Amounts to be received by a partner during liquidation. A condensed balance sheet for a partnership to

Question:

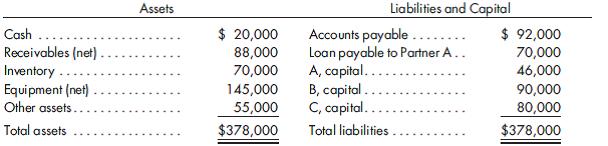

Amounts to be received by a partner during liquidation. A condensed balance sheet for a partnership to be liquidated is as follows:

The profit and loss percentages for Partners A, B, and C are 50%, 30%, and 20%, respectively. For each of the following independent scenarios, determine how much of the available cash, with the exception of $10,000, would be distributed to Partner B.

1. Assume that the receivables and the inventory were liquidated for $140,000 cash.

2. Assume that all noncash assets other than equipment were sold for $53,000 cash.

3. Assume that noncash assets with a book value of $300,000 were sold for $250,000 cash and that a distribution to Partner A was made in order to pay off the loan payable to them.

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor