For many years the milk industry faced an important question: What does the federal government plan to

Question:

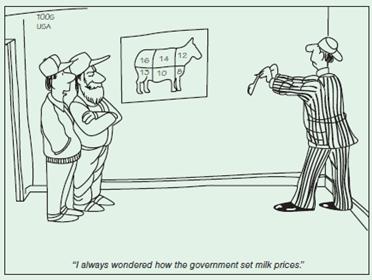

For many years the milk industry faced an important question: What does the federal government plan to do about its dairy price support program, which has helped boost farmers’ income since 1949? Under the price support program, the federal government agrees to buy storable milk products, such as cheese, butter, and dry milk. If the farmers cannot sell all their products to consumers at a price exceeding the price support level, the federal government will purchase any unsold grade A milk production. Although state-run dairy commissions set their own minimum prices for milk, these legal minimums were similar to the federally set prices. To reduce the interstate price competition for milk, each state set its minimum milk price within 3 percent of the prices set by bordering states. The result has been that the government essentially bought up surplus production at supported prices—prices above what would otherwise exist in the market.

These federal price supports on dairy products, as well as other agricultural products, have been controversial. Critics argue that price support programs force consumers to face considerably higher prices for milk and milk-based foods. They also argue that these programs waste taxpayer money. For example, each year the federal government pays billions of dollars to dairy farmers for milk products that sometimes are destroyed or held in storage at a huge cost. Moreover, the problem is compounded because the federal government encourages dairy farmers to use ultramodern farming techniques to increase the production per cow. Another concern is that instead of helping small family farmers, these price supports are a corporate welfare program, and the biggest government price support checks go to the largest farmers. This enables these corporate farms to buy smaller, less-efficient farmers, pushing up land values that prevent young people from entering farming and contributing to the decline in the number of dairy farmers. Finally, opponents of the dairy price support program argue that the market for milk is inherently a competitive industry and that consumers and taxpayers would be better served without government price supports for milk.

Perhaps as a result of the critics, Congress did take action with the passage of the Agricultural Act of 2014, which repealed price supports on dairy products. This legislation, however, has not stopped government from trying to assist farmers. Two new government programs were established with this act: the Margin Protection Program for Dairy (MPPDairy) and the Dairy Product Donation Program (DPDP).

The Margin Protection Program for Dairy (MPP-Dairy) offers dairy producers catastrophic insurance coverage at virtually no cost to them, and some additional insurance at their expense, should the difference between current market prices and the costs of production fall below a certain amount (called the “margin”—currently between $4, which is the basic catastrophic amount, and up $8, where a premium is charged farmers). The Dairy Product Donation Program (DPDP) requires the Secretary of Agriculture to purchase dairy products for donation to low-income groups when the dairy margin falls below $4.00.

The Agricultural Act of 2014 is due to expire December 31, 2018. We will have to see what the future holds as government balances the interests of farmers, consumers, and taxpayers.

What do you think the impact is on dairy farmers, consumers, and taxpayers as a result of the Margin Protection Program for Dairy (MPP-Dairy)? Is this an improvement over the price support program?

Cost Management A Strategic Emphasis

ISBN: 978-0078025532

6th edition

Authors: Edward Blocher, David Stout, Paul Juras, Gary Cokins