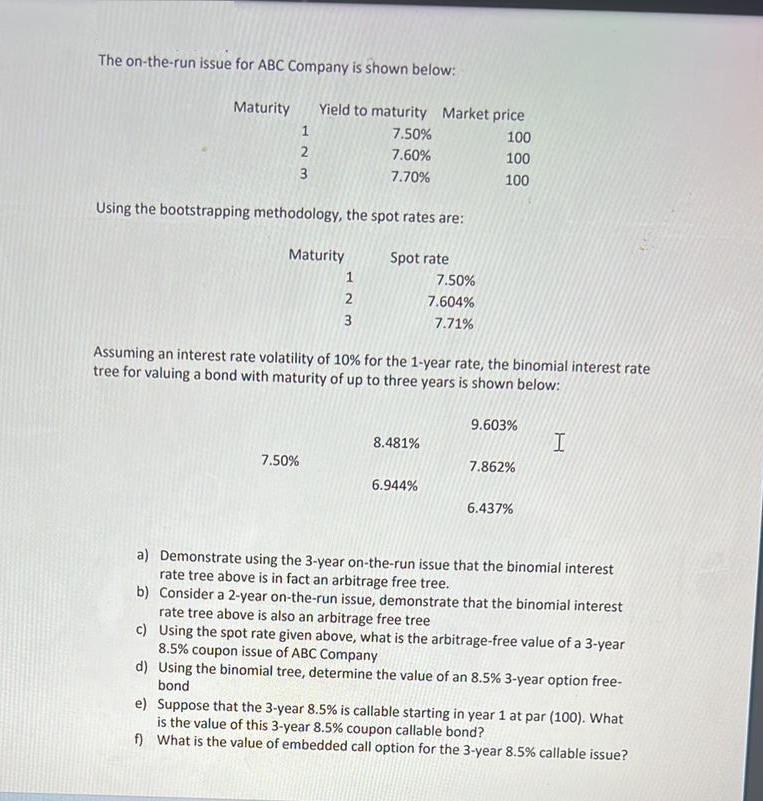

The on-the-run issue for ABC Company is shown below: Maturity 123 Yield to maturity Market price...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

The on-the-run issue for ABC Company is shown below: Maturity 123 Yield to maturity Market price 7.50% 100 7.60% 100 7.70% 100 Using the bootstrapping methodology, the spot rates are: Spot rate Maturity 7.50% 1 2 3 Assuming an interest rate volatility of 10% for the 1-year rate, the binomial interest rate tree for valuing a bond with maturity of up to three years is shown below: 8.481% 7.50% 7.604% 7.71% 6.944% 9.603% 7.862% 6.437% I a) Demonstrate using the 3-year on-the-run issue that the binomial interest rate tree above is in fact an arbitrage free tree. b) Consider a 2-year on-the-run issue, demonstrate that the binomial interest rate tree above is also an arbitrage free tree c) Using the spot rate given above, what is the arbitrage-free value of a 3-year 8.5% coupon issue of ABC Company d) Using the binomial tree, determine the value of an 8.5% 3-year option free- bond e) Suppose that the 3-year 8.5% is callable starting in year 1 at par (100). What is the value of this 3-year 8.5% coupon callable bond? f) What is the value of embedded call option for the 3-year 8.5 % callable issue? The on-the-run issue for ABC Company is shown below: Maturity 123 Yield to maturity Market price 7.50% 100 7.60% 100 7.70% 100 Using the bootstrapping methodology, the spot rates are: Spot rate Maturity 7.50% 1 2 3 Assuming an interest rate volatility of 10% for the 1-year rate, the binomial interest rate tree for valuing a bond with maturity of up to three years is shown below: 8.481% 7.50% 7.604% 7.71% 6.944% 9.603% 7.862% 6.437% I a) Demonstrate using the 3-year on-the-run issue that the binomial interest rate tree above is in fact an arbitrage free tree. b) Consider a 2-year on-the-run issue, demonstrate that the binomial interest rate tree above is also an arbitrage free tree c) Using the spot rate given above, what is the arbitrage-free value of a 3-year 8.5% coupon issue of ABC Company d) Using the binomial tree, determine the value of an 8.5% 3-year option free- bond e) Suppose that the 3-year 8.5% is callable starting in year 1 at par (100). What is the value of this 3-year 8.5% coupon callable bond? f) What is the value of embedded call option for the 3-year 8.5 % callable issue?

