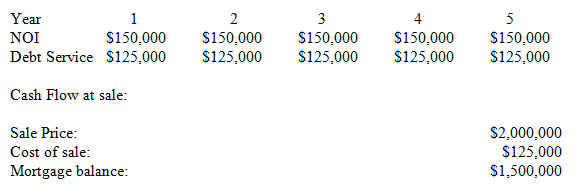

Use the following property data: Cash flow from operations a. Assuming the going-in capitalization rate is 8.00

Question:

Cash flow from operations

a. Assuming the going-in capitalization rate is 8.00 percent, compute a value for the property using direct capitalization.

b. Assuming the required yield/return on unlevered cash flows is 10 percent, and that the property will be held by a buyer for five years, compute the value of the property based on discounting unlevered cash flows.

c. Assuming the relevant required yield/return on levered cash flows is 15 percent, and that the property will be held by a buyer for five years, what is the present value of the levered cash flows?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Real Estate Principles A Value Approach

ISBN: 978-0077836368

5th edition

Authors: David C Ling, Wayne Archer

Question Posted: