The Shaolin Clothing Company owned a couple of PPE assets purchased in the previous year and...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

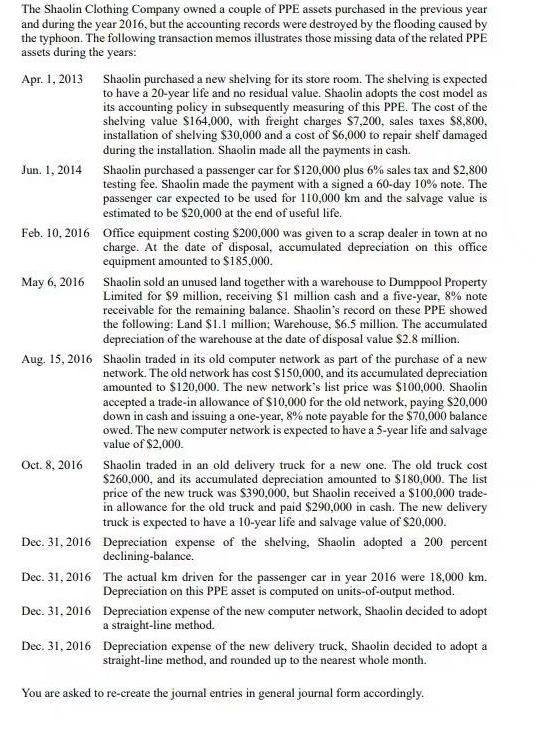

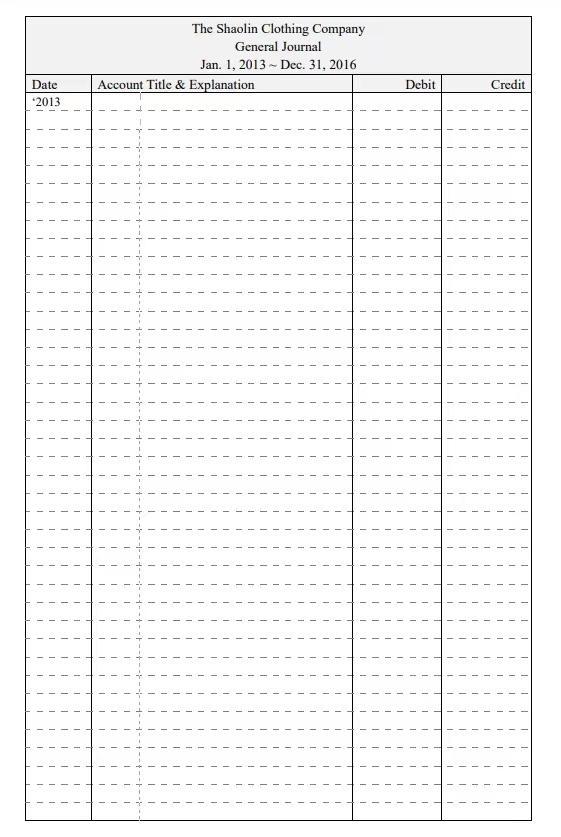

The Shaolin Clothing Company owned a couple of PPE assets purchased in the previous year and during the year 2016, but the accounting records were destroyed by the flooding caused by the typhoon. The following transaction memos illustrates those missing data of the related PPE assets during the years: Apr. 1, 2013 Jun. 1, 2014 Shaolin purchased a new shelving for its store room. The shelving is expected to have a 20-year life and no residual value. Shaolin adopts the cost model as its accounting policy in subsequently measuring of this PPE. The cost of the shelving value $164,000, with freight charges $7,200, sales taxes $8,800, installation of shelving $30,000 and a cost of $6,000 to repair shelf damaged during the installation. Shaolin made all the payments in cash. Feb. 10, 2016 Office equipment costing $200,000 was given to a scrap dealer in town at no charge. At the date of disposal, accumulated depreciation on this office equipment amounted to $185,000. Shaolin purchased a passenger car for $120,000 plus 6% sales tax and $2,800 testing fee. Shaolin made the payment with a signed a 60-day 10% note. The passenger car expected to be used for 110,000 km and the salvage value is estimated to be $20,000 at the end of useful life. May 6, 2016 Shaolin sold an unused land together with a warehouse to Dumppool Property Limited for $9 million, receiving $1 million cash and a five-year, 8% note receivable for the remaining balance. Shaolin's record on these PPE showed the following: Land $1.1 million; Warehouse, $6.5 million. The accumulated depreciation of the warehouse at the date of disposal value $2.8 million. Oct. 8, 2016 Aug. 15, 2016 Shaolin traded in its old computer network as part of the purchase of a new network. The old network has cost $150,000, and its accumulated depreciation amounted to $120,000. The new network's list price was $100,000. Shaolin accepted a trade-in allowance of $10,000 for the old network, paying $20,000 down in cash and issuing a one-year, 8% note payable for the $70,000 balance owed. The new computer network is expected to have a 5-year life and salvage value of $2,000. Dec. 31, 2016 Dec. 31, 2016 Dec. 31, 2016 Dec. 31, 2016 Shaolin traded in an old delivery truck for a new one. The old truck cost $260,000, and its accumulated depreciation amounted to $180,000. The list price of the new truck was $390,000, but Shaolin received a $100,000 trade- in allowance for the old truck and paid $290,000 in cash. The new delivery truck is expected to have a 10-year life and salvage value of $20,000. Depreciation expense of the shelving, Shaolin adopted a 200 percent declining-balance. The actual km driven for the passenger car in year 2016 were 18,000 km. Depreciation on this PPE asset is computed on units-of-output method. Depreciation expense of the new computer network, Shaolin decided to adopt a straight-line method. Depreciation expense of the new delivery truck, Shaolin decided to adopt a straight-line method, and rounded up to the nearest whole month. You are asked to re-create the journal entries in general journal form accordingly. Date *2013 The Shaolin Clothing Company General Journal Jan. 1, 2013 Dec. 31, 2016 Account Title & Explanation Debit Credit 1 1 I 1 1 The Shaolin Clothing Company owned a couple of PPE assets purchased in the previous year and during the year 2016, but the accounting records were destroyed by the flooding caused by the typhoon. The following transaction memos illustrates those missing data of the related PPE assets during the years: Apr. 1, 2013 Jun. 1, 2014 Shaolin purchased a new shelving for its store room. The shelving is expected to have a 20-year life and no residual value. Shaolin adopts the cost model as its accounting policy in subsequently measuring of this PPE. The cost of the shelving value $164,000, with freight charges $7,200, sales taxes $8,800, installation of shelving $30,000 and a cost of $6,000 to repair shelf damaged during the installation. Shaolin made all the payments in cash. Feb. 10, 2016 Office equipment costing $200,000 was given to a scrap dealer in town at no charge. At the date of disposal, accumulated depreciation on this office equipment amounted to $185,000. Shaolin purchased a passenger car for $120,000 plus 6% sales tax and $2,800 testing fee. Shaolin made the payment with a signed a 60-day 10% note. The passenger car expected to be used for 110,000 km and the salvage value is estimated to be $20,000 at the end of useful life. May 6, 2016 Shaolin sold an unused land together with a warehouse to Dumppool Property Limited for $9 million, receiving $1 million cash and a five-year, 8% note receivable for the remaining balance. Shaolin's record on these PPE showed the following: Land $1.1 million; Warehouse, $6.5 million. The accumulated depreciation of the warehouse at the date of disposal value $2.8 million. Oct. 8, 2016 Aug. 15, 2016 Shaolin traded in its old computer network as part of the purchase of a new network. The old network has cost $150,000, and its accumulated depreciation amounted to $120,000. The new network's list price was $100,000. Shaolin accepted a trade-in allowance of $10,000 for the old network, paying $20,000 down in cash and issuing a one-year, 8% note payable for the $70,000 balance owed. The new computer network is expected to have a 5-year life and salvage value of $2,000. Dec. 31, 2016 Dec. 31, 2016 Dec. 31, 2016 Dec. 31, 2016 Shaolin traded in an old delivery truck for a new one. The old truck cost $260,000, and its accumulated depreciation amounted to $180,000. The list price of the new truck was $390,000, but Shaolin received a $100,000 trade- in allowance for the old truck and paid $290,000 in cash. The new delivery truck is expected to have a 10-year life and salvage value of $20,000. Depreciation expense of the shelving, Shaolin adopted a 200 percent declining-balance. The actual km driven for the passenger car in year 2016 were 18,000 km. Depreciation on this PPE asset is computed on units-of-output method. Depreciation expense of the new computer network, Shaolin decided to adopt a straight-line method. Depreciation expense of the new delivery truck, Shaolin decided to adopt a straight-line method, and rounded up to the nearest whole month. You are asked to re-create the journal entries in general journal form accordingly. Date *2013 The Shaolin Clothing Company General Journal Jan. 1, 2013 Dec. 31, 2016 Account Title & Explanation Debit Credit 1 1 I 1 1

