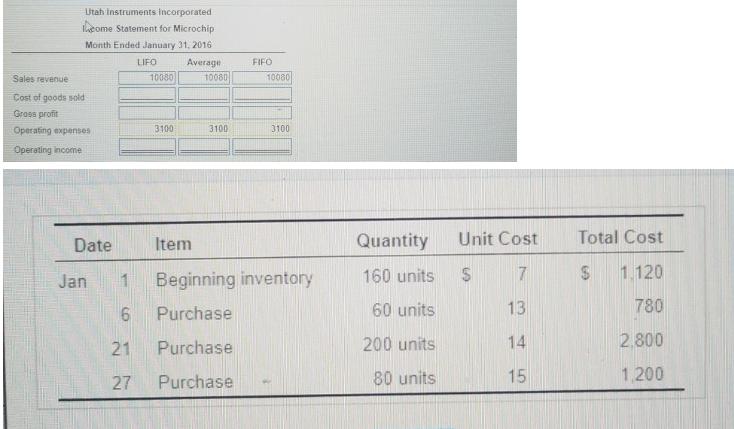

Suppose a division of Utah Instruments Incorporated that sells computer microchips has these inventory records for January

Fantastic news! We've Found the answer you've been seeking!

Question:

Suppose a division of Utah Instruments Incorporated that sells computer microchips has these inventory records for January 2016 E Cick the icon to view the inventory records.) Company accounting records show sales of 420 units for revenue of $10,080. Operating expense for January was $3,100.

Related Book For

Financial Accounting

ISBN: 978-0133472264

5th Canadian edition

Authors: Charles Horngren, William Thomas, Walter Harrison, Greg Berberich, Catherine Seguin

Posted Date: