You are a financial analyst. Based on your analysis of Macys financial statements, provide a report to

Question:

You are a financial analyst. Based on your analysis of Macy’s financial statements, provide a report to guide investors whether Macy’s is a buy (keep) or sell stock. Your report should include the following

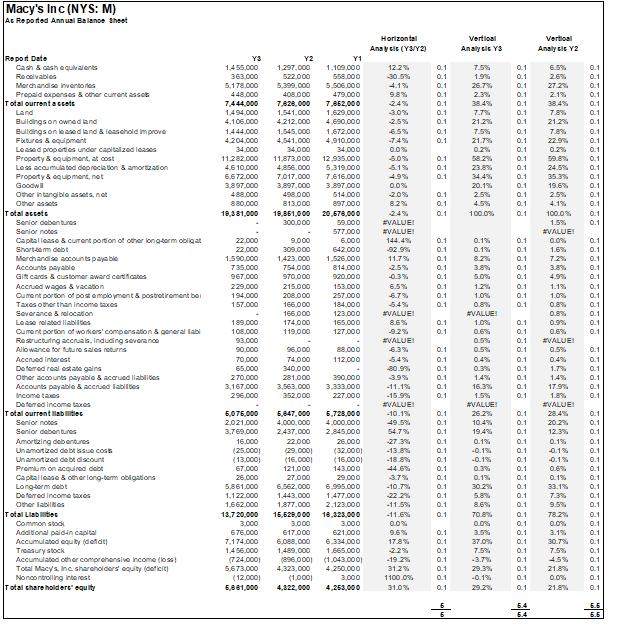

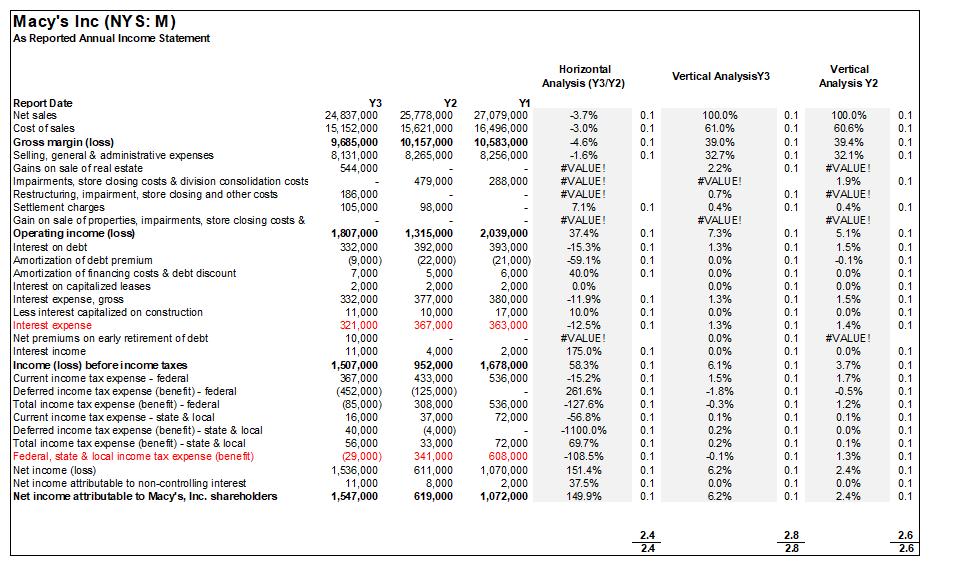

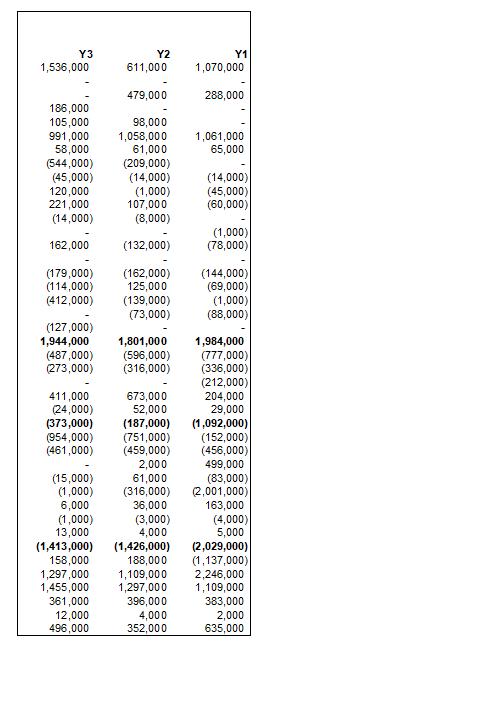

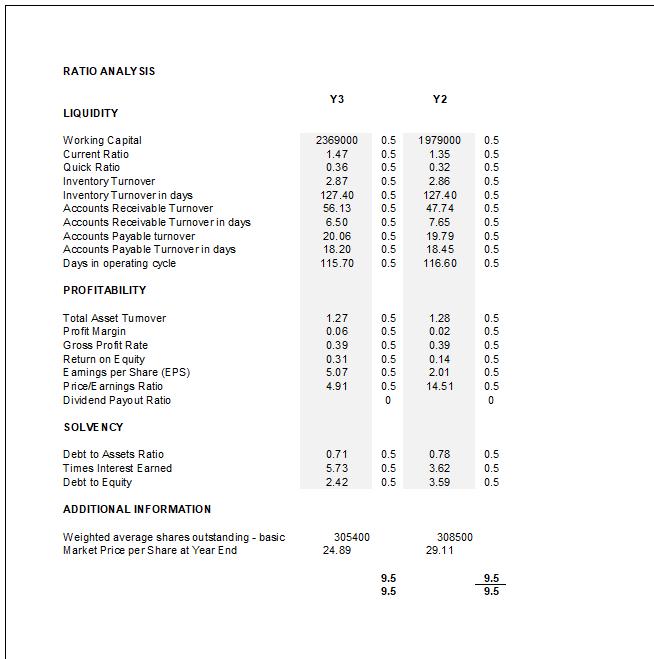

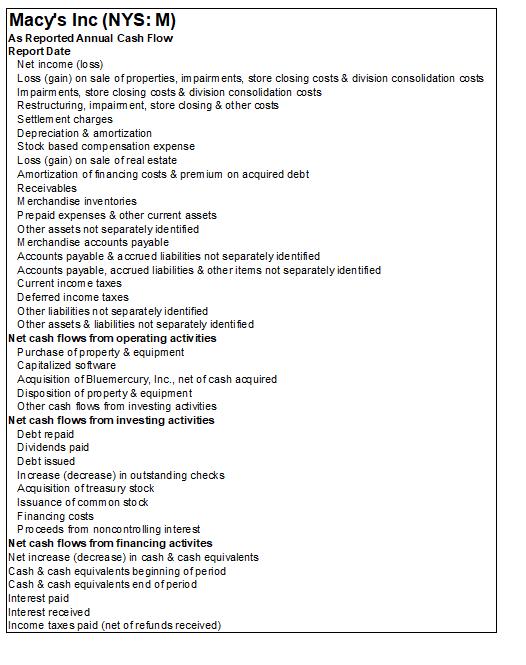

a. An interpretation of trends illustrated by supportive ratios, horizontal and vertical analysis and focus on the main ratios that “tell the story”. (a minimum of one page-not to exceed two pages, single space, 12 font size).

i. horizontal and vertical analysis

ii. Liquidity analysis

iii. Profitability analysis

iv. Solvency analysis

b. Your informed recommendation (buy or sell) about Macy’s with justifications. What is your general impression about Macy’s ? Support your conclusion (1- paragraph)

Macy's Inc (NYS: M) As Reported Annual Balance Sheet Report Date Cash & cash equivalents Receivables Merchandise inventories Prepaid expenses & other current asset Total current accet Land Buildings on owned land Buildings on leased land & leasehold improve Fixtures & equipment Leased properties under capitalized leases Property & equipment, at cost Less accumulated depreciation & amortization Property & equipment, not Goodw Other intangible assets, not other assets Total accets Senior debentures Senior notes Capital lease & current portion of other long-term obligat Short-tem debt Merchandise accounts payable Accounts payable Gift cards & customer award certificates Accrued wages & vacation Cument portion of post employment & postretirement be Taxes other than income taxes Severance & relocation Lease related liabilities Cument portion of workers' compensation & general labi Restructuring accruals, Induding severance Allowance for future sales returns Accrued interest Deferred real estate gains Other accounts payable & accrued liablites Accounts payable & accrued labiles Income taxes Deferred Income taxes Total current lab Senior notes Senior debentures Amortizing debentures Un amortized debt issue cost Un amortized debt discount Promlum on acquired debt Capital lease & other long-term obligations Long-term debt Deferred Income taxes Other Tables Total Liabilities Common stock Additional paidin capital Accumulated equity (det) Treasury stock Accumulated other comprehensive Income (los) Total Macy's, Inc. shareholders equity (deficit) Noncontrolling interest Total shareholdere equity Y3 1,455,000 363,000 5,178,000 22.000 22,000 1.590,000 735,000 967,000 229,000 194,000 157,000 189,000 108.000 448,000 7,444,000 1,494,000 4.106.000 1,444.000 1,545,000 1,672,000 4,204,000 4,541,000 4,910,000 34,000 34,000 34,000 11,282,000 11,873,000 12,935.000 4.610.000 4,856.000 5,319,000 6,672.000 7,017.000 7.616.000 3,897,000 3,897,000 3,897,000 488.000 880,000 514.000 897,000 498.000 813.000 18,861,000 20,678,000 300.000 18,381,000 93,000 90,000 70,000 65,000 270,000 3,167,000 296.000 Y2 1,297,000 522.000 5,861,000 1,122,000 1,662.000 1,109,000 558,000 5,399,000 5,506,000 408,000 479,000 7,828,000 7,862,000 1,541,000 1,629,000 4.212,000 4,690,000 3.000 676,000 7.174.000 1.456.000 9,000 309.000 1,423,000 754,000 970,000 215,000 208.000 166,000 166,000 174,000 119,000 - 96,000 74.000 340,000 281.000 3,563,000 352,000 Y1 59.000 577.000 6,000 642,000 1.526.000 814,000 920.000 (896,000) 4,323,000 (724,000) 5,673,000 (12.000) (1,000) 6,881,000 4,322,000 153,000 257,000 184,000 123,000 165.000 127,000 6,076,000 6,847,000 6,728,000 2,021,000 4,000,000 4,000,000 3,769,000 2,437,000 2,845,000 16.000 22.000 26,000 (25.000) (29,000) (32.000) (13,000) (16,000) (16,000) 67,000 121,000 143,000 26,000 27.000 29,000 88.000 112,000 6,562,000 6,995.000 1.443.000 1,477,000 1,877,000 2.123.000 13,720,000 16,620,000 16,323,000 390,000 3,333,000 227,000 .. 3,000 3,000 617,000 6,088,000 6.334,000 621,000 1,489,000 1,665,000 (1.043,000) 4,250,000 3,000 4,263,000 Horizontal Ana y cic (Y3/Y2) 12.2% -30.5% 4.1% 9.8% -2.4% 3.0% -2.5% 6.5% -7.4% 0.0% 5.0% 4.1% 4.9% 0.0% -2.0% 8.2% -2.4% #VALUE! #VALUE! 144.4% -92.9% 11.7% -2.5% -0.3% 6.5% 6.7% -5.4% #VALUE! 8.6% -9.2% #VALUE! 4.3% -5.4% 80.9% -3.9% -11.1% -15.9% #VALUE! -10.1% 49.5% 54.7% -27.3% -13.8% -18.8% 44.6% 3.7% -10.7% -22.2% -11.5% -11.6% 0.0% 9.6% 17.8% -2.2% -19.2% 31.2% 1100.0% 31.0% 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Vertical Analysis YS 7.5% 1.9% 26.7% 2.3% 38.4% 7.7% 21.2% 7.5% 21.7% 0.2% 58.2% 23.8% 34.4% 20.1% 2.5% 4.5% 100.0% 0.1% 0.1% 8.2% 3.8% 5.0% 1.2% 1.0% 0.8% #VALUE! 1.0% 0.6% 0.5% 0.5% 0.4% 0.3% 1.4% 16.3% 1.5% #VALUE! 26.2% 10.4% 19.4% 0.1% -0.1% -0.1% 0.3% 0.1% 30.2% 5.8% 8.6% 70.8% 0.0% 3.5% 37.0% 7.5% -3.7% 29.3% -0.1% 29.2% 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 55 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 텦 Vertical Analysis Y2 6.5% 2.6% 27.2% 2.1% 38,4% 7.8% 21.2% 7.8% 22.9% 0.2% 50.8% 24.5% 35.3% 19.6% 2.5% 4.1% 100.0% 1.5% #VALUE! 0.0% 1.6% 7.2% 3.8% 4.9% 1.1% 1.0% 0.8% 0.8% 0.9% 0.6% #VALUE! 0.5% 0.4% 1.7% 1.4% 17.9% 1.8% #VALUE! 28.4% 20.2% 12.3% 0.1% -0.1% -0.1% 0.6% 0.1% 33,1% 7.3% 9.5% 78.2% 0.0% 3.1% 30.7% 7.5% 4.5% 21.8% 0.0% 21.8% 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 5 6 ને તે છે કે કોઈ તેને 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 6.6 6.6 Macy's Inc (NYS: M) As Reported Annual Balance Sheet Report Date Cash & cash equivalents Receivables Merchandise inventories Prepaid expenses & other current asset Total current accet Land Buildings on owned land Buildings on leased land & leasehold improve Fixtures & equipment Leased properties under capitalized leases Property & equipment, at cost Less accumulated depreciation & amortization Property & equipment, not Goodw Other intangible assets, not other assets Total accets Senior debentures Senior notes Capital lease & current portion of other long-term obligat Short-tem debt Merchandise accounts payable Accounts payable Gift cards & customer award certificates Accrued wages & vacation Cument portion of post employment & postretirement be Taxes other than income taxes Severance & relocation Lease related liabilities Cument portion of workers' compensation & general labi Restructuring accruals, Induding severance Allowance for future sales returns Accrued interest Deferred real estate gains Other accounts payable & accrued liablites Accounts payable & accrued labiles Income taxes Deferred Income taxes Total current lab Senior notes Senior debentures Amortizing debentures Un amortized debt issue cost Un amortized debt discount Promlum on acquired debt Capital lease & other long-term obligations Long-term debt Deferred Income taxes Other Tables Total Liabilities Common stock Additional paidin capital Accumulated equity (det) Treasury stock Accumulated other comprehensive Income (los) Total Macy's, Inc. shareholders equity (deficit) Noncontrolling interest Total shareholdere equity Y3 1,455,000 363,000 5,178,000 22.000 22,000 1.590,000 735,000 967,000 229,000 194,000 157,000 189,000 108.000 448,000 7,444,000 1,494,000 4.106.000 1,444.000 1,545,000 1,672,000 4,204,000 4,541,000 4,910,000 34,000 34,000 34,000 11,282,000 11,873,000 12,935.000 4.610.000 4,856.000 5,319,000 6,672.000 7,017.000 7.616.000 3,897,000 3,897,000 3,897,000 488.000 880,000 514.000 897,000 498.000 813.000 18,861,000 20,678,000 300.000 18,381,000 93,000 90,000 70,000 65,000 270,000 3,167,000 296.000 Y2 1,297,000 522.000 5,861,000 1,122,000 1,662.000 1,109,000 558,000 5,399,000 5,506,000 408,000 479,000 7,828,000 7,862,000 1,541,000 1,629,000 4.212,000 4,690,000 3.000 676,000 7.174.000 1.456.000 9,000 309.000 1,423,000 754,000 970,000 215,000 208.000 166,000 166,000 174,000 119,000 - 96,000 74.000 340,000 281.000 3,563,000 352,000 Y1 59.000 577.000 6,000 642,000 1.526.000 814,000 920.000 (896,000) 4,323,000 (724,000) 5,673,000 (12.000) (1,000) 6,881,000 4,322,000 153,000 257,000 184,000 123,000 165.000 127,000 6,076,000 6,847,000 6,728,000 2,021,000 4,000,000 4,000,000 3,769,000 2,437,000 2,845,000 16.000 22.000 26,000 (25.000) (29,000) (32.000) (13,000) (16,000) (16,000) 67,000 121,000 143,000 26,000 27.000 29,000 88.000 112,000 6,562,000 6,995.000 1.443.000 1,477,000 1,877,000 2.123.000 13,720,000 16,620,000 16,323,000 390,000 3,333,000 227,000 .. 3,000 3,000 617,000 6,088,000 6.334,000 621,000 1,489,000 1,665,000 (1.043,000) 4,250,000 3,000 4,263,000 Horizontal Ana y cic (Y3/Y2) 12.2% -30.5% 4.1% 9.8% -2.4% 3.0% -2.5% 6.5% -7.4% 0.0% 5.0% 4.1% 4.9% 0.0% -2.0% 8.2% -2.4% #VALUE! #VALUE! 144.4% -92.9% 11.7% -2.5% -0.3% 6.5% 6.7% -5.4% #VALUE! 8.6% -9.2% #VALUE! 4.3% -5.4% 80.9% -3.9% -11.1% -15.9% #VALUE! -10.1% 49.5% 54.7% -27.3% -13.8% -18.8% 44.6% 3.7% -10.7% -22.2% -11.5% -11.6% 0.0% 9.6% 17.8% -2.2% -19.2% 31.2% 1100.0% 31.0% 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Vertical Analysis YS 7.5% 1.9% 26.7% 2.3% 38.4% 7.7% 21.2% 7.5% 21.7% 0.2% 58.2% 23.8% 34.4% 20.1% 2.5% 4.5% 100.0% 0.1% 0.1% 8.2% 3.8% 5.0% 1.2% 1.0% 0.8% #VALUE! 1.0% 0.6% 0.5% 0.5% 0.4% 0.3% 1.4% 16.3% 1.5% #VALUE! 26.2% 10.4% 19.4% 0.1% -0.1% -0.1% 0.3% 0.1% 30.2% 5.8% 8.6% 70.8% 0.0% 3.5% 37.0% 7.5% -3.7% 29.3% -0.1% 29.2% 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 55 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 텦 Vertical Analysis Y2 6.5% 2.6% 27.2% 2.1% 38,4% 7.8% 21.2% 7.8% 22.9% 0.2% 50.8% 24.5% 35.3% 19.6% 2.5% 4.1% 100.0% 1.5% #VALUE! 0.0% 1.6% 7.2% 3.8% 4.9% 1.1% 1.0% 0.8% 0.8% 0.9% 0.6% #VALUE! 0.5% 0.4% 1.7% 1.4% 17.9% 1.8% #VALUE! 28.4% 20.2% 12.3% 0.1% -0.1% -0.1% 0.6% 0.1% 33,1% 7.3% 9.5% 78.2% 0.0% 3.1% 30.7% 7.5% 4.5% 21.8% 0.0% 21.8% 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 5 6 ને તે છે કે કોઈ તેને 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 6.6 6.6

