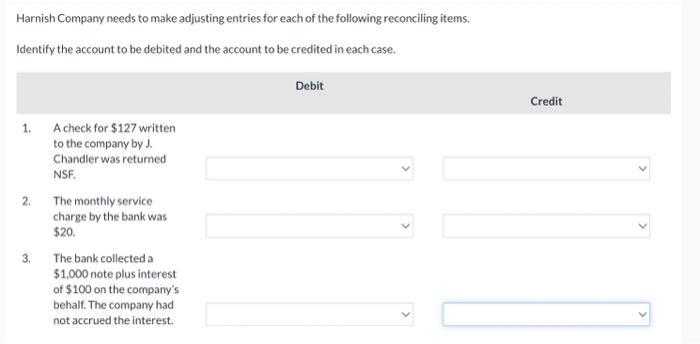

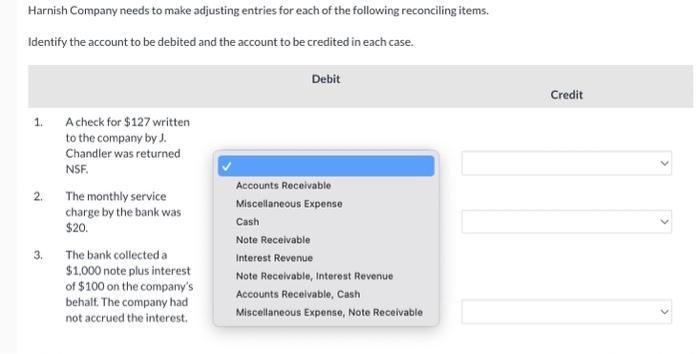

Harnish Company needs to make adjusting entries for each of the following reconciling items. Identify the...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

Harnish Company needs to make adjusting entries for each of the following reconciling items. Identify the account to be debited and the account to be credited in each case. 1. A check for $127 written to the company by J. Chandler was returned NSF. 2. The monthly service charge by the bank was $20. 3. The bank collected a $1,000 note plus interest of $100 on the company's behalf. The company had not accrued the interest. Debit Credit Harnish Company needs to make adjusting entries for each of the following reconciling items. Identify the account to be debited and the account to be credited in each case. 1. 2. 3. A check for $127 written to the company by J. Chandler was returned NSF. The monthly service charge by the bank was $20. The bank collected a $1,000 note plus interest of $100 on the company's behalf. The company had not accrued the interest. Debit Accounts Receivable Miscellaneous Expense Cash Note Receivable Interest Revenue Note Receivable, Interest Revenue Accounts Receivable, Cash Miscellaneous Expense, Note Receivable Credit Harnish Company needs to make adjusting entries for each of the following reconciling items. Identify the account to be debited and the account to be credited in each case. 1. A check for $127 written to the company by J. Chandler was returned NSF. 2. The monthly service charge by the bank was $20. 3. The bank collected a $1,000 note plus interest of $100 on the company's behalf. The company had not accrued the interest. Debit Credit Harnish Company needs to make adjusting entries for each of the following reconciling items. Identify the account to be debited and the account to be credited in each case. 1. 2. 3. A check for $127 written to the company by J. Chandler was returned NSF. The monthly service charge by the bank was $20. The bank collected a $1,000 note plus interest of $100 on the company's behalf. The company had not accrued the interest. Debit Accounts Receivable Miscellaneous Expense Cash Note Receivable Interest Revenue Note Receivable, Interest Revenue Accounts Receivable, Cash Miscellaneous Expense, Note Receivable Credit

Expert Answer:

Answer rating: 100% (QA)

Answer Solution Step 1 I Since you have asked multiple questions we will solve first question ... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

The Nike swoosh may be one of the most recognized logos in the world of sports, but the Under Armour logo (an interlocking U and A) is increasingly in the spotlight as the company gets noticed on and...

-

Although the human colon may be one of the most diverse microbial communities on Earth, the majority of the bacteria are classified as ______________.

-

Global athletic footwear and apparel giant adidas has established itself as a leader in just about every sport. But the area that the company has achieved the most greatness has little to do with...

-

6. Kindly describe the accounting framework. What are the elements and how do they effect the financial statements? 7. What does the accounting model specify? What are the elements involved?

-

Suppose that project sponsors build a facility under a PPP scheme. The public administration pays every cost overrun incurred by the private sponsors during construction and the sponsors fully bear...

-

Riffraff, launched by entrepreneur Kirsten Blowers Stuckey, sells clothing, jewelry, and gifts. Required Kirsten uses variable costing in her business decisions. If Riffraff used absorption costing,...

-

Refer to the information in Problem 21-1B. Tohono Companys actual income statement for 2017 follows. Required 1. Prepare a flexible budget performance report for 2017. Analysis Component 2. Analyze...

-

1. Why is the operations function important in implementing the strategy of an organization? Explain why the changes put in place by Victoria Chen and her team could either hurt or help the bank. 2....

-

Scenario 1: Joey is a 15 year old who is ready to work, but his parents want him to have more responsibility with money first. His parents have already set up checking and savings accounts for him at...

-

The following are the financial statements for Nailsea plc for the years ended 30 June 2014 and 2015: Income statement for years ended 30 June Statements of financial position as at 30 June There...

-

The following select account data is taken from the records of Reese Industries for 2019. Sales Account Reese Industries data Merchandise Inventory Sales Discounts Interest Expense Sales Returns and...

-

Concept map that will illustrate the 10 itemized deductions in Income Taxation. It must be clear and concise.

-

Explain the units below and their functions Public and Media Information General Investigation Communications/911 Center

-

Explain the ethical and social implications of "offshoring". Consider the issue from the perspective of both U.S. employees and foreign employees. Consider the issue from the perspective of companies...

-

Using Westlaw, locate the provision of the North Carolina Constitution that provides for a general and uniform system of free public schools in North Carolina?

-

Explain the problem on the TRAIN Law amendments to zero-rated sales which arose from the CREATE Law.

-

A rectangular football field is 64 meters wide and 100 meters long. A player runs from one corner of the field in a diagonal line to the opposite corner. How far did the player run?

-

Define deferred revenue. Why is it a liability?

-

The Cosmetic Co. is a company producing a variety of cosmetic creams and lotions.The creams and lotions are sold to a variety of retailers at a price of $23.20 for each jar of face cream and $16.80...

-

Explain why a single transfer pricing method cannot serve all four purposes.

-

The modern dynamic business environment has been described as a buyers market in which companies must react to the rapidly changing characteristics of the market and the needs of customers. Many...

-

Show that, in Theorem 19.17, the quadratic variation \(\langle Mangle_{t}\) is a \(\mathscr{G}_{t}\) stopping time.Direct calculation, use Lemma 19.16.c) and A. 15 Data From Theorem 19.17 19.17...

-

The proof of Theorem 19.29 uses, implicitly, the following beautiful result due to Skorokhod [239] which is to be proved: Lemma. Let \(b:[0, \infty) ightarrow \mathbb{R}\) be a continuous function...

-

We have seen in Lemma 19.27.a) that \(\operatorname{supp}\left[d L_{t}^{0}(\omega) ight] \subset\left\{t \geqslant 0: B_{t}(\omega)=0 ight\}\) for almost all \(\omega\). Show that...

Study smarter with the SolutionInn App