Poplar Outdoor Corporation owns 60 percent of the voting stock of Sugg Australia. Date-of-acquisition information is as

Fantastic news! We've Found the answer you've been seeking!

Question:

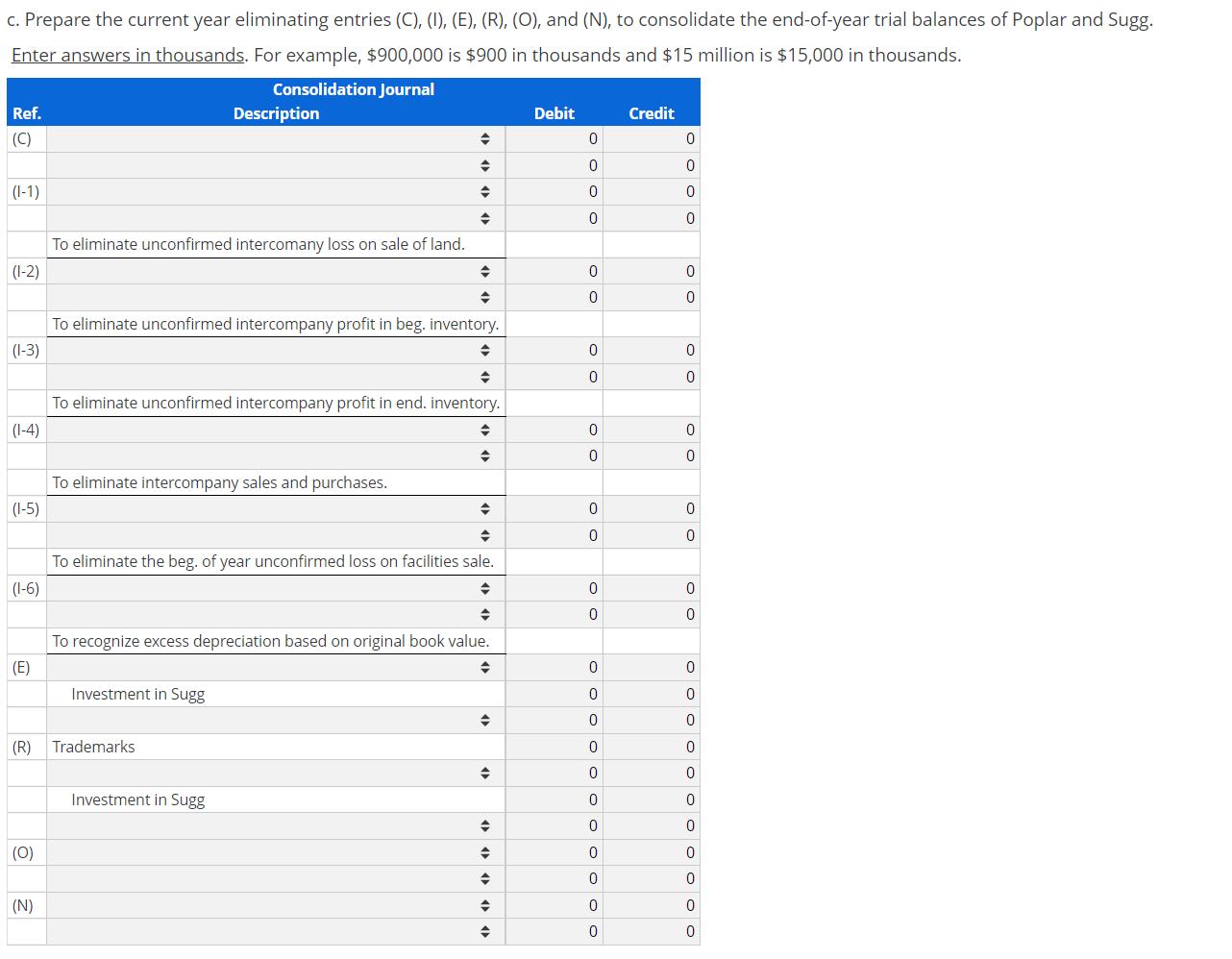

Poplar Outdoor Corporation owns 60 percent of the voting stock of Sugg Australia. Date-of-acquisition information is as follows:

- Acquisition cost: $59.25 million

- Fair value of the noncontrolling interest: $30.75 million

- Sugg's book value: $15 million

- Value of unreported acquired indefinite lived trademarks: $22.5 million.

As of the beginning of the current year, trademarks are impaired by $3 million, and goodwill impairment is $7.5 million. There is no current year impairment for the trademarks, but current year goodwill impairment is $1.5 million. Sugg reports net income of $2.25 million for the current year, and declares no dividends. Its total equity at the beginning of the year is $28.5 million.

Following is information on intercompany transactions between Poplar and Sugg:

- Sugg sold land to Poplar in the current year at a loss of $750,000. Poplar still owns the land.

- Intercompany profit in Poplar's beginning inventory, purchased from Sugg, is $300,000.

- Intercompany profit in Poplar's ending inventory, purchased from Sugg, is $435,000.

- Total sales from Sugg to Poplar, at the price charged to Poplar, were $9 million.

- Poplar sold administrative facilities with a book value of $12 million to Sugg two years ago, at the beginning of the year, for $10.5 million. The facilities had a remaining life of 10 years, straight-line. Sugg still uses the facilities.

Posted Date: