Richmond Inc. reported income from operations during 2019 of $750,000. Additional transactions occurring in 2019 but...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

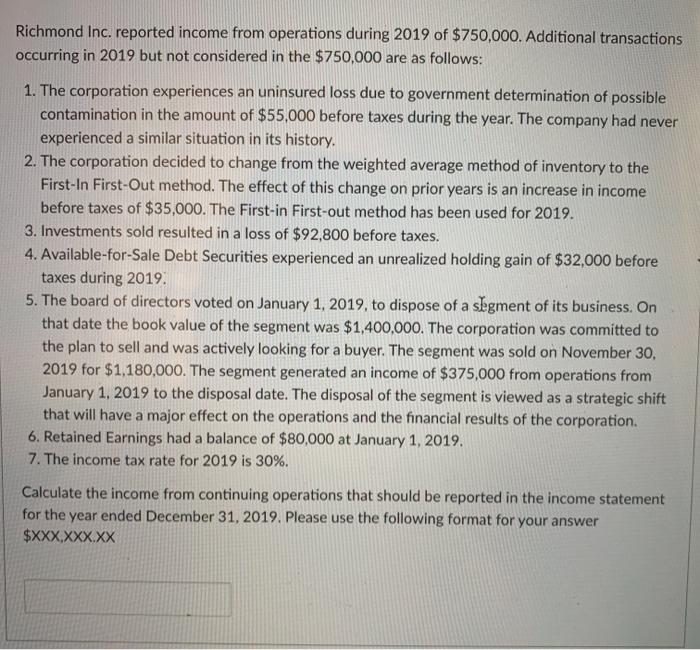

Richmond Inc. reported income from operations during 2019 of $750,000. Additional transactions occurring in 2019 but not considered in the $750,000 are as follows: 1. The corporation experiences an uninsured loss due to government determination of possible contamination in the amount of $55,000 before taxes during the year. The company had never experienced a similar situation in its history. 2. The corporation decided to change from the weighted average method of inventory to the First-In First-Out method. The effect of this change on prior years is an increase in income before taxes of $35,000. The First-in First-out method has been used for 2019. 3. Investments sold resulted in a loss of $92,800 before taxes. 4. Available-for-Sale Debt Securities experienced an unrealized holding gain of $32,000 before taxes during 2019. 5. The board of directors voted on January 1, 2019, to dispose of a segment of its business. On that date the book value of the segment was $1,400,000. The corporation was committed to the plan to sell and was actively looking for a buyer. The segment was sold on November 30, 2019 for $1,180,000. The segment generated an income of $375,000 from operations from January 1, 2019 to the disposal date. The disposal of the segment is viewed as a strategic shift that will have a major effect on the operations and the financial results of the corporation. 6. Retained Earnings had a balance of $80,000 at January 1, 2019. 7. The income tax rate for 2019 is 30%. Calculate the income from continuing operations that should be reported in the income statement for the year ended December 31, 2019. Please use the following format for your answer $XXX,XXX.XX Richmond Inc. reported income from operations during 2019 of $750,000. Additional transactions occurring in 2019 but not considered in the $750,000 are as follows: 1. The corporation experiences an uninsured loss due to government determination of possible contamination in the amount of $55,000 before taxes during the year. The company had never experienced a similar situation in its history. 2. The corporation decided to change from the weighted average method of inventory to the First-In First-Out method. The effect of this change on prior years is an increase in income before taxes of $35,000. The First-in First-out method has been used for 2019. 3. Investments sold resulted in a loss of $92,800 before taxes. 4. Available-for-Sale Debt Securities experienced an unrealized holding gain of $32,000 before taxes during 2019. 5. The board of directors voted on January 1, 2019, to dispose of a segment of its business. On that date the book value of the segment was $1,400,000. The corporation was committed to the plan to sell and was actively looking for a buyer. The segment was sold on November 30, 2019 for $1,180,000. The segment generated an income of $375,000 from operations from January 1, 2019 to the disposal date. The disposal of the segment is viewed as a strategic shift that will have a major effect on the operations and the financial results of the corporation. 6. Retained Earnings had a balance of $80,000 at January 1, 2019. 7. The income tax rate for 2019 is 30%. Calculate the income from continuing operations that should be reported in the income statement for the year ended December 31, 2019. Please use the following format for your answer $XXX,XXX.XX

Expert Answer:

Answer rating: 100% (QA)

Refer the solution in the image and understand what are discontinued operations and extraordinary items as written below A discontinued operation occurs when a business sells a segment usually an unpr... View the full answer

Related Book For

Cornerstones of Financial and Managerial Accounting

ISBN: 978-1111879044

2nd edition

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

Posted Date:

Students also viewed these accounting questions

-

The W27 x 94 beam shown below is laterally supported shown (points A, B, C, and D). The concentrated load is a service live load. Use Fy= 345 MPa and determine the following: a. Lp (2 points) b. Lr...

-

A Co. has annual fixed Costs Of % 1,40,000. In 2012 sales amounted to 6,00,000, as Compared with 2% 4,950,000 in 2011, and profit in 2012 was 2 42,000 higher than that in 2011. i) At what level of...

-

Solar drying has been used for centuries to dry and, thus, preserve fish, fruit, meat, plants, seeds, and wood. What are the advantages and disadvantages of this type of drying? What other types of...

-

Katz Hat Shop received a shipment of hats for which it paid the wholesaler $2,970. The price of the hats was $3,000, but Katz was given a $30 cash discount and required to pay freight charges of $50....

-

The actual concentration of carbon dioxide in exhaled air is about 0.04, or 100 times the ambient concentration. Find the value of S that gives this as the equilibrium. The above problem investigates...

-

Do we as a society focus too much on consumption, and, if so, how would one change that focus?

-

As an example of an interaction mediated by a "particle," imagine tossing a ball back and forth with a friend. You are both standing on an icy surface so slippery that friction is negligible. (a)...

-

Letty is hired as a Sales Executive and her role is to sell items which are given to her in a bag. The bag contains n items where each item has an associated ID. Letty is inherently lazy and plans to...

-

A ( n ) _ _ _ _ _ _ _ _ _ _ contains a specific piece of information within a record. Field Entity Row Database

-

OMalley plc requires a bank loan for additional working capital to finance expansion. The bank has requested an audited income statement for the year 2022. The accountant for OMalley plc provides you...

-

1. Given 100 g of styrene, and the appropriate apparatus and conditions to conduct the anionic polymerization of this monomer with n-butyllithium, calculate the expected average molecular weight of...

-

Taxable income and pretax financial income would be identical for Jiang Group except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income...

-

Sondgeroth Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. (Assume the carryback provision is used for a net operating loss.) The tax rates...

-

Crosley Corp. sold an investment on an installment basis. The total gain of 60,000 was reported for financial reporting purposes in the period of sale. The company qualifies to use the...

-

The following are the interval times (minutes) between eruptions of the Old Faithful geyser in Yellowstone National Park based on data from the U.S. National Park Service. 81 81 86 87 89 92 93 94 95...

-

Eugene Fama and Robert Shiller recently won the Nobel Prize in economics. Go to http://nobelprize.org/nobel_prizes/economics/ and locate the press release on Eugene Fama and Robert Shiller. What was...

-

What is the present value of $3,525 per year, at a discount rate of 10 percent, if the first payment is received 7 years from now and the last payment is received 25 years from now? (Do not round...

-

Digital Fruit is financed solely by common stock and has outstanding 25 million shares with a market price of $10 a share. It now announces that it intends to issue $160 million of debt and to use...

-

From time to time, business news will report that the management of a company has misstated its profits by knowingly establishing an incorrect amount for its ending inventory . Required: 1. Explain...

-

Refer to the information in Cornerstone Exercise 16-24 for data. Now, assume that Hallett has decided to use a plantwide overhead rate based on direct labor hours. At the beginning of the year,...

-

Refer to the information for Filimonov Inc. and assume that the company uses a perpetual inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the...

-

Bhopal is a city in central India with a population, in 1984 , of 800,000 . Because it was, at that time, home to the largest mosque in India, Bhopal was a major railway junction. Its main industries...

-

In the early 1980 s, Colombian drug barons, large landowners, industrialists, and bankers, with the cooperation of the Colombian government, began to create private paramilitary units to combat the...

-

PricewaterhouseCoopers (or PwC, as it is known), one of the United States' "Big 4" accounting firms, has had a tax practice in Russia since the time that country changed from Communist rule. One of...

Study smarter with the SolutionInn App