S Suppose we think we can sell 50,000 cans of shark attractant per year at a...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

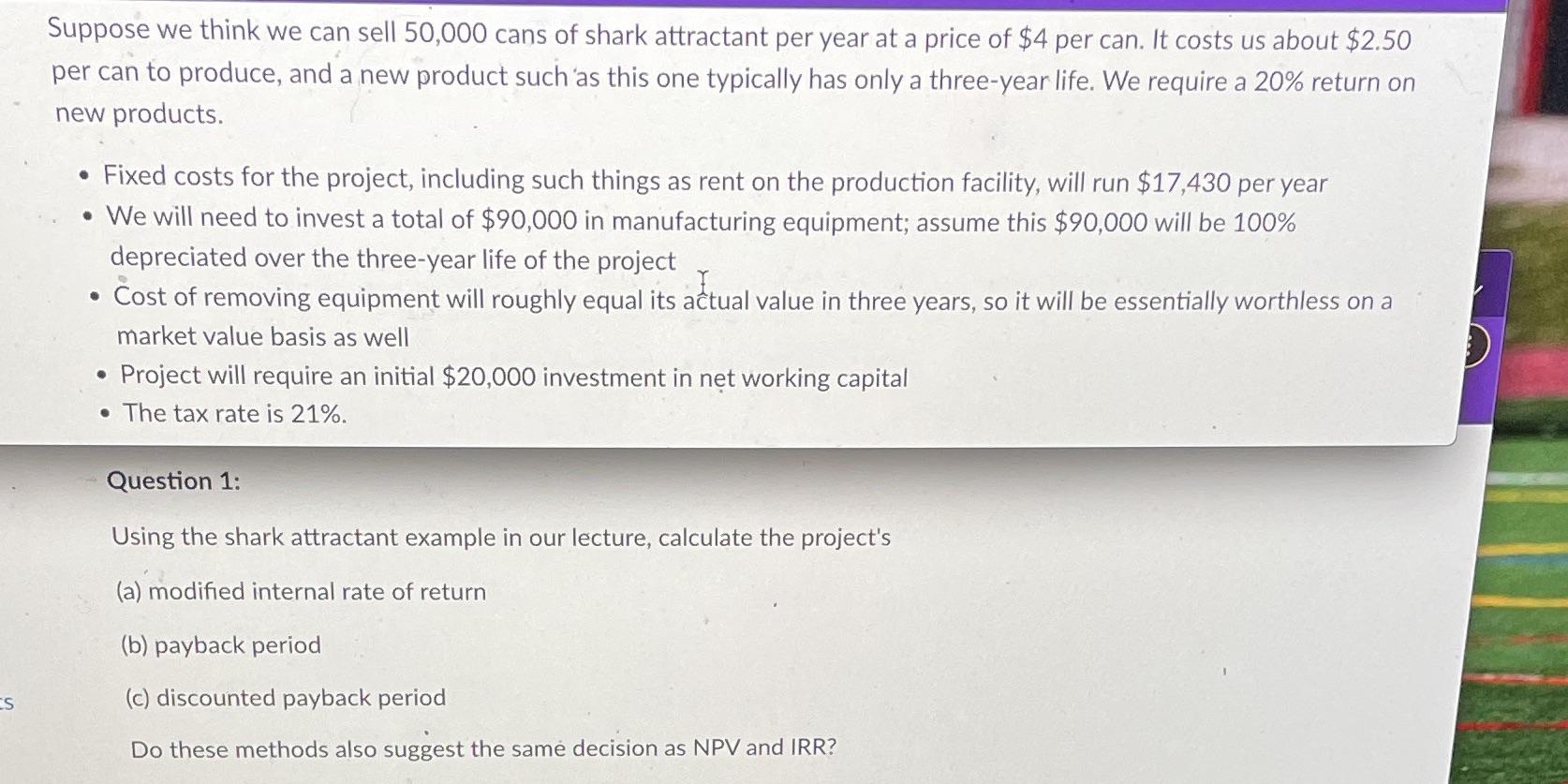

S Suppose we think we can sell 50,000 cans of shark attractant per year at a price of $4 per can. It costs us about $2.50 per can to produce, and a new product such as this one typically has only a three-year life. We require a 20% return on new products. • Fixed costs for the project, including such things as rent on the production facility, will run $17,430 per year . We will need to invest a total of $90,000 in manufacturing equipment; assume this $90,000 will be 100% depreciated over the three-year life of the project • Cost of removing equipment will roughly equal its actual value in three years, so it will be essentially worthless on a market value basis as well • Project will require an initial $20,000 investment in net working capital • The tax rate is 21%. Question 1: Using the shark attractant example in our lecture, calculate the project's (a) modified internal rate of return (b) payback period (c) discounted payback period Do these methods also suggest the same decision as NPV and IRR? S Suppose we think we can sell 50,000 cans of shark attractant per year at a price of $4 per can. It costs us about $2.50 per can to produce, and a new product such as this one typically has only a three-year life. We require a 20% return on new products. • Fixed costs for the project, including such things as rent on the production facility, will run $17,430 per year . We will need to invest a total of $90,000 in manufacturing equipment; assume this $90,000 will be 100% depreciated over the three-year life of the project • Cost of removing equipment will roughly equal its actual value in three years, so it will be essentially worthless on a market value basis as well • Project will require an initial $20,000 investment in net working capital • The tax rate is 21%. Question 1: Using the shark attractant example in our lecture, calculate the project's (a) modified internal rate of return (b) payback period (c) discounted payback period Do these methods also suggest the same decision as NPV and IRR?

Expert Answer:

Answer rating: 100% (QA)

SOLUTION To calculate the modified internal rate of return MIRR payback period and discounted payback period for the shark attractant project we need to first calculate the projects cash flows We can ... View the full answer

Related Book For

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

Posted Date:

Students also viewed these finance questions

-

The lawn mower company A is considering a proposal to start a project that is equally as risky as the overall firm. They invested $50,000 for Research & Development Program 10 years ago. They expect...

-

Your team of four people form a financial analysis team at Aussie Finance Consulting (AFC), a renowned financial institution. The executive management of AFC has assigned you a task to carry out a...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Describe four different definitions of quality.

-

The inventory records of Kuffel Co. reflected the following information for the year ended December 31, 2010: Required: a. Assume that Kuffel Co. uses a periodic inventory system. Calculate cost of...

-

Multiply or divide as indicated. Write answers in lowest terms as needed. 21 8 4 7

-

