que fic The draft statements of financial position at 31 March 2021 and statements of profit...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

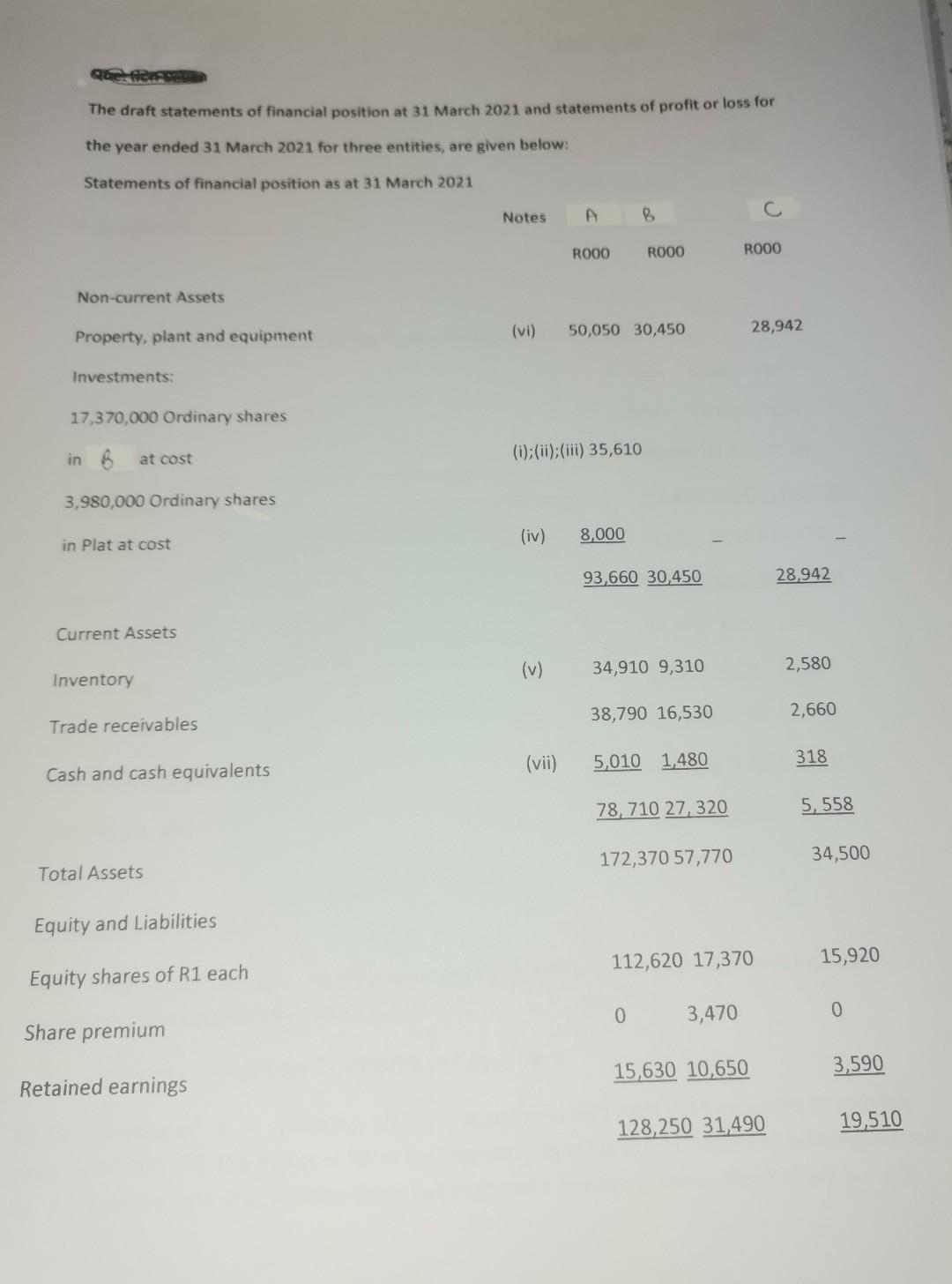

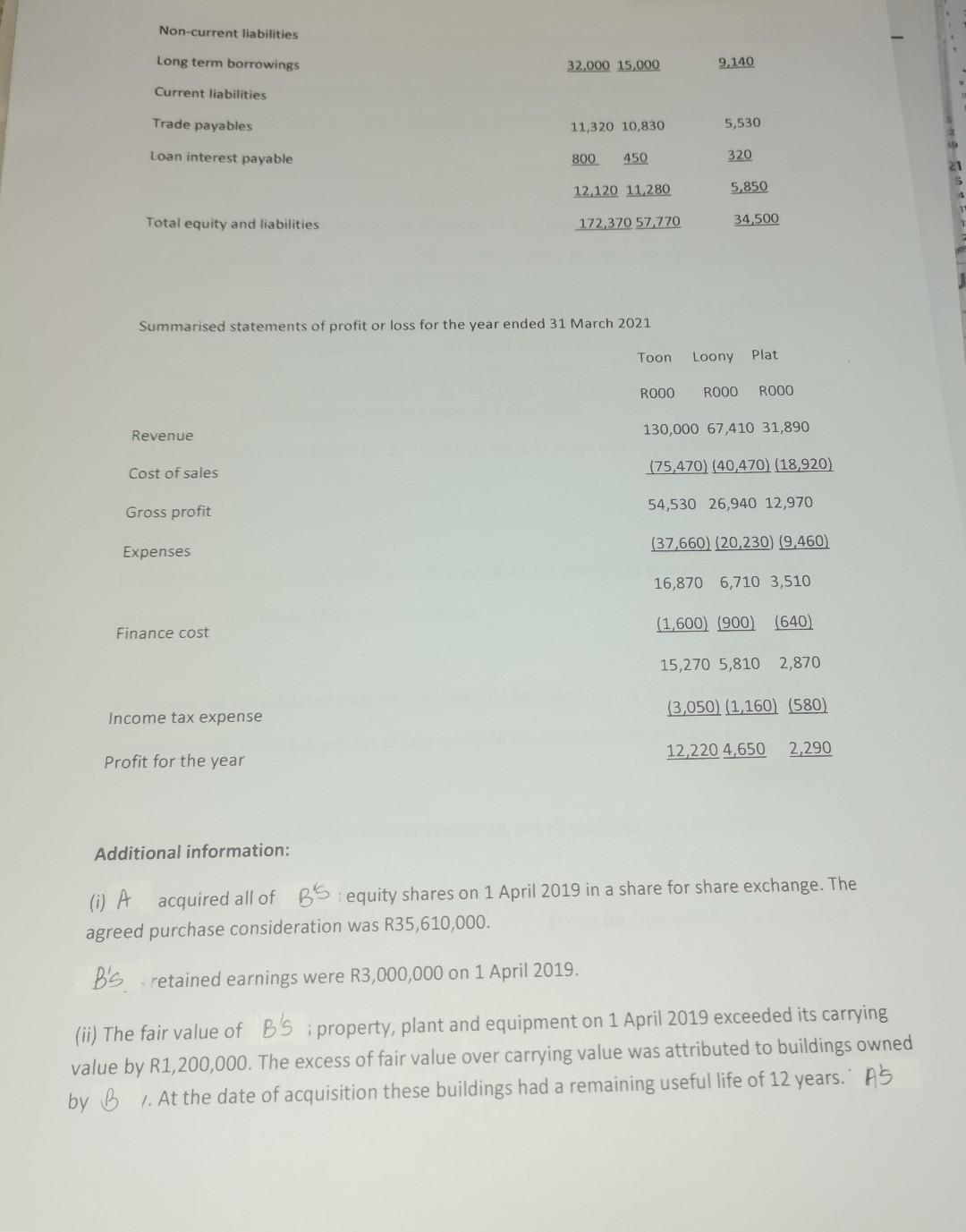

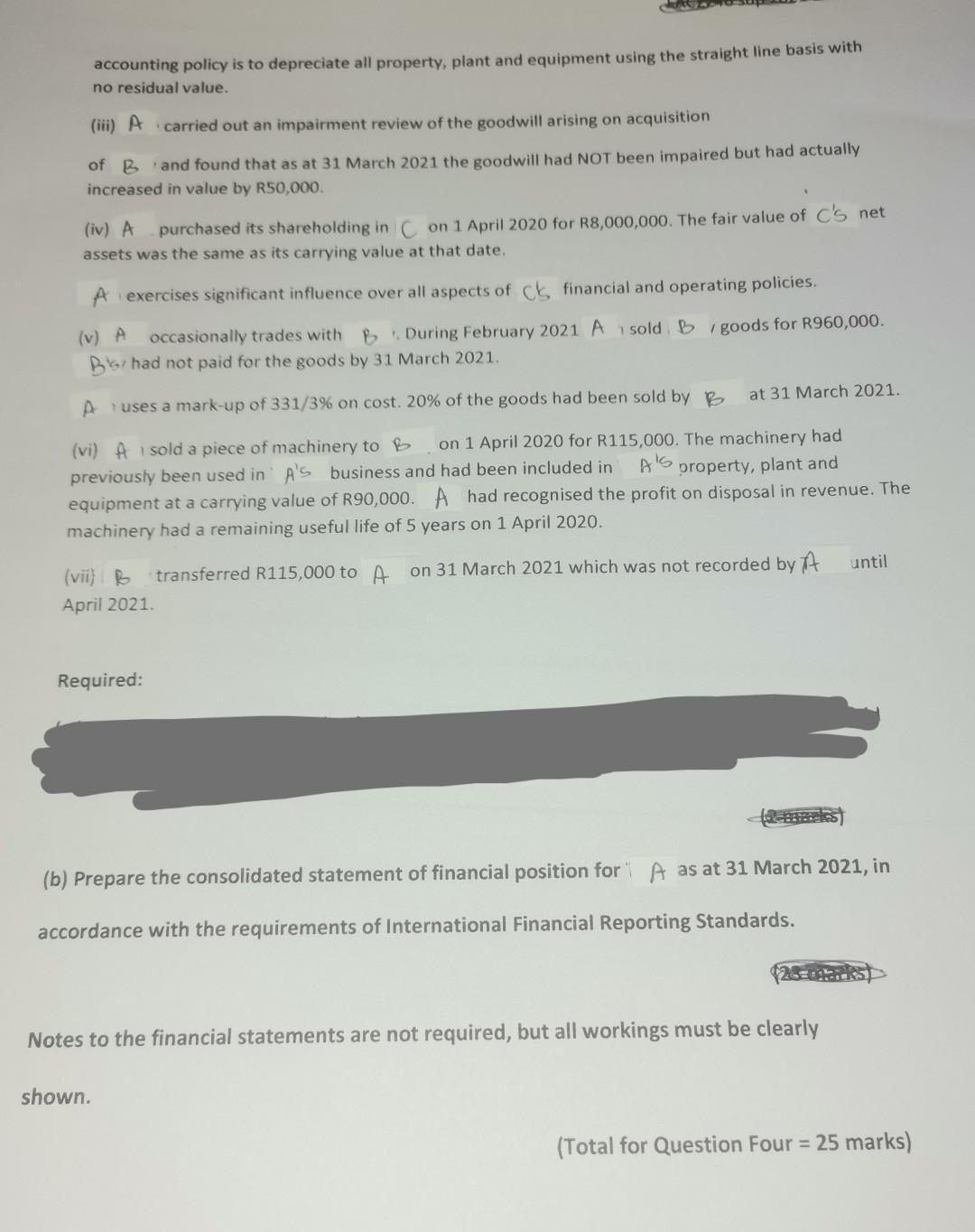

que fic The draft statements of financial position at 31 March 2021 and statements of profit or loss for the year ended 31 March 2021 for three entities, are given below: Statements of financial position as at 31 March 2021 Non-current Assets Property, plant and equipment Investments: 17,370,000 Ordinary shares in 8 3,980,000 Ordinary shares at cost in Plat at cost Current Assets Inventory Trade receivables Cash and cash equivalents Total Assets Equity and Liabilities Equity shares of R1 each Share premium Retained earnings Notes A ROOO (v) (vi) 50,050 30,450 (i); (ii); (iii) 35,610 (iv) 8,000 (vii) B ROOO 93,660 30,450 34,910 9,310 38,790 16,530 5,010 1,480 78,710 27, 320 172,370 57,770 0 ROOO 112,620 17,370 3,470 28,942 15,630 10,650 128,250 31,490 28,942 2,580 2,660 318 5,558 34,500 15,920 0 3,590 19,510 Non-current liabilities Long term borrowings Current liabilities Trade payables Loan interest payable Total equity and liabilities Revenue Cost of sales Gross profit Expenses Summarised statements of profit or loss for the year ended 31 March 2021 Finance cost Income tax expense 32,000 15,000 Profit for the year 11,320 10,830 800 450 12,120 11,280 172,370 57,770 Toon R000 9,140 5,530 320 5,850 34,500 Loony Plat ROOO ROOO 130,000 67,410 31,890 (75,470) (40,470) (18,920) 54,530 26,940 12,970 (37,660) (20,230) (9,460) 16,870 6,710 3,510 (1,600) (900) (640) 15,270 5,810 2,870 (3,050) (1,160) (580) 12,220 4,650 2,290 Additional information: (i) A acquired all of BS equity shares on 1 April 2019 in a share for share exchange. The agreed purchase consideration was R35,610,000. B's retained earnings were R3,000,000 on 1 April 2019. T (ii) The fair value of B's property, plant and equipment on 1 April 2019 exceeded its carrying value by R1,200,000. The excess of fair value over carrying value was attributed to buildings owned by B. At the date of acquisition these buildings had a remaining useful life of 12 years. AS accounting policy is to depreciate all property, plant and equipment using the straight line basis with no residual value. (iii) A carried out an impairment review of the goodwill arising on acquisition of Band found that as at 31 March 2021 the goodwill had NOT been impaired but had actually increased in value by R50,000. (iv) A purchased its shareholding in C on 1 April 2020 for R8,000,000. The fair value of C's net assets was the same as its carrying value at that date. A exercises significant influence over all aspects of ct financial and operating policies. (v) A occasionally trades with During February 2021 Asold goods for R960,000. B had not paid for the goods by 31 March 2021. A uses a mark-up of 331/3% on cost. 20% of the goods had been sold by (vi) Asold a piece of machinery to on 1 April 2020 for R115,000. The machinery had A property, plant and previously been used in A's business and had been included in equipment at a carrying value of R90,000. A had recognised the profit on disposal in revenue. The machinery had a remaining useful life of 5 years on 1 April 2020. transferred R115,000 to A on 31 March 2021 which was not recorded by (vii) B April 2021. Required: at 31 March 2021. shown. (b) Prepare the consolidated statement of financial position for A as at 31 March 2021, in accordance with the requirements of International Financial Reporting Standards. Notes to the financial statements are not required, but all workings must be clearly until (Total for Question Four = 25 marks) que fic The draft statements of financial position at 31 March 2021 and statements of profit or loss for the year ended 31 March 2021 for three entities, are given below: Statements of financial position as at 31 March 2021 Non-current Assets Property, plant and equipment Investments: 17,370,000 Ordinary shares in 8 3,980,000 Ordinary shares at cost in Plat at cost Current Assets Inventory Trade receivables Cash and cash equivalents Total Assets Equity and Liabilities Equity shares of R1 each Share premium Retained earnings Notes A ROOO (v) (vi) 50,050 30,450 (i); (ii); (iii) 