Expert Answer:

Related Book For

Posted Date:

Students also viewed these finance questions

-

Assuming an interest rate volatility of 10%, the binomial interest rate tree for ABC Company with a maturity of up to four years is shown below: If i 1,L is 4.4448%, what is the value of i 1,H ?...

-

Assume the historical return for ABC Company is 11.5% and its beta is .5. Further assume that the risk-free rate of return is 3% and the standard deviation is 30%. Based on these factors (using the...

-

The earning per share for ABC Company is expected to be $13 in 2019. The company pays dividend on the last day of each year (31/12). The company announced today (1/1/2019) that in 2019 they will pay...

-

Did you ever purchase a bag of M&??s candies and wonder about the distribution of colors? Did you know in the beginning they were all brown? Now, peanut M&Ms are 12% brown, 15% yellow, 12% red, 23%...

-

Zap, Inc., manufactures and sells a broadleaf herbicide that kills unwanted grasses and weeds. Via their television commercials, Zap encourages homeowners to take control of their yard by purchasing...

-

Air (k = 0.028 W/m. K, Pr = 0.7) at 50C flows along a 1-m-long flat plate whose temperature is maintained at 20C with a velocity such that the Reynolds number at the end of the plate is 10,000. The...

-

On 1 July 2025 Woojin and William began their partnership by contributing \($550\)000 and \($480\)000 respectively. William contributed another \($70\)000 and Woojin withdrew \($30\)000 of her...

-

Bleeker Company has the following merchandise account balances: Sales $195,000, Sales Discounts $2,000, Cost of Goods Sold $105,000 and Merchandise Inventory $40,000. Prepare the entries to record...

-

1.Which of the following is an advantage of implementing just-in-time inventory management? Pick 1 option The frequency of raw materials deliveries is reduced Monthly finance costs incurred in...

-

Your grandfather urged you to begin a habit of saving money early in your life. He suggested that you put $5 a day into an envelope. If you follow his advice, at the end of the year you will have...

-

How to get the intercooler pressures in a 3-stage compression? Pmin = 1 bar Pmax = 6.9 bar 14 combustion chamber reheater reheater Intercooler intercooler 13 10 12 low medium pressure high pressure...

-

What is going on with your site? I have searched for examples for the following papers and could not find any info on them. They are: 1. Create Visual Communication 2. Comm Regulation and Policy 3....

-

One of your staff members has been asked to give two speeches. Details are as follows: first speech - large target audience; objective: to inform them of company progress over the past year; and ...

-

10:00 Module name: Taxation Planning 2A Module code: TXP02A2 Year: 2022 Semester: First Assessment: Continuous Assessment 3 Release date: 1 April 2022 Submission deadline: 22 April 2022 INFORMATION:...

-

1. What could be the reasons for the price increase in offline retail stores? 2. From the information given in the case, can one conclude that there was a differential price response from the online...

-

On July 1, a company sells inventory on account to a customer for $40,000, with terms of 1/15, n/30. The company uses the net method to account for sales discounts. The customer pays the amount due...

-

Julie inherited $500,000 from a relative that is payable to her when she turns 21, which is 11 years from now Your bank has agreed to buy the inheritance and give her the cash now, and uses a 12%...

-

a. Determine the domain and range of the following functions.b. Graph each function using a graphing utility. Be sure to experiment with the window and orientation to give the best perspective of the...

-

Suppose that $1 billion of pass-throughs is used to create a CMO structure with a PAC bond with a par value of $700 million and a support bond with a par value of $300 million. Answer the below...

-

What is the bond-equivalent yield if the monthly cash flow yield is 0.7%?

-

Assuming the data in the following table for corporate bonds, compute the theoretical hedge ratio at the average spread level for the three credit ratings (X, Y, and Z):

-

Our number system consists of the digits 0, 1, 2, 3, 4, 5, 6, 7, 8, and 9. Because we do not write numbers such as 12 as 012, the first significant digit in any number must be 1, 2, 3, 4, 5, 6, 7, 8,...

-

(a) Simulate the experiment of sampling 100 three-child families to estimate the probability that a three-child family has two boys. (b) Simulate the experiment of sampling 1000 three-child families...

-

A pair of fair dice is rolled. Fair die are die where each outcome is equally likely. (a) Compute the probability of rolling a seven. (b) Compute the probability of rolling snake eyes; that is,...

Study smarter with the SolutionInn App