The Tuckers owned an RV that they insured through American Family. On August 26, 2012, their RV was struck by lightning and damaged. The Tuckers reported the damage to American Family. In March 2013,...

-

Judi Salem opened a law office on July 1, 2017. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owners...

-

DataBase managment design. Do the dowsings: 1. Run the sql commands written in ddl.sql file attached 2. Create_a dummy data. You can use "fake data generators" 3. Write followings - Write the query...

-

Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H & H Tool) on January 1, 1987, in Meadville, PA. The annual reporting period ends December 31. Assume that the trial...

-

You plan to buy a new HDTV. The dealer offers to sell the set to you on credit. You will have 3 months in which to pay, but the dealer says you will be charged a 15 percent interest rate; that is,...

-

?Which of the following is true about Essential Prime Implicants They cover all possible minterms in a function .1 O They are always the largest implicants in a Boolean function 2 O They cannot be...

-

addEventListener('click, functionToTrigger). In the JavaScript snippet above, what value is missing for this event listener to be correctly written? O The DOM API O The type of event to listen for O...

-

1. What does encryption do? It allows data like written text to be represented as strings of bits, so it can be used on a computer O Prevent hackers reading private files Stores the information used...

-

4. On a corporate network, hosts on the same VLAN can communicate with each other, but they are unable to communicate with hosts on different VLANs. What is needed to allow communication between the...

-

When classifying images into tiger and lions, which image classification algorithm finds the best plane that divides a dataset into two classes? 1 1 point Support Vector Machines K - Means Logistic...

-

Find The area of the inner and outer loop of the limacon with polar equation r = 2cos 8-1 The area bounded by the polar curve r = f(0) in the interval a 0 . A=11rde

-

1. Using the information from Problem 16-4B, prepare a statement of cash flows for Lim Garden Supplies Inc. using the direct method of presenting cash flows from operating activities. 2. How does Lim...

-

George McBee owns a small chain of specialty toy stores in Edmonton and Calgary. The companys organization chart follows: The following data about 2010 operations were also available. 1. All five...

-

A motorcycle manufacturer was concerned with declining market share because of foreign competition. To become more efficient, the company was considering changing to a just-in-time (JIT) production...

-

Distinguish between average and marginal tax rates

-

In late 2013, the taxi company Yourcabs.com in Bangalore, India, was facing a problem with the drivers using their platformnot all drivers were showing up for their scheduled calls. Drivers would...

-

Forecasting transportation demand is important for multiple purposes such as staffing, planning, and inventory control. The public transportation system in Santiago de Chile has gone through a major...

-

CRISA is an Asian market research agency that specializes in tracking consumer purchase behavior in consumer goods (both durable and nondurable). In one major research project, CRISA tracks numerous...

Study smarter with the SolutionInn App