35,610 (iv) 8,000 (vii) B ROOO 93,660 30,450 34,910 9,310 38,790 16,530 5,010 1,480 78,710 27, 320 172,370 57,770 0 ROOO 112,620 17,370 3,470 28,942 15,630 10,650 128,250 31,490 28,942 2,580 2,660 318 5,558 34,500 15,920 0 3,590 19,510 Non-current liabilities Long term borrowings Current liabilities Trade payables Loan interest payable Total equity and liabilities Revenue Cost of sales Gross profit Expenses Summarised statements of profit or loss for the year ended 31 March 2021 Finance cost Income tax expense 32,000 15,000 Profit for the year 11,320 10,830 800 450 12,120 11,280 172,370 57,770 Toon R000 9,140 5,530 320 5,850 34,500 Loony Plat ROOO ROOO 130,000 67,410 31,890 (75,470) (40,470) (18,920) 54,530 26,940 12,970 (37,660) (20,230) (9,460) 16,870 6,710 3,510 (1,600) (900) (640) 15,270 5,810 2,870 (3,050) (1,160) (580) 12,220 4,650 2,290 Additional information: (i) A acquired all of BS equity shares on 1 April 2019 in a share for share exchange. The agreed purchase consideration was R35,610,000. B's retained earnings were R3,000,000 on 1 April 2019. T (ii) The fair value of B's property, plant and equipment on 1 April 2019 exceeded its carrying value by R1,200,000. The excess of fair value over carrying value was attributed to buildings owned by B. At the date of acquisition these buildings had a remaining useful life of 12 years. AS accounting policy is to depreciate all property, plant and equipment using the straight line basis with no residual value. (iii) A carried out an impairment review of the goodwill arising on acquisition of Band found that as at 31 March 2021 the goodwill had NOT been impaired but had actually increased in value by R50,000. (iv) A purchased its shareholding in C on 1 April 2020 for R8,000,000. The fair value of C's net assets was the same as its carrying value at that date. A exercises significant influence over all aspects of ct financial and operating policies. (v) A occasionally trades with During February 2021 Asold goods for R960,000. B had not paid for the goods by 31 March 2021. A uses a mark-up of 331/3% on cost. 20% of the goods had been sold by (vi) Asold a piece of machinery to on 1 April 2020 for R115,000. The machinery had A property, plant and previously been used in A's business and had been included in equipment at a carrying value of R90,000. A had recognised the profit on disposal in revenue. The machinery had a remaining useful life of 5 years on 1 April 2020. transferred R115,000 to A on 31 March 2021 which was not recorded by (vii) B April 2021. Required: at 31 March 2021. shown. (b) Prepare the consolidated statement of financial position for A as at 31 March 2021, in accordance with the requirements of International Financial Reporting Standards. Notes to the financial statements are not required, but all workings must be clearly until (Total for Question Four = 25 marks)

