The 2024 income statement and comparative balance sheet of Cobbs Hill, Inc. follow: (Click the icon...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

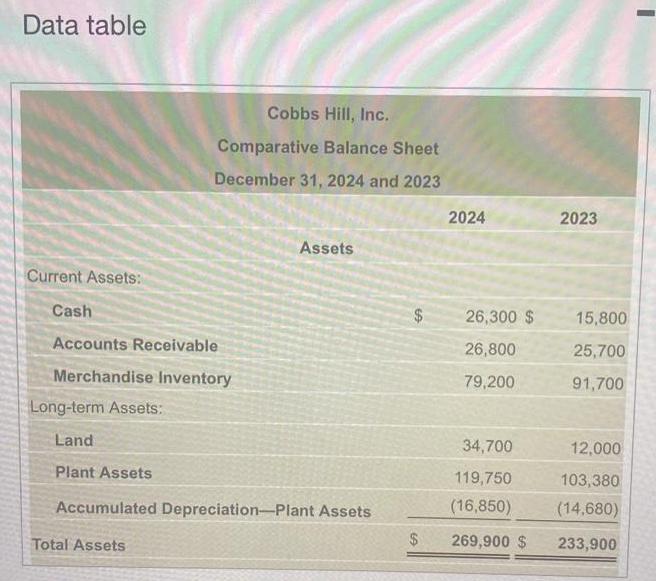

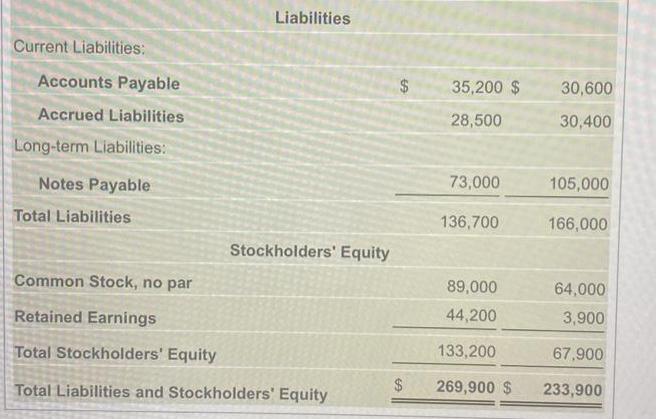

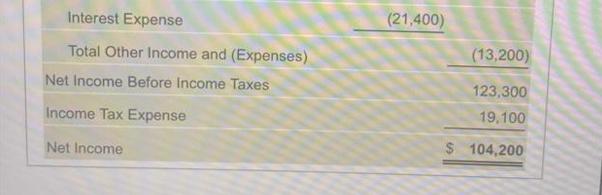

The 2024 income statement and comparative balance sheet of Cobbs Hill, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Data table Cobbs Hill, Inc. Comparative Balance Sheet December 31, 2024 and 2023 Current Assets: Cash Accounts Receivable Merchandise Inventory Long-term Assets: Land Plant Assets Assets Accumulated Depreciation-Plant Assets Total Assets $ 2024 26,300 $ 26,800 79,200 34,700 119,750 (16,850) 269,900 $ 2023 15,800 25,700 91,700 12,000 103,380 (14,680) 233,900 Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities Liabilities Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ EA 35,200 $ 28,500 73,000 136,700 89,000 44,200 133,200 269,900 $ 30,600 30,400 105,000 166,000 64,000 3,900 67,900 233,900 Cobbs Hill, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue SA 72,400 14,800 10,100 8,200 $ 435,000 201,200 233,800 97,300 136,500 Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense Net Income (21,400) (13,200) 123,300 19,100 $ 104,200 1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment? The 2024 income statement and comparative balance sheet of Cobbs Hill, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Data table Cobbs Hill, Inc. Comparative Balance Sheet December 31, 2024 and 2023 Current Assets: Cash Accounts Receivable Merchandise Inventory Long-term Assets: Land Plant Assets Assets Accumulated Depreciation-Plant Assets Total Assets $ 2024 26,300 $ 26,800 79,200 34,700 119,750 (16,850) 269,900 $ 2023 15,800 25,700 91,700 12,000 103,380 (14,680) 233,900 Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities Liabilities Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ EA 35,200 $ 28,500 73,000 136,700 89,000 44,200 133,200 269,900 $ 30,600 30,400 105,000 166,000 64,000 3,900 67,900 233,900 Cobbs Hill, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue SA 72,400 14,800 10,100 8,200 $ 435,000 201,200 233,800 97,300 136,500 Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense Net Income (21,400) (13,200) 123,300 19,100 $ 104,200 1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment?