Expert Answer:

Based on the financial information provided for Macys lets conduct a brief analysis to guide investors on whether Macys is a buy keep or sell stock This will entaiI looking into various aspects such a... View the full answer

Students also viewed these finance questions

-

Prepare a simplified balance sheet and income statement projecting the growth of Walgreens-Boots Alliance, Inc. for the fiscal year ending 8/31/2022. Assume no new issues of equity. Projections can...

-

Produce the following calculations: Gross & Net Margin, EBIT & AT Inventory Turnover ROA, EBIT & AT ROE, AT Current Ratio Debt/Equity Receivables turnover Fixed asset turnover Total asset...

-

Presented below are excerpts from Note 1 to Starbucks' September 30, 2012, consolidated financial statements in which Starbucks describes accounting policy for long-lived assets. a. Leasehold...

-

Figure 11-31 shows a cooling curve for a Pb-Sn alloy. Determine (a) The pouring temperature; (b) The superheat; (c) The liquidus temperature; (d) The eutectic temperature; (e) The freezing range; (f)...

-

A building acquired at the beginning of the year at a cost of $316,000 has an estimated residual value of $48,000 and an estimated useful life of 40 years. Determine (a) The depreciable cost, (b) The...

-

In Exercises, find an equation of the tangent line to the graph of y = f (x) at the given x. Do not apply formula (6), but proceed as we did in Example 4. Example 4. Finding the Equation of the...

-

What are the main objectives of an international compensation plan? Would an integrated solution or a best-of-breed solution make more sense for a large manufacturing corporation? Do you believe that...

-

The following selected transactions were complete by Burton Company during July of the current year. Burton Company uses the periodic inventory system. July 2. Purchased $24,000 of merchandise on...

-

Melissa recently paid $660 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $650 fee to register for the conference,...

-

The links of the chain are made steel that has a working stress of 300 MPa in tension. If the chain is to support the force P = 45 kN, determine the smallest safe diameter d of the links. P

-

Essay Questions Answers should be brief and concise. A maximum of three sentences only. 1. A resident Filipino engaged in business has a cost ratio to sales of 30%. All expenses are supported with...

-

sh (Canada) 2 a 00 Mon Oct 16 C & PO but References A Aa Mailings Review Document4 View Tell me V Po EVE V T AaBbCcDdEe AaBbCcDdEe AaBbCcDc AA V Normal No Spacing Heading 1 V Budget Independent...

-

Tarzor Battery Technology, Inc. (TBT) is a producer and distributor of specialty batteries. Recently, TBT management had the idea of producing an innovative model of lithium batteries for fishing...

-

You are the HR manager in a large multinational company. The corporate office is headquartered in the United States, but it has regional offices in many different countries around the world. In the...

-

After much labor and management conflict, Kaiser Permanente and over 25 unions created this labor management partnership (LMP). Today, it is considered a model of union and labor partnerships for the...

-

Provide a detailed analysis to social well-being, how is social well-being measured at a national level and what policies could be created to improve social quality approach variables (SQA). What are...

-

Andretti Company has only one product called Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The unit costs of the company at this level of...

-

Evaluate how many lines there are in a true rotational spectrum of CO molecules whose natural vibration frequency is w = 4.09 1014 s1 and moment of inertia I = 1.44 1039 g cm2.

-

The Budwell & Son Oil Company is looking at two drilling proposals. One project lasts for three years, costs $20 million to start, pays back quickly, and has an NPV of $15 million. The other project...

-

Watson Waterbed Works Inc. has an EBIT of $2.75 million, can borrow at 15% interest, and pays combined state and federal income taxes of 40%. It currently has no debt and is capitalized by equity of...

-

Inflation is expected to be 5% next year and a steady 7% each year thereafter. Maturity risk premiums are zero for one-year debt but have an increasing value for longer debt. One-year government debt...

-

Consider heat transfer over a flat plate again but now include an additional term due to viscous heating. Show that the similarity method is applicable to this problem as well, and derive the...

-

For the similarity solution, what are the boundary conditions for the constant-wall-flux case? Show that a complete similarity does not exist for this case. Also show the condition for the case where...

-

Integral balances can also be used for heat transfer in a turbulent-flow boundary layer if a form for the velocity profile is assumed. A common form is the 1/7th-power law:...

Study smarter with the SolutionInn App