Expert Answer:

Answer rating: 100% (QA)

Calculate the net Capital gain advice on Impact of for man... View the full answer

Related Book For

Financial and Managerial Accounting

ISBN: 978-1285866307

13th edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Posted Date:

Students also viewed these accounting questions

-

A new project is expected to have an 8-year economic life. The project will have an initial cost of $100,000. Installation and shipping charges for the equipment are estimated at $10,000. The...

-

The Delta Chemical Corporation is expected to have the capital structure for the foreseeable future as given in Table P15.10. The flotation costs are already included in each cost component. The...

-

A new product is expected to have sales of $100,000, variable costs of 60% of sales, and fixed costs of $20,000. 1. Using graph paper, construct a break-even chart and label the sales line, total...

-

How many moles of carbon dioxide, CO2, are in a 22 gram sample of the compound?

-

Refer to the information in E8-5 for Shadee Corp. Each visor requires a total of $4.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of...

-

Prepare budgetary entries, using general ledger control accounts only, for each of the following unrelated situations: (If no entry is required for a transaction/event, select "No Journal Entry...

-

The Wind Map The website hint.fm/wind/ shows the current wind patterns across the US. In order to generate this map, what two variables are being recorded at weather stations across the US?

-

Administrative theorists concluded many decades ago that the most effective organizations have a narrow span of control. Yet todays top-performing manufacturing firms have a wide span of control. Why...

-

Kuala Lumpur Kepong Berhad stock currently sells for RM21.40 per share. The next expected annual dividend is RM0.80, and the growth rate is 4%. a. Find the expected rate of return on this stock. b....

-

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2020: 1....

-

Thomas Scott sells gift baskets filled with various fruits. Each basket sells for $35. Thomas estimates his variable costs to be $28 per basket and fixed costs for the year to be $15,400. From the...

-

We have chosen the company for the Export Marketing Plan: Lassonde Industries Inc. Product is lemonade and the Country is middle east (UAE) Kindly Explain the following Introduction, situation...

-

External Factors opportunities and threats for R.J Reynolds Tobacco Company?

-

CVP Suds Soap Co. produces two types of artisanal soap. One is Citrus Burst and the other is Lavender Fields. The Citrus Burst soap is sold for $6 and has variable costs of $1.50. The Lavender...

-

Factors that influence supply chain and key security activities of the world customs organisation (WCO). Discuss the impact globalisation has on Customs Administration in developing countries....

-

Imagine that you are in charge of a fashion company. Explain one criterion that you should use as you select a company/country to do business with. Give a detailed example to illustrate the criterion...

-

What was Menger's contribution to history of economic thought. Explain and draw his numerical table of allocation of goods.

-

Prove that the mean heat capacities C P H and C P S are inherently positive, whether T > T 0 or T < T 0 . Explain why they are well defined for T = T 0 .

-

Jupiter Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $70 per unit. The company, which is currently operating below full capacity, charges...

-

Yerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during 2016: Feb. 2. Purchased for cash...

-

The beginning inventory at Funky Party Supplies and data on purchases and sales for a three-month period ending March 31, 2016, are as follows: Instructions 1. Record the inventory, purchases, and...

-

When the Glen Canyon hydroelectric power plant in Arizona is running at capacity, 690 m 3 of water flows through the dam each second. The water is released 220 m below the top of the reservoir. If...

-

A pronghorn, the fastest North American animal, is capable of running at 18 m/s (40 mph) for 10 minutes, after which it must slow down. The time limit isnt because the pronghorn runs out of energy;...

-

When the hoof of a galloping horse hits the ground, the digital flexor tendon in its lower leg may stretch by 5% in length, a significant stretch for this 45 cm tendon. The tendon is elastic; mostbut...

Study smarter with the SolutionInn App