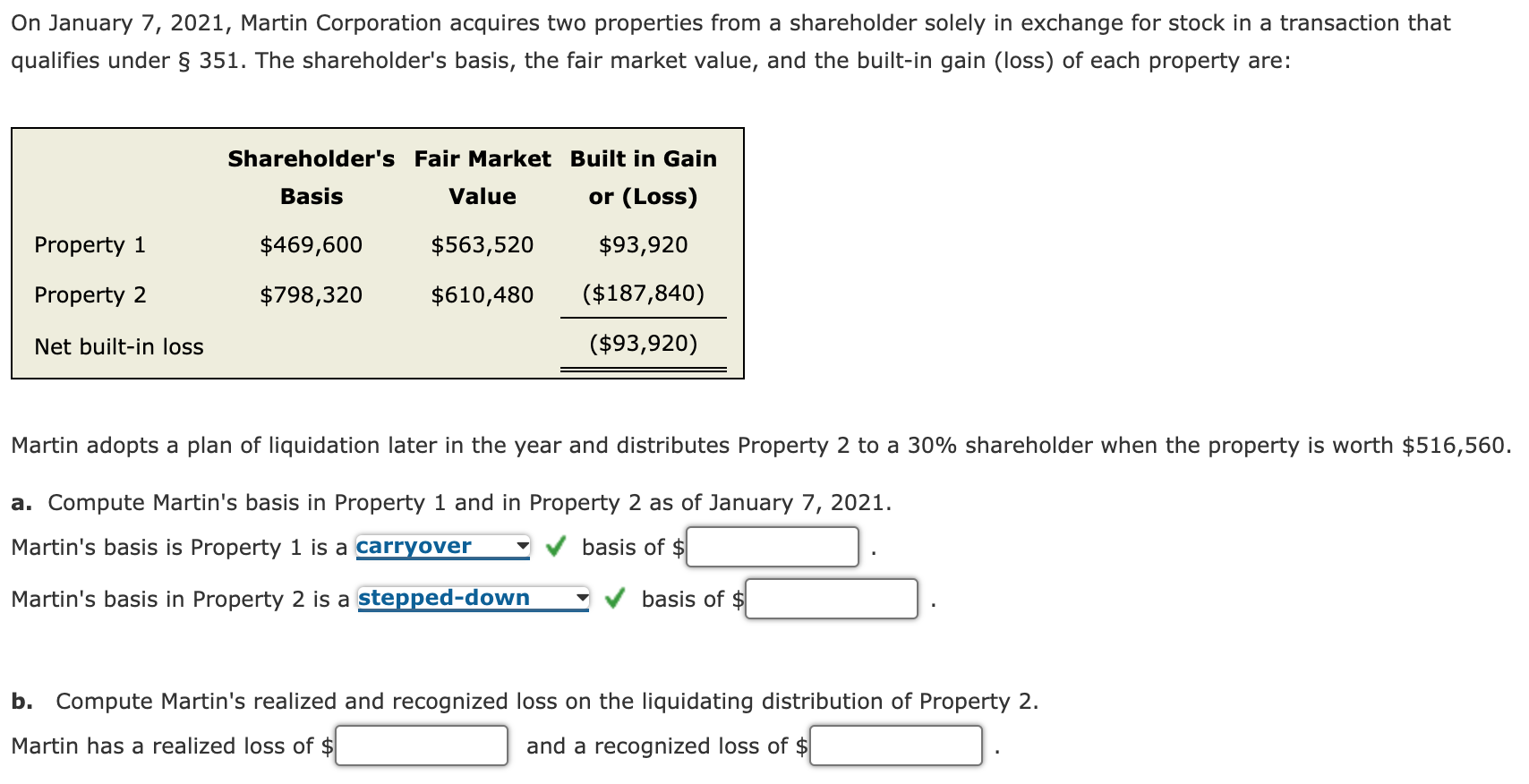

On January 7, 2021, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction that qualifies under § 351. The shareholder's basis, the fair market value, and the built-in gain (loss) of each property are: Shareholder's Fair Market Built in Gain Basis Value or (Loss) Property 1 $469,600 $563,520 $93,920 Property 2 $798,320 $610,480 ($187,840) Net built-in loss ($93,920) Martin adopts a plan of liquidation later in the year and distributes Property 2 to a 30% shareholder when the property is worth $516,560. a. Compute Martin's basis in Property 1 and in Property 2 as of January 7, 2021. Martin's basis is Property 1 is a carryover basis of $ Martin's basis in Property 2 is a stepped-down basis of $ b. Compute Martin's realized and recognized loss on the liquidating distribution of Property 2. Martin has a realized loss of $ and a recognized loss of $ On January 7, 2021, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction that qualifies under § 351. The shareholder's basis, the fair market value, and the built-in gain (loss) of each property are: Shareholder's Fair Market Built in Gain Basis Value or (Loss) Property 1 $469,600 $563,520 $93,920 Property 2 $798,320 $610,480 ($187,840) Net built-in loss ($93,920) Martin adopts a plan of liquidation later in the year and distributes Property 2 to a 30% shareholder when the property is worth $516,560. a. Compute Martin's basis in Property 1 and in Property 2 as of January 7, 2021. Martin's basis is Property 1 is a carryover basis of $ Martin's basis in Property 2 is a stepped-down basis of $ b. Compute Martin's realized and recognized loss on the liquidating distribution of Property 2. Martin has a realized loss of $ and a recognized loss of $

Expert Answer:

Answer rating: 100% (QA)

a Martins basis in Property 1 is a carryover basis of 469600 ... View the full answer

Related Book For

South Western Federal Taxation 2016 Corporations Partnerships Estates and Trusts

ISBN: 9781305399884

39th edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

Posted Date:

Students also viewed these accounting questions

-

On January 2, 2015, Martin Corporation acquires two properties from a shareholder in a transaction that qualifies under § 351. The shareholders basis, the fair market value, and the built-in...

-

On January 4, 2016, Martin Corporation acquires two properties from a shareholder in a transaction that qualifies under § 351. The shareholder's basis, the fair market value, and the built-in...

-

On January 4, 2017, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction that qualifies under § 351. The shareholder's basis, the fair...

-

Which type of Organizational Model put the MOST emphasis on establishing MORALE and AUTONOMY O a. Hierarchical style Model b. O c. O d. Flat Management (Holocracy) Model Multi-divisional style Model...

-

Describe the two targets that the Fed can use when establishing monetary policy. Which target has the Fed focused on in recent years?

-

Many people believe that the crime rate declines with age. a) Take data from the data file to verify whether this is true using a scatterplot. b) Is the relationship between crime rate and age...

-

Consider the multiple linear regression model $\mathbf{y}=\mathbf{X} \boldsymbol{\beta}+\boldsymbol{\varepsilon}$. Show that the least-squares estimator can be written as...

-

A consumer preference study compares the effects of three different bottle designs (A, B, and C) on sales of a popular fabric softener. A completely randomized design is employed. Specifically, 15...

-

Image transcription text Read the questions carefully before answering, any question with two or more answers will be considered wrong. 1. Draw the following lines and explain the purpose of each...

-

Spears was seeking employment and negotiating both with Amazon.com and with a firm called Intelligrated. Amazon made 2 offers to Spears which he rejected, because he believed they did not pay enough,...

-

create a database in MySQL for purposes of academic research. You are free to use ideas that may be flowing related to your planned dissertation research or another area of data collection to solve...

-

In nucleotide excision repair in E. coli, the function of the UvrA/ UvrB complex is to a. detect DNA damage. b. make cuts on both sides of the damage. c. remove the damaged piece of DNA. d. replace...

-

Red eyes is the wild-type phenotype in Drosophila, and several different genes (with each gene existing in two or more alleles) affect eye color. One allele causes purple eyes, and a different allele...

-

An Hfr strain that is leuA+ and thiL+ was mixed with a strain that is leuA and thiL. The data points in the following graph were obtained when conjugation was interrupted at different time points and...

-

As mentioned in question E11, red eyes is the wild-type phenotype in Drosophila. Several different genes (with each gene existing in two or more alleles) are known to affect eye color. One allele...

-

Occasionally during meiosis, a mistake results in a gamete receiving zero or two sex chromosomes rather than one. Bridges made a cross between white-eyed female flies and red-eyed male flies. As you...

-

Consider the following algorithm: 1: MULTIPRINT(A, n) 2: for (i = 0; i

-

What is a content filter? Where is it placed in the network to gain the best result for the organization?

-

To qualify as a partial liquidation, a distribution must not be essentially equivalent to a dividend. Discuss how this requirement is satisfied.

-

Benevolent, Inc., an exempt organization, owns the following properties. Calculate the adjusted basis to Benevolent of its debt-financed property. % Used in Exempt Purpose Acquisition Property...

-

What is the purpose of the three rules that implement the economic effect test?

-

On June 3, 2019, Catherine Shanahan received an unsolicited phone call on her cell phone. When she answered, she heard a prerecorded voice message advertising extended automobile warranties (Service...

-

In July 2006, the International Brotherhood of Teamsters, Local Union 25, filed two petitions and held an election for a collective bargaining representative at two FedEx locations. However, FedEx...

-

Miller filed for Chapter 7 bankruptcy protection on April 26, 2013. Based upon the filing date, the period for determining Millers current monthly income was October 1, 2012, through March 31, 2013....

Study smarter with the SolutionInn App