Expert Answer:

Answer rating: 100% (QA)

Step 1 Operating Activities Indirect Method Start with Net Income 104200 Add Back NonCash Expenses Depreciation Expense 14800 Adjust for Changes in Wo... View the full answer

Related Book For

Financial Accounting and Reporting a Global Perspective

ISBN: 978-1408076866

4th edition

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

Posted Date:

Students also viewed these accounting questions

-

Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tigers statement of cash flows, using the indirect method to present...

-

The 2024 income statement and comparative balance sheet of Sweet Valley, Inc. follow: Additionally, Sweet Valley purchased land of $20,900 by financing it 100% with long-term notes payable during...

-

The 2024 income statement and comparative balance sheet of Rolling Hills, Inc. follow: Additionally, Rolling Hills purchased land of $21,100 by financing it 100% with long-term notes payable during...

-

A population of Ecuadorians have short stature. They have a rare genetic defect that affects the body's response to growth horm one, called Laron syndrome. Recent genetic studies have dem onstrated...

-

Why is revenue sometimes recognized at a time other than the sale?

-

In Problems 3344, graph the function f by starting with the graph of y = x 2 and using transformations (shifting, compressing, stretching, and/or reflecting). If necessary, write f in the form f ( x)...

-

The Anchor Glass Container Corporation and its parent company, Consumers Packaging, Inc. (CPI), entered into a series of agreements with Encore Glass, Inc., to supply glass containers of a specific...

-

Karel Svoboda, a credit officer for Rogue Bank, evaluated and approved his employers extensions of credit to clients. These responsibilities gave Svoboda access to nonpublic information about the...

-

Explain what a database management system is. Describe the functions of a database management system. 5 Paragraph Essay Intro ,Body , Conclusion

-

Write a paragraph in which you explain how an online retailer might use its return policy to gain a competitive advantage.

-

1,200 paid on 1" March followed by 12 equal monthly instalments starting 1 April. The cash balance forecast at the beginning of April is 400. b) Alpha pic operates a retail business. Purchases are...

-

You are in a spaceship approaching Mars with an approach distance, d = 7.1 x 106 m. and a velocity relative to Mars of 2,670 m/sec. (see illustration below). Is your spaceship going to impact the...

-

What type of medium would you use if you specifically wanted to determine the nutritional requirements of a specific microbe?

-

On March 16, 2021, an explosion at Zach Industries caused damage to property in the surrounding area. As at March 31, no claims had been made, though Zach's lawyers deemed it reasonably possible that...

-

A block of mass 9.0 kg is placed on a surface inclined at 0 = 30 as shown in the figure. If the coefficient of kinetic friction = 0.22, Find the acceleration in the block. Fk W FN

-

A 115 g of steam is emitted from a volcano at 100 C. How many kJ of heat should be released for the steam to fall as rain at 15 C?

-

The balance sheet for the newly formed ACME Bank is shown below. ACME Bank Balance Sheet 11 Assets Reserves Property $ Assets Reserves Loans Property Liabilities and net worth i 103,000 Checkable...

-

Evaluate each logarithm to four decimal places. log 0.257

-

Bosch is a German group producing automotive equipment, power tools and home appliances. The consolidated balance sheet and notes to financial statements 2010 and 2011 show the following elements...

-

The Electrolux Group (hereafter Electrolux) is a producer of home appliances and appliances for professional use, selling more than 40 million products to customers in 150 countries. The companys...

-

=> Prepare a 15-minute oral presentation on the history of charts of accounts, with particular reference to the French chart of accounts (dating from 1942). => Prepare a 15-minute oral presentation...

-

A surface with \(N_{0}\) adsorption centers has \(N\left(\leq N_{0}ight)\) gas molecules adsorbed on it. Show that the chemical potential of the adsorbed molecules is given by \[ \mu=k T \ln...

-

Assuming that the latent heat of vaporization of water \(L_{\mathrm{V}}=2260 \mathrm{~kJ} / \mathrm{kg}\) is independent of temperature and the specific volume of the liquid phase is negligible...

-

Define a quantity \(J\) as \[ J=E-N \mu=T S-P V \] Show that for a system in the grand canonical ensemble \[ \overline{(\Delta J)^{2}}=k T^{2} C_{V}+\left\{\left(\frac{\partial U}{\partial...

Study smarter with the SolutionInn App