Expert Answer:

Answer rating: 100% (QA)

Consolidated Statement of Financial Position for A as at 31 March 2021 Assets Amount Noncurrent asse... View the full answer

Related Book For

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone

Posted Date:

Students also viewed these accounting questions

-

The comparative statements of financial position for Ramirez Company as of December 31 are presented on the shown below. Additional information: 1. Operating expenses include depreciation expense of...

-

The current sections of Nasreen SA's statements of financial position at December 31, 2016 and 2017, are presented here. Nasreen's net income for 2017 was ¬147,000. Depreciation expense was...

-

The comparative statements of financial position for Amaral Reis Company SA as of December 31 are presented as follows. Additional information: 1. Operating expenses include depreciation expense of...

-

Practice Problem 6: We-B-Busy, Inc. uses job costing and a predetermined overhead rate based on machine hours (MH). The firm estimated that it would use $240,000 of MOH and 7,500 MH this year. Data...

-

Answer the following questions using the data from Problem 14.42: a. Calculate the coefficient of determination. b. Using α = 0.05, test the significance of the population coefficient...

-

Mary Peterson is in charge of preparing blended flour for exotic bread making. The process is to take two different types of flour and mix them together in order to achieve high-quality breads. For...

-

Match each five number summary with one of the histograms in Figure 2.23. The scale is the same on all four histograms. (a) $(1,3,5,7,9)$ (b) $(1,4,5,6,9)$ (c) $(1,5,7,8,9)$ (d) $(1,1,2,4,9)$ Figure...

-

Delby Industries has manufactured prefabricated houses for over 20 years. The houses are constructed in sections to be assembled on customers lots. Delby expanded into the precut housing market when...

-

13-40. Cycle-1 is a fast-growing start-up firm that manufactures bicycles. The following income statement is available for October: Sales revenue (300 units @ $600 per unit) Less Manufacturing costs...

-

Mr. M has been employed as an engineer by A Ltd., a company incorporated in Hong Kong. During the year ended 31 March 2019, Mr. M had the following income and expenditure. A monthly salary of...

-

How has the proliferation of social media platforms reshaped the landscape of social change dynamics in the 21st century?

-

The balance in Simpson Corp.s foreign exchange loss account was $15,000 on December 31, 20X2, before any necessary year-end adjustment relating to the following: (1) Simpson had a $20,000 debit...

-

Gate Inc. had a $30,000 credit adjustment for the year ended December 31, 20X2, from restating its foreign subsidiarys accounts from their local currency units into U.S. dollars. Additionally, Gate...

-

Dutko Company has three lines of business, each of which is a significant industry segment. Company sales aggregated $1,800,000 in 20X6, of which Segment 3 contributed 60 percent. Traceable costs...

-

Selected data for a segment of a business enterprise are to be reported separately in accordance with ASC 280 when the revenue of the segment exceeds 10 percent of the a. Combined net income of all...

-

Kimber Company operates in four different industries, each of which is appropriately regarded as a reportable segment. Total sales for 20X2 for all segments combined were $1,000,000. Sales for...

-

b) height/head circumference Suppose a doctor measures the height, \( x \), and head circumference, \( y \), of 11 children and obtains the data below. The correlation coefficient is \( 0.825 \) and...

-

Why is homeostasis defined as the "relative constancy of the internal environments? Does negative feedback or positive feedback tend to promote homeostasis?

-

Cuppa and Cake is a charity that runs a small caf to raise money for local children. The following information has been prepared by the treasurer for the year ended 31 December 2014. Additional...

-

The statement of financial position for Sara and Tracey at 30 November 2014 was as follows. Sara and Tracey share profits and losses equally. They have agreed to dissolve the partnership as Sara has...

-

Fratelli Ltd manufactures two products: hexo and zaco. The following information is available about production costs. The direct costs of product are as follows. The company total factory overheads...

-

Use Eqs. (7.27)-(7.31) to verify the entries in Table 7.1. Data from Eq. 7.27 Data from Eq. 7.28 Data from Eq. 7.29 Data from Eq. 7.30 Data from Eq. 7.31 Data from Table 7.1 n = 2 a.m = q- p.

-

Use the definition of the adjoint representation matrices (3.8), to compute the action of a generator \(X_{a}\) on a state \(\left|X_{b} ightangle\) given in Eq. (7.3). Data from Eq. 3.8 Data from...

-

Show that the operators given in Eq. (7.20) have the SU(2) commutators (7.21). Data from Eq. (7.20) Data from Eq. (7.21) Eta a. H E = E3 E = |a| a

Study smarter with the SolutionInn App